–>

Crypto exchange Binance will cease support for deposits and withdrawals of TORN, a native token for crypto mixing service Tornado Cash, which was sanctioned in August 2022.

In a blog announcement on Monday, Nov. 27, 2023, the exchange said it will delist TORN as well as BitShares (BTS), PERL.eco (PERL) and Waltonchain (WTC) on Dec. 7, 2023 at 03:00 (UTC).

After the deadline, Binance will stop accepting deposits with the tokens. Withdrawals of TORN, BTS, PERL and WTC from Binance are expected to be suspended on Mar. 7, 2024 at 03:00 (UTC).

See Also: Breaking: Binance To Delist 10 Trading Pairs

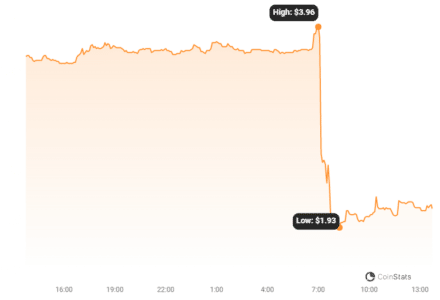

While the reason for the move is not clear, Binance said the tokens no longer meet its standard. After the news broke, TORN price plunged by over 44% below the $2 mark, according to data from Coinstats.

In Sept. 2023, Tornado cash co-founder Roman Storm pleaded not guilty to charges he helped launder over $1 billion of illicit funds generated by North Korean hackers.

Tornado Cash is a decentralized Ethereum-based protocol that enhances transaction privacy by obscuring the link between sender and receiver addresses. Crypto mixing, a service offered by platforms like Tornado Cash, involves pooling and scrambling cryptocurrencies from various users to anonymize transactions and obscure their origin.

The delisting announcement comes shortly after Binance founder Changpeng Zhao pleaded guilty to violating U.S. anti-money-laundering requirements and agreed to step down as the exchange’s head.

See Also: North Korean Hackers Pose as South Korean Government Officials to Steal Crypto

As per the U.S. Treasury Department, Binance “willfully failed” to report to regulators more than 100,000 transactions on its platform tied to illicit activity such as darknet, scams, fraud and other malicious activity.

As part of the $4.3 billion settlement agreement, Binance agreed to a look back to identify and report to FinCEN the “suspicious transactions that it processed and willfully failed to report,” the regulator said.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitcoinworld.co.in/tornado-cashs-token-torn-plunges-45-following-binance-delisting/

- :is

- :not

- $1 billion

- 000

- 10

- 100

- 2022

- 2023

- 2024

- 27

- 7

- a

- accepting

- According

- activity

- addresses

- After

- agreed

- Agreement

- AI

- also

- and

- Announcement

- ARE

- AS

- At

- AUGUST

- back

- BE

- below

- between

- Billion

- binance

- Bitcoinworld

- Blog

- bring

- Broke

- Buterin

- by

- Cash

- Category

- cease

- Changpeng

- Changpeng Zhao

- charges

- Chart

- clear

- CO

- Co-founder

- comes

- crypto

- cryptocurrencies

- Darknet

- data

- deadline

- decentralized

- Default

- DELISTING

- Department

- deposits

- down

- Enhances

- Ethereum-based

- exchange

- expected

- Failed

- far

- FinCen

- following

- For

- founder

- fraud

- from

- fundamental

- funds

- generate

- generated

- Government

- Government Officials

- guilty

- hackers

- Have

- he

- head

- height

- helped

- Holdings

- HTML

- HTTPS

- identify

- illicit

- illicit activity

- in

- IT

- ITS

- Korean

- like

- LINK

- longer

- Look

- mark

- max-width

- Meet

- Mixing

- Monday

- more

- move

- Nations

- native

- Native Token

- news

- no

- North

- north korean hackers

- nov

- of

- offer

- offered

- officials

- on

- origin

- Other

- over

- part

- partners

- per

- plans

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- plunged

- plunges

- pose

- price

- price chart

- privacy

- Processed

- protocol

- pushes

- reason

- regulator

- Regulators

- report

- Requirements

- Reuters

- roman

- ROW

- s

- Said

- Sanctioned

- SBI

- SBI Holdings

- scams

- School

- sender

- sept

- service

- settlement

- Shortly

- sign

- Source

- South

- south korean

- standard

- Step

- Stop

- Storm

- such

- support

- suspended

- TAG

- than

- that

- The

- their

- Tied

- to

- token

- Tokens

- torn

- tornado

- Tornado Cash

- Trading

- transaction

- Transactions

- treasury

- Treasury Department

- tutorial

- u.s.

- U.S. Treasury

- u.s. treasury department

- unite

- users

- using

- UTC

- various

- Violating

- was

- WELL

- which

- width

- will

- with

- Withdrawals

- zephyrnet

- Zhao