Generative AI, the capacity of computers to craft content in ‘unstructured’ forms such as text or images, is a marked change of AI from the traditional ‘structured’ data formats like tables. Generative AI came into grander limelight for many fields, though not yet wealth management, following the debut of OpenAI’s ChatGPT in November 2022.

ChatGPT, a chatbot premised on GPT-3, heralded a paradigm shift where individuals could interact with an AI system in a natural, intuitive manner. It generated written output, which in many instances, was on par to mirror human capabilities. However, outputs from AI systems like ChatGPT do have their limitations.

Since then, all sections of the global economy are projected to feel the effects of this groundbreaking technology. By 2030, AI is expected to contribute a whopping US$15.7 trillion to the global economy, according to PwC’s Global Artificial Intelligence Study. Its integration will cause varying degrees of impact across different industries, and the potentially staggering value added by AI may bring unexpected implications.

The Customisable Power of Generative AI Foundation Models

Numerous large language models akin to GPT are offered by companies such as Meta and Google, which possess the computational resources to train and implement these systems. Often referred to as foundation models, these can be utilised as the backbone for a custom model for a specific task or domain of expertise, eliminating the need to build one from scratch.

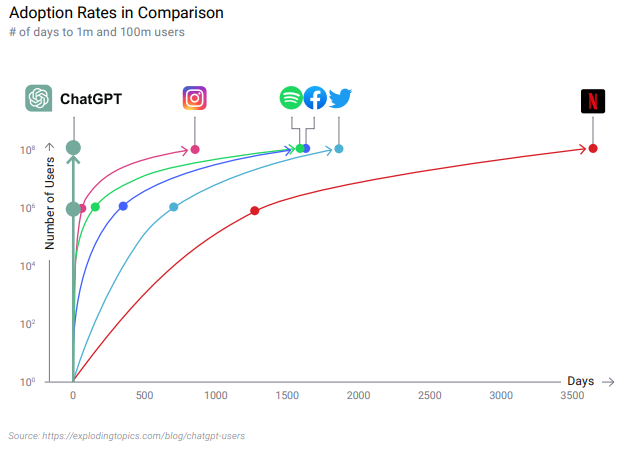

The transformative potential of ChatGPT is signified by its rapid rate of adoption, securing 100 million users in merely 48 hours, making it the fastest proliferating application to date. Thus, every organisation has incentive to begin developing AI capabilities, crafted from their own custom models, underpinned by foundational technology.

Customising or refining foundational models does not only broaden the range of possible use cases but can also mitigate some of the shortcomings. For example, if an organisation has a comprehensive proprietary database of domain-specific research in finance, that is more exhaustive than a model has been trained against, it can be re-trained to incorporate this knowledge, creating a custom model for private use.

Implications for the Finance Sector

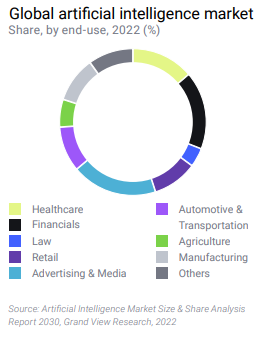

AI remains a hot-button subject in 2023, indicative of being recognised for its vast potential. According to the 2030 Artificial Intelligence Market Size & Share Analysis Report released by Grand View Research last year, the health sector, followed by the automotive and finance sectors, will be most impacted. However, unlike other industries, the adoption cycle will be shorter for these three sectors including finance is set to occur in less than seven years.

Significant changes are forecasted in the finance sector due to AI integration, with custom models trained with proprietary data propelling adoption in health and finance. Remarkably, 70% of finance executives consider it a gamechanger, according to Roland Berger data referenced in the additiv white paper Capitalizing on Generative AI for Wealth Management.

AI Limitations, Potential for Wealth Management

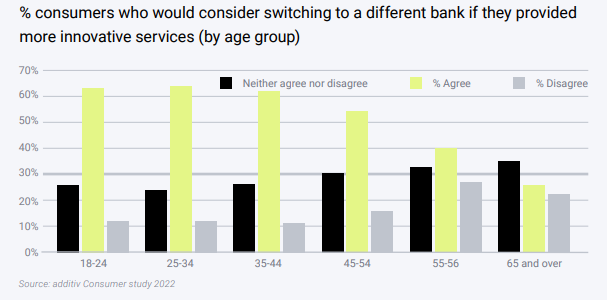

Current perceived limitations of AI, such as trustworthiness, privacy awareness, and security, are inhibiting immediate widespread adoption in finance. However, knowing that generative AI can elevate the client experience via a combination of knowledgeable advice and personalised offers, the need for speed is critical. additiv reports that despite the overall satisfaction with their banks’ offerings, customers are not loyal. Over 60% would switch for an offer deemed more innovative.

The wealth management industry has historically struggled to scale to meet the needs of a wider demographic due to the challenges of providing relationship-based or hybrid services, cost-effectively on a large scale. Generative AI offers the possibility of human-like interaction at an exponential scale.

The Value of AI in Wealth Management

Where will AI deliver most value for wealth management, aside from enhancing the wealth advisor’s capabilities? It can also make human-like services more scalable, such as building a portfolio for newer generations.

For the younger cohorts, especially millennials and older GenZs, aligning investments with personal values, beliefs, and consumer preferences is crucial. AI is well positioned to meet this growing need, providing tailored recommendations matching their personal values.

Investors often find it difficult to understand or relate to wealth management companies and the funds in their portfolios, or they’re overwhelmed by the myriad investment product choices. AI can help investors find the right investments and keep them engaged by delivering rich interactive updates on these investments.

The Future of Wealth Management

AI can significantly lower customer acquisition costs by bringing wealth management closer to the client. It also reduces the cost to serve, making wealth management more hybrid in delivery.

With the marginal cost of creating content almost at zero, AI contributes to information overload. However, an AI-powered recommendation engine can efficiently process and analyse relevant data to deliver actionable investment insight, cutting through the noise and making it easier for individuals to make the right decisions.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://fintechnews.sg/76831/wealthtech/turning-to-the-power-of-generative-ai-to-scale-wealth-management/

- :has

- :is

- :not

- :where

- 100

- 2022

- 2030

- 7

- a

- According

- acquisition

- across

- added

- Adoption

- advice

- against

- AI

- AI-powered

- aligning

- All

- also

- an

- analyse

- analysis

- and

- Application

- ARE

- artificial

- artificial intelligence

- AS

- At

- automotive

- awareness

- Backbone

- BE

- been

- being

- beliefs

- Berger

- bring

- Bringing

- broaden

- build

- Building

- but

- by

- came

- CAN

- capabilities

- Capacity

- capitalizing

- caps

- cases

- Cause

- challenges

- change

- Changes

- chatbot

- ChatGPT

- choices

- client

- closer

- combination

- Companies

- comprehensive

- computers

- Consider

- consumer

- content

- contribute

- contributes

- Cost

- Costs

- could

- craft

- Creating

- critical

- crucial

- custom

- customer

- Customers

- customisable

- cutting

- cycle

- data

- Database

- Date

- debut

- decisions

- deliver

- delivering

- delivery

- demographic

- Despite

- developing

- different

- difficult

- do

- does

- domain

- due

- easier

- economy

- effects

- efficiently

- ELEVATE

- eliminating

- engaged

- Engine

- enhancing

- especially

- Every

- example

- executives

- expected

- experience

- expertise

- exponential

- false

- fastest

- feel

- Fields

- finance

- Find

- fintech

- followed

- following

- For

- forms

- Foundation

- friendly

- from

- funds

- future

- generated

- generations

- generative

- Generative AI

- Global

- Global economy

- Grand View Research

- groundbreaking

- Growing

- Harnessing

- Have

- Health

- help

- historically

- HOURS

- However

- HTML

- HTTPS

- human

- Hybrid

- if

- images

- immediate

- Impact

- impacted

- implement

- implications

- in

- Incentive

- Including

- incorporate

- individuals

- industries

- industry

- information

- insight

- integration

- Intelligence

- interact

- interaction

- interactive

- into

- intuitive

- investment

- Investments

- Investors

- IT

- ITS

- jpg

- Keep

- Knowing

- knowledge

- language

- large

- Last

- Last Year

- less

- like

- limelight

- limitations

- lower

- loyal

- make

- Making

- management

- manner

- many

- marked

- Market

- matching

- max-width

- May..

- Meet

- merely

- Meta

- Millennials

- million

- mirror

- Mitigate

- model

- models

- more

- most

- myriad

- Natural

- Need

- needs

- Noise

- November

- of

- offer

- offered

- Offerings

- Offers

- often

- on

- ONE

- only

- or

- organisation

- Other

- output

- over

- overall

- overwhelmed

- own

- paradigm

- perceived

- personal

- Personalised

- plato

- Plato Data Intelligence

- PlatoData

- portfolio

- portfolios

- positioned

- possess

- possibility

- possible

- potential

- potentially

- power

- preferences

- privacy

- private

- process

- Product

- projected

- propelling

- proprietary

- providing

- PWC

- range

- rapid

- Rate

- recognised

- Recommendation

- recommendations

- reduces

- referred

- refining

- released

- relevant

- remains

- report

- research

- Resources

- return

- Rich

- right

- satisfaction

- scalable

- Scale

- scratch

- sections

- sector

- Sectors

- securing

- security

- serve

- Services

- set

- seven

- Share

- shift

- shortcomings

- significantly

- Singapore

- Size

- some

- specific

- speed

- subject

- such

- Switch

- system

- Systems

- tailored

- Task

- Technology

- than

- that

- The

- their

- Them

- then

- These

- this

- though?

- three

- Through

- Thus

- to

- traditional

- Train

- trained

- transformative

- Trillion

- Turning

- underpinned

- understand

- Unexpected

- unlike

- Updates

- use

- users

- value

- Values

- Vast

- via

- View

- was

- Wealth

- wealth management

- WELL

- which

- white

- wider

- widespread

- will

- window

- with

- would

- written

- year

- years

- yet

- Younger

- zephyrnet

- zero