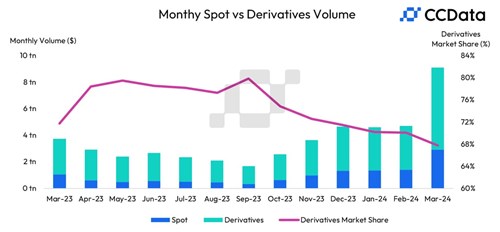

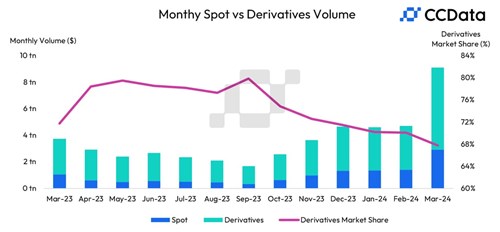

The combined trading volume on centralized cryptocurrency exchanges nearly doubled to a record-breaking $9.1 trillion in March, with spot trading outpacing the growth of derivatives trading.

According to CCData’s latest Exchange Review report, spot trading volumes rose 108% to $2.93 trillion, the highest monthly figure since May 2021, with leading cryptocurrency exchange Binance being able to capitalize on the market frenzy and see trading volume reach its highest level since May 2021.

The platform’s spot trading volume jumped 121% to $1.12 trillion while derivatives volumes rose by 89.7% to $2.91 trillion. Overall, spot and derivatives trading on centralized exchanges rose 92.9% last month.

Trading volumes were driven by Bitcoin’s 15% price increase in March to a record high of $73,776. The report further highlights Binance’s growing market share in the spot market, with the exchange seeing its largest yearly gain and increasing its dominance by 6.21% to capture 38% of the total spot trading volume on centralized exchanges.

Institutional investor participation in the crypto market also saw a significant uptick as volume on the Chicago Mercantile Exchange (CME) reached an all-time high of $155 billion in March, reflecting a 60.6% increase.

The surge in derivatives trading volume was another noteworthy trend observed across exchanges integrated with the CCData API. This metric nearly doubled to $6.18 trillion in March, suggesting increased investor activity and speculation on the future price movements of cryptocurrencies, particularly Bitcoin, as it approached a new all-time high.

Last month, the derivatives trading volume among exchanges integrated with the CCData API also hit a new record after almost doubling to $6.18 trillion.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.cryptocompare.com/email-updates/daily/2024/apr/05/

- 1

- 12

- 15%

- 2021

- 2024

- 60

- 89

- 91

- a

- Able

- across

- activity

- After

- almost

- also

- among

- an

- and

- Another

- api

- April

- April 2024

- AS

- being

- Billion

- binance

- Bitcoin

- by

- capitalize

- capture

- centralized

- centralized cryptocurrency

- Centralized Exchanges

- chicago

- Chicago Mercantile Exchange

- CME

- COM

- combined

- crypto

- Crypto Market

- crypto roundup

- CryptoCompare

- cryptocurrencies

- cryptocurrency

- Cryptocurrency Exchange

- Cryptocurrency Exchanges

- Derivatives

- derivatives trading

- Dominance

- doubled

- doubling

- driven

- exchange

- Exchanges

- Figure

- frenzy

- further

- future

- Future Price

- Gain

- Growing

- Growth

- High

- highest

- highlights

- Hit

- HTTPS

- in

- Increase

- increased

- increasing

- integrated

- investor

- IT

- ITS

- jpg

- Jumped

- largest

- Last

- latest

- leading

- Level

- March

- Market

- market share

- May..

- Mercantile

- metric

- Month

- monthly

- movements

- nearly

- New

- noteworthy

- of

- on

- overall

- participation

- particularly

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- price

- reach

- reached

- record

- reflecting

- report

- ROSE

- roundup

- s

- saw

- see

- seeing

- Share

- significant

- since

- speculation

- Spot

- spot market

- Spot Trading

- surge

- The

- The Future

- this

- to

- Total

- Trading

- trading volume

- trading volumes

- Trend

- Trillion

- volume

- volumes

- was

- were

- while

- with

- yearly

- zephyrnet