Decentralized finance has seen incredible growth and adoption since 2020 and has more than 60 billion worth of total value locked under various Defi verticals of Token swapping, Yield Farming, Liquidity pool, Lending & borrowing. Decentralized exchanges like AAVE, UniSwap, PancakeSwap Compound, SushiSwap, etc have given the right kind of platform for crypto investors to experience all kinds of decentralized financial services allowing them to make that extra bit of passive income against their crypto assets.

Today we will explore one such innovative Defi platform named SushiSwap.

SushiSwap Shots :

- SushiSwap was launched in September 2020 as a fork of Uniswap.

- SushiSwap was founded by the pseudonymous entity known only as Chef Nomi.

- It is a Decentralized exchange based on the Ethereum blockchain which supports Yield Farming, Liquidity pool, Crypto lending, and borrowing, etc…

- SushiSwap DEX uses the automated market maker (AMM)concept to support crypto trading on its platform.

- The total value locked on SushiSwap Dex is around 2.9 billion

Now that you are aware of the Sushiswap dex, in brief, it’s time to define

SushiSwap is an Ethereum based decentralized exchange that makes use of the Automated Market Maker model instead of the Order book, to facilitate an array of Defi functionalities like

- Token Swapping

- Yield Farming

- Crytpo lending and borrowing

Without relying upon any centralized authority.

What Makes SushiSwap Special?

Unlike centralized exchanges like Coinbase, Robinhood, KuCoin, Binance, the Defi exchange like UniSwap and SushiSwap doesn’t rely on the order-book, instead, they let people like us provide the assets and overall liquidity using liquidity pools, to support the AMM functionality and enable the trading request.

A liquidity pool is a smart contract holding a pair of assets giving one another value.

Sushiswap is a true manifestation of decentralized crypto, where it provides the following services:

- There is no single authority or middleman to snatch the fee instead the fee directly goes to the Liquidity providers

- Unlike traditional centralized exchanges, using Sushi can be much simpler and faster to use when it comes to buy and sell cryptocurrencies.

- This Defi exchange doesn’t require you to go through the complex KYC process, they hardly care for your personal info.

- Also, they provide you an extra source of earning in the form of crypto by allowing you to stake, pool, lend or borrow your idle assets.

- Also unlike UniSwap, SushiSwap rewards liquidity providers with 0.25% of pool fees + 0.05% paid to SUSHI token holders.

- Also unlike UniSwap which closed its UNI token farming period, SUSHI yield farming remains alive and well, with rewards in some pools reaching as high as >80% APY.

SushiSwap platform took its first breath in Aug 2020, where the pseudonymous creator Chef Nomi and other collaborators forked the open-source code from Uniswap Dex, made some key modifications to bring in SUSHI as a governance token that can allow users to trade and have a say in the future of the SushiSwap DEX.

SushiSwap ran into trouble soon after its launch, due to the controversial Vampire mining feature, which was devised to drain the liquidity out of the Uniswap pool, using a reward scheme, that provided SUSHI in exchange for users’ Uniswap liquidity pool (LP) tokens. Those LP tokens would then be exchanged for the original assets put into the Uniswap liquidity pools, thereby draining UniSwap’s liquidity and creating a liquidity pool for SushiSwap instead.

This vampire mining intention to outcompete UniSwap was not a welcoming move for the creators, also the founder didn’t stop here and one of the founders Chef Nomi reportedly cashed out about $14 million worth of SUSHI from the DEX’s developer funds for Ethereum — on Uniswap, which led to to the demise of SushiSwap as its price nosedived. This really generated a lot of hatred for this promising Defi project among the SuhSwap community

Bank Fredman The Saviour :

Nomi though decided to reverse course and returned the funds, and ultimately decided to quit from SushiSwap. Sam Bankman-Fried, head of Alameda Research and centralized derivatives trading platform FTX, took over the charge & oversaw the successful completion of the vampire mining campaign.

Sam passed on the control to SushiSwap trusted community to ensure the very fabric of Decentralization remains intact, since then SushiSwap has grown leaps & bounds and has not seen any such mishappening.

“Quite a start, isn’t it ?”

Now that you are aware of the crazy history of SushisSwap, it is time to go deeper and learn how the heck it works?

SushiSwap a UniSwap Fork, is an AMM: Automated Market Maker system that is driven by smart contract blockchain rules to process the user transactions. AMM smart contacts are responsible to create and manage liquidity pools of tokens and deciding upon the price of these tokens based on a mathematical algorithmic formula.

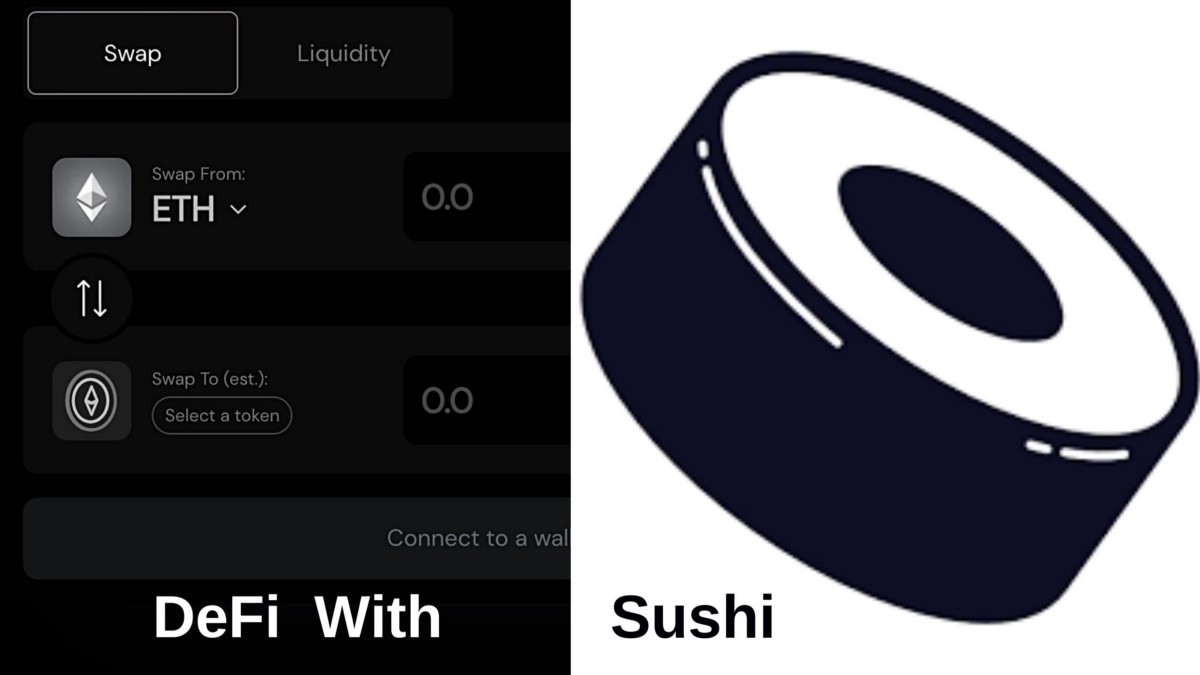

How To Use SushiSwap?

So if want to be a Defi Chef with Sushi, you can do so with ease.

For Token Swapping: All you have to do is

- &

- 2020

- 9

- Absolute

- Adoption

- All

- Allowing

- among

- around

- Assets

- Automated

- Automated Market Maker

- Billion

- binance

- Bit

- blockchain

- Borrowing

- buy

- Campaign

- care

- charge

- closed

- code

- community

- Compound

- contract

- Creating

- creator

- crypto

- crypto trading

- cryptocurrencies

- Decentralization

- decentralized

- Decentralized Exchange

- DeFi

- Derivatives

- derivatives trading

- Developer

- Dex

- driven

- EC

- ethereum

- exchange

- Exchanges

- fabric

- farming

- Feature

- Fees

- finance

- financial

- financial services

- First

- fork

- form

- founder

- founders

- FTX

- funds

- future

- Giving

- governance

- Growth

- head

- here

- High

- history

- How

- hr

- HTTPS

- ia

- Income

- info

- Investors

- IP

- IT

- Key

- Kucoin

- KYC

- launch

- LEARN

- Led

- lending

- Liquidity

- liquidity providers

- LP

- maker

- Market

- medium

- million

- Mining

- model

- move

- open-source code

- order

- Other

- People

- platform

- pool

- Pools

- price

- project

- research

- reverse

- Rewards

- rules

- sell

- Services

- smart

- smart contract

- So

- stake

- start

- successful

- support

- Supports

- system

- time

- token

- Tokens

- trade

- Trading

- Transactions

- Uniswap

- us

- users

- value

- works

- worth

- Yield