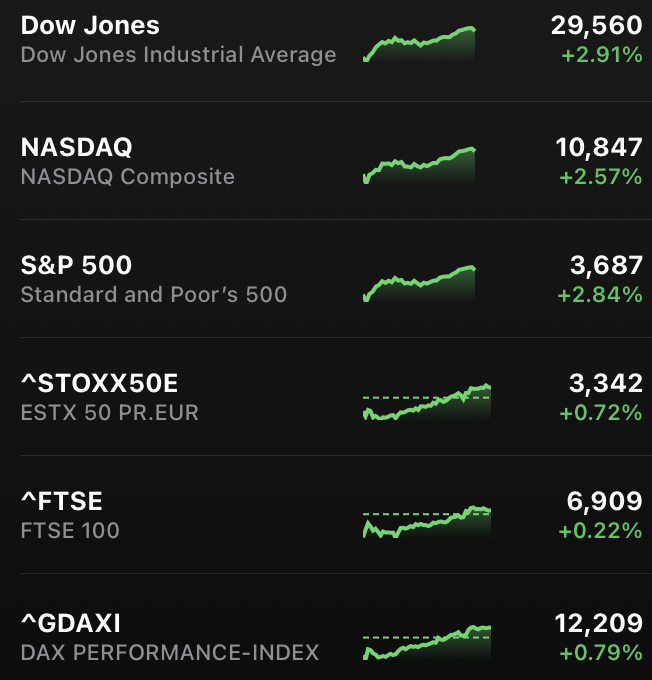

US stocks have unusually jumped by about 3%, far higher than futures suggested, as market turbulences in bonds appear to be spreading with Credit Suisse seeing a huge rise in credit default swap rates.

That may have contributed to an unscheduled emergency meeting by the Federal Reserve Banks held earlier today.

The subject of the closed door meeting was stated as the: “Review and determination by the Board of Governors of the advance and discount rates to be charged by the Federal Reserve Banks.”

Fed recently hiked interest rates by 0.75%, bringing them to above 3%, in what may have been the last straw as a currency war has developed since.

The 10 year Treasury yields have also risen to 3.65%, up from 0.5% in July 2020 when the government was borrowing trillions.

This has led to a rise in corporate bonds as well, where matters may get more dicey as there’s more room for speculation regarding debt affordability by at least some corporations.

Credit Suisse is well capitalized, JP Morgan said, but that hasn’t stopped intense speculation on social media, furnished with some actual fake news.

The Swiss bank has been weathering difficulties for some time, with it and Deutsche Bank disproportionally targeted by US regulators with fines.

Losses of $4 billion for Credit Suisse in the past three quarters may well have sharks circling the waters now that debt has become expensive.

This is a systemic bank however, and therefore any actual problems would raise systemic concerns.

Yet some media repeats as of certain that interest rates will keep hiking to 4%, even as the view ‘the Fed is breaking things,’ as CNBC headlines, is now gaining prominence.

So much so that the UN has gotten involved, urging Fed to halt interest rate increases.

Amid all these developments, stock investors may well be re-pricing the chances of some sort of pivot, with the Fed’s emergency meeting adding fuel to those speculations.

Not least because with pressures in corporate bond markets, far more expensive debt may well turn even somewhat healthy companies into wobbly if they rely on short or medium term financing.

Bitcoin though is still not quite moving through all this. Such bank related concerns you’d think would reflect on its price, but that they haven’t may well suggest investors are not quite taking these chatters on Credit Suisse very seriously.

Yet, markets are clearly a bit on edge. The discovery that British pension funds were shorting rising interest rates and with leverage of as much as 7x, may well have turned investors – or sharks – attention towards looking at what else might have worked fine in the previous monetary ‘era,’ and may break now that debt is becoming very expensive.

In the current circumstances, Fed’s chair Jerome Powell may even speak, though there’s been no statement to such effect, and you’d expect Joe Biden to speak to Opec+ as well and their incomprehensible decision to cut supply by 1 million barrels when oil prices are so high and inflation has run amok.

That’s in effect an attack of sorts, and may well complicate Powell’s job, as well as the fragile global economy, considering it would be inflationary when interest rates are already starting to edge.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- Markets

- news

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Second

- Stocks

- Trustnodes

- W3

- zephyrnet