The best-performing cryptocurrency of 2020

Almost two years ago I wrote an article covering HEX that looked at it with quite a skeptical mindset. It piqued my interest upon joining DappRadar mainly as it was classified in the rankings as High-Risk. Additionally, I knew people holding the token. Furthermore, it is worth mentioning that whilst I wasn’t new to the industry, I wasn’t as experienced as I am today.

The motivation at that time was that I had looked at the structure of the dapp, its marketing efforts, its founder Richard Heart and it did seem to promote a pyramid scheme type of mechanic. Plus, some of the YouTube videos of Richard were less than complimentary. But, he did always seem to fully know what he was talking about. He was an old skool Bitcoin maximalist and I did quite like that. More importantly, and as highlighted in our report on the high-risk dapp category back in May 2020 there had been an explosion of activity on Ethereum, and the vast majority was due to HEX.

What is HEX?

HEX is an ERC20 token designed to replace the Certificate of Deposit and be a store of value. The project launched in December 2019. In the traditional finance industry, Certificates of Deposit are offered by commercial banks and usually provide a slightly higher interest rate to standard savings.

However, to achieve this higher interest rate, depositors are not permitted to withdraw their funds as they please. The condition is that the funds should not be withdrawn generally for one, three, or six months, all the way up to ten years. In this way, HEX is designed to pay interest to participants who lock their coins through a stake in the platform. Just like a bank needs liquidity to operate, so does HEX. The longer the stake, the higher the reward.

How was it distributed?

HEX was originally a free airdrop for bitcoin holders. Importantly, It was not an ICO, and users did not need to pay any gas fees at any time of the claiming process. The distribution to bitcoin holders was 10,000 HEX per 1 BTC. Bitcoin holders could claim HEX only during the first year of launch. During this period, 90% of the claimed HEX was locked for one year. At the end of the first year of release, all coins that had not been claimed by bitcoin holders were distributed to other HEX users with active stakes.

HEX is also available to purchase on several decentralized exchanges such as Uniswap. Interestingly it actually popularized the DEX in its early days. Importantly, it is not available on any centralized exchanges such as Coinbase. Not your keys, not your crypto. This I now believe says more about HEXs creator Richard Heart than I gave credit for a few years ago.

What do you do with HEX?

HEX allows the user to stake their HEX coins for a share of the issue of new HEX coins or inflation. In addition, it contains features designed to stimulate behavior that encourages price appreciation and disincentivize practices that promote harm to the price.

In human language, the HEX smart contract penalizes users who terminate their stake early and accordingly rewards them for staking more significant amounts of HEX for more extended periods. HEX’s creator, Richard Heart, said at the launch that HEX is the world’s first blockchain Certificate of Deposit, allowing users to stake their tokens in return for interest. Users can enjoy interest payments ranging from 3.69% up to an incredible 369%. Also the earlier and longer you stake the better the T share rate given. I.e a bigger share of penalties and better APY. For example – If you stake for 10 years, you would need to serve at least 5 years to get your original tokens back but you would lose any interest accrued. It is clear the platform is intended for long-term investment and not for scalpers.

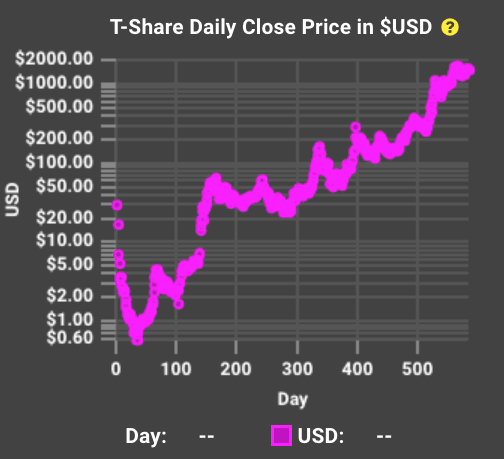

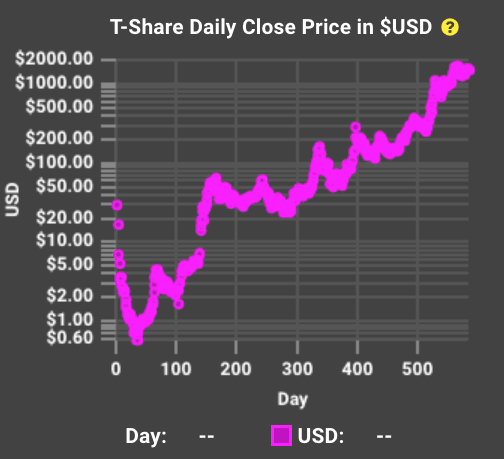

T Shares

Once HEX is staked it is replaced with T Shares and the HEX is burnt. The number of T Shares you receive will dictate what return you will receive at maturity. Additional to a share of the penalties collected from other stakers that ended early. This is a bit of a grey area when it comes to circulating supply. Leading to different ranking sites calculating the market capitalization differently. HEX is number five on Nomics for example and 201st on CMC. It works like this so that the smart contract can calculate what percentage of the penalties are owed – based on how many T Shares you received for your stake. I believe the core reason for it being ranked differently is that it is actually very dynamic. In that when stakes are ended HEX gets minted again. In a nutshell, It simply takes more updating than CMC is willing to do It appears.

The interest payments are made in HEX, which means that the monetary value of such an amount depends entirely on the market value of HEX at the time of maturity. As explained above, the Certificate of Deposit, which can be thought of like a savings account. Is one of the most popular banking products. And in short, HEX was the first blockchain version.

Yield Farming V.1

So far this isn’t sounding too different from what has been presented through yield farming in the last 18 months. Arguably since Compound introduced its COMP governance token. As mentioned earlier, my original article was written some time ago and before any yield farming initiatives became widely adopted. But now, with more context, it’s clearer to see what HEX was, and still is.

In essence, It’s a yield farm. With pretty limited options compared to today’s complex DeFi offers. Buy HEX. Lock up HEX for an extended period to earn HEX. Sounds familiar, and it’s not something that’s being tagged as high-risk in most cases. These days, It’s called staking, vesting, or just simply earning a passive income. Additionally, it has become clearer to me that crypto purists should be excited about HEX. It truly is just two parties involved. The user and the smart contract.

This is important as the majority of exploits occur as one party holds power over the smart contracts or has made omissions to the contract not easily seen by all the investors. Who, let’s be honest, generally don’t know how to, or take the time to read the smart contracts that power these complex finance dapps.

My thoughts on HEX today

Rewind 18 months. The idea of taking a piece of my ETH and selling it for a token called HEX that gave me rewards for the simple act of staking seemed a bit far-fetched. Plus, I never heard of Richard Heart or HEX. I presumed there must be a catch to these impressive percentages. But, I believe I was wrong. My research at that time was flawed and misguided. The catch was there to be seen all along in a vital statement made by Richard Heart himself in the marketing language.

The interest payments are made in HEX, which means that the monetary value of such an amount depends entirely on the market value of HEX at the time of maturity.

So if the price of HEX had plummeted there would be many unhappy people. But, that’s not what happened. It has been on a steady trajectory upwards and enjoyed the recent bull run.

Keep in mind that most rug pull or token dump projects, as they have become known, only last a few weeks or months. HEX has been active now since December 2019. Claiming that over 200,000 wallets own HEX so far.

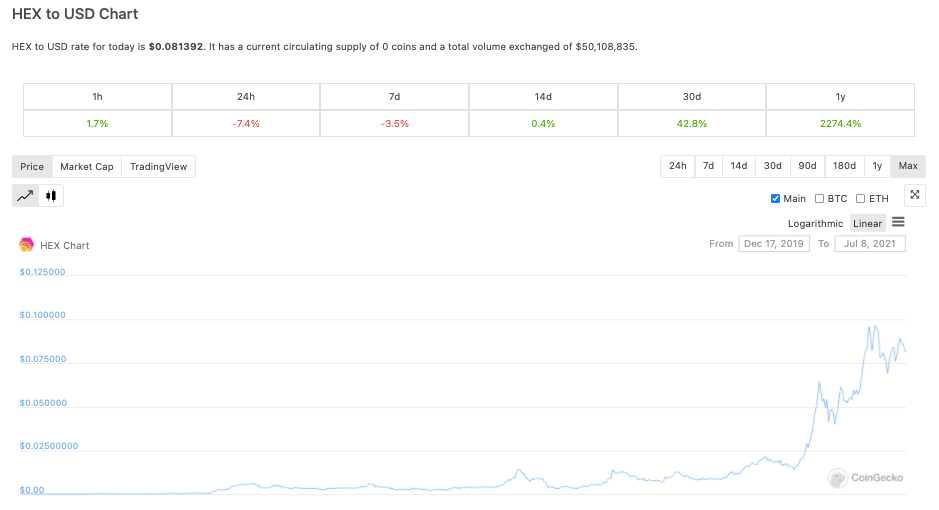

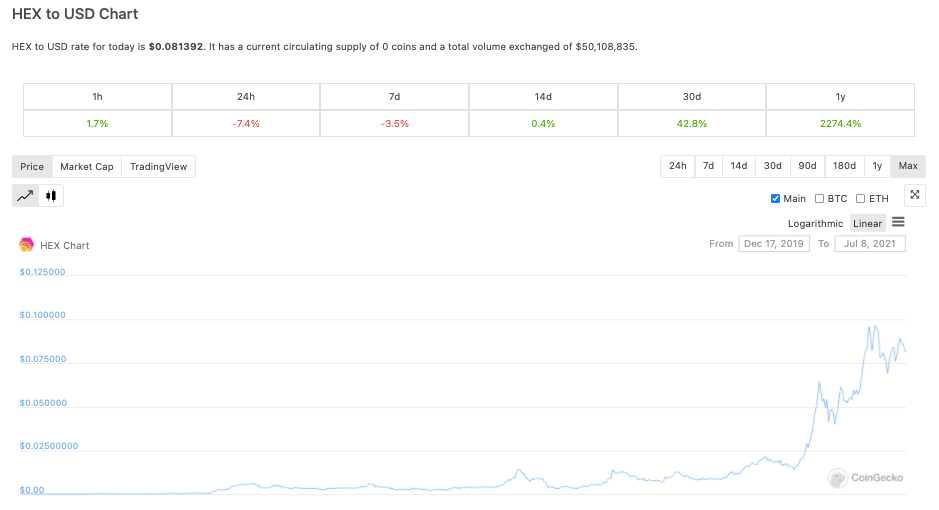

Looking at the HEX token lifetime chart reveals that the confidence some placed in HEX could indeed be very well-founded. Those that received it as an airdrop probably being the ones with the biggest smiles.

BTC price grew by 255% year to date whilst HEX has grown almost 2275%. Possibly even more interesting is that whilst the entire cryptocurrency market dropped and has been moving sideways ever since late May 2021. HEX has been rising. Climbing from $0.03 to $0.08 over the last 6 weeks. Moreover, it appears to the long-term staking mechanic so brutally enforced by the dapp and adhered to by stakers that keeps the price moving upwards.

We spoke to a long-term HEX holder

To get some more depth on HEX I wanted to speak to somebody that had got in from very early. To understand their motivation, initial thoughts, and how they came to hear about HEX in the first instance. Below is a word-for-word conversation with a person that bought, and is still staking HEX.

1. How did you first find out about HEX?

I was a long-time listener of Richard Hearts YouTube channel.

2.What were your first thoughts on the project? Did it look like a scam or did something make you think – no – this is legitimate?

I listened to him talk about it for over a year before it launched so I didn’t think it was a scam, but the marketing tactics used reminded me of some scams. Flashy vids and whacky clothing didn’t help the cause. But he really appeared to be a very intelligent guy who knew what he was talking about.

3. Do you see HEX as a high-risk dapp or a DeFi dapp?

I would say it’s proved itself to be very low risk, 100% uptime, no admin keys, 2 code audits, one economics audit, all volume on-chain, and doesn’t trade on any centralized exchanges. The crypto purist should love it, just you and the smart contract.

4. if you don’t mind telling us what your principal investment was? Did you buy that or was it an airdrop?

$2,500 USD investment from day 1 to about day 100. Still staked today.

5. How do you feel about HEX today?

Very confident, and that people mistake the promise of interest in HEX minted by the smart contract with the promise of USD gains. This does not need new users to honor its promises. The contract is programmed to mint interest in HEX no matter if new users come or what market value HEX has.

6. If you were trying to pitch HEX to somebody in 2 minutes – what would you say?

Price has gone up around 60,000% over 18 months. Best performing asset of 2020, even without factoring in interest. It rewards delayed gratification when all other staking options I have seen allow you to get out of the stake whenever you want. With HEX once you are locked in that’s that, or you get penalized for ending the stake early. That penalty goes to the others who are staked. That stings a little bit too much in my opinion.

Interesting…

The answers to these questions have been given further perspective. Especially the fact that HEX does not require more users for the smart contract to honor interest payments. Obviously more people being involved would stimulate the price to some degree but it’s not dependent on that fact. Plus the fact that such harsh penalties are placed on those that withdraw early seems to be working well. Also, this person bought into Richard Hearts narrative and idea, and of course did their own research before getting involved.

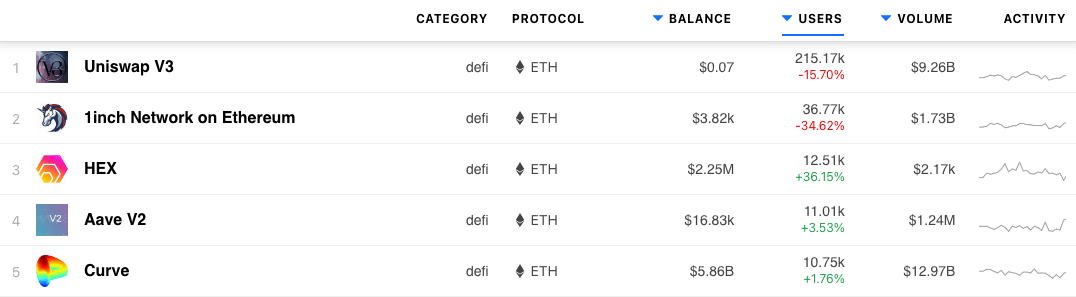

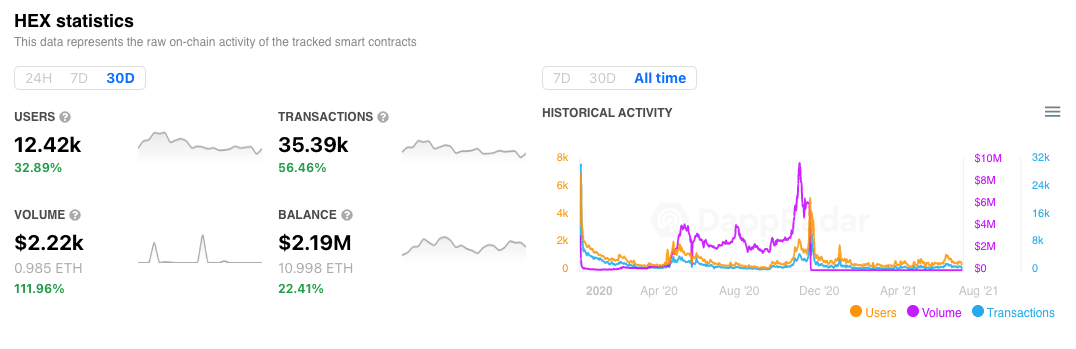

Looking at the performance of the HEX dapp rather than token gives further insight into the situation. In the last 30 days, the dapp has attracted over 12,420 unique active wallets that completed 35,390 transactions. An increase of over 56% month over month. Is it possible that during the crypto crash of 2021 users identified HEX as a safe store of their assets and a way to earn a passive income in a downturn? It’s very possible given the metrics observed.

Pulse Chain Update

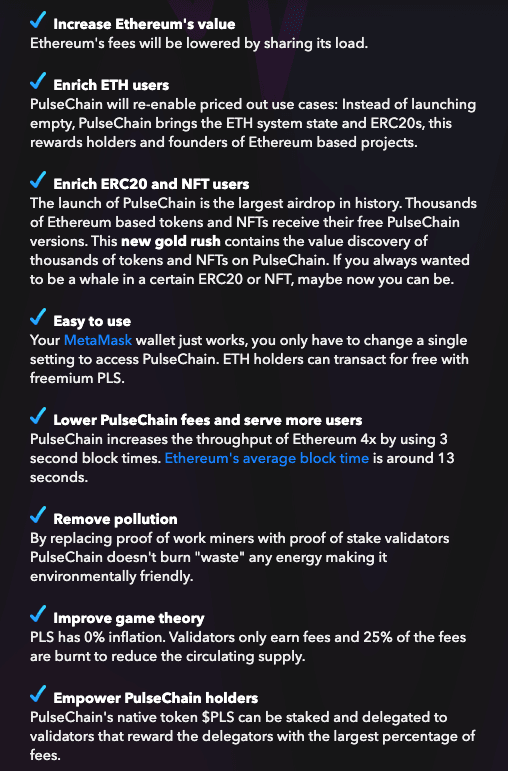

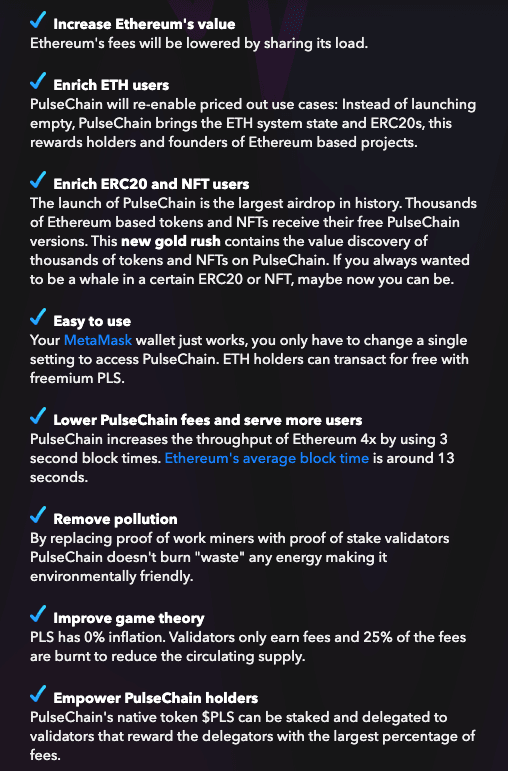

As if all this wasn’t interesting enough, Richard Heart recently came out with another bombshell. Stating that he would be launching Pulse Chain – an Ethereum fork with lower fees. Additionally, it has been billed as a blockchain built specifically for HEX holders to withdraw and deposit funds cheaply. Although, it will clearly have a wider utility as seen in the below image taken from the website.

The launch of PulseChain will be the largest airdrop in history. Thousands of Ethereum based token holders and NFTs will receive their free PulseChain versions. Interestingly, the marketing language is one of friendly cooperation with Ethereum. Stating that – Ethereum’s fees will be lowered by sharing its load. But, the real message – PulseChain’s native token PLS can be staked and delegated to validators. Another earning opportunity being presented by Richard Heart and Pulse Chain.

Looking ahead

Obviously, at this point, I am retracting my previous statements from almost two years ago. I am of course still weary and will exercise further research and due diligence. But, at this point, I am quite disappointed in myself for jumping on the high-risk bandwagon. Especially after now writing a plethora of articles detailing dapps offering exactly the same offer as HEX. Some with far less life span and arguably more potential for fraudulent activity. It has become clearer to me what HEX is. I believe it was one of the first iterations of yield farming offered in the crypto space. As such, it arguably deserves more respect than is being afforded to it. As a result of this deeper analysis HEX has now been placed into the DeFi category. Which has placed it 3rd within the top 5 Ethereum dapps.

Additionally, the dapp categories on DappRadar are under constant review. While some may say (Including Richard himself) it should not have been labeled as high-risk to start with. I for one am pleased that a dapp offering a high risk, high reward structure was labeled as such at a time when we needed stability in the space and not more potential fraudulent activity. Now, after a good stretch of time has passed. The dapp, its creator, and price seem very stable.

Remember, the decentralized application industry is still very early in its lifespan. As such DappRadar is evolving with it and will endeavor to provide the most accurate and trusted dapp data to our users and wider audience.

.mailchimp_widget {

text-align: center;

margin: 30px auto !important;

display: flex;

border-radius: 10px;

overflow: hidden;

flex-wrap: wrap;

}

.mailchimp_widget__visual img {

max-width: 100%;

height: 70px;

filter: drop-shadow(3px 5px 10px rgba(0, 0, 0, 0.5));

}

.mailchimp_widget__visual {

background: #006cff;

flex: 1 1 0;

padding: 20px;

align-items: center;

justify-content: center;

display: flex;

flex-direction: column;

color: #fff;

}

.mailchimp_widget__content {

padding: 20px;

flex: 3 1 0;

background: #f7f7f7;

text-align: center;

}

.mailchimp_widget__content label {

font-size: 24px;

}

.mailchimp_widget__content input[type=”text”],

.mailchimp_widget__content input[type=”email”] {

padding: 0;

padding-left: 10px;

border-radius: 5px;

box-shadow: none;

border: 1px solid #ccc;

line-height: 24px;

height: 30px;

font-size: 16px;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”] {

padding: 0 !important;

font-size: 16px;

line-height: 24px;

height: 30px;

margin-left: 10px !important;

border-radius: 5px;

border: none;

background: #006cff;

color: #fff;

cursor: pointer;

transition: all 0.2s;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”]:hover {

box-shadow: 2px 2px 5px rgba(0, 0, 0, 0.2);

background: #045fdb;

}

.mailchimp_widget__inputs {

display: flex;

justify-content: center;

align-items: center;

}

@media screen and (max-width: 768px) {

.mailchimp_widget {

flex-direction: column;

}

.mailchimp_widget__visual {

flex-direction: row;

justify-content: center;

align-items: center;

padding: 10px;

}

.mailchimp_widget__visual img {

height: 30px;

margin-right: 10px;

}

.mailchimp_widget__content label {

font-size: 20px;

}

.mailchimp_widget__inputs {

flex-direction: column;

}

.mailchimp_widget__content input[type=”submit”] {

margin-left: 0 !important;

margin-top: 0 !important;

}

}

The above does not constitute investment advice. The information given here is purely for informational purposes only. Please exercise due diligence and do your research. The writer holds positions in ETH, BTC, ADA, NIOX, AGIX, SAFEMOON, SDAO, CAIT, CAKE, LINK, GRT, CRO, SHIBA INU, AND OCEAN.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet