NFT artwork finds new real-world applications

TreeDefi is a DeFi yield farming platform that focuses on environmentally friendly activities. So much so that one-third of the deposit fees on the platform go to tree planting organizations and private planting projects. More recently the protocol has started the implementation of their new features for their entry into the Carbon Credit business.

TreeDefi’s goal is to eliminate intermediaries from their planting activities and manage everything in-house while offering companies and individuals the opportunity to offset their carbon footprint. Their recent release of the NFTrees marketplace is the first step into the ever-growing Carbon Credit field.

What Are NFTrees?

NFTrees are non-fungible tokens backed by real trees planted around the world. Each NFTree is directly connected to a real tree and tracked accurately through the blockchain, offering metadata on CO2 absorption, name, identification code, birth date, and place. Holding an NFTree will yield the user CO2 tokens, emitted correspondingly with the amount of CO2 absorbed by the real tree in question. Afterward, the user or company can use the tokens to create CO2 offset certificates for their activities. CO2 tokens will also be purchasable through TreeDefi’s upcoming automated market maker, arguably giving the token both utility and speculative value.

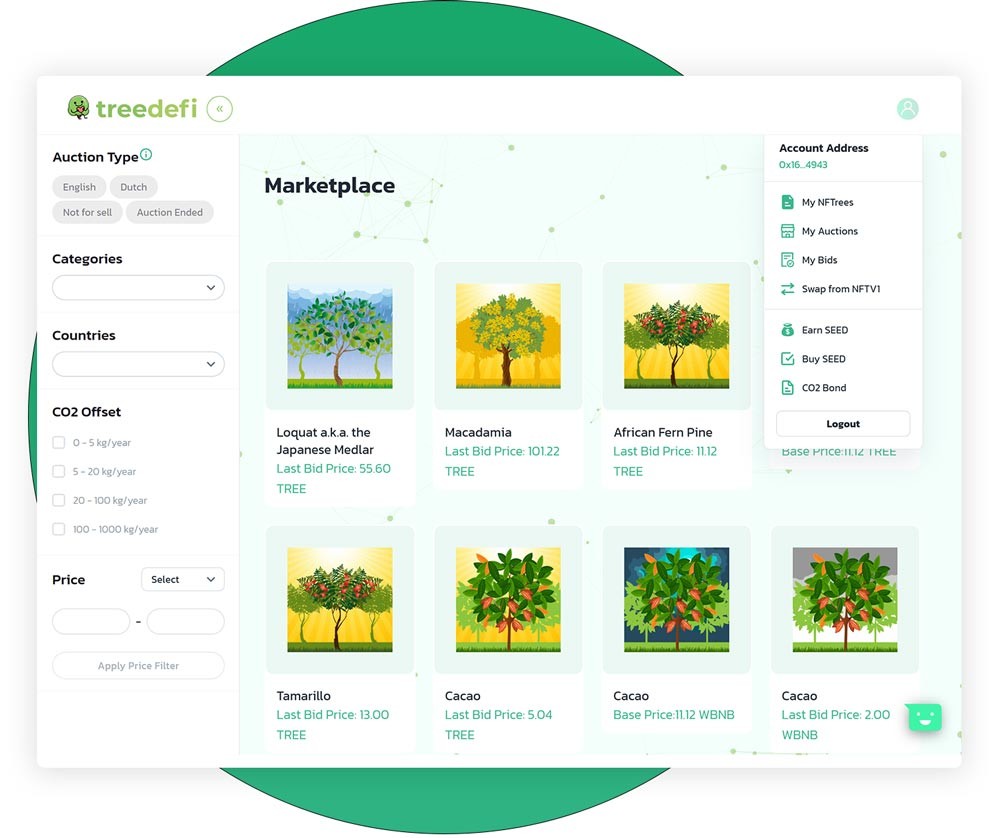

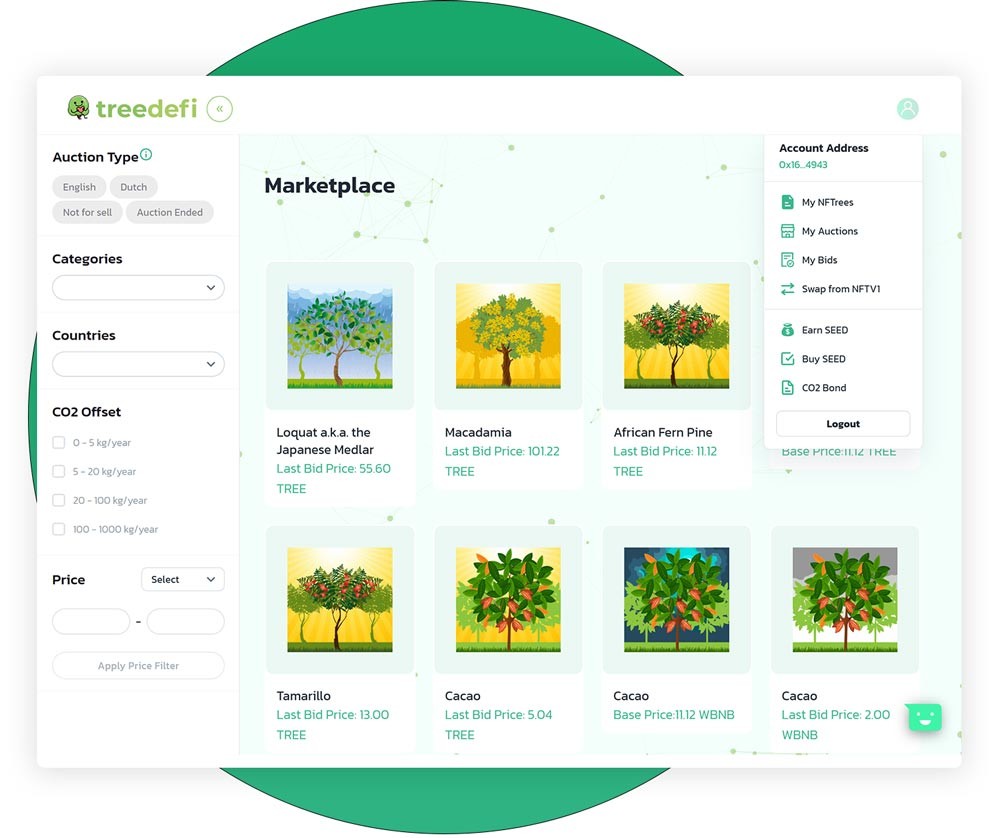

NFTree Marketplace

In order to optimize the user experience, TreeDefi has launched a marketplace that acts as a home for NFTrees while offering various innovative features. Users can purchase the NFTs with WBNB or with TreeDefi’s native tokens, SEED, and TREE. The marketplace allows the platform to bring NFTs to the real world, through real connections with the environment by creating purchasable artwork directly correlated with a tree planted in real life. The first collection featured 9 NFTrees and the initial sale burned 90% of the raised SEED, while the other 10% went into the marketing activities vault. Of course, users could then sell their newly purchased NFTrees.

Each NFTree can be put up for auction through the English or Dutch auction systems. In the English system, the user can set a base price, an auction length and then choose his preferred bid. In the Dutch system, the user can choose a maximum price, a minimum price, and auction length. As the auction goes on the price will start to drop until someone goes through with a bid. The Marketplace also features various convenient research filters to help users find their preferred NFTree, including tree category, country of origin, CO2 offset range, price range.

TreeDefi will have lots of work to plant enough trees to supply the demand for carbon credits and to not allow extreme scarcity on the NFTrees that may make the price too high for companies and players interested in buying them for offset purposes. That is why 50% of the bidding fees are allocated toward planting activities. The current NFTrees are coming from various events that TreeDefi promoted across the world.

Additionally, they will also start planting trees in Brazil due to an exclusive partnership with landowners and specialists in the environmental field in the country. It is also important to mention that TreeDefi also has active planting projects in Indonesia and the Philippines, which can be checked on their Youtube channel.

Earning Opportunities

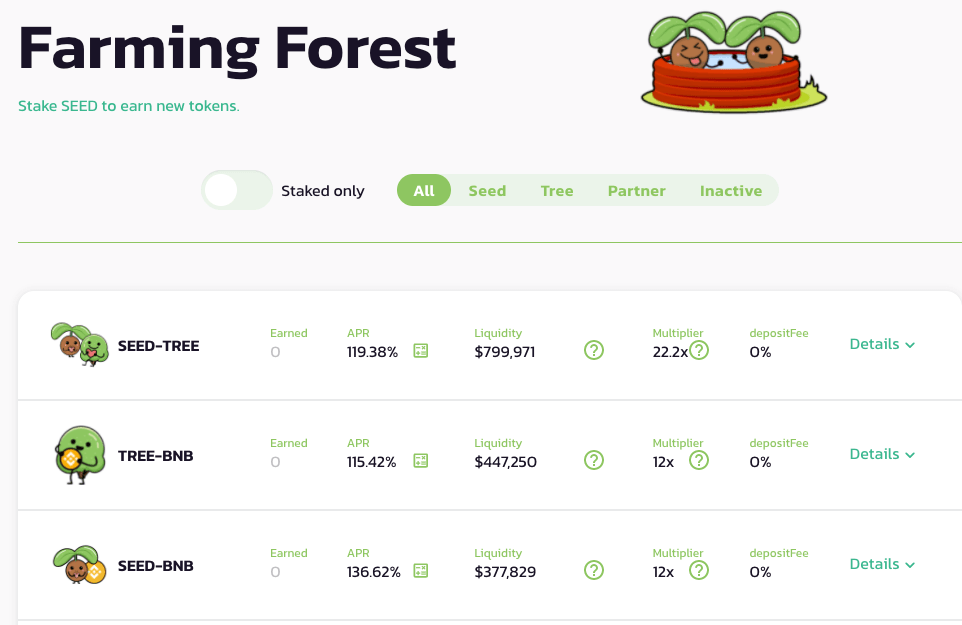

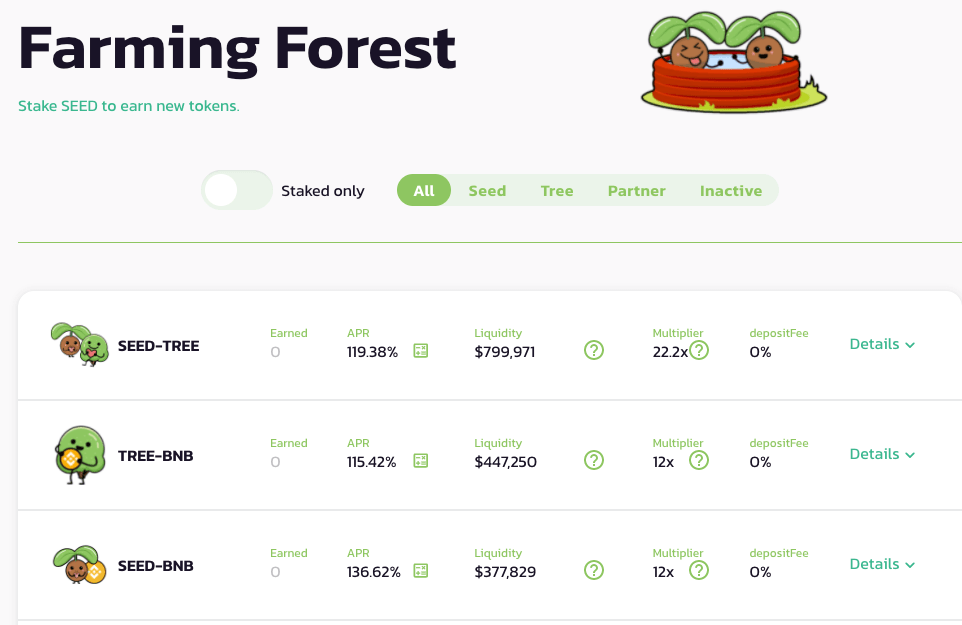

At its core, TreeDeFi is a yield farming platform with the added bonus for users of helping the environment. The tokenomics are based on a two token system, SEED, and TREE. SEED is the token that features a low deflationary emission starting at 0.15 SEED per block while TREE is a capped token with a supply of only 16,001 tokens. TREE mainly acts as the governance token while SEED is the key component of the farms and pools on the platform.

The system is based on a scarcity proposition as the project wanted to avoid going for high emission rates. Instead, the aim is to start the project slowly and give it time to grow without the use of incentives and insane returns on assets. Moreover, the farms and pools are designed to provide minimal selling pressure by incentivizing the users to hold the platform’s tokens.

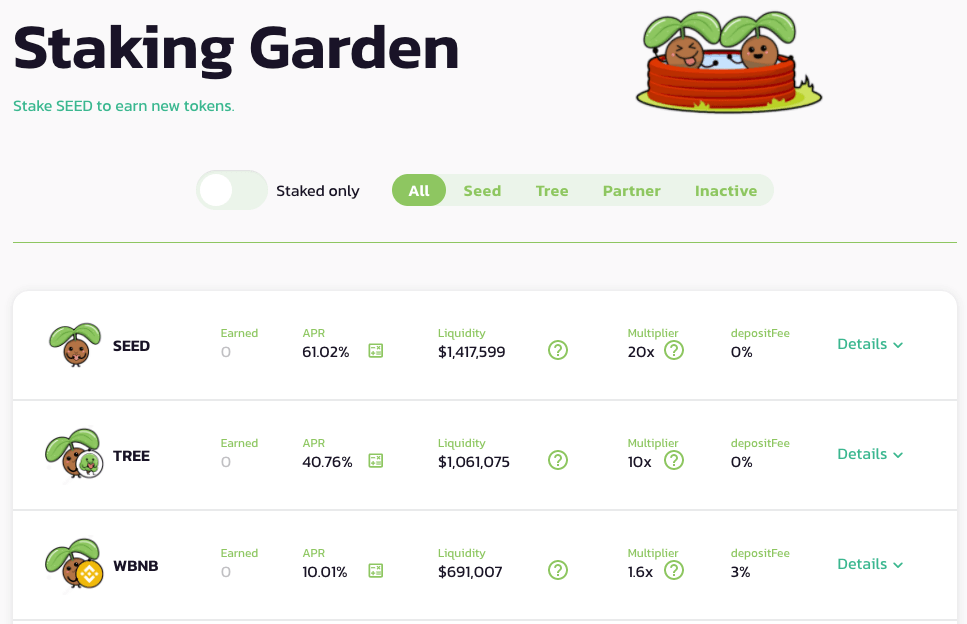

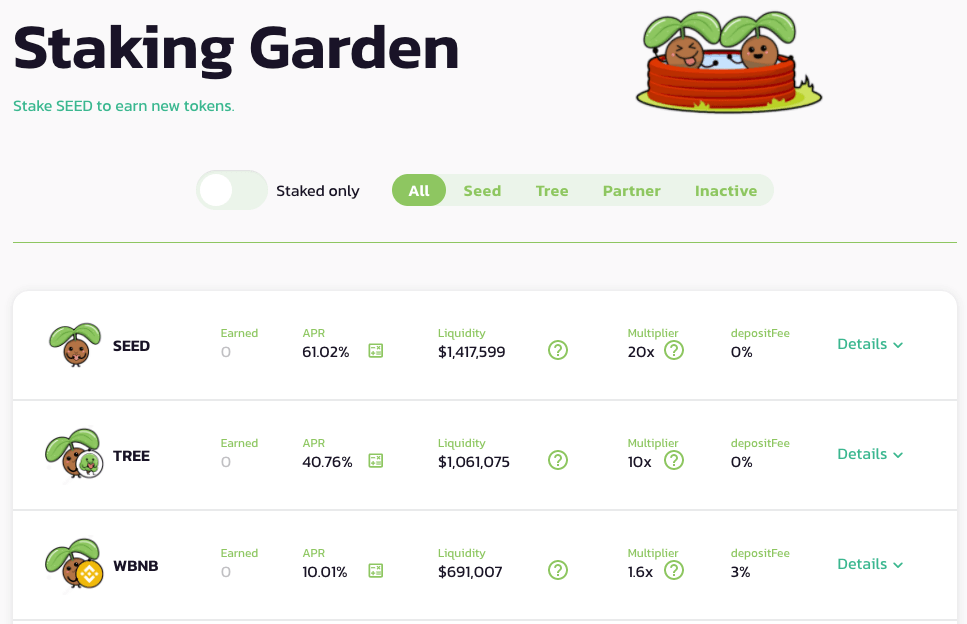

TreeDeFi farms offer users the opportunity to earn tokens for locking up their holdings. With the biggest rewards to those that opt for returns on the native tokens, incentivizing users to purchase and hold these tokens. All the native farms have zero deposit fees and good multipliers. Additionally, the platform offers farming options on BNB/BUSD and DAI/BUSD pairs. To combat users wanting to farm these tokens for free and quickly sell off any profits the allocation of points to these farms is not very high, plus there is a 3% deposit fee.

Arguably, for new investors staking presents the simplest form of involvement. Here users are invited to stake a token, including SEED and TREE to earn other tokens. The same deposit fees exist here as the farming options so as to incentivize the staking of the platform’s native tokens. Native token staking pools have zero deposit fees and high multiplies while non-native tokens are subject to a 3% deposit fee and lower multipliers. As you can see in the image above, staking SEED returns over 61% whilst staking WBNB returns just 10%.

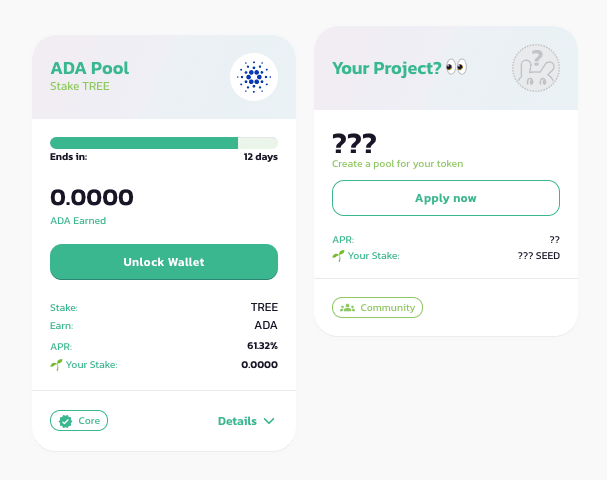

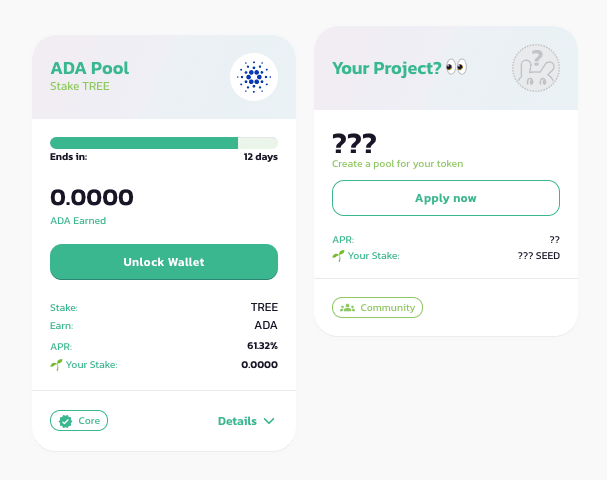

Launch pools are like Kickstarter for new projects. Users are invited to stake their TREE or SEED tokens in return for various rewards from the projects utilizing the feature on the platform. This feature is the same as ApeSwaps IAO and other projects offering IDO’s. In a nutshell, it’s a way for a new project to get its tokens into the hands of the community. But the most common launch pools on TreeDefi are generally chosen by investors through polls.

For a full run-down of all the staking and farming mechanics offered by TreeDeFI, their whitepaper makes an excellent starting point.

Venture Capital Opportunities

The Carbon Credit field doesn’t only bring a lot of utility to a DeFi project, it also opens up doors for venture capital firms that are trying to join but don’t see corporate potential in most DeFi protocols. The list of clients for CO2 offset services on the blockchain would also be plentiful, thanks to the proposition it could offer to many companies looking for legitimate and easy-to-use services.

Green Crypto Mining companies, for example, would benefit immensely from such features. The current business models of Carbon Credit companies are often vague and sometimes borderline illegal, so trackability and data immutability is a must for the future of the sector, which is exactly what TreeDefi is aiming to fix.

Future Forecast on the Carbon Credit Market

We assume that most readers have heard about carbon credits at least once in the past, which is a good indicator of the popularity of this asset. Talking about prices, the prices of carbon credits increased 115% in the last 12 months in Europe and the prediction of specialists is one of extreme growth during the following decade. The average prediction made by the UN for 2030 is 80$ per carbon credit, which is considered a conservative prediction since the market in general values them at 100$ by 2025.

Recently Enjin (ENJ Token) promoted an event with the UN that plans to use NFTs to stimulate sustainability and equality, creating a project that will boost promising NFT platforms, like TreeDefi for example. Last week Binance brought up the subject ‘How do NFTs impact the Environment?’, which mentioned the potential that Binance sees in this market, how to measure the carbon footprint created by minting NFTs, and how this technological progress can be responsible for saving the future of humanity. In this post made by Binance, they made clear the preference of PoS (Proof of Stake) NFTs and how they perform much better in this niche than PoW (Proof of Work) NFTs.

Additionally, this year, we experienced a lot of turmoil in the market due to declarations coming from Elon Musk about the concerns of PoW and cryptocurrency mining itself. After this negative market trend, many projects started their PoS migration and the ones that stayed on PoW started to search for alternatives to reduce the possible damages to the Environment.

TreeDefi is setting itself up as a pioneer and one of the few DeFi projects trying to bring the blockchain to the real world through applications that will help companies, individuals, and most importantly the environment. In such a seemingly promising business only time can tell the heights that will be reached in the next decade.

.mailchimp_widget {

text-align: center;

margin: 30px auto !important;

display: flex;

border-radius: 10px;

overflow: hidden;

flex-wrap: wrap;

}

.mailchimp_widget__visual img {

max-width: 100%;

height: 70px;

filter: drop-shadow(3px 5px 10px rgba(0, 0, 0, 0.5));

}

.mailchimp_widget__visual {

background: #006cff;

flex: 1 1 0;

padding: 20px;

align-items: center;

justify-content: center;

display: flex;

flex-direction: column;

color: #fff;

}

.mailchimp_widget__content {

padding: 20px;

flex: 3 1 0;

background: #f7f7f7;

text-align: center;

}

.mailchimp_widget__content label {

font-size: 24px;

}

.mailchimp_widget__content input[type=”text”],

.mailchimp_widget__content input[type=”email”] {

padding: 0;

padding-left: 10px;

border-radius: 5px;

box-shadow: none;

border: 1px solid #ccc;

line-height: 24px;

height: 30px;

font-size: 16px;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”] {

padding: 0 !important;

font-size: 16px;

line-height: 24px;

height: 30px;

margin-left: 10px !important;

border-radius: 5px;

border: none;

background: #006cff;

color: #fff;

cursor: pointer;

transition: all 0.2s;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”]:hover {

box-shadow: 2px 2px 5px rgba(0, 0, 0, 0.2);

background: #045fdb;

}

.mailchimp_widget__inputs {

display: flex;

justify-content: center;

align-items: center;

}

@media screen and (max-width: 768px) {

.mailchimp_widget {

flex-direction: column;

}

.mailchimp_widget__visual {

flex-direction: row;

justify-content: center;

align-items: center;

padding: 10px;

}

.mailchimp_widget__visual img {

height: 30px;

margin-right: 10px;

}

.mailchimp_widget__content label {

font-size: 20px;

}

.mailchimp_widget__inputs {

flex-direction: column;

}

.mailchimp_widget__content input[type=”submit”] {

margin-left: 0 !important;

margin-top: 0 !important;

}

}

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet