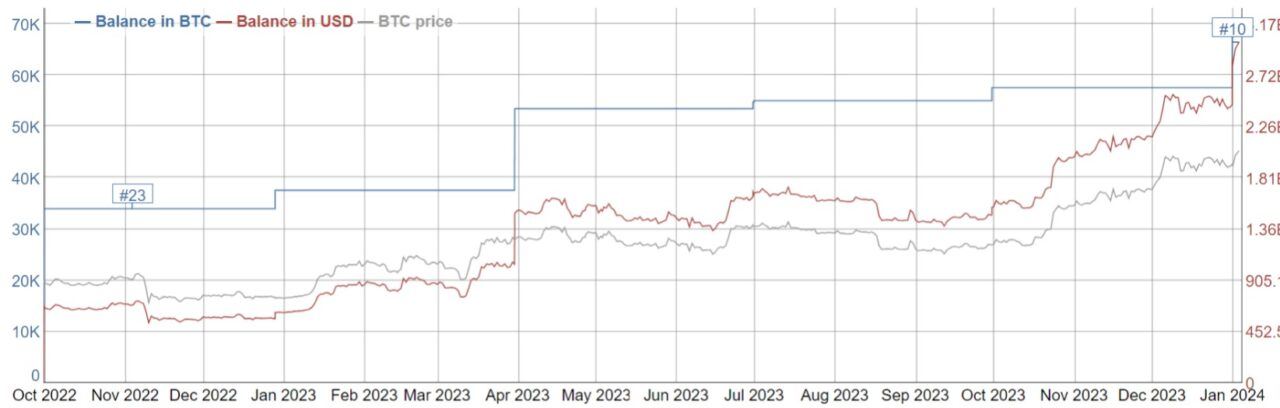

Leading stablecoin issuer Tether may currently control the 10th largest Bitcoin (BTC) wallet, according to on-chain research conducted by Tom Wan, a digital asset strategy associate at 21.co.

Wan speculated that Tether’s Bitcoin holdings could be of around $1.5 billion or around 53,495 coins at the time his research was conducted, making it then the 12th largest BTC holders, with inflows coming from the stablecoin issuer’s sister company Bitfinex.

Since then the wallet has been steadily accumulating Bitcoin which, coupled with BTC’s price rise over the last few months, means it now holds over $3 billion worth of the flagship cryptocurrency, with 66,465.2 BTC in the wallet, according to BitInfoCharts.

Wan’s analysis assumes that Tether is amassing all of its BTC into a single address, which it very well may be doing if it keeps accumulating the funds in a cold storage address protected from hackers online.

Tether, it’s worth noting, revealed last year plans to use 15% of its realized net operating profits to invest in the flagship cryptocurrency. The firm earns income from its large portfolio of U.S. Treasury bills, gold, and other investments.

<!–

–> <!–

–>

Unlike traditional banks, which operate on a fractional reserve basis, Tether maintains its cryptocurrencies backed by mostly cash and short-term U.S. Treasury bills. At the time of writing, 1-month U.S. Treasurys are yielding around 5.39%.

The price of Bitcoin has recently briefly surpassed the $45,000 mark amid speculation a spot Bitcoin exchange-traded fund (ETF) could soon be approved in the United States.

Investors believe such a fund would bring in institutional investors, as it allows them to gain exposure to the flagship cryptocurrency without actually having to manage their own private keys.

As reported, major financial powerhouses that collectively manage an astounding $27 trillion in assets are making inroads into the world of Bitcoin and cryptocurrency after a race to list the first spot Bitcoin ETF in the US kicked off.

Featured image via Unsplash.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.cryptoglobe.com/latest/2024/01/tethers-suspected-bitcoin-holdings-reach-3-billion-marking-it-10th-largest-btc-holder/

- :has

- :is

- :not

- $3

- 000

- 10th

- 12th

- 15%

- 66

- a

- According

- actually

- address

- Ads

- After

- All

- allows

- Amassing

- Amid

- an

- analysis

- and

- approved

- ARE

- around

- AS

- asset

- Associate

- assumes

- At

- backed

- Banks

- basis

- BE

- been

- believe

- Billion

- Bills

- Bitcoin

- Bitcoin and cryptocurrency

- Bitcoin ETF

- Bitfinex

- briefly

- bring

- BTC

- by

- Cash

- CO

- Coins

- cold

- Cold Storage

- collectively

- coming

- company

- conducted

- control

- could

- coupled

- cryptocurrencies

- cryptocurrency

- CryptoGlobe

- Currently

- digital

- Digital Asset

- doing

- ETF

- exchange-traded

- exchange-traded fund (ETF)

- Exposure

- few

- financial

- Firm

- First

- flagship

- fractional

- Fractional Reserve

- from

- fund

- funds

- Gain

- Gold

- hackers

- having

- his

- holder

- holders

- Holdings

- holds

- HTTPS

- if

- image

- in

- Income

- inflows

- Institutional

- institutional investors

- into

- Invest

- Investments

- Investors

- Issuer

- IT

- ITS

- keeps

- keys

- large

- largest

- Last

- Last Year

- List

- maintains

- major

- Making

- manage

- mark

- marking

- max-width

- May..

- means

- months

- mostly

- net

- noting

- now

- of

- off

- on

- On-Chain

- online

- operate

- operating

- or

- Other

- over

- own

- plans

- plato

- Plato Data Intelligence

- PlatoData

- portfolio

- powerhouses

- price

- price rise

- private

- Private Keys

- profits

- protected

- Race

- reach

- realized

- recently

- Reported

- research

- Reserve

- Revealed

- Rise

- s

- Screen

- screens

- short-term

- single

- sister

- sizes

- soon

- speculation

- Spot

- Spot Bitcoin Etf

- stablecoin

- Stablecoin issuer

- States

- steadily

- storage

- Strategy

- such

- surpassed

- Tether

- that

- The

- the world

- their

- Them

- then

- time

- to

- tom

- traditional

- treasury

- Trillion

- u.s.

- U.S. Treasury

- U.S. Treasurys

- United

- United States

- us

- use

- very

- Wallet

- was

- WELL

- which

- with

- without

- world

- worth

- would

- writing

- year

- yielding

- zephyrnet