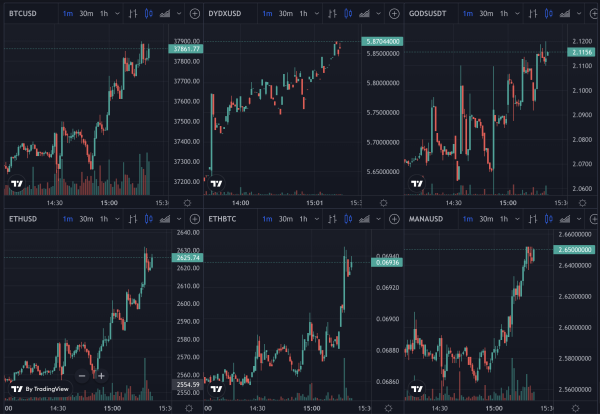

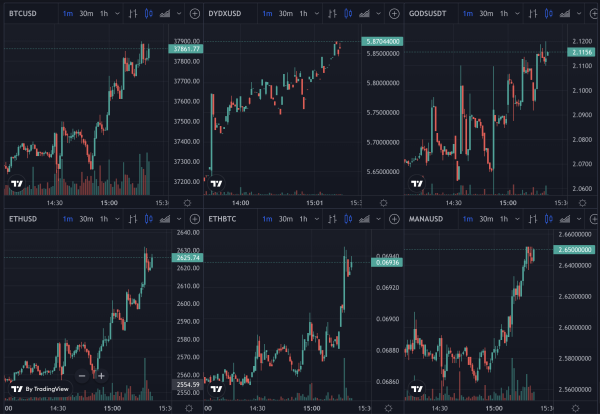

Bitcoin is close to overtaking $38,000 while ethereum has risen above $2,600 with Nasdaq gaining 2% as of 3PM London time.

Bitcoin rose above $38,000 during the weekend, but dipped to $36,700 with it now heading upwards again.

Ethereum on the other hand has seen its ratio gain close in onto 0.07 bitcoin per eth from a recent low of 0.065 BTC.

This bit of green follows a turn on Friday after weeks of selling with Nasdaq seeing one of its worst month since 2012.

Huge growth in US and Europe may have contributed towards a turn in sentiment as many companies exceed expectations in their earnings.

Tensions in Ukraine may have also eased as although the rhetoric still continues, the market appears to think it unlikely Vladimir Putin, Russia’s president, would go in with one of Russia’s main stock index, Moex, bouncing.

Some speculate the tension or the on-goin negotiation is more Putin setting the stage for him to leave next year as a 7th term must be too much even for Russia.

He may thus want to set the ground rules for potential cooperation with a new leader, which may be Dmitry Medvedev who has also served as President while Putin was Prime Minister and with whom Europe can probably work with.

But, the troops are there and they’re ready to go if the order is given, so you never know. However, Moex would probably crash by 80% with speed if that happened, Russia’s GDP would fall by another 50%, and that’s to say nothing of on the ground potential responses by some European players, so it sounds a bit way too much to go in at least as far as the market is suggesting.

On interest rates, two days of green may well be enough to make them an old story. Some say as much as five hikes have already been priced in, while Fed’s chair Jerome Powell says the median is three, but he doesn’t know how many there will be.

On the good news front lockdowns are ending and on some countries all emergency powers are ending too with Britain set to end all emergency public health measures and set to go back to pre-2020 where that aspect is concerned. The rest will follow, or they’ll become China-ised.

That means more growth should be expected for this year as the economy gets back to full swing with some of the labour departure perhaps leading to a decent rise in middle class wages for the first time since the 70s.

That should lubricate consumer spending, the biggest engine of growth by far, and so the velocity of money should rise which also means inflation that you can hedge with bitcoin.

To keep it in check, interest rates of 1% by year end may be more with a look to see whether that growth comes down, or whether we are structurally in a new economy where we actually get sustained decent growth.

If the latter, then there’s plenty of growth and company profits so this generation will get to party for once, but China is on holiday currently so it may just be their reking economy is giving us all a holiday.

Or it may be that sets the decoupling with America up and China down in a reversal of the aftermath of 2008 as fiat tricks maybe set the stage for a proper growth economy in Europe and USA.

Source: https://www.trustnodes.com/2022/01/31/stocks-ethereum-and-bitcoin-go-green

- 000

- 2022

- All

- already

- Although

- america

- Biggest

- Bit

- Bitcoin

- BTC

- China

- Companies

- company

- consumer

- continues

- contributed

- countries

- Crash

- crypto

- Doesn’t

- down

- Earnings

- economy

- ETH

- ethereum

- Europe

- European

- expected

- Fiat

- First

- first time

- follow

- Friday

- full

- GDP

- Giving

- good

- Green

- Growth

- Health

- How

- HTTPS

- index

- inflation

- interest

- Interest Rates

- IT

- Labour

- leading

- lockdowns

- London

- Market

- money

- Nasdaq

- news

- order

- Other

- perhaps

- Plenty

- president

- profits

- public

- public health

- Rates

- REST

- rules

- Russia

- sentiment

- set

- setting

- So

- speed

- Spending

- Stage

- stock

- Stocks

- time

- Ukraine

- us

- USA

- VeloCity

- Vladimir Putin

- weekend

- WHO

- Work

- year