Top Defi tokens like Uni and Curve are dropping in value as the markets start cooling down over the past 24 hours as we are reading more today in our latest altcoin news.

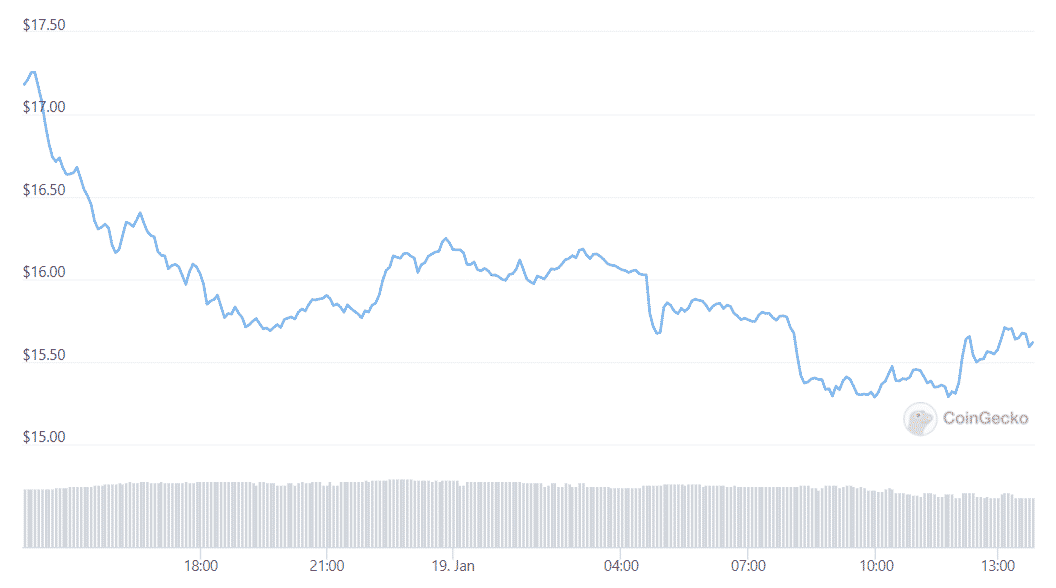

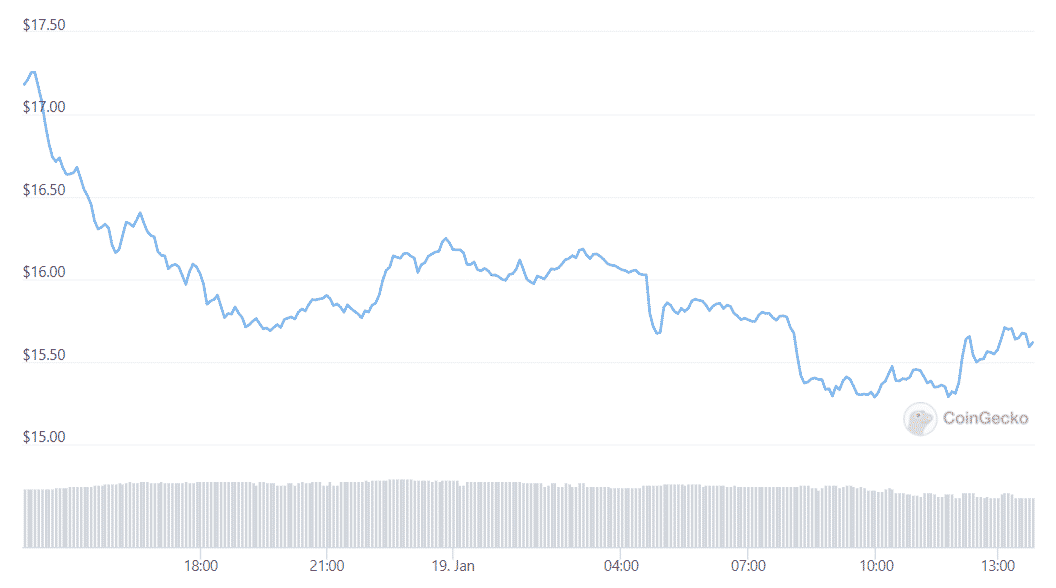

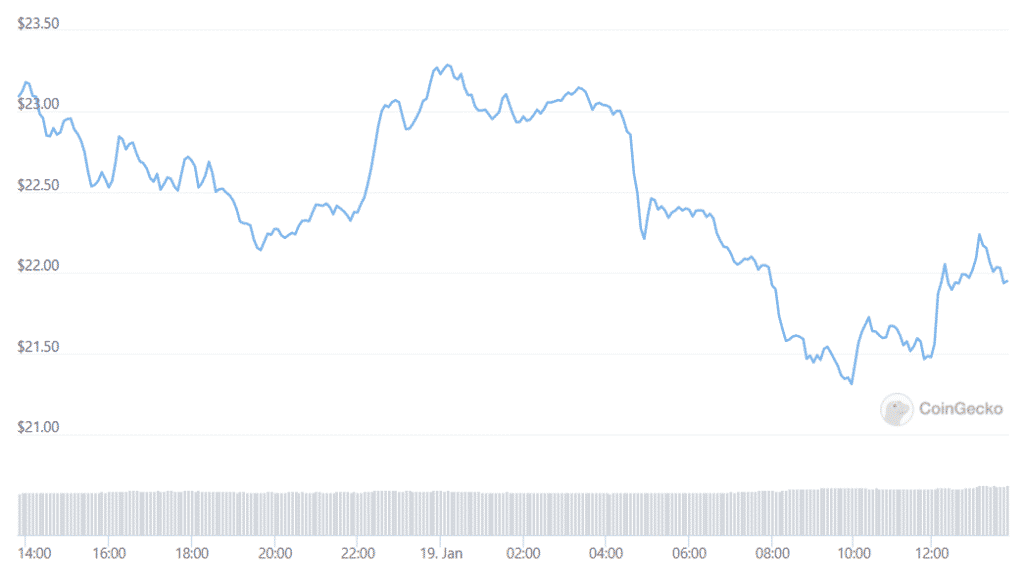

The DEFI sector took quite the hit over the past day with some of the top defi tokens like Uniswap’s UNI suffering major losses. UNI is down by 11.8% slipping to a low of $15.29and the token lost about 16% of the value in the past two weeks and it is now 65.9% off the all-time high of the $44.9 seen in May last year. LINK as the native token of Chainlink slipped to a two-week low and lost 7.1% over the day and 20% in the past week. Chainlink’s co-founder Sergey Nazarov revealed that the project plans to add a staking option for LINK holders later this year.

The initial enthusiasm took LINK above $28 a week ago but it is slowly dropping down with the token trading at $21.56 at press time. CRV as the token from Curve Finance, a decentralized trading platform focused on stablecoins and similar other assets, is also down by 7% and changing hands at $4.32. CRV surged above $6.50 at the start of the year but the tokens’ price retraced again and lost about 30% in the past two weeks.

LRC as the native token of the Layer-2 crypto exchange Loopring is defying the downtrend and increased by 3.7% over the day to a high of $1.19. this will come as a consolation to the longer-term LRC holders as the token is down by 20% over the past week as much as 42.5% in the past two weeks. Looking at the data, the total value locked in DEFI protocols dropped by $25 billion since the start of the year and it is now standing at $226.92 billion.

As recently reported, Defi needs new multichain products because they facilitate interactions between incompatible blockchains allowing the industry to develop faster and in a short period of time. As a result, producing interoperable products became a necessity for the continued growth of DEFI. For DEFI to reach its full potential, the multichain approach has to be prioritized. Supporting multi-chain assets in DEFI allows for the discovery of new liquidity and the expansion of the DEFI industry user base.

- 11

- 7

- 9

- About

- Allowing

- Altcoin

- Assets

- Billion

- Chainlink

- Co-founder

- CoinGecko

- CRV

- crypto

- crypto exchange

- Crypto Markets

- curve

- data

- day

- decentralized

- DeFi

- develop

- discovery

- down

- Drop

- dropped

- exchange

- expansion

- finance

- focused

- full

- Growth

- High

- holders

- HTTPS

- increased

- industry

- IT

- latest

- LINK

- Liquidity

- looking

- major

- Markets

- news

- Option

- Other

- platform

- press

- price

- Products

- project

- Reading

- Revealed

- sector

- Short

- similar

- Stablecoins

- Staking

- start

- time

- today

- token

- Tokens

- top

- Trading

- value

- week

- year