TL;DR Breakdown

- The UNI/USD trading pair is trading between $18.8 and $19.60.

- Sellers are concentrated around the $19 price mark

- As of this writing, Uniswap is trading at $19.59 against the US dollar

Uniswap Price Analysis: General price overview

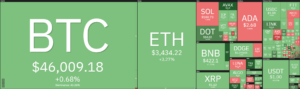

Today’s Uniswap price analysis suggests market neutrality after the bears attempted to hijack a bullish uptrend over the weekend. Through the remaining part of the daily trading chart, market participants anticipate a downtrend as there is still massive resistance at $20. Besides, the relative strength index is lying within the negative region and slanting towards neutrality.

Important news around the cryptocurrency includes the dismissal of digital currencies and stablecoins by the People’s Bank of China, claiming they are only a speculative tool and a significant threat to financial security. Furthermore, investors worldwide anticipate a bearish market movement ahead of the Grayscale Bitcoin Trust, unlocking the largest amount of BTC.

Uniswap price movement in the last 24 hours

According to observations on the daily trading chart for our Uniswap price analysis, the UNI/USD trading pair trades between $18.8 and $19.60.The present market capitalization based on Coinmarketcap is $190,653,178.30. Uniswap stands at position ten among the top ten cryptocurrencies by market cap.

The market choppiness index is slanting towards 20, suggesting multidirectional solid price movement. Uniswap has been trading on a consistent bearish trendline since yesterday after a downswing corrected lower from $21. The bulls are attempting to recover the price above the $18 – $19 stalemate. However, the odds are stacked against their favor.

On the other hand, the bears are trying to build a supply zone below $18, a situation that might pull Uniswap all the way to $15 and $13. Thereby crashing all hopes by buyers to hit the main $30 target in the medium term.

Meanwhile, there is a buy signal indicated by the 1-hour moving average convergence divergence. However, the blue and yellow lines are almost closing in once again, showing instability and market indecision.

UNI/USD 4-hour chart

Sellers are concentrated around the $19 price mark and increasing pressure sunk the price through a trough, hence forming a cup with a handle pattern on the 4-hour chart. The floor of the pattern had its lower bottom at $18.82, which is also the intraday low. Meanwhile, the price is on a recovery phase on the 1-hour chart as it completes the handle of the pattern. As of this writing, Uniswap is trading at $19.59 against the US dollar.

Presently, the RSI curve is oscillating around 62, which is a slight indecision zone and points towards the undervalued region.

Uniswap Price Analysis: Conclusion

Overall, the Uniswap market is neutral, with both bulls and bears split in indecision. Most indicators favor the bears, but there is no telling what the bulls could do as they lace up for the $30 target. In the meantime, check out our comprehensive crypto learning section and learn more about cryptocurrencies.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Source: https://www.cryptopolitan.com/uniswap-price-analysis-2021-07-13/

- advice

- All

- among

- analysis

- around

- Bank

- Bank of China

- bearish

- Bears

- Bitcoin

- BTC

- build

- Bullish

- Bulls

- buy

- China

- CoinMarketCap

- crypto

- cryptocurrencies

- cryptocurrency

- currencies

- curve

- digital

- digital currencies

- Dollar

- financial

- General

- Grayscale

- hijack

- HTTPS

- index

- information

- investment

- Investments

- Investors

- IT

- LEARN

- learning

- liability

- Making

- mark

- Market

- Market Cap

- Market Capitalization

- medium

- news

- Other

- Pattern

- People’s Bank Of China

- present

- pressure

- price

- Price Analysis

- Recover

- recovery

- research

- security

- split

- Stablecoins

- supply

- Target

- top

- trades

- Trading

- Trust

- Uniswap

- us

- US Dollar

- weekend

- within

- worldwide

- writing