1. Market Movements

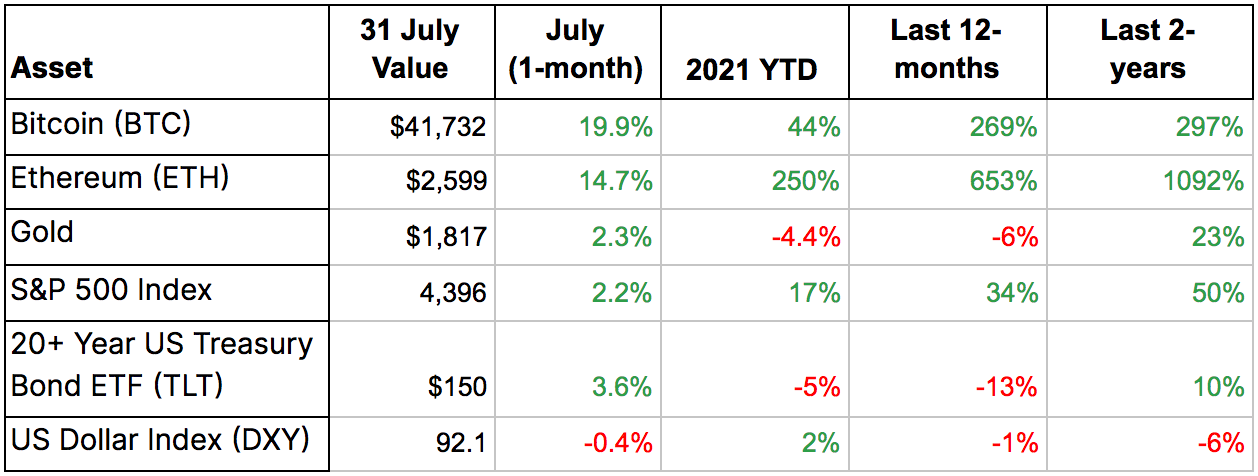

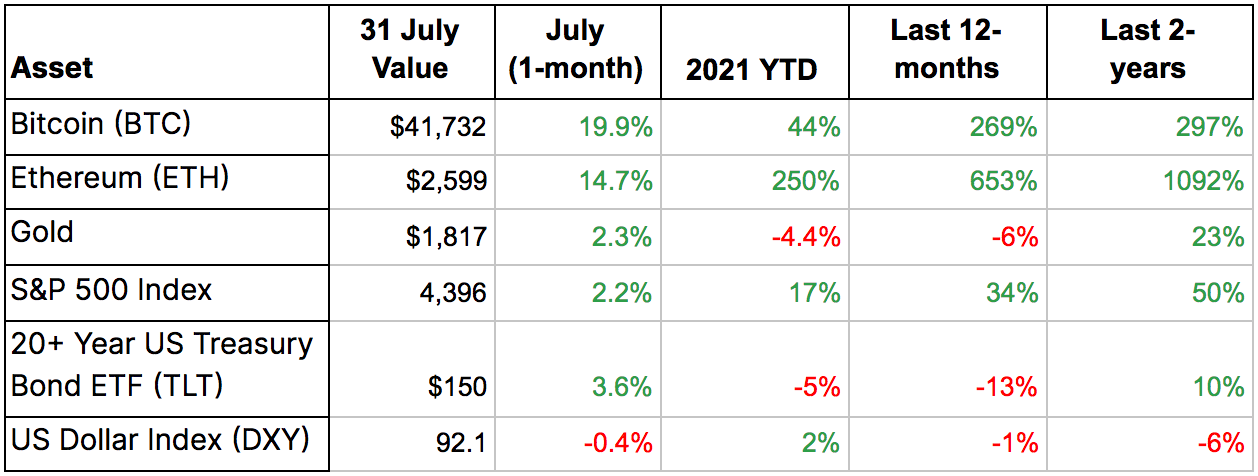

In July, Bitcoin (BTC) saw its first positive monthly close since March with bitcoin +20%. Ethereum (ETH) was up+15% for July.

Table 1: Price Comparison: Bitcoin, Ethereum, Gold, US Equities, Long-dated US Treasuries, US Dollar (% Change)

In contrast with the constructive price action in July we saw a continued slowdown in most on-chain metrics for the month.

Table 2: July vs June Bitcoin network activity

2. The Final Crypto Adoption Frontier

Of the major investor categories, only one remains officially on the crypto investment sidelines: government.

Now, governments have in the past and continue to “own” cryptoassets like bitcoin. This is due to law enforcement seizures since at least the 2013 Silk Road dark marketplace enforcement action, as well as to suspected nation state hacking attacks.

Some local government officials like Miami Mayor Francis Suarez have also expressed interest in owning bitcoin as a treasury reserve asset. And El Salvador’s legalization of bitcoin as legal tender certainly opens the strong possibility of that nation holding bitcoin as a state reserve asset.

But as of today not a single government entity has declared publicly that it currently owns bitcoin or any other cryptoasset for investment purposes.

All we have are circumstantial evidence and secondhand reports of government controlled entities owning crypto for investment purposes.

We believe this is going to change.

Sovereign institutions, including central banks, are one of if not the largest holders of gold (at least $2 trillion USD). And like other individual and Wall Street gold investors we expect sovereigns to increasingly diversify into “digital gold” (bitcoin).

Concerns over the declining purchasing power of the US dollar, along with its “weaponization” for the application of US policy objectives, are also pushing many governments to consider alternative reserve assets.

Even a minor % allocation from some select governments around the world that we believe are most likely to move first in this direction (eg excluding US, Europe, China, etc.) could dramatically increase the flow of funds into bitcoin (Table 3).

Table 3: Sovereigns represent a multi-trillion dollar market for bitcoin

Direct public ownership of cryptoassets by governmental institutions will also help remove some of the ongoing regulatory uncertainty that clouds crypto adoption, as we discuss in the next section.

3. A shifting regulatory landscape for crypto

The ongoing cryptocurrency bull market has, like those before it, once again put this industry on the radar of policymakers and regulators.

In general, the regulatory environment of the U.S. and countries that follow its lead is still favorable toward cryptocurrencies. There is a settlement that an individual user of the network, be they a payer/payee, miner, or node, is not regulated as a financial intermediary might be. Similarly, the SEC has seemingly settled on where they view the line on whether or not a particular token is a security. Overall, this is good news for cryptocurrency networks.

There are some areas of concern however. These mostly relate to companies that have built businesses on top of cryptocurrency networks, rather than the networks themselves. Unlike the networks, companies have regulatory obligations and can be targets for enforcement.

Here are some areas we are watching:

Non-US exchanges

It’s no secret that some of the largest players in the cryptocurrency exchange space can attribute their rapid growth to offering high leverage and other regulatory arbitrage products. It seems that patience has run out for this behavior. In particular, Binance, which is the largest exchange by volume, has been targeted by regulators in the UK, Germany, Japan, Canada, and Italy.

Another large exchange, FTX, has similarly come under scrutiny for its high leverage (100x) trading and issuing of so-called “stock tokens’’ which offer US securities to non-US customers. As both exchanges move toward compliance, stock tokens have been delisted and leverage limited to 20x.

Simply due to their size, more severe enforcement would likely be disruptive in the short term. They are racing to compliance, but it may not be fast enough.

Stablecoins

Stablecoins, crypto asset tokens that are designed to hold a peg to something like the dollar, have become the preferred way to move value through the crypto ecosystem and increasingly beyond. There is genuine innovation here, and from using them it becomes immediately obvious that they are superior to bank transfers.

However, their growing size and opacity of reserves has regulators around the world concerned. In particular, the looming Facebook entry to this market is feared to be systemically important from day one.

The two most popular stablecoins, Tether and USDC, have revealed their reserves to be substantially composed of commercial paper and other securities. In a recent speech, SEC chairman Gary Gensler suggested that a “stable value token backed by securities” is a security.

Should the SEC pursue this, and these companies fail to make their case, there would be repercussions in how money moves through the crypto ecosystem, particularly toward DeFi where these tools are uniquely valuable.

DeFi

Decentralized Finance applications, built as smart contracts on a blockchain like Ethereum, are growing fast. Many of the services offered by these contracts recreate activities that are typically tightly regulated, such as derivatives.

Regulators are currently actively watching this space and charting their approach. Doubtless they wish to quash or disincentivize the creation and promotion of such tools.

It remains unclear how enforcement might be approached. A truly decentralized exchange, for example, would have no entity that can be enforced against. However, a company that manages a particular centralized point such as a website url or somehow earns profit from its use might be a tempting target.

Uniswap, a popular DEX (decentralized exchange), is a series of smart contracts on Ethereum. It can’t be shut down. However, the company Uniswap Labs maintains the most popular front-end interface for this contact, Uniswap.com.

Uniswap Labs recently delisted many questionable tokens from its U.S. based front end website. However they are still available to anyone who knows how to interact with the Ethereum blockchain. It remains to be seen if this will satisfy regulators. And given the continued availability of the actual tool, it is unclear how much of an impact this might have beyond an initial spooking of the market.

4. What we’re reading, hearing, and watching.

Crypto

Beyond Crypto

- Action

- activities

- Adoption

- advisory

- allocation

- Application

- applications

- arbitrage

- around

- asset

- Assets

- availability

- Bank

- Banks

- binance

- Bitcoin

- blockchain

- BTC

- businesses

- Canada

- Central Banks

- chairman

- change

- China

- Coindesk

- commercial

- Companies

- company

- compliance

- continue

- contracts

- countries

- crypto

- Crypto adoption

- crypto asset

- Crypto ecosystem

- cryptocurrencies

- cryptocurrency

- Cryptocurrency Exchange

- Customers

- day

- decentralized

- Decentralized Exchange

- DeFi

- Derivatives

- Dex

- Dollar

- DX

- ecosystem

- Environment

- ETH

- ethereum

- ethereum (ETH)

- Europe

- EV

- exchange

- Exchanges

- FAST

- finance

- financial

- First

- flow

- follow

- FTX

- funds

- General

- Germany

- Gold

- good

- Government

- Governments

- Growing

- Growth

- hacking

- here

- High

- hold

- How

- How To

- hr

- HTTPS

- ia

- Impact

- Including

- Increase

- industry

- Innovation

- institutions

- interest

- investment

- investor

- Investors

- IT

- Italy

- Japan

- July

- Labs

- large

- Law

- law enforcement

- lead

- Legal

- Leverage

- Limited

- Line

- local

- Local Government

- major

- March

- Market

- marketplace

- Mayor

- medium

- Metrics

- money

- Most Popular

- move

- network

- networks

- news

- offer

- offering

- opens

- Other

- Paper

- policy

- Popular

- power

- price

- Products

- Profit

- promotion

- public

- racing

- radar

- Reading

- Regulators

- Run

- SEC

- Securities

- security

- Series

- Services

- settlement

- Short

- Silk Road

- Size

- smart

- Smart Contracts

- Space

- Stablecoins

- State

- stock

- street

- Target

- Tether

- token

- Tokens

- top

- Trading

- u.s.

- Uk

- Uniswap

- us

- US Dollar

- USD

- USDC

- value

- View

- volume

- Wall Street

- Website

- WHO

- Wikipedia

- world