Since the beginning of June 2021, everyone has been talking about the possibility that the current range construction for the price of Bitcoin corresponds to a Wyckoff Accumulation.

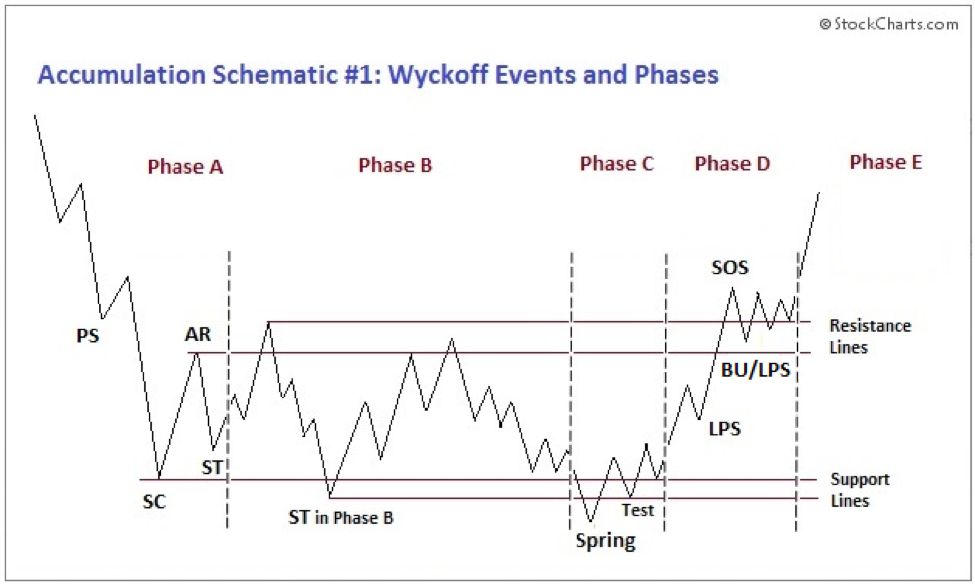

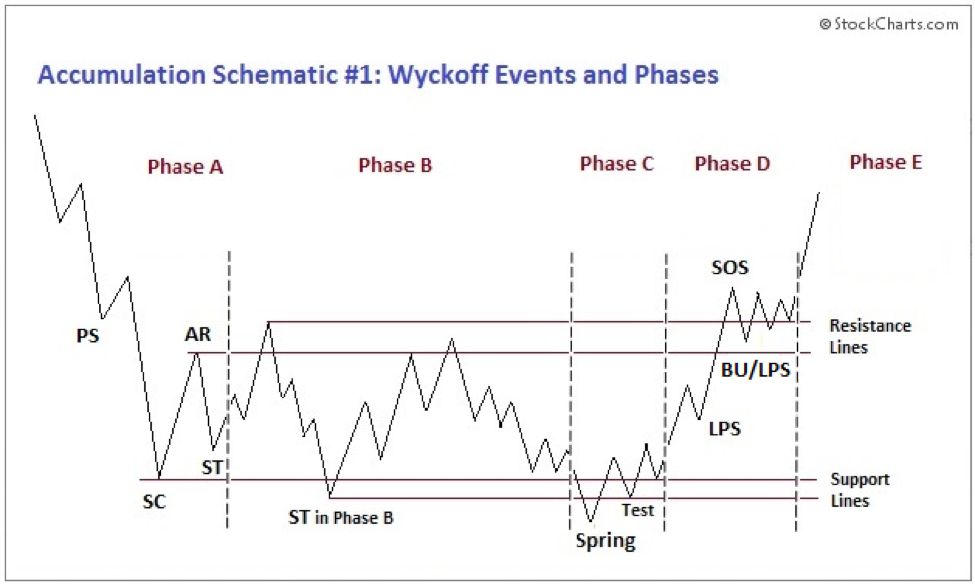

Here is the diagram associated with this asset price pattern:

You can see that there are different phases and events. If the Bitcoin price followed this accumulation pattern, we would clearly be in phase D by now.

If you look at the evolution of the Bitcoin price over the last few weeks, you can actually see the similarities with a Wyckoff Accumulation:

Of course, the Bitcoin price will have to confirm this pattern in the coming days and weeks.

To do this, Bitcoin will need to break $35.5K as a first step before it can tackle the $38K area. The next step is the $42K resistance. If this is breached, the road to $50K would open wide for Bitcoin.

Created by David Puell in March 2019, the Puell Multiple explores market cycles from a mining revenue perspective. This metric looks at the supply side of Bitcoin’s economy — bitcoin miners and their revenue. Bitcoin miners are often seen as compulsive sellers because of their need to cover their fixed costs for mining equipment in a market where the price is extremely volatile.

The income they generate can therefore influence the price of Bitcoin over time.

There are periods of time when the value of Bitcoin mined and entering the ecosystem is too large or too small by historical standards. Those who understand these periods can benefit significantly.

Here is the current state of the Puell Multiple:

You can see that the Puell Multiple is entering the green zone as it did in March 2020 for example. If you have confidence in Bitcoin, now is probably the time to accumulate more.

The opportunity to buy Bitcoin is now to take advantage of it in the months to come when its price resumes its ascent towards the $100K mark, which for me is still a target by the end of 2021.

Since the beginning of June 2021, as extreme fear gripped the market, we have seen something quite classic in this situation. The long-term holders of Bitcoin started to accumulate more:

On the other hand, Bitcoin’s short-term holders have started selling massively again:

This always happens in the same way and it helps to understand why it is always the same people who benefit fully from Bitcoin. These people are simply the ones who know how to take the long view and take action when everyone else is overly afraid.

First of all, let me redefine what funding rates are. Funding rates are periodic payments between traders to make the perpetual futures contract price is close to the index price.

Funding rates represent the sentiment of traders on the positions they take in the perpetual swaps market. Positive funding rates imply that many traders are bullish and long traders pay funding to short traders.

Negative funding rates imply many traders are bearish and short traders pay funding to long traders.

Looking at all exchanges funding rates, we can see that it is gradually moving out of the negative zone:

Those who want to make big profits with Bitcoin should probably act now. It’s when no one wants to buy that the best opportunities are available. That’s the case right now. But then again, you need to take a long-term view of the Bitcoin revolution.

In the Bitcoin world, the Stock-to-Flow model is extremely popular. The fact that it has been confirmed many times since its inception has added to its credibility. However, the recent crash in the price of Bitcoin has brought back a lot of criticism of it.

For some, this would be proof that it no longer works.

Nevertheless, this model could not foresee an event as brutal as a ban on Bitcoin from China being implemented in a matter of weeks. In fact, we will have to see if the price of Bitcoin returns to what the Stock-to-Flow model predicts in the coming weeks and months.

For those who still believe in this model, and there are many of them, you should carefully observe this chart which highlights the deflection between the current Bitcoin price and the area predicted by the Stock-to-Flow model:

This deflection has just reached its lowest point. For me, this is a new signal that Bitcoin is currently extremely undervalued. An opportunity to accumulate more of it for big profits in the future.

The Bitcoin Liquid Supply Ratio clearly shows a Bullish divergence at present:

As the price drops, strong hands are aggressively accumulating Bitcoin in preparation for the phenomenal months ahead.

This is further confirmation that the majority of Bitcoin sales are coming from new entrants to the Bitcoin world. These investors are generally referred to as weak hands. By selling their Bitcoin at a loss, they unwittingly allow strong hands to take advantage of it.

At your level, it is obviously in your best interest to be on the side of the strong hands. This means developing your knowledge of Bitcoin so that you can better manage the current situation.

- 2019

- 2020

- 420

- Action

- ADvantage

- All

- AR

- AREA

- asset

- Ban

- bearish

- BEST

- Bitcoin

- Bitcoin Price

- Bullish

- buy

- buy bitcoin

- Charts

- China

- coming

- confidence

- construction

- contract

- Costs

- Crash

- Current

- Current state

- DID

- economy

- ecosystem

- equipment

- EU

- Event

- events

- evolution

- Exchanges

- First

- funding

- future

- Futures

- Green

- How

- How To

- hr

- HTTPS

- ia

- idea

- Income

- index

- influence

- interest

- Investors

- IP

- IT

- knowledge

- large

- Level

- Liquid

- Long

- Majority

- March

- march 2020

- mark

- Market

- medium

- Miners

- Mining

- model

- months

- open

- Opportunity

- Other

- Pattern

- Pay

- payments

- People

- perspective

- Popular

- present

- price

- proof

- range

- Rates

- returns

- revenue

- sales

- Sellers

- sentiment

- Short

- small

- So

- standards

- started

- State

- supply

- talking

- Target

- time

- Traders

- value

- View

- WHO

- works

- world