The Ukrainian crypto exchanges volume surged especially after the central bank limited e-money transfers and cash withdrawals in a response to the Russian invasion so let’s find out more in today’s latest crypto news.

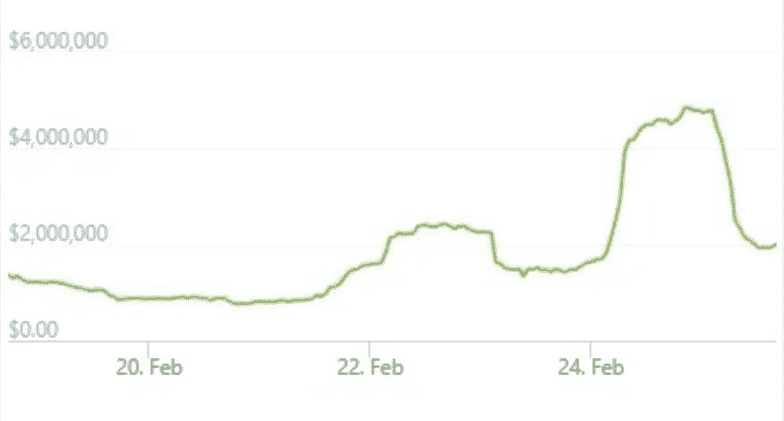

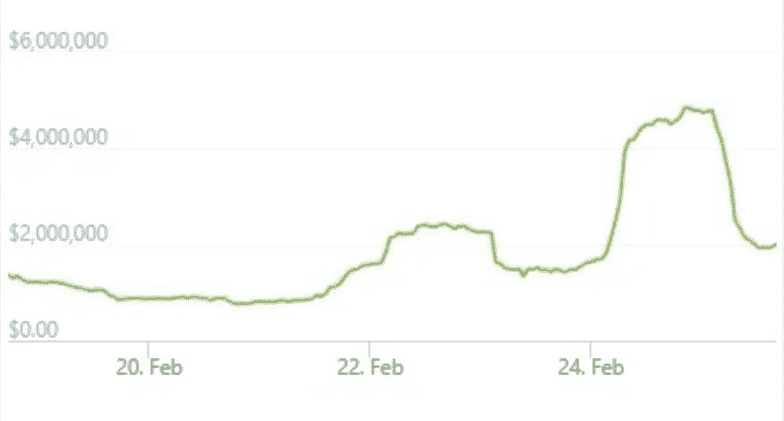

The trading volume of BTC and other cryptocurrencies on Ukrainian crypto exchanges like Kuna, surged over 200% according to the data from Coingecko. From under $1 million, the trading volumes on Kuna reached new highs of $4.8 million which is the highest volume seen on the exchange since May 2021 before stabilizing near $2 million.

Russia launched a full-scale invasion of Ukraine and now a state of national emergency has been declared including a ban on digital money transfers. Ukraine introduces even further currency controls. Tens of Thousands of Ukrainians are fleeing the conflict as the Russian troops surrounded the capital Kyiv from the north, east, and south with the invasion could force up to five million Ukrainians to flee the homeland as per the United Nations.

As a part of the emergency measures, Ukraine’s central bank suspended the issuance of electronic money and banned all electronic wallets with electronic money and their distribution. The measure will affect fiat currencies held in digital accounts via the platforms like PayPal and Venmo. The Ukrainian currency dropped to levels not seen since 2015 when the country was on the verge of default. The central bank in Ukraine responded by spending the foreign market and limited cash withdrawals and imposing a prohibition on the issuance of the foreign currency from the retail bank accounts.

Amid the geopolitical uncertainty, most Ukrainians turned to cryptocurrencies as the founder of Kuna exchange Michael Chobanian said:

“The majority of people have nothing else to choose apart from crypto. We’re talking about millions of dollars of cash that wants to go into crypto.”

Ukrainians are paying a premium for Tether’s USDT stablecoin which is pegged to the US dollar price. The increasing demand for crypto propelled the exchange rate for 1 USDT to 33 Hryvna at exchanges like Binance and Kuna. At Kuna, BTC is trading at$40,820. Despite trading at a premium against the Hryvnia, USDT hasn’t really been affected by the volatility experienced by crypto assets like BTC and ETH.

Earlier this month, the Ukrainian parliament ratified a law that paved the way for the central bank to issue its own digital currency only days before the Russian invasion and the country even legalized BTC and other cryptocurrencies with more plans to open crypto market to businesses and investors.

- 2021

- About

- According

- All

- Assets

- Ban

- Bank

- Banks

- binance

- BTC

- businesses

- capital

- Cash

- Central Bank

- CoinGecko

- conflict

- could

- country

- crypto

- Crypto Exchanges

- Crypto Market

- Crypto News

- cryptocurrencies

- currencies

- Currency

- data

- Demand

- Despite

- digital

- digital currency

- Digital Money

- distribution

- Dollar

- dollars

- dropped

- especially

- ETH

- exchange

- Exchanges

- experienced

- Fiat

- founder

- HTTPS

- Including

- Investors

- issue

- latest

- Law

- Limited

- Majority

- Market

- measure

- million

- millions

- money

- most

- National

- Near

- news

- North

- open

- Other

- parliament

- PayPal

- People

- Platforms

- Premium

- price

- Prohibition

- RE

- response

- retail

- Said

- So

- South

- Spending

- stablecoin

- State

- surge

- surrounded

- talking

- thousands

- Trading

- transfers

- Ukraine

- United

- united nations

- us

- US Dollar

- USDT

- Venmo

- Volatility

- volume

- Wallets