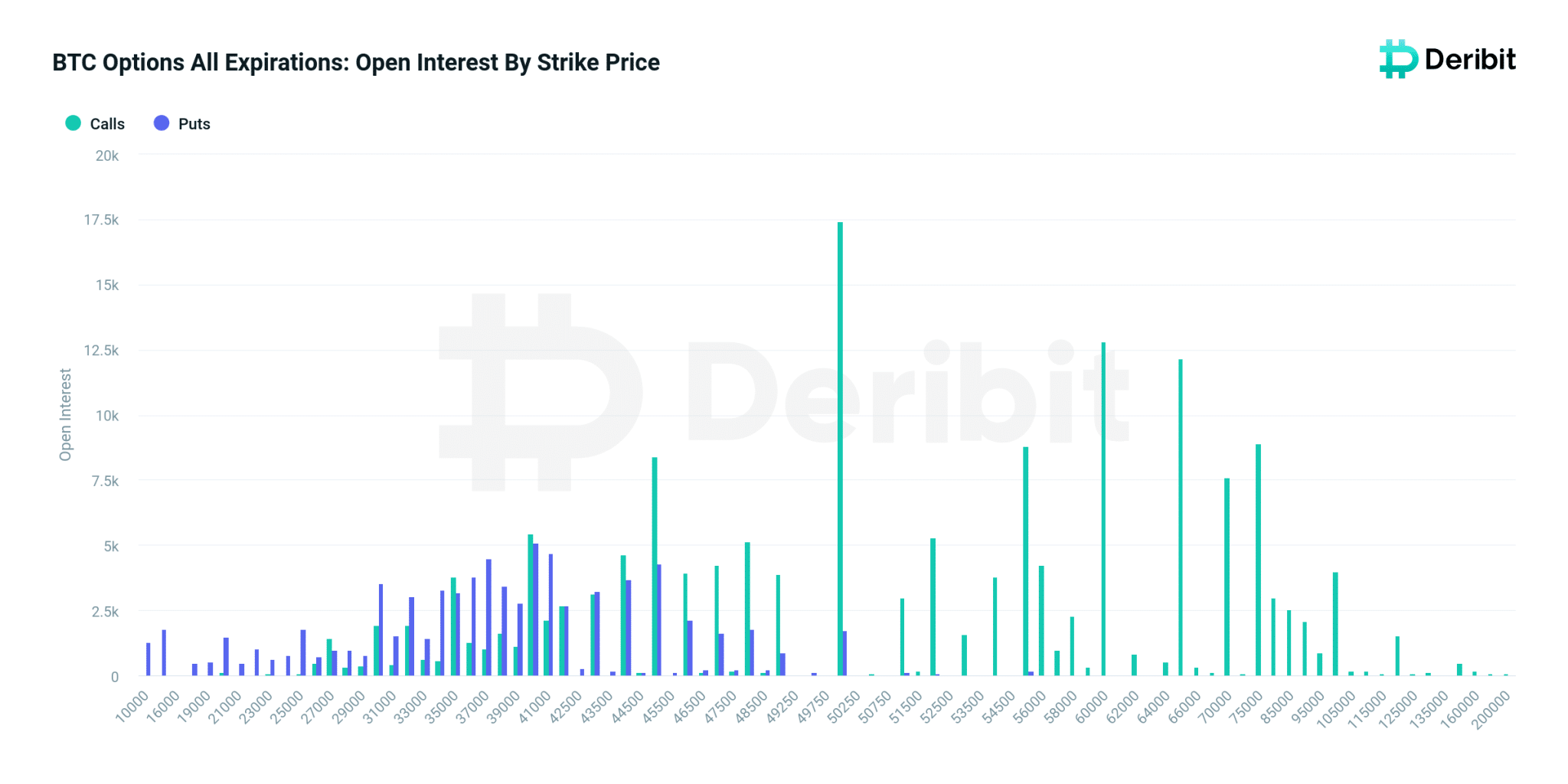

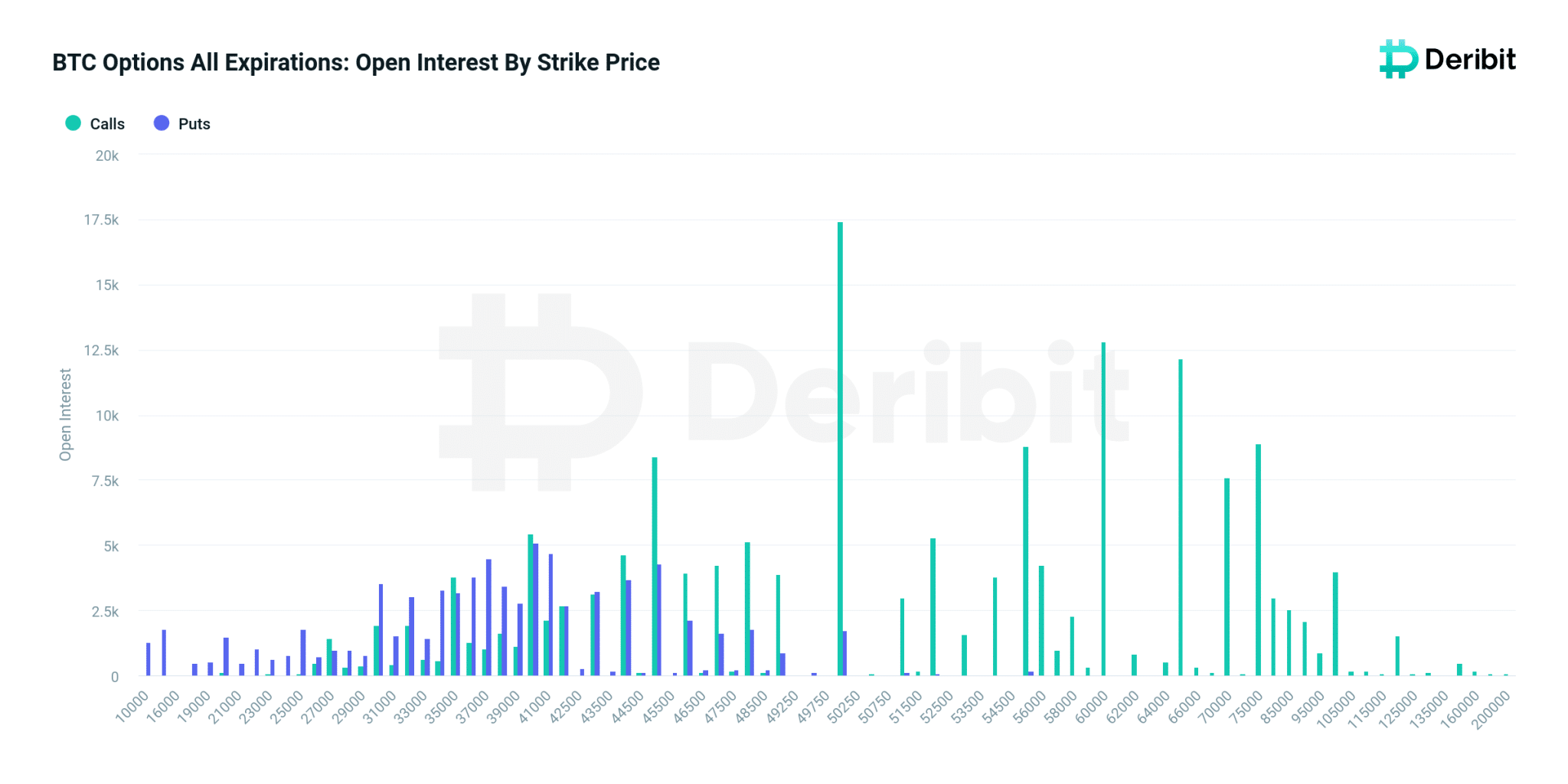

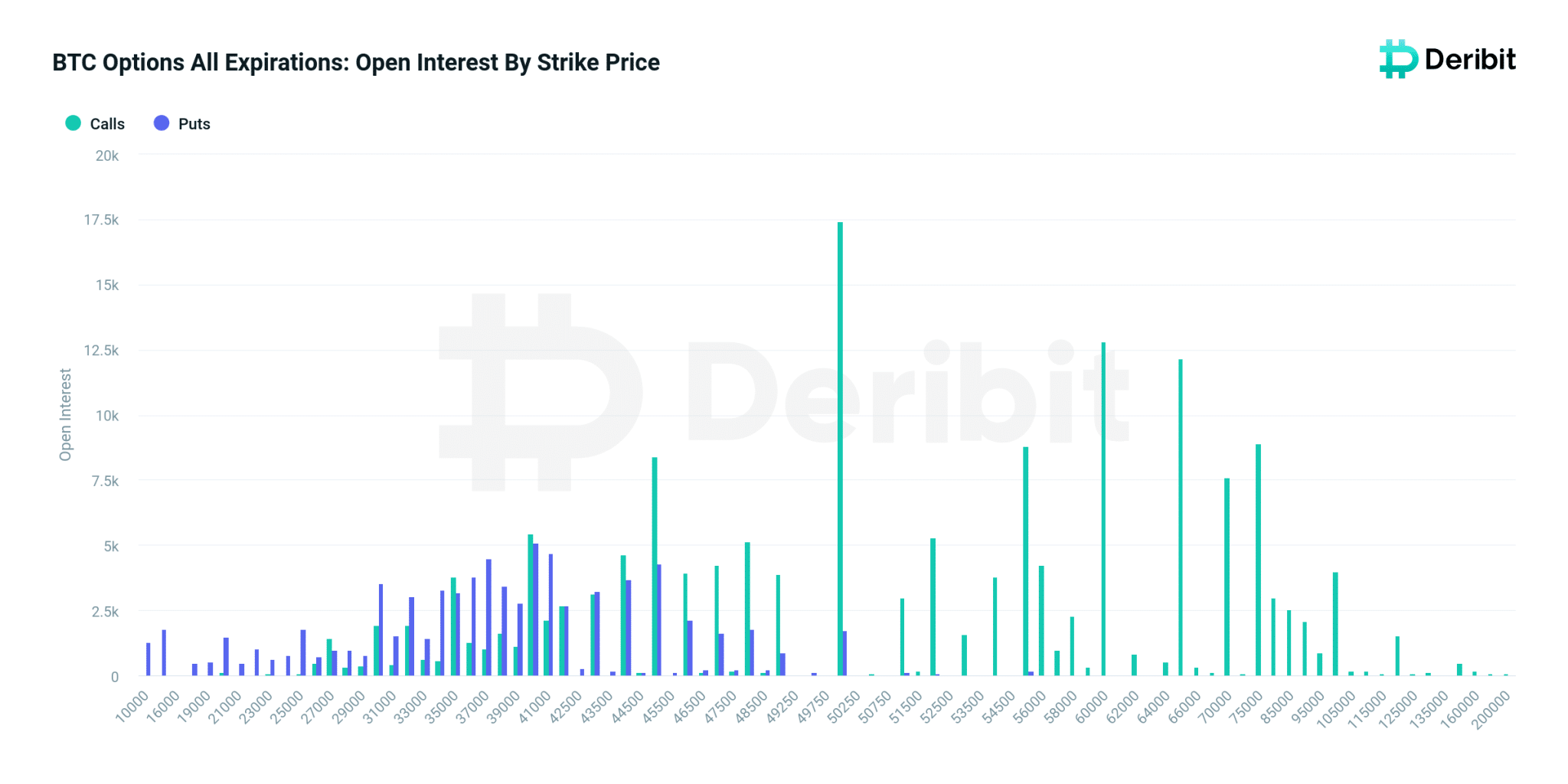

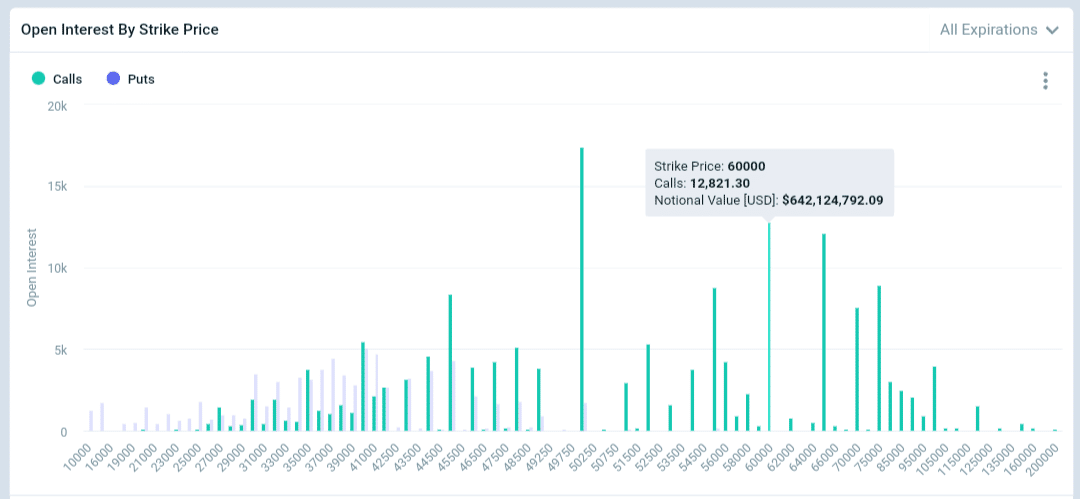

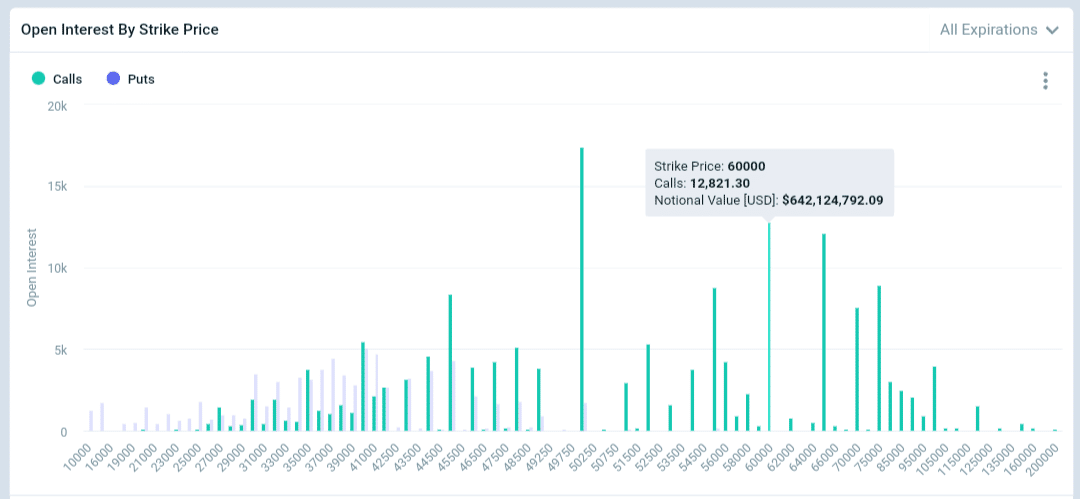

Bitcoin (BTC) traders are betting big on the crypto asset, with calls around the $60,000 strike price seeing a surge to a notional value of $642 million.

Data from leading crypto derivatives trading platform Deribit confirms this metric, suggesting that market participants have demonstrated a remarkable increase in bullish interest toward Bitcoin on the back of the asset’s recent push above $50,000.

Recall that BTC recently breached the crucial $50,000 psychological threshold today. The last time BTC saw this price was during the 2021 bull run.

The crypto asset recently soared to a 26-month high of $50,368 before witnessing resistance that has pushed it below the $50,000 level.

Bitcoin Calls Surpass Puts on Deribit

Amid the struggle to seal its hold above $50,000, Bitcoin has triggered renewed optimism among traders.

Deribit data indicates that Bitcoin call options have surged since yesterday, with Open Interest (OI) on calls spiking to 170,131 BTC worth $8,480,375,345 ($8.48 billion) against prevailing rates.

For the uninitiated, call options are financial contracts that give the buyer the right to purchase a specific amount of an asset (in this case, BTC) at a predetermined price (strike price) before the expiration date. However, the buyer is not obliged to buy the asset at this price.

– Advertisement –

Call options differ from put options because, unlike calls, puts give the trader the right to sell an asset at a particular price before or at the expiration date.

Traders place call options when they expect the asset’s price to increase and create put options when they believe the token could drop in value.

Interestingly, Bitcoin’s call options far surpass put options on Deribit, showcasing increased confidence in Bitcoin’s performance. Notably, the Open Interest on put options on the trading platform currently stands at 79,355 BTC worth $3,964,100,463 ($3.96 billion).

Traders Bet on BTC to Hit $60,000

The fact that BTC calls on Deribit have increased to $8.48 billion indicates that most investors are betting on the asset to increase from its current price.

In particular, the majority of these calls, amounting to $642 million, have a strike price of $60,000. This entails that these traders expect BTC to clinch the $60,000 level.

Besides the calls on a Bitcoin rally to $60,000, traders have also placed call options with the hope that BTC surges to $65,000, $75,000 and even $125,000.

The $65,000 strike price has one of the highest notional values, standing at $609 million. This shows that a large number of traders are optimistic of this price goal.

Meanwhile, BTC currently trades for $49,971, with a 4.37% 24-hour rise as it battles to reclaim and retain the $50,000 threshold.

Trade volume for the token has spiked 92% over the past 24 hours to $39,440,390,303 ($39.4 billion). This figure represents Bitcoin’s largest daily volume since Jan. 12.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thecryptobasic.com/2024/02/13/traders-bet-on-bitcoin-hitting-60k-with-calls-amounting-to-642m/?utm_source=rss&utm_medium=rss&utm_campaign=traders-bet-on-bitcoin-hitting-60k-with-calls-amounting-to-642m

- :has

- :is

- :not

- $3

- 000

- 100

- 11

- 12

- 2021

- 24

- 7

- 971

- a

- above

- Advertisement

- advice

- against

- also

- among

- amount

- an

- and

- any

- ARE

- around

- article

- AS

- asset

- At

- author

- back

- basic

- battles

- BE

- because

- before

- believe

- below

- Bet

- Betting

- Big

- Billion

- Bitcoin

- Bitcoin BTC

- BTC

- bull

- Bull Run

- Bullish

- buy

- BUYER..

- call

- Calls

- case

- confidence

- considered

- content

- contracts

- could

- create

- crucial

- crypto

- crypto asset

- Current

- Currently

- daily

- data

- Date

- decisions

- demonstrated

- deribit

- Derivatives

- differ

- do

- Drop

- during

- encouraged

- Even

- expect

- expiration

- expressed

- fact

- far

- Figure

- financial

- financial advice

- For

- from

- Give

- goal

- Have

- High

- highest

- Hit

- hitting

- hold

- hope

- HOURS

- However

- http

- HTTPS

- ID

- in

- include

- Increase

- increased

- indicates

- Informational

- interest

- investment

- Investors

- IT

- ITS

- Jan

- large

- largest

- Last

- leading

- Level

- losses

- Majority

- Making

- Market

- max-width

- May..

- metric

- million

- most

- notably

- Notional

- number

- obliged

- of

- on

- ONE

- open

- open interest

- Opinion

- Opinions

- Optimism

- Optimistic

- Options

- or

- over

- participants

- particular

- past

- performance

- personal

- Place

- platform

- plato

- Plato Data Intelligence

- PlatoData

- price

- psychological

- purchase

- Push

- pushed

- put

- Puts

- rally

- Rates

- readers

- recent

- recently

- reflect

- remarkable

- renewed

- represents

- research

- Resistance

- responsible

- retain

- right

- Rise

- Run

- s

- saw

- seeing

- sell

- should

- showcasing

- Shows

- since

- soared

- specific

- standing

- stands

- strike

- Struggle

- surge

- Surged

- Surges

- surpass

- TAG

- that

- The

- The Crypto Basic

- These

- they

- this

- thorough

- threshold

- time

- to

- today

- token

- toward

- trader

- Traders

- trades

- Trading

- Trading Platform

- triggered

- unlike

- value

- Values

- views

- volume

- W3

- was

- webp

- when

- with

- witnessing

- worth

- yesterday

- zephyrnet