The global stock market cap has grown by another $400 billion just last week according to data from Bloomberg.

The global stocks market cap has increased to $122.35 trillion, its highest level in history. Amounting to 145% of global GDP, also an all time high.

Bitcoin by comparison is at about 1% of the global stock market cap at $1.2 trillion, and the entire crypto market cap at $2.8 trillion amounts to just about 2.5% of global stocks.

The Millennial Boom in Innovation

The primary driver for this roaring 20s, at least in tech and finance, is innovation with the top companies now barely existing a few decades ago or even a few years ago in some cases.

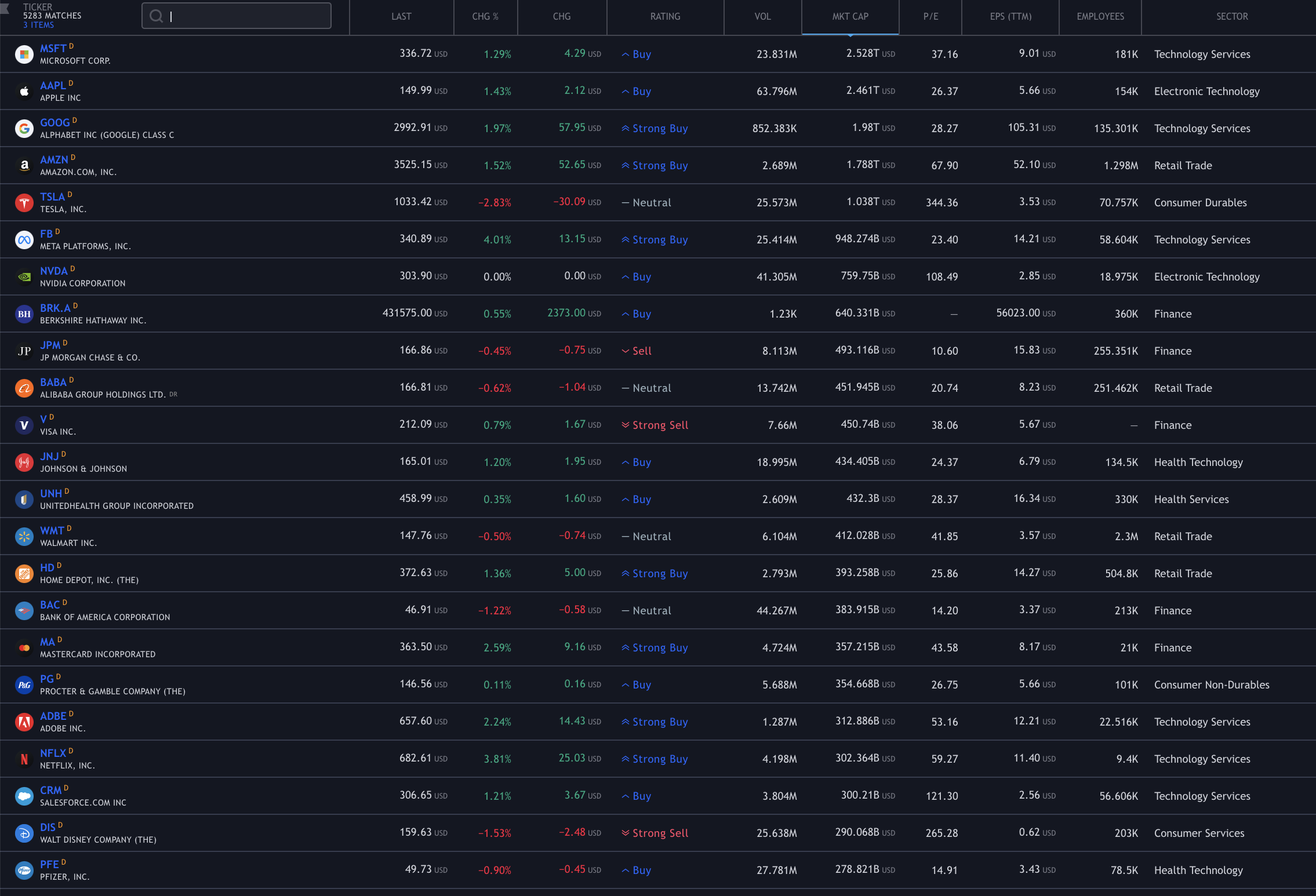

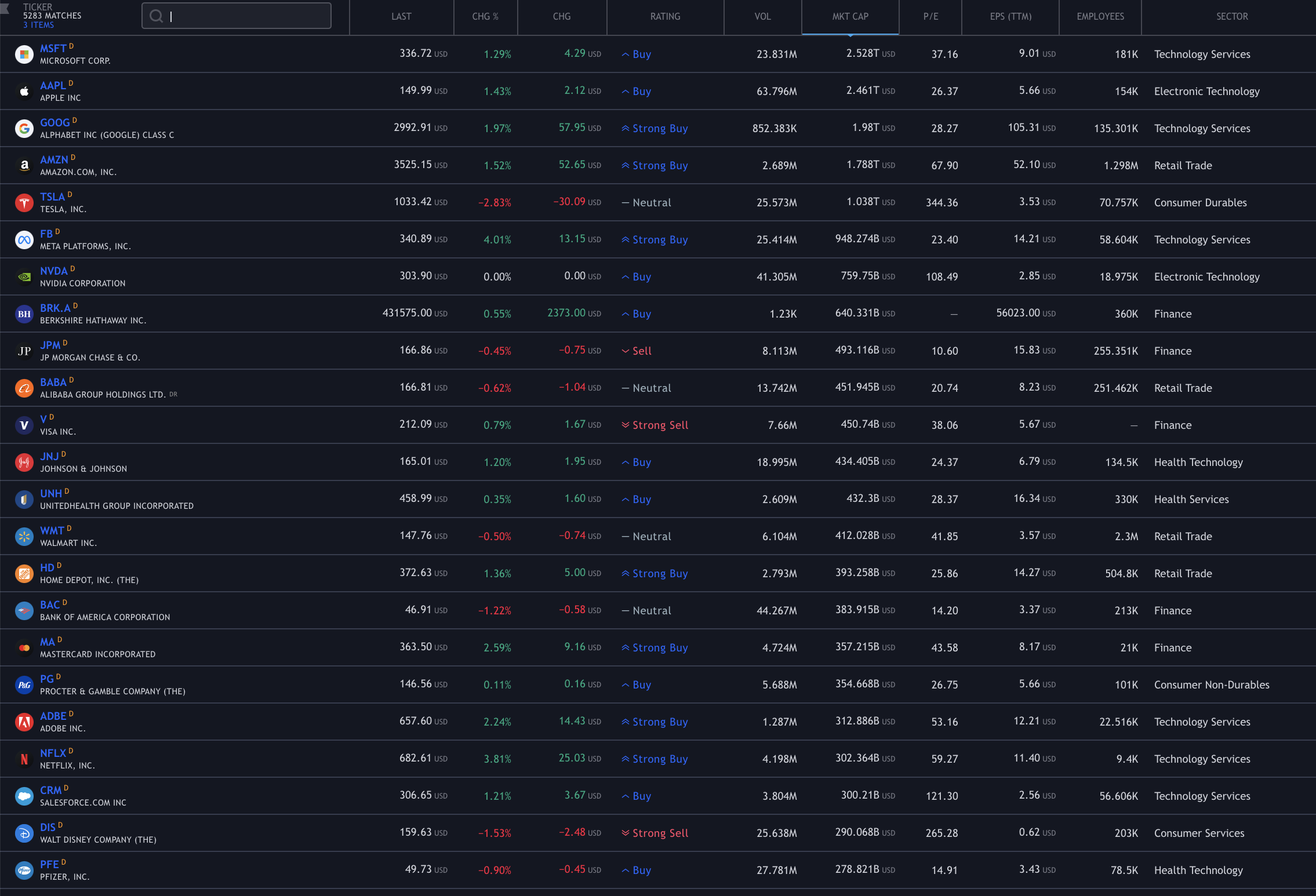

Microsoft, Apple, Google and Amazon are all at near $2 trillion each or above, with Tesla and Facebook at about $1 trillion.

Tesla is the odd one out, but the sign of things to come as the tech revolution continues marching into other industries outside of the digital space.

Tesla is also the newest entrant to this very top echelon as they turn their cars into effectively computers with the addition of battery engines.

A lot more similar stories will come as this decade develops, especially in flying cars or air taxis as they call them. Another industry, healthcare, is ripe for tech-nification (?) and disruption but things move slowly there so it may be the glimpses that come this decade, and the rankings next.

Solar, hydrogen, wind, none of them is ranking. Big oil used to, these will too you’d think, eventually.

Law and accounting software is not here, both old boys guild like industries ripe for disruption, yet only through ignoring unreasonable laws and regulations that fortify the walls and doors of those guilds.

Industrial technification, and this includes things like blockchenzising supply chains – that itself means augmenting goods or containers with sensors and gps – or technifying manufacturing through bots as well as raw invention, is probably more the medium term story that has just began.

The current one is still dominated by digital tech. Snowflake gave an exciting IPO for its cloud-based data storage and analytics. Datarobot might follow. C3Ai is all over the place stock price wise with its big data analysis and optimization.

But even now, digital tech is competing with industrial tech in capital markets. Joby is racing Lilium to the Paris Olympics in 2024, the target date for air taxis in production. Rocket Lab feels at time more volatile than bitcoin as the market’s excitement about the space industry tries to contain itself with raw figures.

Then there’s Roblox, a pretty rubbish metaverse from what we saw, but there aren’t many of them on the stock market.

A Boom in Opportunities

This acceleration in innovation has led to a premium on skilled labour that digitization now offers the opportunity to go on their own.

The so called Great Resignation, led by millennials now in their late 20s or 30 something, is in turn causing a labor or skill shortage in some industries that should translate to higher overall wages.

Higher wages means more savings, more capital to invest, with the rate of investment by the general public now probably at highs as well because of crypto in some ways teaching many young ones about investing, and because of apps like Robinhood that increase access to investments.

One could easily therefore say that this boom is just because Powell is printing money, but we could also say that even in that case, a lot of that money seems to be put to good use considering the level of innovation.

A lot more money will also be needed for public infrastructure to keep up with such innovation. A solar panel on every street light and bus stop top.

That’s ‘good’ spending that gives significant returns, and potentially contributes to more innovation or its facilitation.

The narrative therefore is now probably running on two tracks. One, the funny money business. And the other what we could call digitization, but that doesn’t include the industrial tech elements. So we’re calling technofication, which is creating new things, building new things, and so is creating new value through the invention of code.

We haven’t even gotten to our space with all the code-ification of finance or its automation that often isn’t automatic because someone has to tell the bots what to do. It’s more the turning of financial instruments into code rather than paper based or a digital ‘scan’ of such paper based instruments.

Then there’s NFTs. A hodler jokingly threatened to sue if you touch them, but this debate on whether tokenized jpegs are worth anything, though vibrant in some other places, is over as far as we are concerned and was arguably closed by the burned Banksy.

It’s a token, the token is unique in a way no one can copy it, just like you can’t copy a bitcoin, and thus the token can have value. These sort of tokens can also look nice, or rubbish, or can contain other things, including other hidden images or assets, or can give access, and so you can do things with it that you can’t do with a jpeg.

This debate however will probably never end, but more and more are becoming NFT holders now and when you’re one is probably different than when you’re not. Value is a very funny thing.

This is the surface. What is not easily seen is just what a lot of artists are doing with this new thing. How it is inspiring so many and how they’re creating beautiful experiences that we’d be far poorer without.

The jpeg joke is part of the fun, but all this fun has greenback value because it is also a very very serious business of reviving art.

Such art is in the jpegs themselves, but from what we’ve seen in the metaverse, the environment that can be created is or can be not just valuable but pricless.

We NFT because we can and we give them value because we want to. As it happens they cool as well, so keep on debating while we keep on creating.

This innovation will take some time to come to the man on the street. So currently it might feel like tech and finance is detached, that the stock market gaining half a trillion is something to ree at rather than heil the ingenuity of man.

Gradually however, it will come to every home, even in Africa. It will take time, but slowly things will change in the street too, and so there is no detachment, there is no artificiality, value is being created. It’s just some are at the frontier, others are spectating or unaware, and gradually the frontier will become the common air.

Source: https://www.trustnodes.com/2021/11/15/stocks-gain-nearly-half-a-trillion-in-one-week

- access

- Accounting

- africa

- All

- Amazon

- analysis

- analytics

- Apple

- apps

- Art

- Artists

- Assets

- Automation

- battery

- Big Data

- Billion

- Bitcoin

- Bloomberg

- boom

- bots

- Building

- bus

- business

- call

- capital

- Capital Markets

- cars

- cases

- change

- closed

- code

- Common

- Companies

- computers

- Containers

- continues

- Creating

- crypto

- Crypto Market

- Current

- data

- data analysis

- data storage

- debate

- digital

- digitization

- Disruption

- driver

- Environment

- Experiences

- finance

- financial

- follow

- fun

- funny

- GDP

- General

- Global

- good

- goods

- healthcare

- here

- High

- history

- Home

- How

- HTTPS

- Including

- Increase

- industrial

- industries

- industry

- Infrastructure

- Innovation

- investing

- investment

- Investments

- IPO

- IT

- labor

- Labour

- Laws

- Laws and regulations

- Led

- Level

- light

- man

- manufacturing

- Market

- Market Cap

- Markets

- medium

- Millennial

- Millennials

- money

- move

- Near

- NFT

- NFTs

- Offers

- Oil

- olympics

- Opportunity

- Other

- Paper

- paris

- Premium

- price

- Production

- public

- racing

- Raw

- regulations

- returns

- Robinhood

- running

- So

- Software

- solar

- Space

- Spending

- stock

- stock market

- Stocks

- storage

- Stories

- street

- supply

- Supply chains

- Surface

- Target

- Teaching

- tech

- Tesla

- time

- token

- Tokens

- top

- touch

- value

- week

- What is

- wind

- worth

- years