Long time readers of Nextbigfuture know that I have been optimistic about China’s economy for well over two decades. Those were correct and accurate tracking and forecasts. There would be complaints that tracking the situation every few months was boosterism for China.

Well the change has happened.

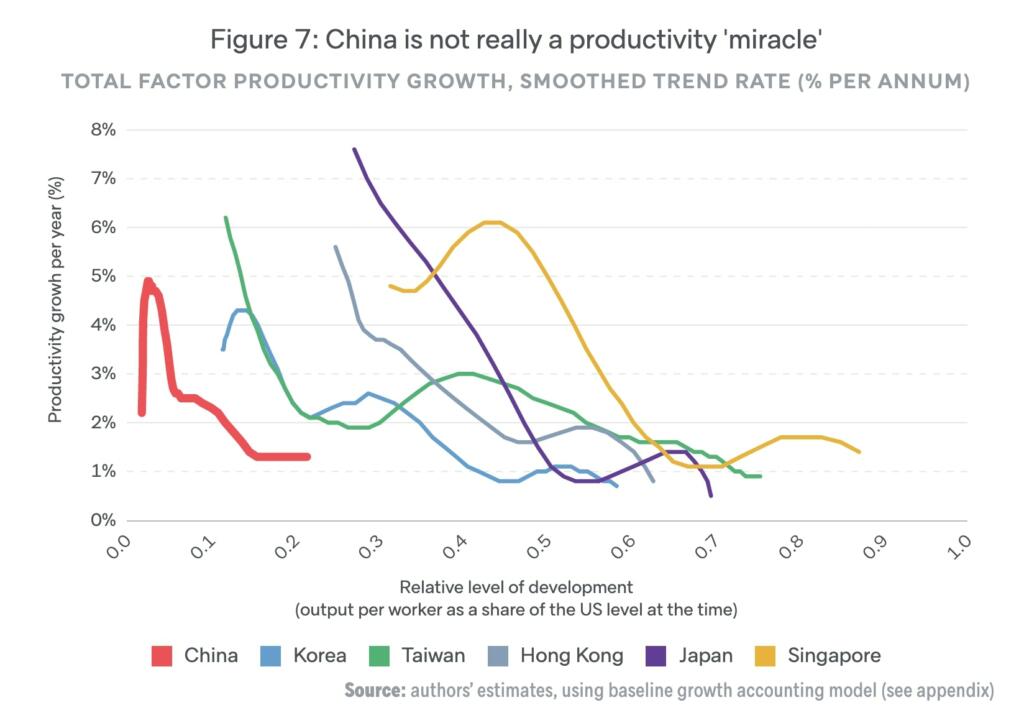

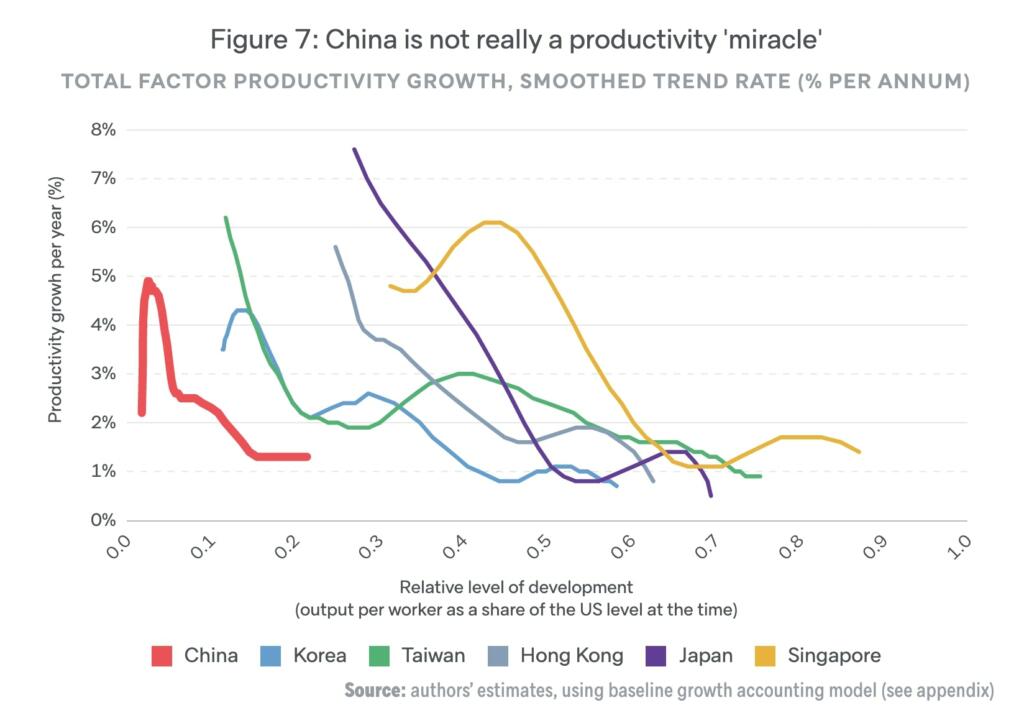

China’s economy has basically stalled out. China’s economy was extraordinary and outperformed relative to other countries. It did this by catching up. Catching up is a big deal especially for the largest national population in the world.

There are those saying China will have an economic collapse because of the real estate and debt crisis. I believe that China will mostly be able to avoid those situations. China has levers that they can pull that other countries cannot. China can tear down millions of homes if there was a glut of overbuilding. China’s leaders can appoint some companies to complete buildings that a major company could not complete. They can force home buyers to continue to make payments or face jail penalties.

However, letting situations deteriorate where such extreme measures are needed shows a lack of competence.

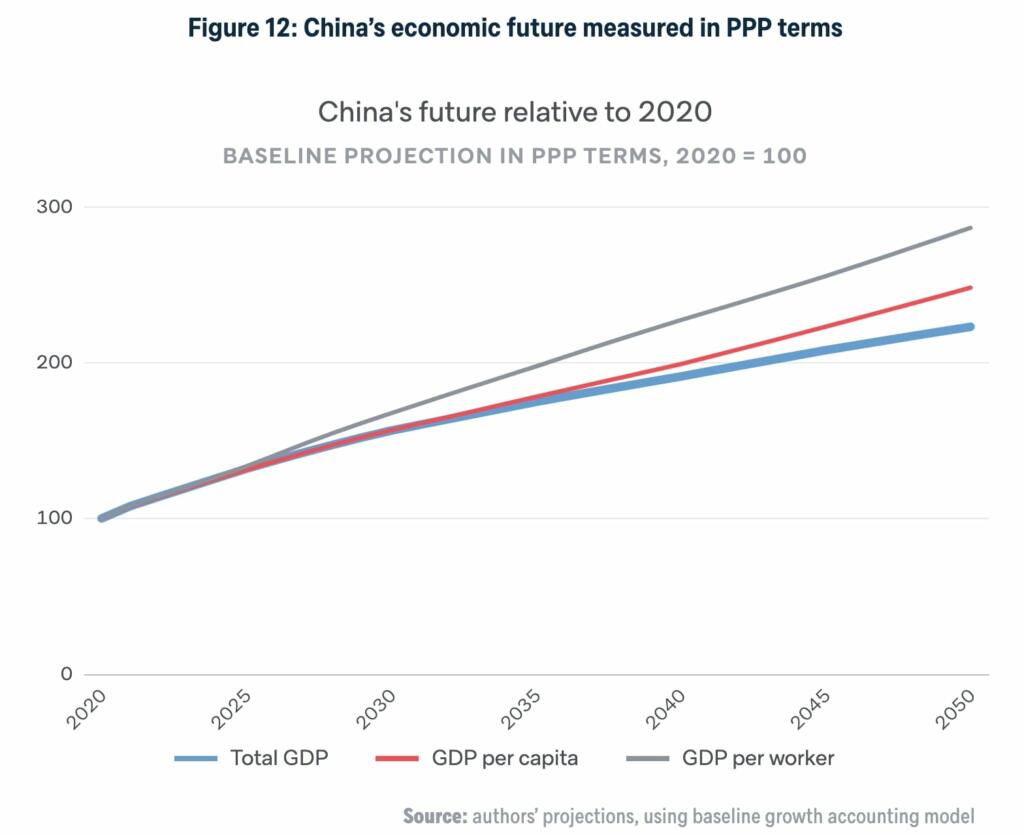

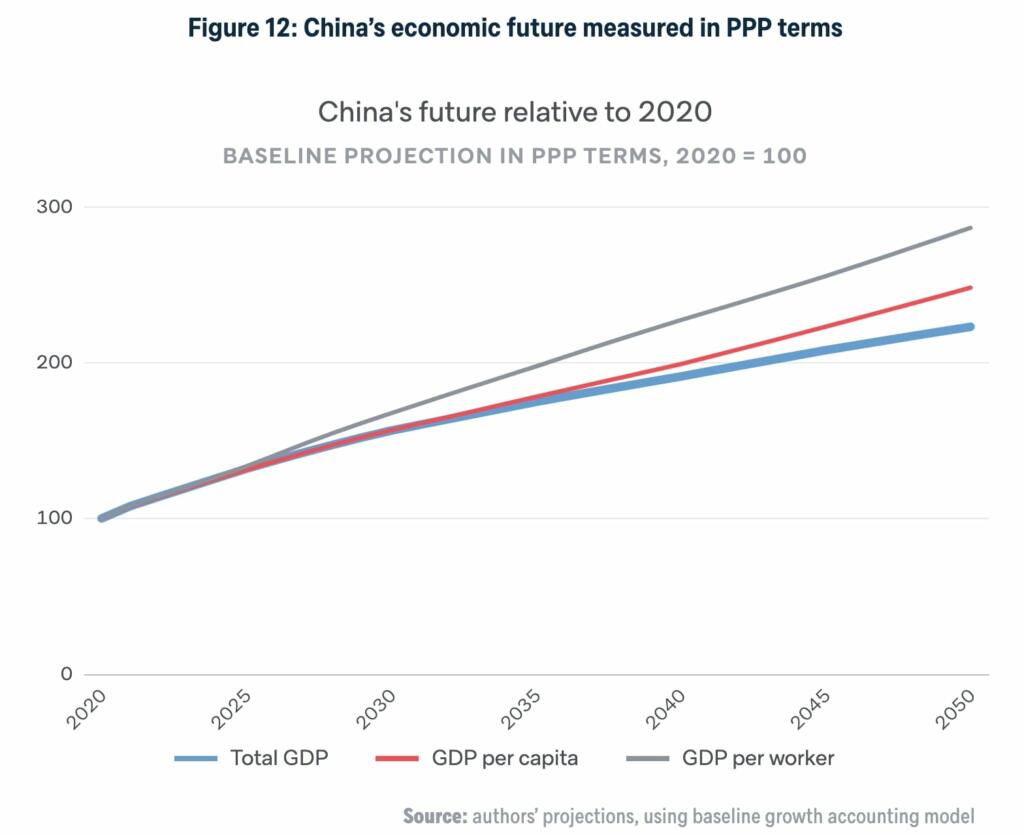

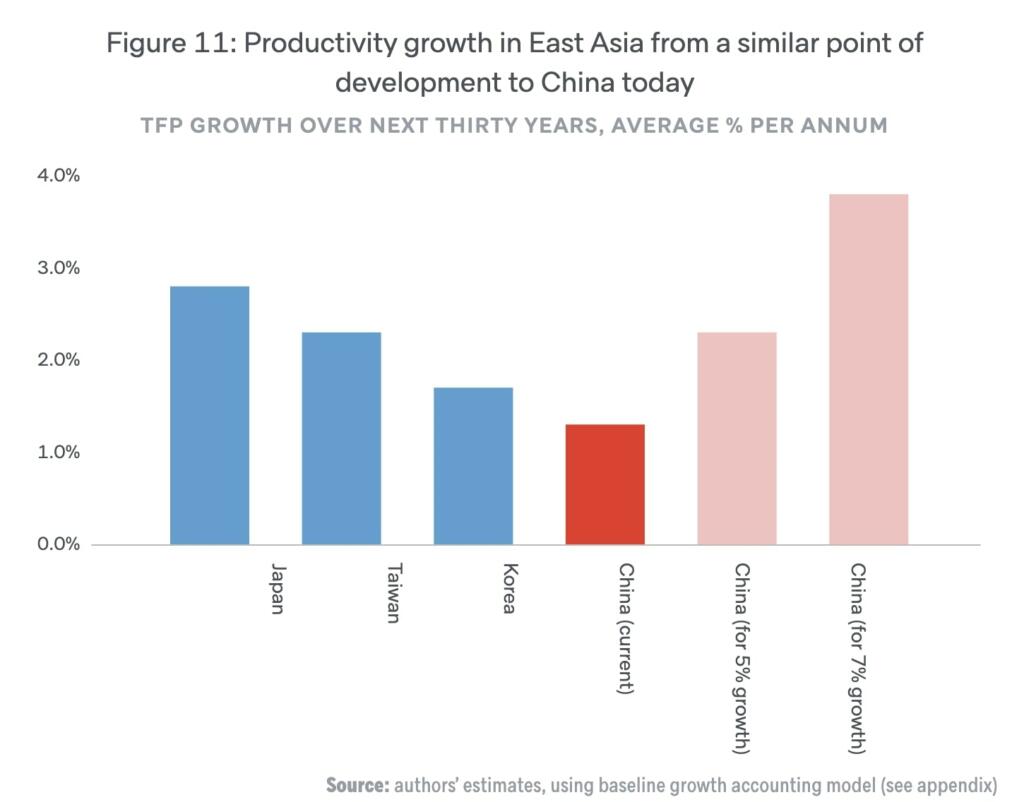

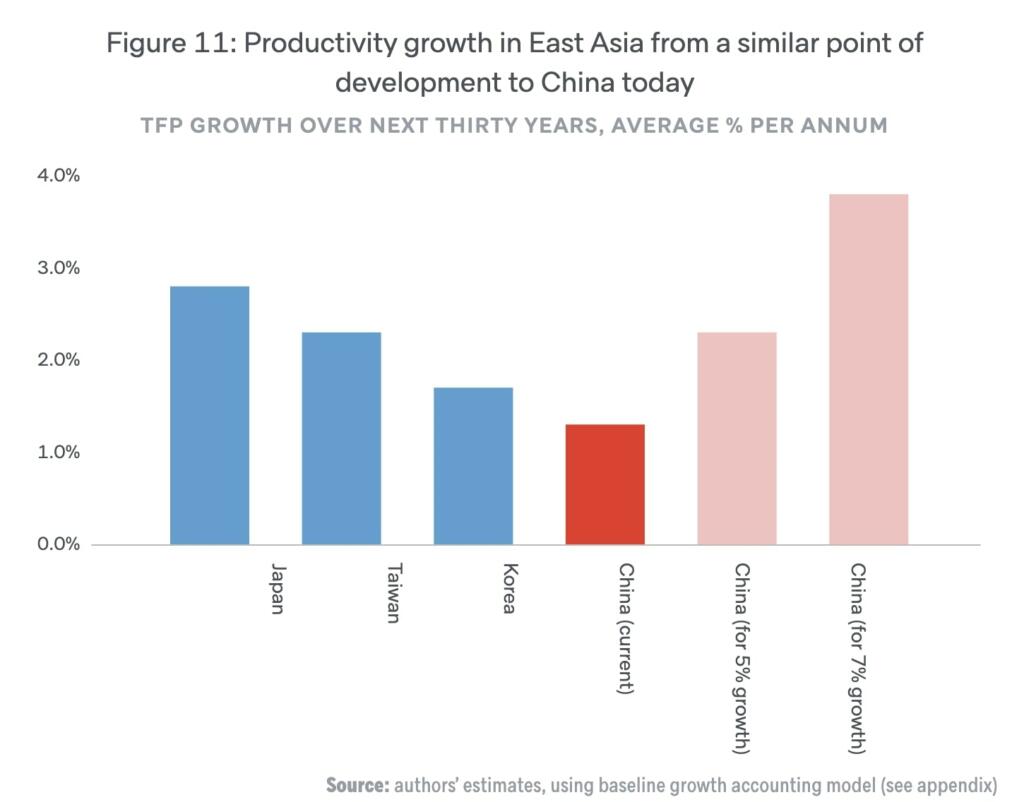

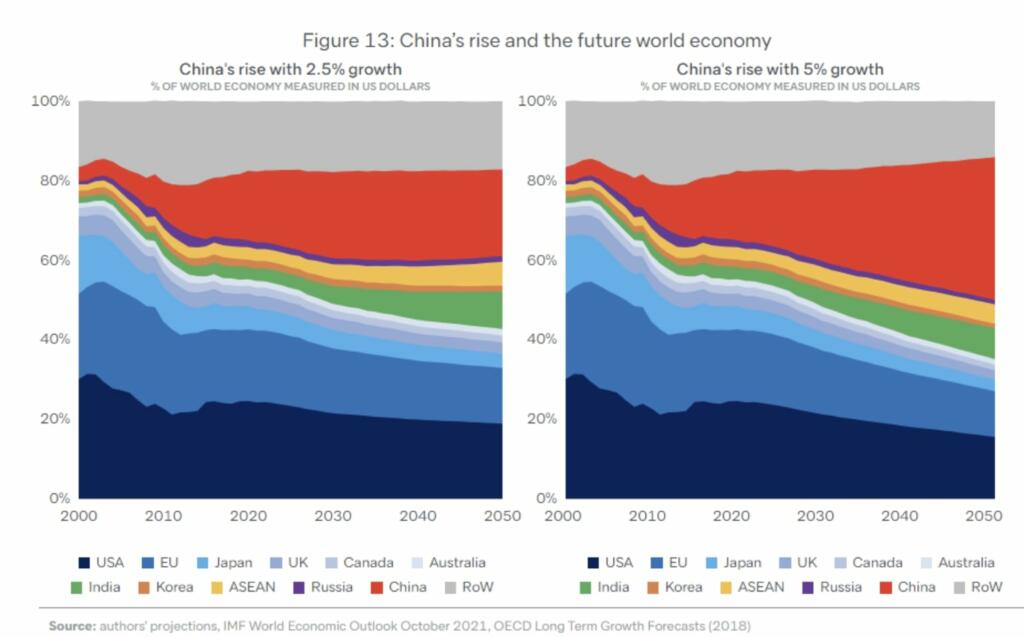

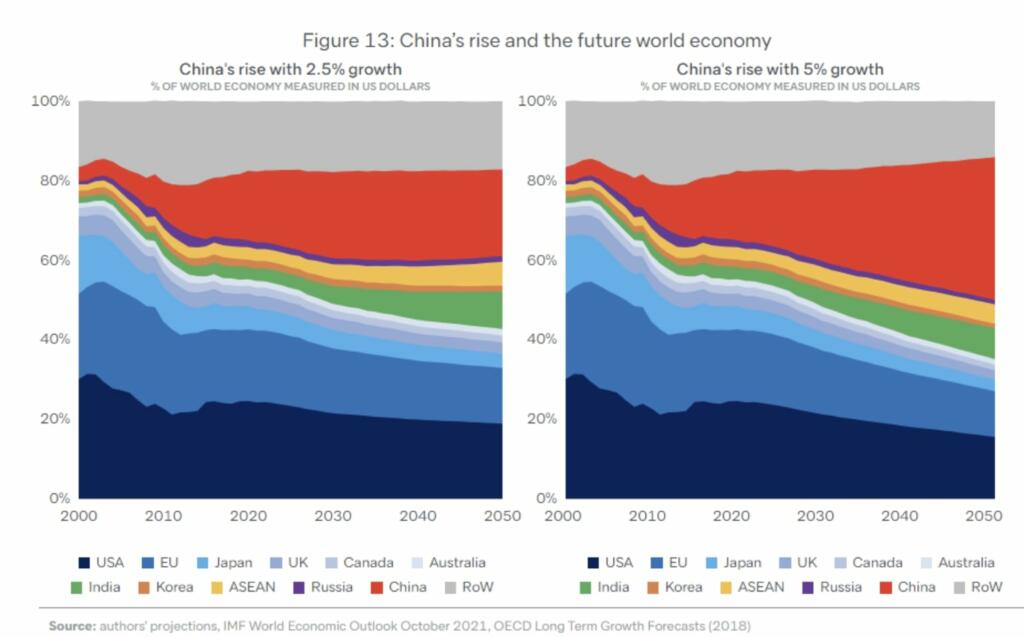

The Lowy Institute used to also forecast China’s economy rising out to 2050. They now have adjusted that downwards and I agree on the downward revision. The central expectation should be for Chinese economic growth to be around 2–3% a year to 2050, implying a significant downward revision in the narrative of a rising China.

I also have a forecast that the world could see massive economic improvements from self-driving cars, humanoid robot in the 2020s and 2030s and radical life extension in the 2040s. However, those technological improvements will not be layered on top of a continued economic boom in China.

China’s overall economy is larger than the US on a purchasing power parity basis. It is about 1.2 times bigger than the US. China now might get to 1.3 to 1.4 times bigger than the US economy and then peak at that level.

Over the past two decades, China’s housing investment is estimated to have doubled to 14% of GDP, accounting for about half of all private fixed investment. By comparison, total real estate investment was 6% of GDP in the United States at the height of its own construction boom in the mid-2000s. Real estate investment could drop by 10% of GDP to 4% of GDP.

China can still experience economic booms and busts but it will not be from an average trajectory of +7% per year of +5% per year. China’s economy will be at a middle of the global pack level baseline.

If China started doing everything right they could get to 5% per year economic growth and perhaps get to double the US economy in 2050. However, China has not been going everything right for a decade or more.

China faces a -10% drop in its workforce for every decade from now to 2050.

China economy could even drop to -1% or -2% per year from the global baseline. This will be because of the workforce decline and the real estate and debt issues.

China would be like Japan and Europe if radical life extension were developed. If suddenly people over 65 were as healthy and active as people in their 30s or 40s then countries with a lot of old people would greatly benefit and see five to ten years of up to 10% GDP growth. However, this is unlikely to happen at scale until the late 2030s at the earliest.

There are currently no economic miracle countries in the world. There some countries doing relatively OK. India can get to about 6% GDP growth and Indonesia and many ASEAN countries are near that level.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

- algorithim

- artificial intelligence

- blockchain

- China

- coingenius

- cryptography

- cypher

- Economic Impact

- energy

- future

- ibm quantum

- medicine

- Military

- Next Big Futures

- plato

- plato ai

- Plato Data Intelligence

- Plato Game

- PlatoData

- platogaming

- Quantum

- quantum computers

- quantum computing

- quantum physics

- robotics

- Science

- Technology

- world

- zephyrnet