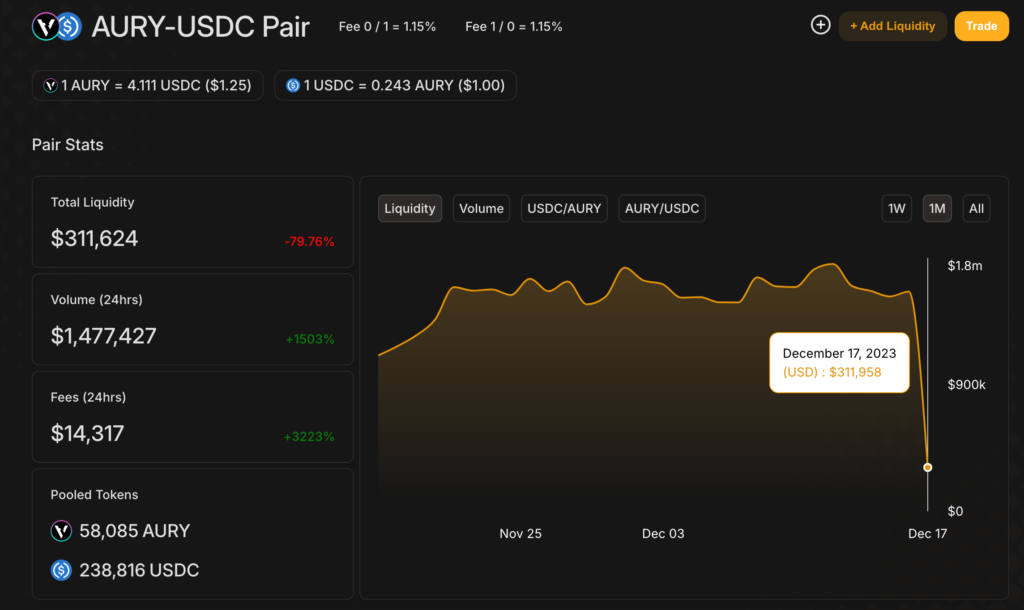

- On December 17, Solana-based gaming ecosystems Aurory experienced a web3 hack, resulting in a drop of nearly 80% in the liquidity of the AURY-USDC pool.

- The web hack targeted Aurory’s SyncSpace bridge on Arbitrum’s native DEX Camelot around 13:00 UTC(16:00 EAT).

- According to Solana, Aurory has raised over $108 million worth of commitment at a 1.55 billion $AURY valuation.

The Web3 industry has significantly evolved over the past few years. What started as a mere digital currency has grown into a trillion-dollar franchise, a widespread technology with the capacity to change various sectors and an entirely new wave of applications. From the fundamental aspects of Bitcoin, developers have managed to duplicate its functioning to create numerous alternative coins or Altcoins.

Developers mainly did this to develop a cryptocurrency that would surpass Bitcoin, but unfortunately, the original crypto coin has dominated the franchise for some time. With the domination of Bitcoin, all too apparent developers took different roles; thus, instead of competing with Bitcoin, they sought to improve and expand its functionalities.

This led to the development of blockchain ecosystems like Ethereum, Solana, and many more. Unfortunately, their success eventually became their undoing as web3 hacking has become the norm within the industry. So far, web3-based ecosystems have lost billions via unsecured blockchain networks, solar engineering, and zero-day hacks.

In recent developments, Solana-based ecosystem Aurory, a popular web3 game, has become the industry’s latest victim, losing almost 80% of its pool’s liquidity in a recent web3 hack.

Aurory, Solana’s web3 game

The hierarchy of the crypto sphere is a combination of supply and demand. Despite these, key crypto coins like Ether and Bitcoin have consistently dominated their franchises. As a result, many altcoins have chosen to go for different routes and venture into other sectors to maintain their popularity and valuation. Amid this trend, web3 games have become a popular method of ensuring demand while expanding the reach of the web3 ecosystem.

Also, Read Justin Sun’s Crypto Empire Under Siege: HTX and Heco Chain Suffer $115 Million hack.

Solana, a popular altcoin, is among the few cryptocurrencies that chose to expand the ecosystems of web3 rather than compete in the man-eat-man world of the crypto sphere. This approach led to the development of the popular rate web3 game, Aurory.

Aurory is a blockchain-based massive multiplayer online role-playing game. It resides on the Solana ecosystems and is a gaming project that tested the mechanics of play-to-earn features. Aurory is one of the first web3 games to show a polished demo venturing into an ever-expanding world. Its unique storyline and various components have significantly grown its popularity over the years.

$AURY’s price instantly shoots down after the hack.Photo/Cointelegraph]

According to Solana, the Aurory project was its earliest adopter of incentivized blockchain-based gaming. The web3 game has set the standard for Play-to-Earn(P2E) games via its innovative and attractive gameplay. The web3 game is a masterpiece of the web3 franchise. It has one of the well-developed in-game economies and has its obviative token, the $AURY.

In addition, the game’s design heavily accommodated NFT technology, allowing gamers to have unique characters and in-game items. The web3 game has become an enormous success, attracting a lot of investors and gamers alike. According to Solana, Aurory has raised over $108 million worth of commitment at a 1.55 billion $AURY valuation.

This has given the Solana-based gaming ecosystems the financial might to become market leaders and is one of Solana’s Triple A-rated games. Unfortunately, its success has recently made the web3 game a target of unwanted attention.

Aurory lost 80% of its pool’s liquidity in a web3 hack.

On December 17, Solana-based gaming ecosystems Aurory experienced a web3 hack, resulting in a drop of nearly 80% in liquidity of the AURY-USDC pool on the decentralized exchange Carmelot. According to a report on social media platform X, the web hack targeted Aurory’s SyncSpace bridge on Arbitrum’s native DEX Camelot around 13:00 UTC(16:00 EAT). The perpetrators went on to siphoned the AURY-USDC pool from $1.5 million to roughly $312,000.

Generally, users usually switch items between on-chain and off-chain with a single transaction via SyncSpace, which acts as Aurory’s bridge. This enables in-game assets in the off-chain branch to move into Solana’s blockchain ecosystems when the user chooses to DeSync them.

Also, Read Curve Finance guarantees users a refund following the US$62 million hack.

Unfortunately, this has raised questions over the security features of Solana, especially after boasting that its SyncSpace was un-hackable. Aurora has responded by clarifying that the assets stolen during the web3 hak were immediately sold. In an X post, they said, “We’ve been buying back the tokens as we’re investigating what happened.”

Unfortunately, this recent web3 hack has significantly damaged the valuation of $AUR. According to CoinMarketCap, Aurory’s process is at $1.13 at the time of writing, representing a 20.60% drop in the last 24 hours.

Wrapping up

Unfortunately, Aurory has yet to make an official comment on its recent security breach, but the damage has already been done. If the web3 game is unable to clarify what transpired and provide the means to reimburse its users, it could spell doom. Blockchain security is still an evolving concept, with security experts finding new ways to bolster its existing features.

However, the same is true for hackers and scammers. As the crypto sphere continues to grow in valuation, hackers and scammers will continue to find new ways to compete with existing blockchain security features. This has become a long-standing plague in the crypto industry as many traders and participants in the franchise continue to question if digital assets are genuinely safer means than traditional banking.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://web3africa.news/2023/12/22/news/aurory-solana-web3-hack/

- :has

- :is

- 000

- 1

- 13

- 16

- 17

- 20

- 24

- 32

- 610

- a

- According

- acts

- addition

- After

- alike

- All

- Allowing

- almost

- already

- Altcoin

- Altcoins

- alternative

- Amid

- among

- an

- and

- apparent

- applications

- approach

- ARE

- around

- AS

- aspects

- Assets

- At

- attention

- attracting

- attractive

- Aurora

- back

- Banking

- became

- become

- been

- between

- Billion

- billions

- Bitcoin

- blockchain

- Blockchain networks

- Blockchain security

- blockchain-based

- boasting

- bolster

- Branch

- breach

- BRIDGE

- but

- Buying

- by

- Capacity

- chain

- change

- characters

- chose

- chosen

- Coin

- CoinMarketCap

- Coins

- combination

- comment

- commitment

- compete

- competing

- components

- concept

- consistently

- continue

- continues

- could

- create

- crypto

- Crypto Coin

- Crypto Coins

- Crypto Industry

- cryptocurrencies

- cryptocurrency

- Currency

- damage

- December

- decentralized

- Decentralized Exchange

- Demand

- demo

- Design

- Despite

- develop

- developers

- Development

- developments

- Dex

- DID

- different

- digital

- Digital Assets

- digital currency

- dominated

- done

- doom

- down

- Drop

- during

- earliest

- eat

- economies

- ecosystem

- Ecosystems

- Empire

- enables

- Engineering

- enormous

- ensuring

- entirely

- especially

- Ether

- ethereum

- eventually

- evolved

- evolving

- exchange

- existing

- Expand

- expanding

- experienced

- experts

- far

- Features

- few

- finance

- financial

- Find

- finding

- First

- first web3

- following

- For

- franchise

- from

- functionalities

- functioning

- fundamental

- game

- gameplay

- Gamers

- Games

- gaming

- genuinely

- given

- Go

- Grow

- grown

- guarantees

- hack

- hackers

- hacking

- hacks

- happened

- Have

- heavily

- hierarchy

- HOURS

- HTTPS

- if

- immediately

- improve

- in

- in-game

- incentivized

- industry

- industry’s

- innovative

- instantly

- instead

- into

- investigating

- Investors

- IT

- items

- ITS

- Key

- Last

- latest

- leaders

- Led

- like

- Liquidity

- long-standing

- Loses

- losing

- lost

- Lot

- made

- mainly

- maintain

- make

- managed

- many

- Market

- massive

- masterpiece

- max-width

- means

- mechanics

- Media

- mere

- method

- might

- million

- more

- move

- multiplayer

- native

- nearly

- networks

- New

- NFT

- NFT technology

- numerous

- of

- official

- on

- On-Chain

- ONE

- online

- or

- original

- Other

- over

- P2E

- participants

- past

- Plague

- platform

- plato

- Plato Data Intelligence

- PlatoData

- play to earn

- pool

- Popular

- popularity

- Post

- price

- process

- project

- provide

- question

- Questions

- raised

- Rate

- rather

- reach

- recent

- recently

- reed

- refund

- report

- representing

- result

- resulting

- Role-Playing

- roles

- roughly

- routes

- s

- safer

- Said

- same

- Scammers

- Sectors

- security

- set

- show

- significantly

- single

- So

- so Far

- Social

- social media

- Solana

- solar

- sold

- some

- sought

- SPELL

- standard

- started

- Still

- stolen

- success

- supply

- Supply and Demand

- surpass

- Switch

- Target

- targeted

- Technology

- tested

- than

- that

- The

- their

- Them

- These

- they

- this

- Thus

- time

- to

- token

- Tokens

- too

- took

- Traders

- traditional

- traditional banking

- transaction

- Trend

- Triple

- true

- unable

- under

- unfortunately

- unique

- unprecedented

- unsecured

- unwanted

- User

- users

- usually

- Valuation

- various

- venture

- via

- Victim

- was

- Wave

- ways

- web

- Web3

- Web3 Ecosystem

- Web3 game

- web3 games

- Web3 industry

- webp

- went

- were

- What

- when

- which

- while

- widespread

- will

- with

- within

- world

- worth

- would

- writing

- X

- years

- yet

- zephyrnet