Decentralized exchanges (DEXs) built on Solana Network have experienced a surge in liquidity over the last two months, data on the TVL aggregator for DeFi DefiLlama shows.

The rise in trading volume of these DEXs is highly influenced by the recent airdrops hosted by Solana DeFi protocols Pyth and Jito, according to the online crypto website Blockworks.

(Read more: Ultimate Guide to Solana Airdrops 2023 – 2024 and 10 Potential Crypto Airdrops to Watch Out For in 2024)

(Also read: Solana Airdrop Checker Tool Guide To Check If Your Wallet is Eligible and BONKbot Telegram Bot Guide: Fastest Way to Buy and Sell Solana Coins)

Table of Contents

Trading Volume Growth in Solana DEXs

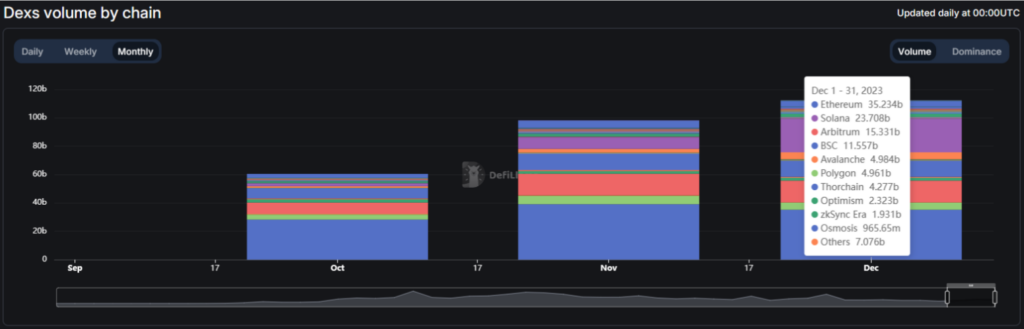

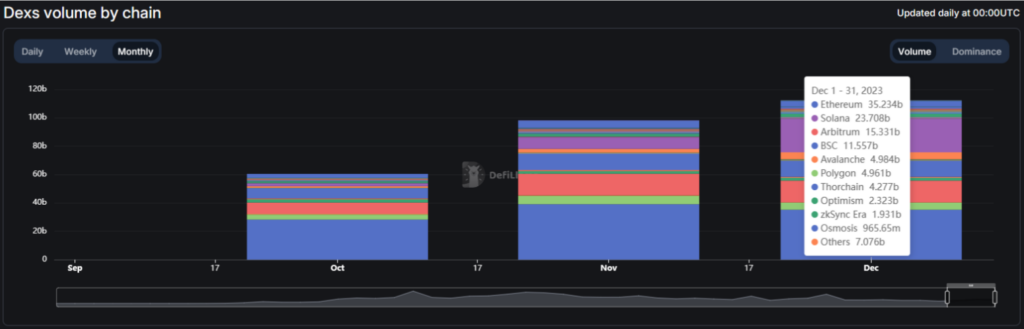

In November, the recorded trading volume on Solana-based DEXs was $8.079 billion, which was considered the monthly high record.

But as of this writing, the recorded trading volume for the month of December has already reached $23.708 billion, almost three times compared to November’s data.

Furthermore, Solana also took over the top spot for the 7-day trading volume record from Ethereum for the first time in history. As of this writing, Solana DEXs hosted 26% of the total transactions for the past week.

The said reign started on December 21, 2023. Blockworks considered it a victory for Solana, as Ethereum has been holding the crown since 2021, and the discrepancy between the two networks in terms of DEX volume worsened when Sam Bankman-Fried, who is a known Solana backer, was involved in the infamous FTX fraud.

The Catalyst: Solana Airdrops

Allegedly, the surge in trading volume on Solana DEXs was because of the massive airdrops of the two protocols on the network—Pyth in November and Jito earlier this month.

“The DEX revival came on the heels of sizable token airdrops from Solana DeFi protocols Pyth and Jito. Some liken airdrops to DeFi network stimulus checks, but this framing depends on who is actually on the receiving end of the free tokens,” Blockworks’ Jack Kubinec wrote.

In November, Pyth Network introduced the Pyth Network Retrospective Airdrop program, which distributed around $87 million worth of $PYTH to community members and DeFi participants who used decentralized applications powered by Pyth data.

A month later, Jito Foundation launched its governance token, $JTO. The $228 million worth of $JTO can be claimed for the next two years.

However, the surge in DEX trading volume is expected to continue as there is an upcoming huge airdrop again, according to Kubinec—the Jupiter Exchange.

Jupiter Exchange is a decentralized exchange created by a unanimous developer or group of developers with a pseudonymous name, Meow.

It operates as a liquidity aggregator, gathering liquidity from various DEXs and automated market makers (AMMs) within the network’s ecosystem. This means that the exchange aggregates the best prices on all the DEXs on Solana by connecting DEX markets and AMM pools.

In its whitepaper, the developers confirmed the DEX’s airdrop by allocating 40% of the total supply of $JUP, its utility and governance token, to the airdrop alone.

To qualify, users must use Jupiter’s limit orders, bridge, and perpetual contract features.

Read more to learn about the Jupiter Exchange and its upcoming potential: What is Jupiter Exchange? A DEX With 40% of Tokens Allocated for Airdrop

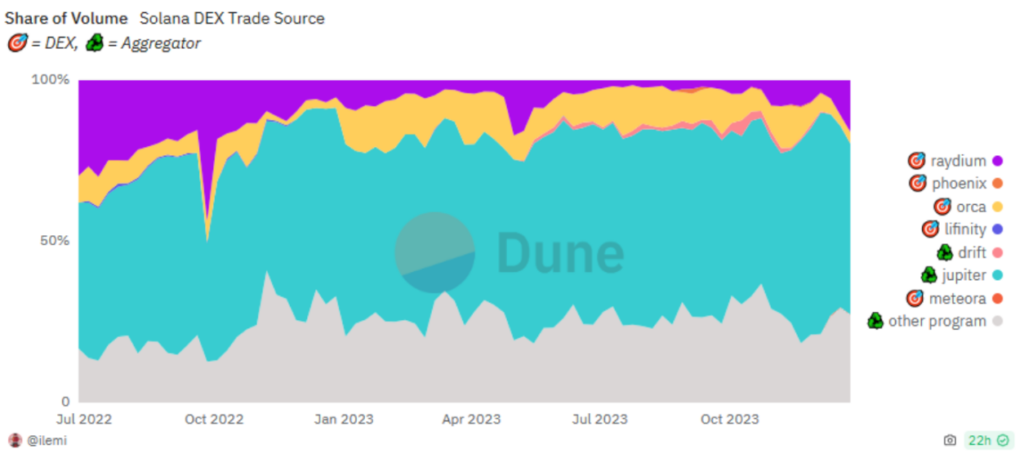

This led to the Jupiter Exchange hosting the majority of Solana’s recent DEX trading volume, or about 60%, as per data posted by Dune Analytics user Ilemi.

This article is published on BitPinas: Solana-Based DEXs See Growth in Trading Volume After $JTO, $PYTH Airdrops

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitpinas.com/cryptocurrency/solana-dex-growth/

- :has

- :is

- :not

- 11

- 12

- 13

- 2021

- 2023

- 26%

- a

- About

- According

- actions

- actually

- advice

- After

- again

- aggregates

- Aggregator

- airdrop

- Airdrops

- All

- allocated

- almost

- alone

- already

- also

- AMM

- AMMs

- an

- analytics

- and

- any

- applications

- appropriate

- ARE

- around

- article

- AS

- Automated

- Bankman-Fried

- BE

- because

- been

- before

- BEST

- best prices

- between

- Billion

- BitPinas

- Blockworks

- Bot

- BRIDGE

- built

- but

- buy

- by

- came

- CAN

- carry

- Catalyst

- check

- Checks

- claim

- claimed

- community

- compared

- CONFIRMED

- Connecting

- considered

- constitute

- content

- continue

- contract

- created

- Crown

- crypto

- cryptocurrency

- data

- December

- decentralized

- Decentralized Applications

- Decentralized Exchange

- decisions

- DeFi

- DeFi protocols

- depends

- Developer

- developers

- Dex

- DEXs

- diligence

- discrepancy

- distributed

- does

- due

- Dune

- Dune Analytics

- Earlier

- ecosystem

- end

- essential

- ethereum

- exchange

- Exchanges

- expected

- experienced

- fastest

- Features

- financial

- First

- first time

- For

- Foundation

- Free

- from

- FTX

- Gains

- gathering

- governance

- Governance Token

- Group

- Growth

- guide

- Have

- High

- highly

- history

- holding

- hosted

- hosting

- HTTPS

- huge

- if

- in

- infamous

- influenced

- Informational

- investing

- investment

- involved

- IT

- ITS

- jack

- Jupiter

- known

- Last

- later

- LEARN

- Led

- LIMIT

- limit orders

- Liquidity

- losses

- Majority

- Makers

- Making

- Market

- market makers

- Markets

- massive

- max-width

- May..

- means

- Members

- million

- Month

- monthly

- monthly high

- months

- more

- must

- name

- network

- networks

- next

- November

- of

- on

- online

- online crypto

- only

- operates

- or

- orders

- out

- over

- own

- participants

- past

- per

- Perpetual

- photo

- plato

- Plato Data Intelligence

- PlatoData

- Pools

- position

- posted

- potential

- powered

- Prices

- professional

- Program

- protocols

- provides

- published

- purposes

- Pyth

- pyth network

- qualify

- reached

- Read

- receiving

- recent

- record

- recorded

- responsibility

- responsible

- Rise

- Said

- Sam

- Sam Bankman-Fried

- see

- Seek

- sell

- Shows

- since

- sizable

- Solana

- solely

- some

- specific

- Spot

- started

- stimulus

- stimulus checks

- supply

- surge

- Telegram

- terms

- that

- The

- There.

- These

- this

- three

- time

- times

- to

- token

- Tokens

- took

- tool

- top

- Total

- Trading

- trading volume

- Transactions

- TVL

- two

- upcoming

- use

- used

- User

- users

- utility

- various

- victory

- volume

- Wallet

- was

- Watch

- Way..

- Website

- week

- when

- which

- Whitepaper

- WHO

- will

- with

- within

- worth

- writing

- wrote

- years

- You

- Your

- zephyrnet

![[Event Recap] Web3 Philippines First Ever Community Meetup [Event Recap] Web3 Philippines First Ever Community Meetup PlatoBlockchain Data Intelligence. Vertical Search. Ai.](http://platoblockchain.com/wp-content/uploads/2022/10/IMG_8005-1024x575-1-360x202.jpg)

![[Event Recap] Mid-Winter Fireside Chat Second Panel: Crypto PH Builders in the Bear Market [Event Recap] Mid-Winter Fireside Chat Second Panel: Crypto PH Builders in the Bear Market PlatoBlockchain Data Intelligence. Vertical Search. Ai.](http://platoblockchain.com/wp-content/uploads/2022/08/IMG_7051-1024x768-1-300x225.jpg)