Welcome to BitPinas Key Points: Easily digestible news in concise formats for easy reading. Let’s check the latest crypto news stories in the last 24 hours in the Philippines and abroad.

Table of Contents

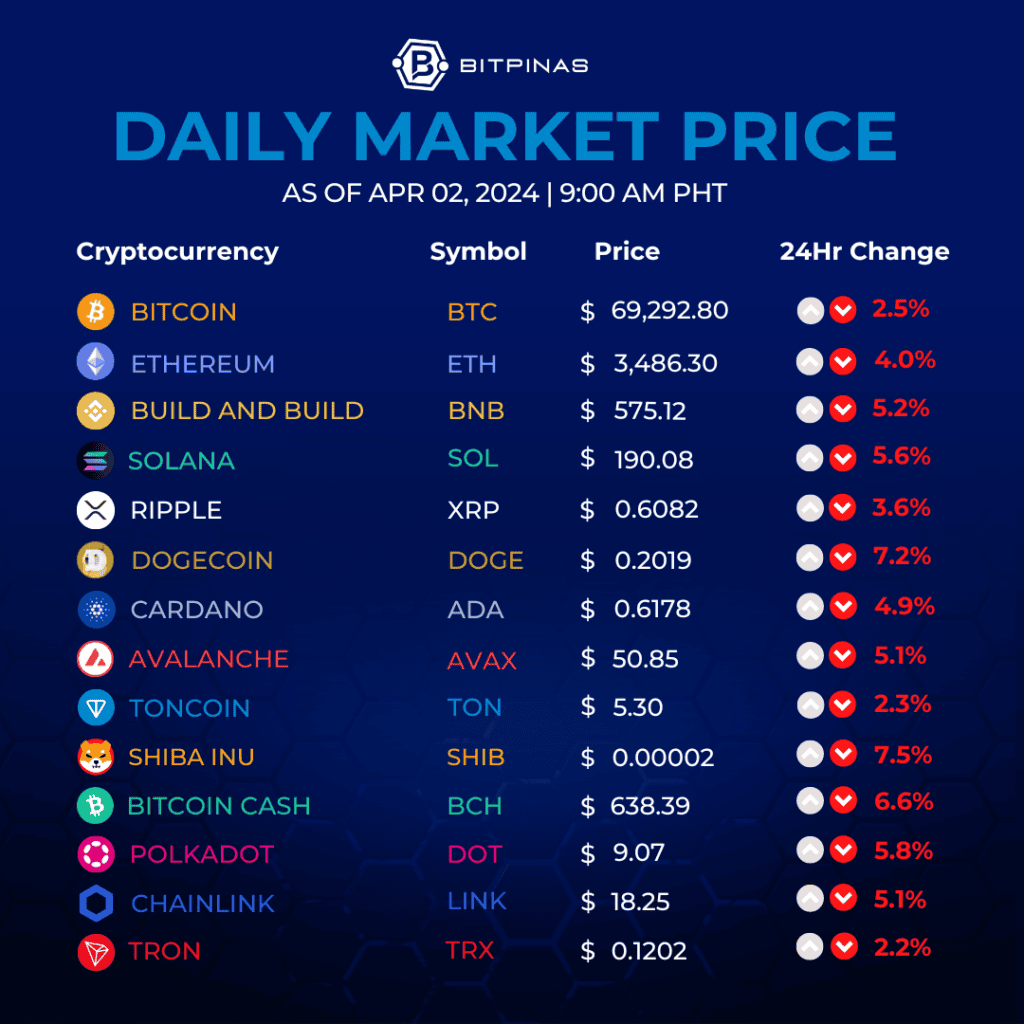

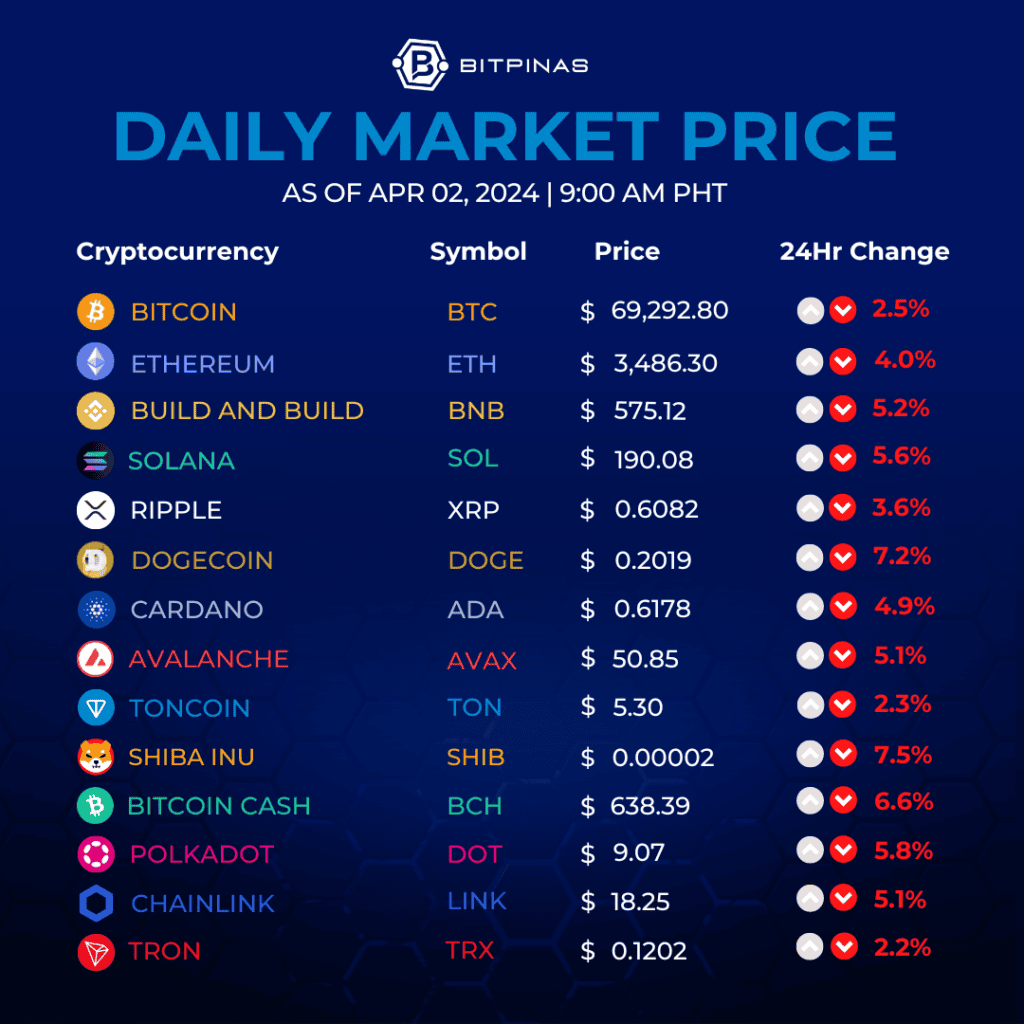

Crypto Price Update

Market News

- Bitcoin price remains stable around $70,000: The market seems calm before the upcoming Bitcoin halving event, leading to some calling it “crypto zen mode.”

- However, its volatility is starting to increase again as the halving is days away.

- Meme coins, particularly those on the Degen Chain, are experiencing a boom with a new Layer 3 solution attracting high trading volumes.

Feature News: Telegram Bot Shuts Down After User Funds Drained

Solareum, a Telegram trading app enabling the purchase and sale of Solana-based tokens, declared its shutdown following a security breach that resulted in approximately $523,000 in SOL being siphoned from users’ wallets.

- Over 300 Solana users fell victim to a wallet-draining exploit last week, initially causing suspicion towards the BONKbot trading bot.

- However, the issue was later linked to Solareum, leading to its decision to cease operations.

- The team behind the BONK meme coin and its associated Telegram bot, BONKbot, refuted claims of a security flaw within their system, clarifying that affected users had compromised their security by using their private keys in other applications.

In a message to its Telegram followers, Solareum expressed regret over the closure, citing a “recent security breach,” insufficient funds, and changing market dynamics as key reasons behind their difficult decision.

While Solareum has committed to contacting authorities to potentially freeze stolen assets on centralized exchanges, they have yet to announce any plans for compensating the affected users, leading to unrest and legal threats from the community.

Regulation

- In the Philippines, to regulate the registration and trading of cryptocurrencies in the country, Department of Finance (DOF) Secretary Ralph Recto disclosed that the department is coordinating with the Securities and Exchange Commission (SEC) to establish comprehensive guidelines.

- Speaking of the SEC, the newly appointed Commissioner Hubert Guevara unexpectedly dies at 56.

- Bitkub Capital Group Holdings, the owner of Thailand’s largest cryptocurrency exchange, is planning an initial public offering (IPO) for 2025. The company aims to go public on the Stock Exchange of Thailand in an effort to boost its profile and raise capital.

- Consensys, the blockchain and web3 software development company, has responded to the United States Securities and Exchange Commission (SEC) regarding concerns about Ethereum’s proof-of-stake (PoS) consensus mechanism. The SEC had inquired whether Ethereum’s unique features, including its PoS system and concentration of control, raise any fraud and manipulation risks related to spot ether exchange-traded funds (ETFs).

DeFi and NFT

- This week, the crypto market is poised for a surge in assets due to airdrops from Wormhole and Ethena Labs, which are expected to inject approximately $2.4 billion in value.

- On April 1, the total value locked (TVL) in liquid restaking token (LRT) protocols saw a significant rise of 4%, reaching a new peak of over $8.5 billion as reported by DeFi Llama. This achievement comes amid continuous expansion from leading LRT projects, notably Renzo, which experienced a remarkable weekly surge of 51.4%.

- MakerDAO, a prominent DeFi project, is contemplating a significant move to allocate 600 million DAI into USDe and staked USDe (sUSDe) through Morpho Labs, a DeFi lending platform. USDe and sUSDe are stablecoins developed by Ethena Labs. This decision is currently a proposal and awaits the MakerDAO community’s approval.

Onchain Gaming

- Andreessen Horowitz (a16z) has announced its intention to invest $30 million in startups through the a16z Speedrun program. Andrew Chen, a General Partner at a16z and overseer of the firm’s Game Fund One, revealed on X (formerly known as Twitter) that each participating startup would receive $750,000.

- This initiative aims to support startups by providing investment, mentorship, and exposure to top investors. Although Game Fund One, a $600 million fund, primarily focuses on gaming and technologies like AI, VR, AR, and more, it also extends its investment to web3 startups, indicating a broad interest in cutting-edge and emerging technologies.

Upcoming Event

In this webcast we will talk to Marso Ya, artist and content creator at YGG Pilipinas, together with Patrik Ferrer, the founder of The Roundtable to discuss the basics of airdrops and what are the best strategies to start airdrop hunting for free!

Register here: https://fb.me/e/1ws0yYUPA

Also, will they share some alpha leaks?

This article is published on BitPinas: Airdrops From Wormhole, Ethena to Inject Millions in the Market | Key Points | April 2, 2024

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitpinas.com/feature/keypoints-2024-04-02/

- :has

- :is

- :not

- 000

- 1

- 2024

- 2025

- 24

- 29

- 300

- 51

- 600

- 8

- 9

- a

- a16z

- About

- abroad

- Accusations

- achievement

- actions

- advice

- affected

- After

- again

- AI

- aims

- airdrop

- Airdrops

- allocate

- Alpha

- also

- Although

- Amid

- an

- and

- Andrew

- Announce

- any

- app

- applications

- appointed

- appropriate

- approval

- approximately

- April

- AR

- ARE

- around

- article

- artist

- AS

- Assets

- associated

- At

- attracting

- Authorities

- Basics

- before

- behind

- being

- BEST

- Billion

- Bitcoin

- Bitcoin halving

- BitPinas

- blockchain

- blockchain and web3

- bonk

- boom

- boost

- Bot

- breach

- broad

- but

- by

- calling

- CAN

- capital

- carry

- causing

- cease

- centralized

- Centralized Exchanges

- chain

- changing

- check

- chen

- claim

- claims

- closure

- Coin

- Coindesk

- Coins

- comes

- commission

- commissioner

- committed

- community

- company

- comprehensive

- Compromised

- concentration

- Concerns

- concise

- Consensus

- consensus mechanism

- constitute

- content

- continuous

- control

- coordinating

- country

- creator

- crypto

- Crypto Market

- Crypto News

- cryptocurrencies

- cryptocurrency

- Cryptocurrency Exchange

- Currently

- cutting-edge

- DAI

- decision

- decisions

- DeFi

- DeFi lending

- DeFi llama

- degen

- Department

- developed

- Development

- Development Company

- difficult

- digestible

- diligence

- discuss

- do

- does

- DOF

- down

- drained

- due

- dynamics

- each

- easily

- easy

- effort

- emerging

- emerging technologies

- enabling

- essential

- establish

- ETFs

- Ether

- Ethereum's

- Event

- exchange

- exchange-traded

- exchange-traded funds

- Exchanges

- Exit

- exit scam

- expansion

- expected

- experienced

- Exploit

- Exposure

- expressed

- extends

- Features

- finance

- financial

- flaw

- focuses

- followers

- following

- For

- formerly

- founder

- fraud

- Freeze

- from

- fund

- funds

- Gains

- game

- gaming

- General

- Go

- going

- got

- Group

- guidelines

- had

- Halving

- Happening

- Have

- here

- High

- Holdings

- Horowitz

- HOURS

- HTTPS

- Hunting

- in

- In other

- Including

- Increase

- indicating

- Informational

- initial

- initial public offering (IPO)

- initially

- Initiative

- inject

- Intention

- interest

- into

- Invest

- investing

- investment

- Investors

- IPO

- issue

- IT

- ITS

- Key

- keys

- known

- Labs

- largest

- Last

- later

- latest

- layer

- Layer 3

- leading

- Leaks

- Legal

- lending

- lending platform

- like

- linked

- Liquid

- Llama

- locked

- losses

- Lot

- MakerDao

- Making

- Manipulation

- Market

- max-width

- May..

- mechanism

- meme

- meme coin

- Mentorship

- message

- million

- millions

- money

- more

- move

- New

- newly

- news

- notably

- of

- offering

- on

- ONE

- only

- Operations

- Other

- out

- over

- own

- owner

- part

- participating

- particularly

- partner

- Peak

- Philippines

- photo

- plans

- platform

- plato

- Plato Data Intelligence

- PlatoData

- points

- PoS

- position

- Post

- potentially

- price

- primarily

- private

- Private Keys

- professional

- Profile

- Program

- project

- projects

- prominent

- Proof-of-Stake

- proof-of-stake (PoS)

- proposal

- protocols

- provides

- providing

- public

- published

- purchase

- purposes

- raise

- reaching

- Reading

- reasons

- receive

- regarding

- Registration

- regret

- Regulate

- Regulation

- related

- remains

- remarkable

- Reported

- responsibility

- responsible

- Revealed

- risks

- sale

- saw

- Scam

- SEC

- secretary

- Securities

- Securities and Exchange Commission

- security

- security flaw

- Seek

- seems

- Share

- shutdown

- Shuts

- significant

- Software

- software development

- SOL

- Solana

- solely

- solution

- some

- specific

- Spot

- stable

- Stablecoins

- Staked

- start

- Starting

- startup

- Startups

- States

- stock

- Stock Exchange

- stolen

- Stories

- strategies

- support

- surge

- system

- Talk

- team

- Technologies

- Telegram

- Thailand’s

- that

- Thats

- The

- The Basics

- The Philippines

- their

- they

- this

- those

- threats

- Through

- to

- together

- token

- Tokens

- top

- Total

- total value locked

- towards

- Trading

- trading bot

- trading volumes

- true

- TVL

- unique

- United

- United States

- United States Securities and Exchange Commission

- unrest

- upcoming

- User

- user funds

- users

- using

- value

- Victim

- Volatility

- volumes

- vr

- Wallet

- Wallets

- was

- we

- Web3

- WEB3 STARTUPS

- Website

- week

- weekly

- WELL

- were

- What

- whether

- which

- while

- widespread

- will

- with

- within

- wormhole

- would

- X

- yet

- YGG

- YGG Pilipinas

- You

- Your

- Zen

- zephyrnet