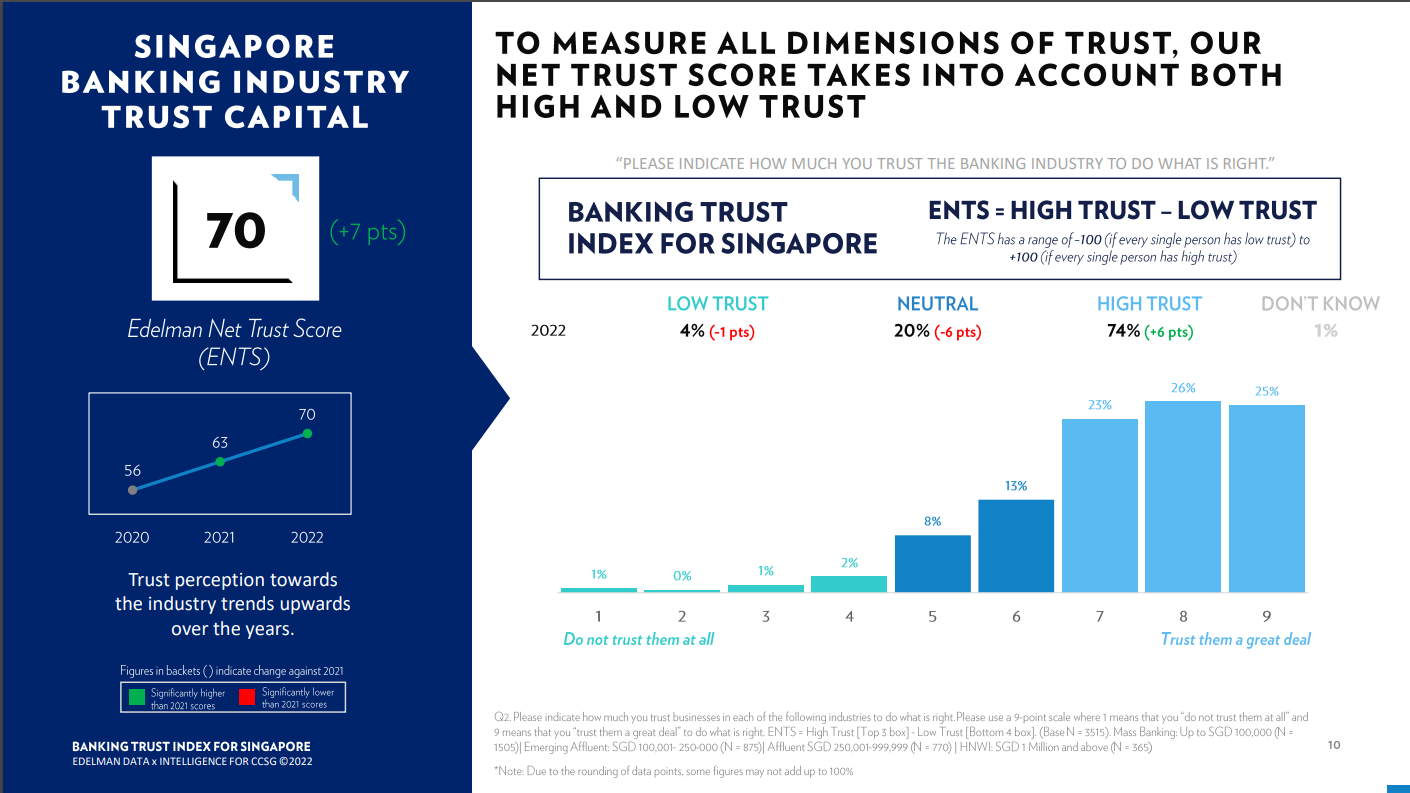

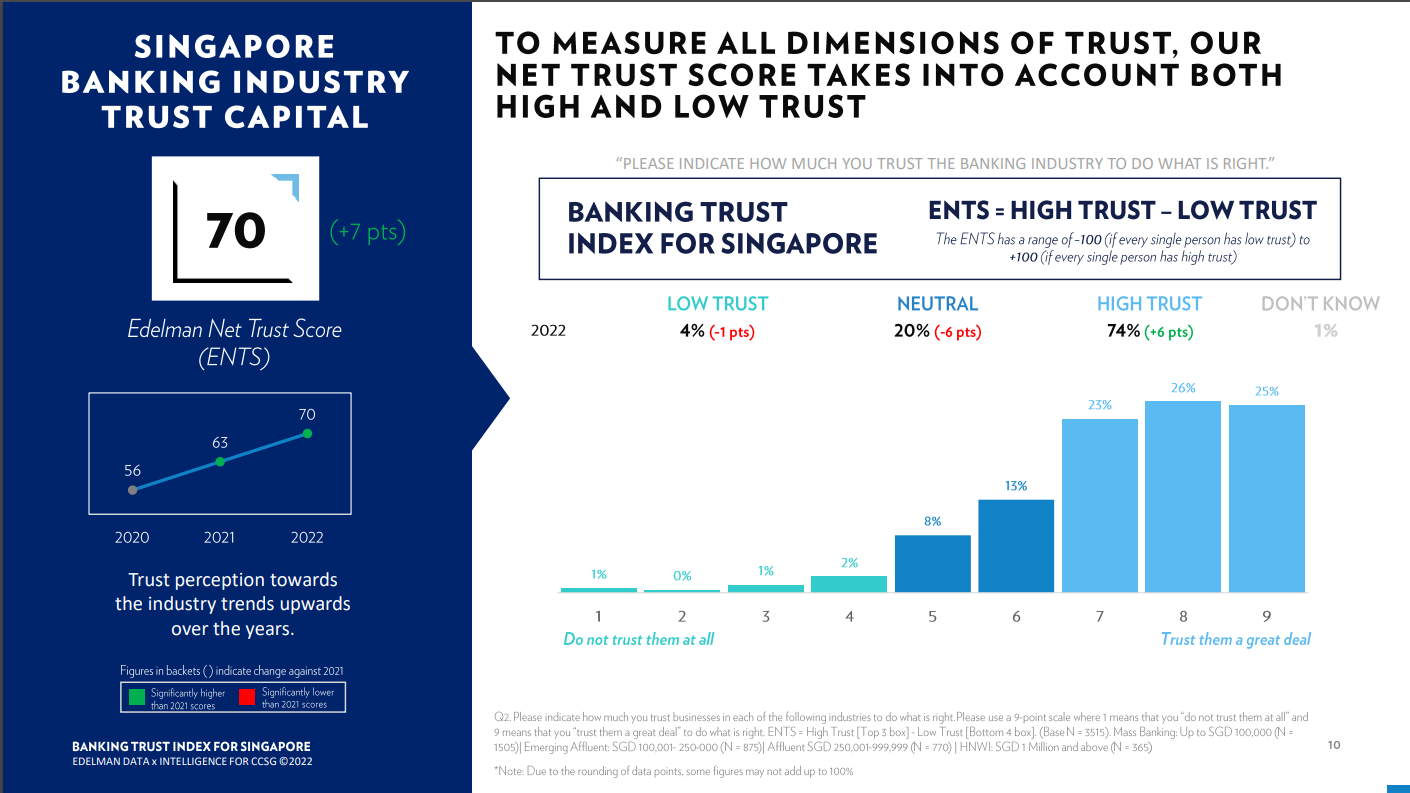

A survey conducted by Edelman Data and Intelligence has found that trust in the Singapore banking industry has increased for a second straight year since 2020.

The third annual Banking Trust Index for Singapore (BTIS) survey was commissioned by the Association of Banks in Singapore (ABS).

15 banks included in the scope of the survey include Bank of China, Bank of Singapore, Citibank, Credit Suisse, DBS, Deutsche Bank AG, HSBC, Industrial and Commercial Bank of China Limited Singapore Branch, JP Morgan, Maybank, Nomura Singapore, OCBC, Standard Chartered Bank, UBS AG, and UOB.

Source: Banking Trust Index for Singapore, Edition 2022

Findings from the report

Respondents attribute their trust in the industry to banks’ resilience as seen in their strong business and financial performance through the pandemic.

They also appreciate the efforts by the industry to help customers guard themselves against scams, as well as banks’ handling of customer data with integrity.

The survey showed that the public is confident that over the next three to five years, banks in Singapore will continue to advance in harnessing technology and innovation to offer convenience and security to customers.

The respondents also believe that banks will be taking necessary measures to curb re-occurrence of past errors, and raising customer awareness about protecting their accounts from fraud.

Additionally, the report suggested that banks could further strengthen public trust by being more forthcoming about their business values and positive contribution to the wider community.

Areas where the industry could most improve on include transparency about mistakes, aligning with customer values, fair employment practices and positive social and environmental impact.

Leveraging the BTIS survey findings for an action plan

The ABS Culture and Conduct Steering Group (ABS CCSG) and the banks will leverage the findings of the report to focus on several areas.

ABS said that it will continue to facilitate collaboration among banks and a close partnership with MAS, the Police, the Inter-Ministry Committee on Scams, and other ecosystem partners to uplift the security of digital banking services and help customers avoid becoming victims of digital scams.

Apart from enhancing authentication and fraud surveillance, the association will look to coordinate industry efforts to heighten digital security awareness and good cyber hygiene among customers.

An information paper will also be published to raise awareness of and provide guidance on the risk of “dark patterns”, in which website/app interface design and patterns are used to negatively influence consumer choices.

CCSG said that it will continue to monitor and review industry trends of customer complaints, to ensure that they are addressed in a fair and timely manner.

The association added that thematic issues and drivers of complaints have been developed to enable the implementation of action plans, where relevant, to address issues and improve the management of complaints.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://fintechnews.sg/69728/fintech/trust-in-singapore-banks-continues-to-be-on-the-rise-says-abs-survey/

- 2020

- 7

- a

- About

- ABS

- Accounts

- Action

- added

- address

- advance

- AG

- against

- among

- and

- annual

- appreciate

- areas

- Association

- Authentication

- awareness

- Bank

- Bank of China

- Banking

- Banks

- becoming

- being

- believe

- Branch

- business

- caps

- Chartered

- China

- choices

- Citibank

- Close

- collaboration

- commercial

- committee

- community

- complaints

- Conduct

- confident

- consumer

- continue

- continues

- contribution

- convenience

- coordinate

- could

- credit

- credit suisse

- Culture

- customer

- customer data

- Customers

- cyber

- data

- DBS

- Design

- Deutsche Bank

- developed

- digital

- digital banking

- drivers

- ecosystem

- edition

- efforts

- employment

- enable

- enhancing

- ensure

- environmental

- Errors

- facilitate

- fair

- financial

- financial performance

- Focus

- forthcoming

- found

- fraud

- friendly

- from

- further

- good

- Group

- Guard

- Handling

- Harnessing

- help

- HSBC

- HTTPS

- Impact

- implementation

- improve

- in

- include

- included

- increased

- index

- industrial

- industry

- influence

- information

- Innovation

- integrity

- Intelligence

- Interface

- issues

- IT

- jp morgan

- Leverage

- Limited

- Look

- management

- manner

- MAS

- max-width

- measures

- mistakes

- Monitor

- more

- Morgan

- most

- necessary

- negatively

- next

- nomura

- ocbc

- offer

- Other

- pandemic

- Paper

- partners

- Partnership

- past

- patterns

- performance

- plans

- plato

- Plato Data Intelligence

- PlatoData

- Police

- positive

- practices

- protecting

- provide

- public

- public trust

- published

- raise

- raising

- relevant

- report

- resilience

- return

- review

- Rise

- Risk

- Said

- says

- scams

- scope

- Second

- security

- Security Awareness

- Services

- several

- since

- Singapore

- Social

- standard

- Standard Chartered

- Standard Chartered Bank

- straight

- Strengthen

- strong

- Suisse

- surveillance

- Survey

- taking

- Technology

- The

- their

- thematic

- themselves

- Third

- three

- Through

- to

- Transparency

- Trends

- Trust

- ubs

- UOB

- Uplift

- Values

- victims

- which

- wider

- Wider Community

- will

- year

- years

- zephyrnet