- The PSA was an overarching regulatory structure for traditional and crypto exchanges.

- The MAS promptly issued the Notice PSN02 or Crypto Travel Rule, popularly known as the detailed Anti-Money Laundering and Combating the Financing of Terrorism guidelines.

- The Monetary Authority of Singapore unveiled a comprehensive regulatory framework on stablecoins.

The crypto market has its fair share of drawbacks that have plagued the industry since Bitcoin emerged. Many individuals have attributed volatility to the bane of cryptocurrency, but it’s the lack of undefined regulatory frameworks. For years, regulatory bodies, governments, and even organizations have tried to place a leash around the crypto market, but all in vain.

Sakamoto designed Bitcoin to forgo standard financial systems and cater to the user directly. This primary goal has plagued many financial institutions and even threatened the existence of banking systems. Despite this, several organizations created a bottleneck around digital assets, giving rise to custodial or centralized crypto exchanges.

Unfortunately, the era of centralized crypto exchanges is fading after the FTX fiasco highlighted its significant flaws. This left many with only one alternative: designing a regulatory framework for crypto that wouldn’t infringe on its primary objective and cater to the economic growth of a nation. For instance, Singapore’s crypto ecosystem is among the few that have thrived thanks to its positive regulatory framework.

The Monetary Authority of Singapore has integrated digital assets into its economy without trying to control them. Below are some of the positive steps the MAS has taken to propel Singapore’s crypto ecosystem.

The effort of the Monetary Authority of Singapore to promote blockchain and cryptocurrency

As mentioned, at the very core, decentralized applications, digital assets, and the entirety of Web3 run on a single principle: empower the user directly. Most individuals often think that organizations and services that run on Web2 technology give users complete control over their data. Unfortunately, most of the time, such beliefs are built from the marketing strategies of such organizations.

In reality, in Web2, a user only has as much control over the data as the organizations storing the information allow it. Companies and organizations are known for selling user information or distributing it across partner franchises. This is why, in most cases, when conversing with a colleague or anyone and the topic revolves around one of you desiring a specific service or goods, you will receive a nomination or ad for such an item.

Also, Read Coinbase Exchange acquires Singapore’s crypto license.

Web3 is designed to forgo this charade of control and give the user complete control over their information. Unfortunately, to surpass the workings and reach of Web3, blockchain technology and decentralized applications must find a way to co-exist with government and economies.

The Monetary Authority of Singapore is among the few regulatory bodies that have successfully created several regulatory frameworks, positively impacting Singapore’s crypto ecosystem. Currently, Singapore is a model nation when it comes to adopting balanced regulators and legal frameworks. Since its government tasked the MAS to monitor the risk of crypto-related transactions, the organization has achieved this directive without suppressing its technological innovations.

The MAS has made a significant effort to ensure its county’s ecosystem has a balanced regulatory framework.[Photo/Medium]

Among its first feats was the Payment Services Act, introduced in January 2020. According to the official notice, the PSA was an overarching regulatory structure for traditional and crypto exchanges. It essentially brought all payment-related services under a single legislation. It also introduces detailed license and money laundering compliance requirements that bolster the nation’s view on cryptocurrency. Upon achieving this feat, Singapore’s crypto ecosystem gained a new pace as crypto-based business operators adhered to the set guidelines.

Regulations on Security

The PSA refers to digital currency as digital payment. Tokens officially recognize Bitcoin and Ether as cryptocurrencies. Through this feature, the MSA approved crypt legal assets in Singapore, allowing their citizens and government to treat them as other asset classes.

Within the same year, the MAS brought public offerings and any issues of DPTs under the Securities and Futures Act. This meant that its government could treat digital assets as capital market products for all purposes.

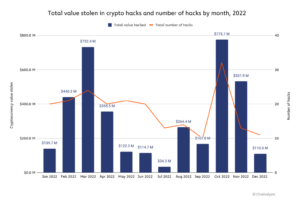

Unfortunately, the rise of cyber hackers and illegalities surrounding digital assets worldwide began to raise concern amid SIngapore’s crypto ecosystem. The region’s positive outlook on cryptocurrency would likely become a haven for money laundering activities and potential targets for crypto hacks.

The MAS promptly issued the Notice PSN02 or Crypto Travel Rule, popularly known as the detailed Anti-Money Laundering and Combating the Financing of Terrorism guidelines. The AML/CFT required that all crypto-related services perform customer due diligence. This procedure would require them to report suspicious customer transactions and provide a detailed transaction monitoring process for signs of misuse.

This initially ruffled some feathers, with crypto traders sighting that the new amendment could be a coverup to control transactions amid Singapore’s crypto ecosystems. However, the MAS clarified that the monitoring services were in place to only monitor any suspicious transactions over some time.

The Monetary Authority of Singapore introduced a regulatory framework for single-currency stablecoins.

Despite the MAS’s massive efforts to regulate cryptocurrency, the FTX cash essentially brought the world’s and Singapore’s crypto ecosystem to its knees. Despite the low transaction volume, a new trend steadily rose to fame amid the chaos: stablecoins.

Also, Read Benchmarking with the top three blockchain countries.

The 2023 crypto market has seen an unprecedented rise in stablecoin use. Its high valuation compared to most fiat currencies and low volatility rate has increased the use of stablecoin globally. Singapore’s crypto ecosystem experienced the same trend, and its government did not miss the opportunity.

The Monetary Authority of Singapore unveiled a comprehensive regulatory framework on stablecoins. Generally, they intend to establish a more transparent and accountable framework for their operations within the country.

The MAS’s stablecoin regulatory framework encompasses several requirements on value stability, capital, redemption at par, and security of audit results to users. According to the official report, the MAS intends to ensure high-value stability for regulated stablecoins in Singapre’s crypto ecosystems. The regulatory framework will enhance the credibility of stablecoins and a digital medium of exchange. It will bridge the gap between the fiat and digital assets ecosystem when fully rolled out.

In addition, old regulatory frameworks will complete the effort of this stablecoin framework, allowing smooth execution. According to the central bank, the single-currency stablecoin will be pegged to the Singaporean dollar or any G10 currency. This includes the US dollar, the error, and the British pound. As a reference, the stablecoins must hold a minimum base capital of 1 million Singapore dollars ($740,000) and provide redemption within no more than five business days of a request.

Wrapping Up

Singapore’s crypto ecosystem has significantly improved over the years. The intervention of the MAS and its central bank has showcased how a positive outlook on crypto can transform nations. As the industry transitions into its 2024 bull run, the region’s ecosystem is set to improve. Aside from the stablecoin, Singapore intends to introduce a CBDC shortly.

Also, Read Crypto.com receives Bank of Spain’s approval to expand crypto services.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://web3africa.news/2023/11/27/news/monetary-authority-of-singapore/

- :has

- :is

- :not

- 000

- 1

- 2020

- 2023

- 2024

- 33

- 7

- a

- According

- accountable

- achieved

- achieving

- Acquires

- across

- Act

- activities

- Ad

- addition

- adhered

- Adopting

- After

- All

- allow

- Allowing

- also

- alternative

- Amid

- among

- an

- and

- anti-money laundering

- any

- anyone

- applications

- approval

- approved

- ARE

- around

- AS

- aside

- asset

- Assets

- At

- audit

- authority

- balanced

- Bank

- Banking

- base

- BE

- become

- began

- beliefs

- below

- between

- Bitcoin

- blockchain

- blockchain technology

- bodies

- bolster

- BRIDGE

- British

- British Pound

- brought

- built

- bull

- Bull Run

- business

- but

- CAN

- capital

- cases

- Cash

- cater

- CBDC

- central

- Central Bank

- centralized

- Chaos

- Citizens

- clarified

- classes

- colleague

- COM

- combating

- comes

- Companies

- compared

- complete

- compliance

- comprehensive

- Concern

- control

- Core

- could

- country

- created

- Credibility

- crypt

- crypto

- Crypto ecosystem

- Crypto Ecosystems

- Crypto Exchanges

- crypto hacks

- Crypto Market

- crypto traders

- Crypto Travel Rule

- crypto-based

- cryptocurrencies

- cryptocurrency

- currencies

- Currency

- Currently

- custodial

- customer

- cyber

- data

- Days

- decentralized

- Decentralized Applications

- designed

- designing

- Despite

- detailed

- DID

- digital

- Digital Assets

- digital currency

- Digital Payment

- diligence

- directly

- distributing

- Dollar

- dollars

- drawbacks

- due

- Economic

- Economic growth

- economies

- economy

- ecosystem

- Ecosystems

- effort

- efforts

- emerged

- empower

- encompasses

- enhance

- ensure

- entirety

- Era

- error

- essentially

- establish

- Ether

- Even

- exchange

- Exchanges

- execution

- existence

- Expand

- experienced

- fair

- FAME

- feat

- Feature

- few

- Fiat

- fiat currencies

- financial

- Financial institutions

- financial systems

- financing

- Find

- First

- five

- flaws

- For

- Framework

- frameworks

- from

- FTX

- fully

- Futures

- gained

- gap

- generally

- Give

- Giving

- Globally

- goal

- goods

- Government

- Governments

- Growth

- guidelines

- hackers

- hacks

- Have

- haven

- High

- Highlighted

- hold

- How

- However

- HTTPS

- impacting

- improve

- improved

- in

- includes

- increased

- individuals

- industry

- information

- initially

- innovations

- instance

- institutions

- integrated

- intend

- intends

- intervention

- into

- introduce

- introduced

- Introduces

- Issued

- issues

- IT

- ITS

- January

- jpg

- known

- Lack

- Laundering

- left

- Legal

- Legislation

- License

- likely

- Low

- made

- many

- Market

- Marketing

- Marketing Strategies

- MAS

- massive

- max-width

- meant

- medium

- medium of exchange

- mentioned

- million

- minimum

- miss

- misuse

- model

- Monetary

- monetary authority

- Monetary Authority of Singapore

- money

- Money Laundering

- Monitor

- monitoring

- more

- most

- much

- must

- nation

- Nations

- New

- no

- nomination

- Notice..

- objective

- of

- Offerings

- official

- Officially

- often

- Old

- on

- ONE

- only

- Operations

- operators

- Opportunity

- or

- organization

- organizations

- Other

- out

- Outlook

- over

- overarching

- Pace

- partner

- payment

- pegged

- Perform

- Place

- plagued

- plato

- Plato Data Intelligence

- PlatoData

- positive

- positively

- potential

- pound

- primary

- principle

- procedure

- process

- Products

- promote

- Propel

- provide

- public

- purposes

- raise

- Rate

- reach

- Reality

- receive

- receives

- recognize

- redemption

- reference

- refers

- Regulate

- regulated

- Regulators

- regulatory

- report

- request

- require

- required

- Requirements

- Results

- revolves

- Rise

- Risk

- Rolled

- ROSE

- Rule

- Run

- s

- same

- Securities

- security

- seen

- Selling

- service

- Services

- set

- several

- Share

- Shortly

- showcased

- significant

- significantly

- Signs

- since

- Singapore

- Singapore’s

- Singaporean

- single

- smooth

- some

- specific

- Stability

- stablecoin

- Stablecoins

- standard

- steadily

- Steps

- storing

- strategies

- structure

- Successfully

- such

- surpass

- Surrounding

- suspicious

- Systems

- taken

- targets

- technological

- Technology

- Terrorism

- than

- Thanks

- that

- The

- the information

- their

- Them

- they

- think

- this

- three

- Through

- time

- to

- Tokens

- top

- topic

- Traders

- traditional

- transaction

- Transactions

- Transform

- transforms

- transitions

- transparent

- travel

- Travel Rule

- treat

- Trend

- tried

- true

- trying

- undefined

- under

- unfortunately

- unprecedented

- unveiled

- upon

- us

- US Dollar

- use

- User

- users

- vain

- Valuation

- value

- very

- View

- Volatility

- volume

- was

- Way..

- Web2

- Web3

- were

- when

- why

- will

- with

- within

- without

- workings

- world’s

- worldwide

- would

- year

- years

- You

- zephyrnet