The Terra community unanimously voted to destroy 1.3 billion in UST tokens with more than 99% of the votes approving the proposal and now we will see the UST stablecoin drop by 11% so let’s read more today in our latest cryptocurrency news.

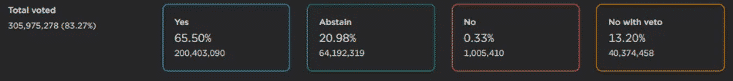

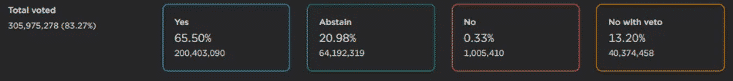

The governance vote on the Terra proposal 1747 to burn 1.388 billion UST stablecoins was passed after the Terra community unanimously voted to burn the tokens. The burn process will reduce UST’s supply by 11% of its total supply of 11.28 billion tokens. About 99% of the 154 million votes supported the burn proposal and less than 1% abstained. The main objective behind the proposal is to reduce the debt in the Terra economy will help to restore the stablecoin dollar peg by burning UST tokens from the community pool.

Out of the total 1.388 billion UST to be burned, the Terra community pool has about 1.017 billion UST with the remaining 371 million coming from Ethereum cross-chain bridges. Terra’s community pool funds can only be used upon approval from the community. The proposal reads:

“If this proposal passes, the 1,017,233,195 UST from the Community Pool will be sent to the Community Core Burn module. Additionally, the 371 million cross-chain UST will be bridged back to Terra and burned.”

The mass burn is expected to reduce the price pressure on LUNA that was caused by the inflated UST supply and the proposal also stated that burning these tokens will help alleviate the peg pressure on the stablecoins. The high reward on the on-chain swap spread is the main cause of the economic burden on the Terra ecosystem. The current UST burn rate is slow and made it hard to eliminate the economic burn that was incurred by the ecosystem.

Earlier this month, UST lost its dollar peg and didn’t recover afterward. Unlike the popular stablecoins such as Circle’s USDC and Tether’s USDT, Terra’s algorithmic stablecoin was not backed by other assets so the algorithm that kept UST at a dollar peg as an arbitrage trade between UST and the LUNA token. When UST dropped below its peg, the users could buy the discounted UST and swap it with a dollar worth of LUNA Classic.

When the dollar peg of UST dropped, the mechanism was not helpful and resulted in a swift increase of the LUNA supply, crashing its value by 100%. following the crash, Do Kwon the founder of Terraform Labs proposed to launch a new blockchain and to rename the existing blockchain as Terra Classic and the new iteration will not include the algorithmic stablecoin.

- 1.3

- 11

- 28

- About

- algorithm

- algorithmic

- arbitrage

- Assets

- backed

- below

- Billion

- blockchain

- buy

- Cause

- caused

- classic

- coming

- community

- Core

- could

- Crash

- Cross-Chain

- cryptocurrency

- Cryptocurrency News

- Current

- Debt

- destroy

- Dollar

- Drop

- dropped

- Economic

- economy

- ecosystem

- eliminate

- ethereum

- existing

- expected

- following

- founder

- funds

- governance

- help

- helpful

- High

- HTTPS

- include

- Increase

- IT

- Labs

- launch

- made

- million

- Month

- more

- news

- On-Chain

- Other

- pool

- Popular

- popular stablecoins

- pressure

- price

- process

- proposal

- proposed

- Recover

- reduce

- remaining

- Results

- So

- spread

- stablecoin

- Stablecoins

- stated

- station

- supply

- Supported

- SWIFT

- Terra

- today

- token

- Tokens

- trade

- USDC

- USDT

- users

- value

- Vote

- voted

- votes

- worth