- US core inflation and personal spending softens

- Bond yields pare earlier losses; 10-year yield now only down 1bps to 4.565%

- US near-term inflation expectation drop to lowest levels since 2021

After a disastrous week, month, and quarter as the bond market selloff would not relent, US dollar long positions got closed out after further evidence supported the case that the Fed might be done hiking rates. The latest round of economic data that showed spending and core inflation cooled. The final reading of the University of Michigan confirmed that pricing pressures are easing. The near-term inflation gauge showed prices are expected to rise 3.2% over the next year, while long-term expectations edged higher to 2.8%. Wall Street is welcoming all data that prevents the Fed from overtightening and especially if it allows traders to hold onto soft-landing hopes.

Fed’s favorite inflation gauge

The inflation news was rather positive, Core PCE posted the smallest rise since November 2020. When you combine today’s PCE and consumer data with yesterday’s downward revised personal consumption numbers, one should expect that economic activity will slowdown quicker in the fourth quarter.

Cooling inflation is sending both the dollar and Treasury yields down and providing a less compelling case for the Fed hawks. Given the rising risk that we could see a one- or two-week government shutdown, there is a growing chance that the data-dependent Fed won’t have enough data to seriously consider hiking at the November 1st meeting.

Looming shutdown

Congress has less than three days to avoid a government shutdown and if that goes into the middle of next week, traders might not get the latest NFP report. A Biden administration official noted that the Bureau of Labor Statistics could cease all program operations, which is different from what happened with the last shutdown that started December 2018.

If the shutdown lasts beyond next week, the September inflation report could also be in jeopardy. A quick (over the next few days) resolution is becoming less likely and that might make the next Fed meeting an easy hold. Fed swaps are pricing only a 16.6% chance the Fed will raise rates at the November meeting, with traders becoming less convinced that they will move at the December 13th meeting.

The Republicans however might not want to drag this shutdown out as it could support a delayed boost for Q1, which is the start of the pivotal 2024 election cycle. A shutdown of 1-2 weeks could be the way this plays out, but anything longer would be troubling on so many levels. The short-term hit to the economy becomes troubling if the shutdown enters a second week. The longer the shutdown last, the more of a hit the Republicans appear poised to take.

UAW

Negotiations between the United Auto Workers (UAW) union and Big Three automakers are slowly making progress. Today, the UAW announced they will expand the strike against Ford and GM. Yesterday, the UAW said they are targeting a 30% pay raise, which is down from the 46% they were asking for in early September. Automakers have raised their offer to 20% but were not offering much on retirement benefits. The longer this drags, the more both sides lose, so a deal should be reached in the next week or two.

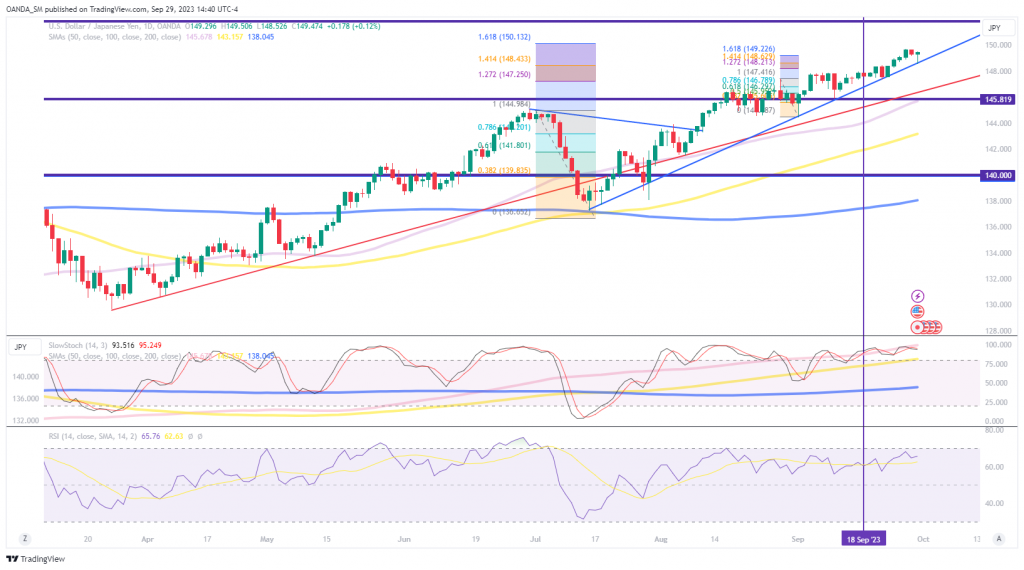

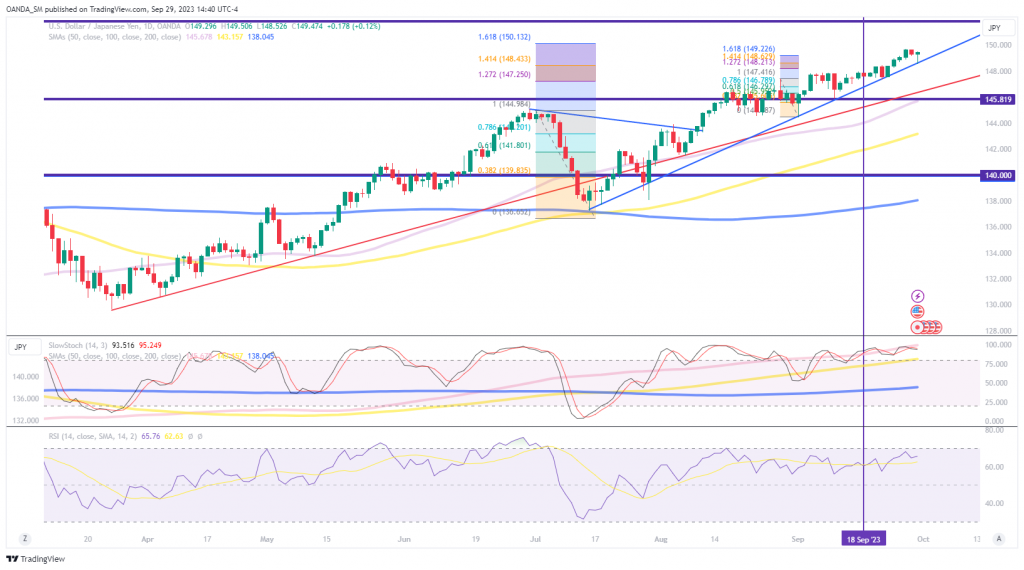

USD/JPY daily chart

The dollar-yen currency pair didn’t see substantial weakness despite a return to risk aversion at the end of the US session. It looks like this will be a choppy trade going forward as the last key higher lows was breached. It seems 150 will happen in a matter of time, but what everyone wants to know will that be enough to trigger action by Japanese authorities.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.marketpulse.com/newsfeed/usd-jpy-cooling-inflation-allows-dollar-rally-to-pause/emoya

- :has

- :is

- :not

- :where

- 150

- 16

- 2%

- 20

- 2018

- 2020

- 2023

- 2024

- 7

- 700

- a

- About

- above

- access

- across

- Action

- activity

- administration

- ADvantage

- advice

- affiliates

- After

- against

- All

- allows

- also

- an

- analysis

- analyst

- and

- announced

- any

- anything

- appear

- ARE

- AS

- asking

- asset

- associated

- At

- author

- Authorities

- authors

- auto

- automakers

- aversion

- avoid

- award

- Bank

- based

- BE

- becomes

- becoming

- below

- benefits

- between

- Beyond

- biden

- Biden Administration

- Big

- Bloomberg

- bond

- bond market

- boost

- both

- Both Sides

- Box

- brokerages

- Bureau

- bureau of labor statistics

- business

- but

- buy

- by

- Career

- case

- cease

- central

- Central Bank

- Central Bank Policies

- Chance

- classes

- closed

- CNBC

- COM

- combine

- Commodities

- compelling

- CONFIRMED

- Consider

- consumer

- consumer data

- consumption

- contact

- content

- convinced

- Core

- core inflation

- Corporate

- Corporate News

- could

- Course

- coverage

- cryptocurrencies

- Currency

- cycle

- daily

- data

- Days

- deal

- December

- Delayed

- departments

- Despite

- different

- Directors

- disastrous

- Dollar

- done

- down

- downward

- Drop

- Earlier

- Early

- easing

- easy

- Economic

- Economics

- economy

- ed

- Election

- end

- enough

- Enters

- especially

- events

- everyone

- evidence

- Expand

- expect

- expectation

- expectations

- expected

- experience

- expertise

- Favorite

- Fed

- fed meeting

- few

- final

- finance

- financial

- Find

- fixed

- fixed income

- For

- Forbes

- Ford

- forex

- Forex Trading

- Forward

- found

- Fourth

- fox

- Fox Business

- from

- further

- FX

- gauge

- General

- geopolitical

- get

- given

- Global

- global markets

- GM

- Goes

- going

- got

- Government

- Growing

- Guest

- happen

- happened

- Have

- he

- higher

- his

- Hit

- hold

- holds

- hopes

- However

- HTTPS

- if

- in

- Inc.

- Including

- Income

- Indices

- inflation

- information

- into

- investment

- IT

- ITS

- Japanese

- journal

- jpg

- Key

- Know

- labor

- Last

- latest

- leading

- less

- levels

- lies

- like

- likely

- live

- Long

- long-term

- longer

- LOOKS

- lose

- losses

- lowest

- Lows

- major

- make

- Making

- many

- Market

- Market Analysis

- market reaction

- MarketPulse

- Markets

- MARKETWATCH

- Matter

- max-width

- meeting

- Michigan

- Middle

- might

- Month

- more

- most

- move

- MSN

- much

- necessarily

- networks

- New

- New York

- New York Times

- news

- next

- next week

- nfp

- noted

- November

- now

- numbers

- of

- offer

- offering

- officers

- official

- on

- ONE

- only

- onto

- Operations

- Opinions

- or

- out

- over

- pair

- particular

- pause

- Pay

- pce

- personal

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- plays

- please

- poised

- policies

- positions

- positive

- posted

- press

- pressures

- prevents

- Prices

- pricing

- Produced

- producing

- Program

- Progress

- provided

- providing

- publications

- purposes

- Q1

- Quarter

- Quick

- quicker

- raise

- raised

- rally

- range

- Rates

- rather

- reached

- reaction

- Reading

- recently

- regular

- regularly

- Renowned

- report

- Republicans

- research

- Resolution

- retirement

- return

- Reuters

- Rise

- rising

- Risk

- round

- rss

- Rutgers University

- Said

- Second

- Securities

- see

- seems

- sell

- SellOff

- sending

- senior

- September

- seriously

- service

- Services

- session

- several

- sharing

- short-term

- should

- showed

- shutdown

- Sides

- since

- site

- Sky

- Slowdown

- Slowly

- So

- soft-landing

- solution

- Solutions

- some

- Spending

- start

- started

- statistics

- Stocks

- street

- strike

- substantial

- such

- support

- Supported

- Swaps

- Take

- targeting

- teams

- television

- than

- that

- The

- the Fed

- The New York Times

- their

- There.

- they

- this

- three

- time

- times

- to

- today

- today’s

- trade

- Traders

- Trading

- treasury

- Treasury yields

- trigger

- troubling

- trusted

- tv

- two

- union

- United

- university

- us

- US Dollar

- USD/JPY

- v1

- views

- Visit

- Wall

- Wall Street

- Wall Street Journal

- want

- wants

- was

- Way..

- we

- weakness

- week

- Weeks

- welcoming

- were

- What

- when

- which

- while

- wide

- Wide range

- will

- winning

- with

- worked

- workers

- world’s

- would

- year

- yesterday

- Yield

- yields

- york

- You

- zephyrnet