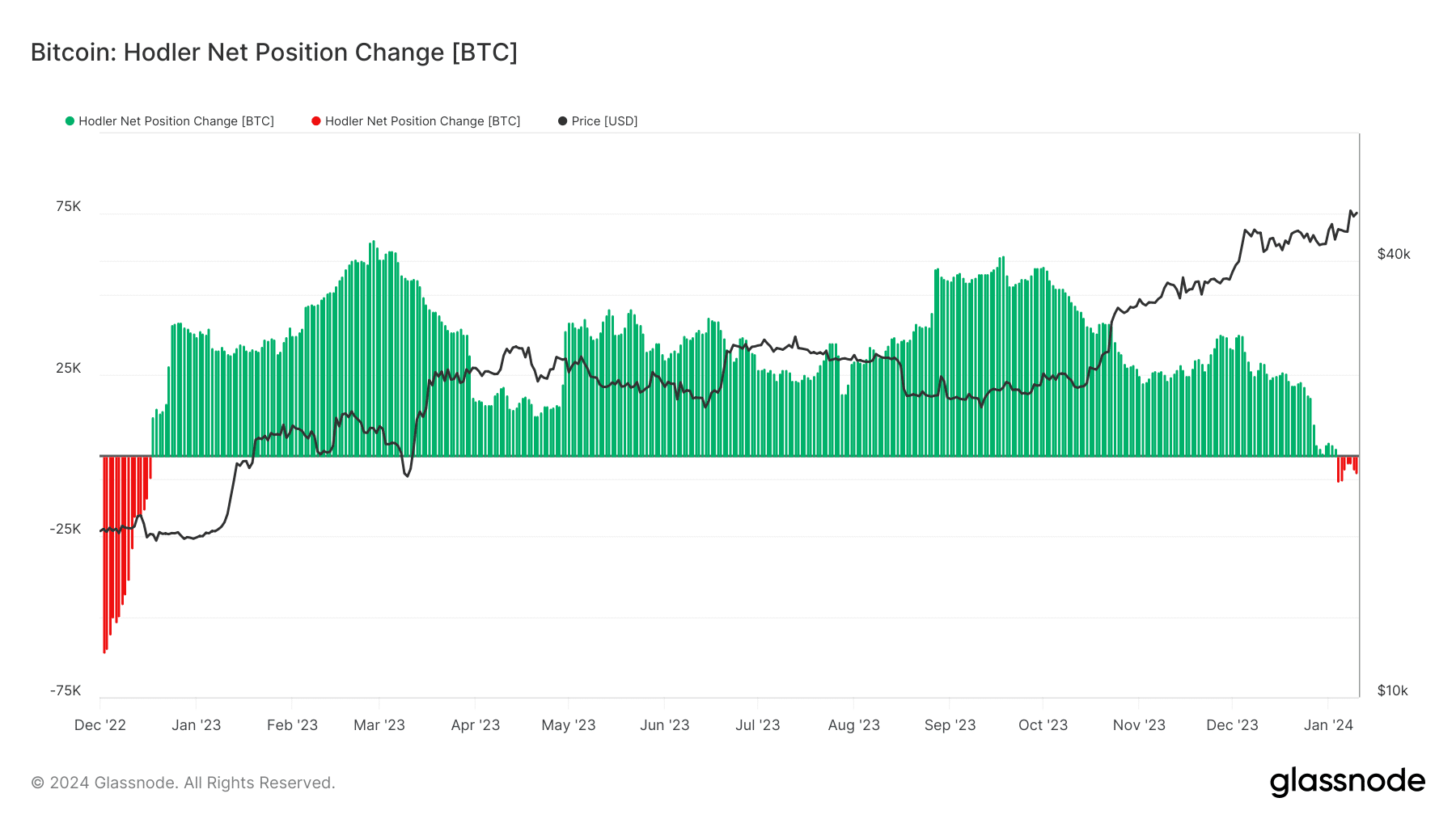

Long-term investors have been selling BTC in the last week, after more than a year of buying, according to blockchain analytics firm Glassnode.

Just as the masses are expected to buy Bitcoin, long-term investors are selling some of theirs.

(Glassnode)

Posted January 11, 2024 at 3:26 pm EST.

Long-term Bitcoin investors have offloaded some of their holdings during the week culminating in the U.S. Securities and Exchange Commission’s approval of spot Bitcoin exchange-traded funds (ETFs), data from blockchain analytics firm Glassnode shows.

The net position change of Bitcoin “HODLers,” crypto parlance for long-term investors, has been negative for each of the seven days from Jan. 4 to 10. A negative net position change indicates that HODLers have cashed out.

This is the first time since Dec. 2022 that this metric has been negative, although the magnitude of the differentials in 2022 was much more severe. The net position change among Bitcoin HODLers in the past week ranged from -2,389 BTC to as large as -8,019 BTC. Between Nov. 11, 2022 and Dec. 17, 2022, the net position change on each day was on average -36,776 BTC.

And the circumstances today versus a year ago could not be more different.

In the winter of 2022, the crypto ecosystem had been rocked by a series of failures and frauds among some of the most coveted brands in the industry. FTX had filed for bankruptcy in November, and by December, Binance was facing rumors and questions about whether it would fold in the next apocalyptic collapse. BTC was hovering around $17,000 at this time, down 75% from its all-time high of around $69,000 in Nov. 2021.

“In December of 2022, we faced complete and utter panic that the ‘trusted’ centralized exchanges were going to fold. This concern played out with some realizing BTC positions to prepare for the worst-case scenario,” wrote Charles Storry, co-founder of crypto index platform Phuture, to Unchained on Telegram.

During the subsequent bear market of 2023, Bitcoin HODLers accumulated new net positive positions every single day.

With spot Bitcoin ETFs legally available to investors from Wall Street to Main Street, however, investors may be adjusting their behavior to lock in their profits. “Large institutions I’ve spoken with were pondering whether the ETF announcement is already factored into current prices, sparking concerns among long-term players,” said Storry.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://unchainedcrypto.com/some-bitcoin-hodlers-have-cashed-out/

- :has

- :is

- :not

- 000

- 10

- 11

- 17

- 1800

- 2021

- 2022

- 2023

- 2024

- 26%

- 31

- 33

- 35%

- 87

- a

- About

- According

- Accumulated

- After

- ago

- already

- Although

- among

- analytics

- and

- Announcement

- approval

- ARE

- around

- AS

- At

- available

- average

- Bankruptcy

- BE

- Bear

- Bear Market

- been

- behavior

- between

- binance

- Bitcoin

- bitcoin hodlers

- bitcoin investors

- blockchain

- BLOCKCHAIN ANALYTICS

- brands

- BTC

- buy

- buy bitcoin

- Buying

- by

- centralized

- Centralized Exchanges

- change

- Charles

- circumstances

- Co-founder

- Collapse

- complete

- Concern

- Concerns

- could

- coveted

- crypto

- Crypto ecosystem

- CRYPTO INDEX

- culminating

- Current

- data

- day

- Days

- dec

- December

- different

- down

- during

- each

- ecosystem

- ETF

- ETFs

- Every

- exchange

- exchange-traded

- exchange-traded funds

- Exchanges

- expected

- faced

- facing

- factored

- failures

- filed

- Firm

- First

- first time

- For

- frauds

- from

- FTX

- funds

- Glassnode

- going

- had

- Have

- High

- Hodlers

- Holdings

- However

- HTTPS

- in

- index

- indicates

- industry

- institutions

- into

- Investors

- IT

- ITS

- Jan

- January

- just

- large

- Last

- legally

- lock

- long-term

- Main

- Market

- masses

- max-width

- May..

- metric

- more

- most

- much

- negative

- net

- New

- next

- nov

- November

- of

- on

- out

- Panic

- past

- platform

- plato

- Plato Data Intelligence

- PlatoData

- played

- players

- pm

- position

- positions

- positive

- posted

- Prepare

- Prices

- profits

- Questions

- realizing

- rocked

- Rumors

- s

- Said

- scenario

- Securities

- Selling

- Series

- seven

- severe

- since

- single

- some

- spoken

- Spot

- street

- subsequent

- Telegram

- than

- that

- The

- their

- this

- time

- to

- today

- u.s.

- U.S. Securities

- Unchained

- Versus

- Wall

- Wall Street

- was

- we

- week

- were

- whether

- Winter

- with

- would

- wrote

- year

- zephyrnet