Do you recall the times when selecting a service provider meant dealing with physical software and frequent updates? In 2006, tech giants like

Google and Amazon led a transformative movement by embracing the limitless potential of cloud computing.

Their forward-looking initiative has subsequently sparked changes across various sectors, although the domain of money transfer and remittance platforms has shown some hesitation in fully adopting this internet-based technology.

Reasonable concerns about security and regulations have contributed to a slower rate of acceptance.

Although it’s heartening that

more than half of remittance software implementations now exist in the cloud, a substantial portion—40%—still rely on outdated methods.

This persistent discrepancy presents both a challenge and an opportunity for the industry to navigate the journey toward a more adaptable and secure future.

Unlocking the Potential of Cloud Migration

With the ascent of fintech and the rapid acceleration of digital transformation propelled by the impact of COVID-19, stakeholders within the remittance and money transfer sector are now acknowledging the possibilities presented by transitioning their legacy applications to cloud-based environments.

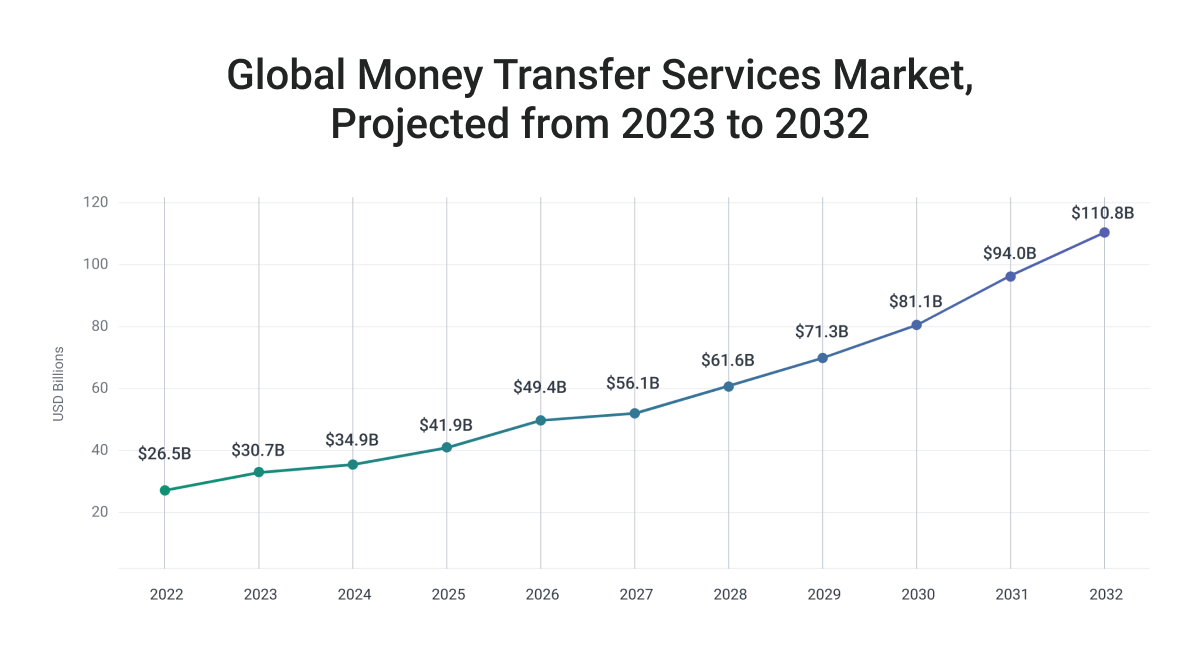

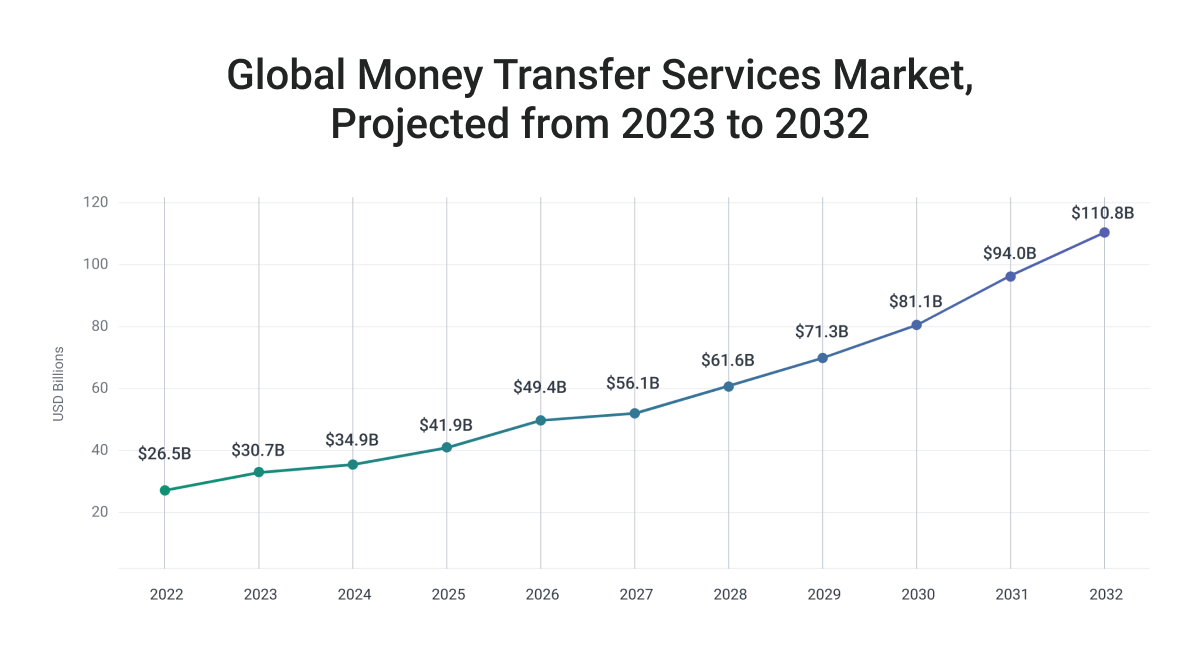

Projections indicate that the

Global Money Transfer Services Market is poised for significant expansion throughout the forecast period spanning from 2023 to 2032.

As outlined in a 2023 research report authored by Transparency Market Research, this market is anticipated to surge from $26.5 billion in 2022 to an approximate valuation of $110.8 billion by 2032. This escalation underscores the substantial promise and profitability inherent in the realm of money transfer and remittance.

With the continuous expansion of the market, enterprises that embrace modernization by migrating their money transfer platforms to the cloud will establish a competitive advantage, positioning themselves to capture a larger portion of this lucratively burgeoning market.

Advantages of Cloud Migration for Money Transfer and Remittance Platforms

Transitioning money transfer and remittance platforms to the cloud presents an array of advantages that empower enterprises and foster competitiveness. These key benefits encompass heightened:

Cloud platforms extend unparalleled scalability, flexibility, and agility beyond the capabilities of traditional legacy systems, enabling businesses to swiftly respond to market shifts and customer requirements.

In greater detail, some of the key advantages include:

1. Enhanced Scalability and Agility

Compared to legacy systems, cloud-based platforms offer unparalleled scalability and agility. The dynamics of money transfer and remittance platforms often entail fluctuations in transaction volumes, particularly during peak periods.

Cloud migration equips businesses to seamlessly adjust their resources according to demand, ensuring seamless operations and optimal performance.

This adaptability not only accommodates growth and elevated transaction volumes but also accommodates evolving customer needs.

2. Improved Operational Efficiency

Migration to the cloud facilitates streamlined operations and heightened efficiency for money transfer platforms. Conventional legacy systems often involve intricate manual processes and interventions.

Embracing cloud technologies empowers companies to automate diverse tasks, including transaction processing, compliance checks, and reconciliation.

Automated workflows mitigate the risk of human errors while liberating valuable resources for focusing on strategic initiatives and higher-value activities.

3. Enhanced Security and Compliance

Security and compliance are paramount concerns in the realm of money transfer. Cloud providers deliver advanced security features and robust encryption protocols to safeguard sensitive customer data.

Extensive investments fortify infrastructure security, incorporating stringent access controls and advanced threat detection and prevention mechanisms.

Cloud platforms also furnish tools and services that aid in meeting regulatory mandates such as anti-money laundering (AML) and know-your-customer (KYC) regulations.

4. Global Accessibility and Connectivity

Cloud-based money transfer systems establish global accessibility and seamless connectivity, facilitating cross-border transactions.

Users can effortlessly access these platforms from any location with an internet connection, streamlining international money transfers and remittances.

Cloud-based systems seamlessly integrate with diverse payment networks and APIs, simplifying connections with financial institutions, mobile wallets, and other payment service providers.

This interconnectedness broadens the reach of money transfer platforms, enabling them to cater to a wider customer base.

5. Real-time Data Analytics and Insights:

Cloud-based platforms offer robust analytics and reporting capabilities, empowering money transfer enterprises to extract valuable insights from their data.

Leveraging real-time data analytics enables businesses to monitor transaction trends, identify potential risks, and make informed decisions.

These insights drive enhancements in customer experiences, operational optimizations, and the identification of new business avenues.

6. Cost Optimization and Scalable Pricing Models:

Cloud migration frequently ushers in cost optimization benefits for money transfer platforms. Instead of investing in costly hardware infrastructure and periodic software updates, businesses can leverage the pay-as-you-go model extended by cloud providers.

This approach enables companies to pay solely for the resources consumed, aligning infrastructure and costs with actual demand. Upfront capital expenditures are eliminated, and cost predictability enhances financial planning efficiency.

7. Accelerated Time-to-Market for Innovation:

Cloud-based platforms empower money transfer entities to harness the latest technologies and innovations at an accelerated pace.

Cloud providers offer an extensive array of services, including artificial intelligence (AI), machine learning (ML), and blockchain, which can be seamlessly integrated into money transfer systems.

This facilitation enables companies to introduce novel features, enhance user experiences, and spur innovation without protracted development cycles.

The rapid deployment of fresh functionalities empowers businesses to retain competitiveness within a rapidly evolving market.

Considerations & Challenges for Cloud Migration

Deciding to transition a money transfer or remittance payment system to the cloud requires careful reflection on the ensuing considerations and challenges:

-

Security and Compliance:

Given the sensitivity of financial information managed by money transfer platforms, security, and compliance assume paramount importance.

Prioritize a cloud provider with robust security protocols encompassing data encryption, access controls, and alignment with industry regulations (e.g., PCI DSS, AML, KYC).

Rigorously assess the cloud provider’s security certifications and audit reports to ascertain alignment with your precise compliance prerequisites.

2. Data Privacy and Sovereignty:

Operational jurisdiction introduces varying legal and regulatory stipulations concerning data privacy and sovereignty.

Familiarize yourself with data protection laws within your operational realms and ensure the chosen cloud provider upholds these regulations. Consider data residency choices while affirming that customer data remains within the confines of appropriate jurisdictions.

3. Migration Strategy and Planning:

Effecting the migration of an intricate money transfer system to the cloud necessitates meticulous planning and a clearly defined migration strategy.

Account for facets such as data migration, application re-architecture, and integration with pre-existing systems. Articulate a comprehensive migration blueprint, spanning a phased implementation approach and exhaustive testing, to mitigate disruptions and ensure a seamless transition.

4. Network Connectivity and Latency:

Network connectivity forms a foundational pillar for the functioning of money transfer systems, entailing transaction processing, and interaction with financial institutions.

Scrutinize the array of network connectivity alternatives furnished by the cloud provider, encompassing bandwidth, latency, and redundancy. Assess the proximity of the cloud provider’s data centers to your target markets, minimizing latency and underpinning optimal performance.

5. Vendor Lock-In and Exit Strategy:

Appraise potential vendor lock-in risks when electing a cloud provider. Ascertain the cloud provider’s endorsement of industry-standard technologies and open APIs, facilitating interoperability and the portability of your applications and data.

Draft an exit strategy delineating the methodologies for migrating your systems and data to an alternate provider or back to an on-premises environment, if deemed necessary.

6. Cost Management and Optimization:

While cloud migration affords cost-saving prospects, judicious cost management assumes paramount significance. Monitor resource utilization, leverage cost management tools provided by the cloud provider, and subject your infrastructure to periodic scrutiny, eliminating superfluous resources.

Reflect on the utility of reserved instances or spot instances for cost optimization, while vigilantly accounting for supplementary expenses like data transfer and storage fees.

7. Business Continuity and Disaster Recovery:

Assertive safeguards for backup and disaster recovery are imperative offerings from the chosen cloud provider, safeguarding against data loss and service interruptions.

Institute comprehensive backup strategies, institute redundant systems, and subject your disaster recovery mechanisms to regular testing, cementing business continuity in the face of adversities.

8. Skillset and Expertise:

Cloud migration mandates specific competencies and expertise. Gauge the proficiencies of your internal IT team and ascertain the need for supplementary training or external support.

Consider forging partnerships with cloud migration specialists or consultants adept in migrating similar financial systems through successful and streamlined migration processes.

Examples of Money Transfer Systems’ Cloud Migration

Highlighted below are several real-world instances of successful migrations of money transfer and remittance payment systems to cloud-based environments:

- TransferWise (Wise): A prominent fintech entity, TransferWise, boasts an online money transfer platform. Their complete infrastructure was

seamlessly migrated to the cloud via Amazon Web Services (AWS). This strategic shift endowed TransferWise with the necessary scalability and flexibility, aptly accommodating rapid expansion and international growth. Notably, the cloud transition facilitated accelerated transaction processing, elevated user satisfaction, and operational cost reduction. - Western Union: Acknowledged as a global leader in money transfer services, Western Union

harnessed cloud technology to modernize its entrenched legacy systems. By adopting a hybrid cloud methodology, and integrating public and private cloud solutions, Western Union embarked on an evolution toward heightened digital proficiency. This transition translated to amplified transaction processing speeds and introduced more user-friendly, secure avenues for worldwide money transfers. - Remitly: Remitly, the digital remittance platform enabling international money transfers,

embraced a cloud-centric migration by harnessing AWS. The adoption paved the way for notable advancements in application performance, scalability, and security for Remitly. Noteworthy enhancements encompassed an increased capacity to manage higher transaction volumes, reinforced availability, and expedited introduction of novel features to cater to evolving customer demands.

Embracing the Cloud for Future Success

Transitioning money transfer and remittance platforms to the cloud holds transformative potential for the industry. By embracing cloud technology, enterprises can liberate themselves from the constraints of outdated systems, mitigate technical burdens, and attain enhanced operational efficiency.

Cloud tech consulting can be the first step to joining the 60% of remittance platforms already on the cloud. However, the shift to cloud isn’t solely a technical upgrade; it embodies a strategic step capable of reshaping your business and unveiling hitherto unexplored prospects.

Take the leap, embrace the change, and let the cloud propel your business to new heights.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.finextra.com/blogposting/24751/the-cloud-chasm-why-nearly-half-of-remittance-companies-arent-on-the-cloud?utm_medium=rssfinextra&utm_source=finextrablogs

- :has

- :is

- :not

- 2006

- 2022

- 2023

- 7

- 8

- a

- About

- accelerated

- acceptance

- access

- accessibility

- According

- Accounting

- acknowledged

- across

- activities

- actual

- Adopting

- Adoption

- advanced

- advancements

- ADvantage

- advantages

- against

- AI

- Aid

- aligning

- alignment

- already

- also

- alternatives

- Although

- Amazon

- Amazon Web Services

- Amazon Web Services (AWS)

- AML

- Amplified

- an

- analytics

- and

- anti-money laundering

- Anticipated

- any

- APIs

- Application

- applications

- approach

- appropriate

- approximate

- ARE

- Array

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- assess

- assume

- assumes

- At

- attain

- audit

- automate

- availability

- avenues

- AWS

- back

- Backup

- Bandwidth

- base

- BE

- below

- benefits

- Beyond

- Billion

- blockchain

- boasts

- both

- burgeoning

- business

- business continuity

- businesses

- but

- by

- CAN

- capabilities

- capable

- Capacity

- capital

- capture

- careful

- cater

- cementing

- Centers

- certifications

- challenge

- challenges

- change

- Changes

- Checks

- choices

- chosen

- clearly

- Cloud

- cloud computing

- CLOUD TECHNOLOGY

- Cms

- Companies

- competitive

- competitiveness

- complete

- compliance

- comprehensive

- computing

- Concerns

- connection

- Connections

- Connectivity

- Consider

- considerations

- constraints

- consultants

- consumed

- continuity

- continuous

- contributed

- controls

- conventional

- Cost

- Cost Management

- cost reduction

- costly

- Costs

- COVID-19

- cross-border

- customer

- customer data

- cycles

- data

- Data Analytics

- data centers

- data loss

- data privacy

- data protection

- dealing

- decisions

- deemed

- defined

- deliver

- Demand

- demands

- deployment

- detail

- Detection

- Development

- digital

- Digital Transformation

- disaster

- discrepancy

- disruptions

- diverse

- domain

- drive

- during

- dynamics

- e

- efficiency

- effortlessly

- elevated

- eliminated

- eliminating

- embarked

- embodies

- embrace

- embracing

- empower

- empowering

- empowers

- enables

- enabling

- encompass

- encompassing

- encryption

- enhance

- enhanced

- enhancements

- Enhances

- ensure

- ensuring

- enterprises

- entities

- entity

- entrenched

- Environment

- environments

- Errors

- escalation

- establish

- evolution

- evolving

- exist

- Exit

- Exit Strategy

- expansion

- expenses

- Experiences

- expertise

- extend

- extensive

- external

- extract

- Face

- facets

- facilitated

- facilitates

- facilitating

- Features

- Fees

- financial

- financial information

- Financial institutions

- financial planning

- financial systems

- fintech

- First

- Flexibility

- fluctuations

- focusing

- For

- Forecast

- Forging

- forms

- forward-looking

- Foster

- frequent

- frequently

- fresh

- from

- fully

- functionalities

- functioning

- future

- gauge

- giants

- Global

- greater

- Growth

- Half

- Hardware

- harness

- Harnessing

- Have

- heightened

- heights

- higher

- holds

- However

- HTTPS

- human

- Hybrid

- Identification

- identify

- if

- Impact

- imperative

- implementation

- importance

- improved

- in

- include

- Including

- incorporating

- increased

- indicate

- industry

- information

- informed

- Infrastructure

- inherent

- Initiative

- initiatives

- Innovation

- innovations

- insights

- instead

- Institute

- institutions

- integrate

- integrated

- Integrating

- integration

- Intelligence

- interaction

- internal

- International

- Internet

- internet connection

- Internet-based

- Interoperability

- interventions

- into

- introduce

- introduced

- Introduces

- Introduction

- investing

- Investments

- involve

- isn

- IT

- ITS

- joining

- journey

- jurisdiction

- jurisdictions

- Key

- KYC

- larger

- Latency

- latest

- Laundering

- Laws

- leader

- Leap

- learning

- Led

- Legacy

- Legal

- let

- Leverage

- like

- limitless

- location

- loss

- machine

- machine learning

- make

- manage

- managed

- management

- Management Tools

- mandates

- manual

- Market

- market research

- Markets

- meant

- mechanisms

- meeting

- methodologies

- Methodology

- methods

- meticulous

- migrated

- migrating

- migration

- minimizing

- Mitigate

- ML

- Mobile

- model

- models

- money

- Money Transfers

- Monitor

- more

- movement

- Navigate

- nearly

- necessary

- necessitates

- Need

- needs

- network

- networks

- New

- notable

- notably

- noteworthy

- novel

- now

- of

- offer

- Offerings

- often

- on

- online

- only

- open

- operational

- Operations

- Opportunity

- optimal

- optimization

- or

- Other

- outlined

- Pace

- Paramount

- particularly

- partnerships

- Pay

- payment

- payment networks

- payment system

- Payment Systems

- Peak

- performance

- period

- periodic

- periods

- Phased

- physical

- Pillar

- planning

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- poised

- portion

- positioning

- possibilities

- potential

- precise

- prerequisites

- presented

- presents

- Prevention

- pricing

- privacy

- private

- processes

- processing

- profitability

- prominent

- promise

- Propel

- propelled

- prospects

- protection

- protocols

- provided

- provider

- providers

- public

- rapid

- rapidly

- Rate

- reach

- real world

- real-time

- real-time data

- realm

- realms

- reconciliation

- recovery

- reduction

- reflection

- regular

- regulations

- regulatory

- rely

- remains

- Remittance

- Remittances

- report

- Reporting

- Reports

- Requirements

- requires

- research

- reserved

- resource

- Resources

- Respond

- retain

- Risk

- risks

- robust

- s

- safeguarding

- safeguards

- satisfaction

- Scalability

- scalable

- scrutiny

- seamless

- seamlessly

- sector

- Sectors

- secure

- security

- selecting

- sensitive

- Sensitivity

- service

- Service Provider

- service providers

- Services

- several

- shift

- Shifts

- shown

- significance

- significant

- similar

- simplifying

- skillset

- Software

- solely

- Solutions

- some

- sovereignty

- spanning

- sparked

- specialists

- specific

- speeds

- Spot

- stakeholders

- Step

- storage

- Strategic

- strategies

- Strategy

- streamlined

- streamlining

- subject

- Subsequently

- substantial

- successful

- such

- support

- surge

- swiftly

- system

- Systems

- Target

- tasks

- team

- tech

- tech giants

- Technical

- Technologies

- Technology

- Testing

- than

- that

- The

- their

- Them

- themselves

- These

- this

- threat

- Through

- throughout

- times

- to

- tools

- toward

- traditional

- Training

- transaction

- Transactions

- transfer

- transfers

- Transferwise

- Transformation

- transformative

- transition

- transitioning

- Transparency

- Trends

- underpinning

- underscores

- union

- unparalleled

- unveiling

- Updates

- upgrade

- User

- user-friendly

- utility

- Valuable

- Valuation

- various

- vendor

- via

- volumes

- Wallets

- was

- Way..

- web

- web services

- Western

- western union

- when

- which

- while

- why

- wider

- will

- WISE

- with

- within

- without

- workflows

- worldwide

- You

- Your

- yourself

- zephyrnet