Read Time: 5 minutes

The Merge event is a milestone holding the greatest significance in the journey of Ethereum. And not to mention, Ethereum is now at the brim of transition from Proof of work to proof of stake consensus for mining Ether through this merge.

Since the time the Ethereum team gave an announcement about the Ethereum Merge launch set to happen shortly, the price of Ether started rallying towards an upward curve. And so do the misconceptions around the upgrade.

In that regard, this blog tries to paint a better picture of the Ethereum Merge by busting the myths revolving around the internet. Let’s get into the details of the discussion.

Highlights

- Ethereum’s core team member, Tim Beiko, proposed a tentative date for the crucial merge of Ethereum to happen on September 19th, 2022.

- In light of the biggest upgrade ever, there has been a 22% surge in the Ethereum price in the past few days reaching a one-month high of $1,573.

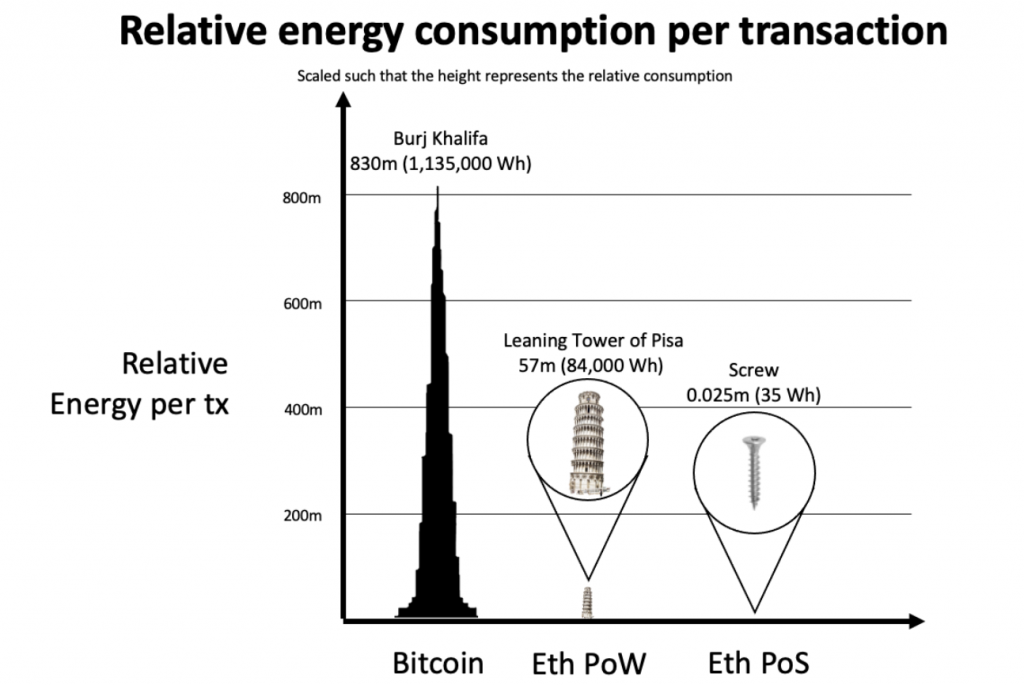

- The transition to proof of stake drives down the energy usage by 99.95%, making Ethereum more environment-friendly.

#Myth 1: Merge Will Reduce The Cost Of Using Ethereum

As per the official disclosure by the Ethereum team, there will be no reduction in the gas fees. The Merge essentially involves modifying the consensus that does not cause any changes to the network capacity or the gas fee. Let’s understand on what basis the gas fee is charged?

The high gas fee is due to the popularity of Ethereum. Ethereum transactions require computational resources for successful execution. The gas fee is paid for calculating, storing or manipulating data and performing transactions.

Source: https://blog.ethereum.org/2021/05/18/country-power-no-more/

Considering the network’s capacity, when the demand is high, the users pay higher tips to add their transactions to the block preferentially. Since the merge event has nothing to do with the network scalability or throughput, the possibility of charging a lower gas fee is ruled out.

However, in the plan to work on the Sharding upgrade, the Ethereum team is supposed to address the exponential growth of network capacity.

#Myth 2: Staking 32 ETH Is Mandatory To Run A Node

Running a node does not mandate staking ETH tokens, provided the node type. To simplify this further, let’s understand the two types of nodes.

The two types of nodes are the one that has the ability to propose blocks and the other that doesn’t.

The ability to propose the next block is called the validator nodes that require the staking of ETH tokens in the proof of stake or committing GPU hash power resource in case of proof of work. In return, the validator earns protocol rewards.

On the other hand, other nodes do not propose blocks but still hold a crucial role in securing the network. They check the validators adding the new blocks and verify that they obey the network consensus rules.

While running this node does not require to stake any ETH except they need computer hardware with 1-2 TB storage and a good internet connection. Since they are significant to Ethereum, these nodes gain improved security, privacy and censorship resistance privileges.

#Myth 3: Creation Of New Tokens

Ethereum team clearly states that the swapping to proof of stake from the genesis keeps all the assets of the user intact and unaltered. Therefore, users needn’t have to transfer any funds from the wallet or update anything from their side.

There have been instances where hackers tried to exploit this situation and convince users to swap ETH tokens to the ETH2 version.

There is no such thing as ETH2 tokens clarified by the guidance issued by the Ethereum team.

#Myth 4: Validators Cannot Access Liquid ETH Rewards Until Shanghai Upgrade

Validators will have access to the fee rewards credited on block proposals, says the Ethereum foundation team. However, the staked ETH and newly issued ETH are locked until the Shanghai upgrade.

To elaborate further, the transactions on the Ethereum mainnet, also called the execution layer, involve a gas fee and tip paid to the validator as ETH. This ETH is available for the validator immediately.

Whereas, Beacon chain, the consensus layer is accountable for the newly issued and staked ETH and that which is locked. The block proposers can withdraw them only after the subsequent Shanghai upgrade.

#Myth 5: Can Withdraw Staked ETH After The Merge

As discussed above, staked and newly issued ETH will still be locked on the Beacon chain even after The Merge.

And the team cleared out that the withdrawals of these assets are scheduled in the upcoming Shanghai upgrade.

Concluding Note

More precisely, the Ethereum merge aims to address the energy consumption issue, saving about 99.95% of the energy usage through the consensus transition. Furthermore, this upgrade also reduces the amount of ETH that can be mined and will be let into circulation.

This upgrade also proves to be advantageous to users in terms of gaining increased annual returns for the staked ETH and being eco-friendly.

In short, Merge is less energy-intensive, excluding all the fallacies.

Get in touch with QuillAudits to stay secure from the rising Web3 hacks and exploits.

FAQs

Will the Ethereum Merge cause a price increase?

The Ethereum Merge catalyses the trading of ETH for now because this is the most notable upgrade in history and which is the culmination of years of efforts. However, crypto is not immune, but definitely, the Merge would have a huge environmental impact.

Will ETH2 replace ETH?

The Ethereum team clearly expressed that they are not introducing any ETH2 coins and any notifications on ETH2 updates are a scam to trick users.

What does Ethereum consensus layer Merge mean?

The Beacon chain, which will merge with Ethereum, forms the consensus layer where the staked ETH and newly mined tokens are locked. Through this consensus layer merge, the energy usage is drastically reduced for processing transactions.

What is the next Ethereum upgrade following Merge?

The Shanghai upgrade is planned after The Merge, facilitating the stakers to withdraw the locked assets in the Beacon consensus layer.

158 Views

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- Ethereum blockchain

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Quillhash

- trending

- W3

- zephyrnet