So, as you can see first hand, Blockchain based so-called ‘stablecoin’ issuers, are completely full of shit when it comes to them being unable to be audited. A stablecoin backed by USD and safe USD denominated assets can in fact be audited, and can be transparent about what’s in the basket of assets. There are auditors today that already know how to audit something like the SPAXX.

And they can do this while still providing you some of the interest generated. It’s not much, but it’s far and above and beyond what so-called “Stablecoins” are doing today.

It would be possible today to design a stablecoin that simply copies the SPAXX and pocket all of the interest, and it would be able to be audited and transparent about the holdings!

It would be miles ahead of what we see today with “Blockchain” based so-called “Stablecoins”.

So why aren’t “blockchain” based so-called “Stablecoins” just copying the SPAXX, which collects hundreds of millions of dollars in fees before passing the remainder to SPAXX ‘hodlers’.

Good question.

And what are you getting by holding Tether and letting them keep all of the interest for themselves?

Fidelity provides 48 pages of annual detailed reports and 12 page monthly detailed reports, of their holdings of $221 billion dollars.

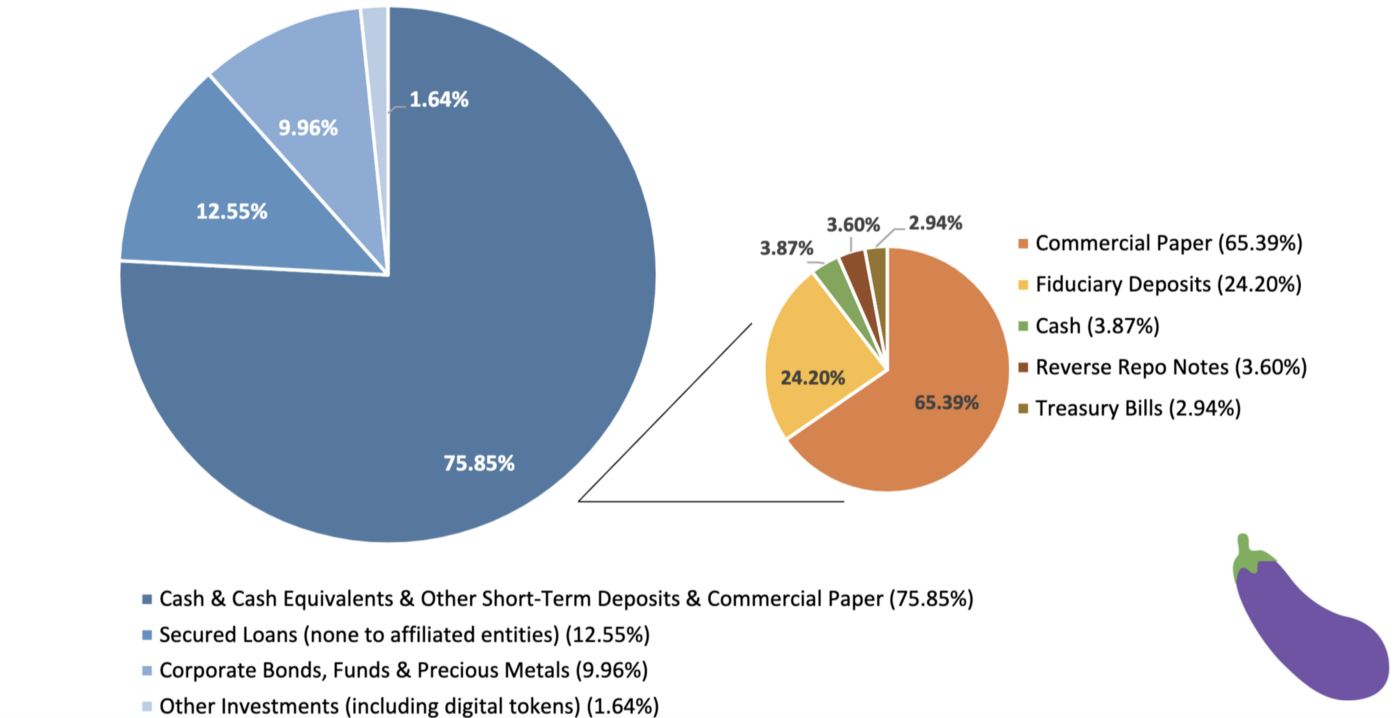

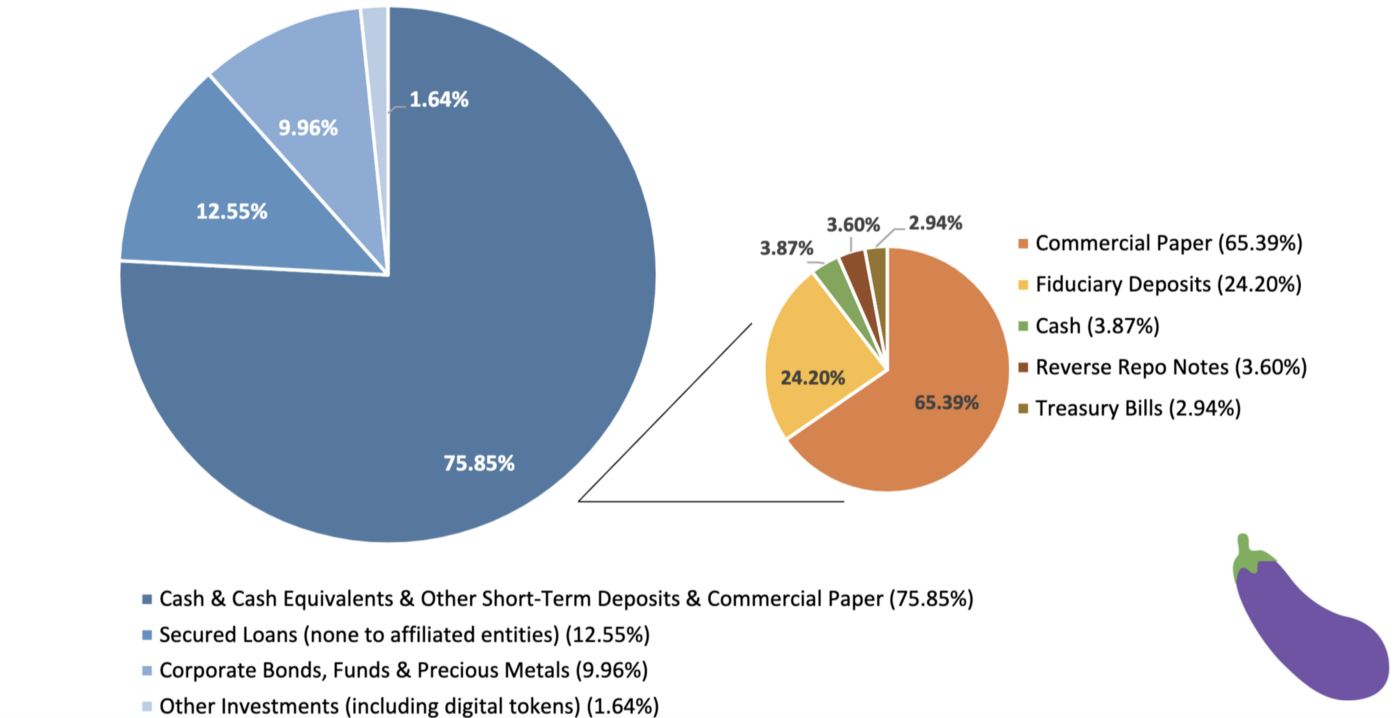

Tether provides a single page pie chart for $62 billion dollars and refuses to disclose the breakdown or counterparties, and as an added bonus, the Fidelity SPAXX didn’t hand over nearly a billion dollars to money launderers and then attempt to cover up the losses by speculating on crypto currencies.

Tether effectively charges you substantially more money, for substantially less transparency and flagrantly irresponsible behavior with customer funds.

USDC also has transparency problems as well, so I’m not letting them off the hook, and they can expect to see me pushing them for transparency the same way I have hit Tether, if they continue to drag their feet about the transparency about their reserves. Stop bullshitting and produce the reports, just like what the Fidelity SPAXX provides investors with today. There are no excuses.

If the Fidelity SPAXX can do it, so can blockchain so-called ‘stablecoins’. They have invented nothing new that an auditor would not be able to understand.

It literally already existed before ‘blockchain’ so-called ‘stablecoins’.

Trade carefully.

–Bitfinex’ed