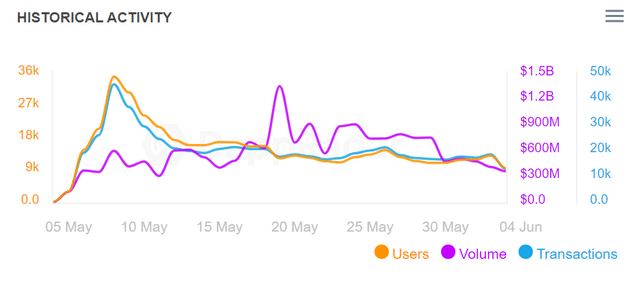

Almost 10% of the trading volume happened on May 19th

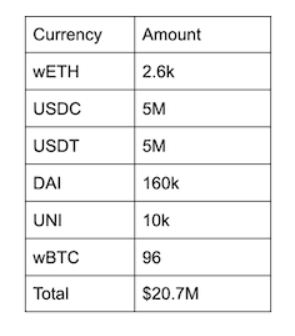

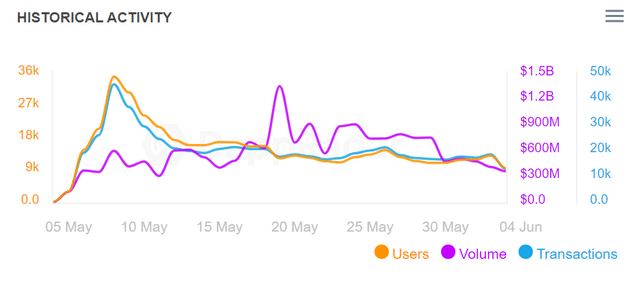

In its first 30 days Uniswap V3 handled more than $17,36 billion in trading volume from more than 288,130 user wallets. May 19th was the busiest day so far, with $1,4 billion in volume according to data from the Uniswap V3 dapp page.

On May 8th the most user wallets connected to the token swap platform, registering 35,100 active user wallets. After that peak, user activity went in decline and stabilized around 12,000 active wallets per day. During its first month, users of Uniswap V3 have made an average of 2,1 transactions per connected wallet.

It’s very clear that Uniswap V3 hasn’t taken over the favorable position of its predecessor. Uniswap V2 still attracts approximately 50,000 wallets per day. In the past 30 days alone more than 659,880 wallets have been trading on Uniswap, with an average of 7,4 transactions per wallet.

Because Uniswap is an on-chain system, older versions of the platform remain available to users. Even the very first version of Uniswap is still being used. In the past 30 days the original version of Uniswap still served 681 users, responsible for $12,92 million according to data from DappRadar.

Wait, what is Uniswap V3?

Uniswap launched the third iteration of its Ethereum-based token swap platform on May 5th. The upgraded platform allows liquidity providers to add liquidity within a concentrated price range. As a result capital is positioned and handled more efficiently. In addition liquidity providers (LPs) earn higher returns on their capital. The platform stores these positions as an NFT, which users can trade on any NFT marketplace.

Basically this allows traders or liquidity providers to bet on future price ranges. The longer the token price remains in the range of their LP tokens, the more profitable the position (or NFT) becomes. You could describe it as a yield farming NFT in a very specific price range. According to Uniswap this would make an LP position 4,000 times more efficient. Read more about it here.

Learn more about DeFi

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet