- Resurgence of inflationary pressures in Japan due to higher import costs from energy prices.

- The Bank of Japan may face renewed political pressure to normalize its current dovish monetary policy stance to negate significant JPY’s weakness.

- Recent uptick in 10-year JGB yield from an 11-week low may trigger another potential down leg in USD/JPY.

- Watch the 150.20 key short-term resistance on USD/JPY.

The latest nationwide Japan core inflation for October (excluding fresh food) ticked higher for the first time in four months to 2.9% y/y (slightly below the consensus of 3% y/y) from September’s 13-month low of 2.8% y/y. Overall, it has stayed above the Bank of Japan (BoJ)’s 2% inflation target for the consecutive 19th month.

Meanwhile, the core-core inflation rate (excluding fresh food & energy) inched lower to 4% y/y (but still its highest level since 1981) in October from September 4.2% y/y, the second consecutive month of softness which indicates that the recent rallies seen in benchmark oil prices from August to September were likely one of the main drivers that contribute to the resurgence of inflationary pressures in October.

Economic activities in the services sector have started to improve slightly in November where the flash Services PMI rose to 51.7 from 51.6 in October but still below its 12-month average of around 53.5.

In contrast, manufacturing activities have continued to be in the doldrums as the flash Manufacturing PMI for November contracted further to 48.1 from 48.7 in October, its sixth consecutive month of contraction and its steepest decline since February 2023.

Potential mounting political pressure on BoJ due to higher imported inflationary pressures

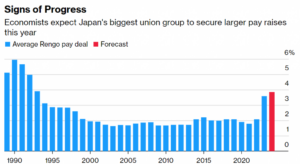

Overall, it’s a mixed set of economic readings but the recent months of elevated imported inflation via the lagged effects of higher oil prices that drove up import costs have put Bank of Japan Governor Ueda in a tight spot as he has so far “stubbornly” remained dovish on Japan’s monetary policy and adopted a wait & see approach for further evidence on substantial wage increases before embarking on a path of normalization away from negative short-term interest rates.

The current dovish stance from BoJ has led the JPY to plummet to a 33-year low against the US dollar and is the current primary driver of higher import costs, in turn, putting increasing political pressure on BoJ to act fast to negate this knock-on effect on elevated import costs in order to boost consumer and business sentiment as Japanese Prime Minster Kishida’s most recent approval ratings declined to the lowest level in his current two-year premiership.

The USD/JPY has staged a rebound of +260 pips since the start of this week after it plummeted to a 10-week low print of 147.15 on Tuesday, 21 November in line with broad-based US dollar weakness seen last week.

The recent rebound is likely due to technical factors as the prior steep decline from its 151.95 major resistance has hit oversold conditions on several short-term (hourly) momentum indicators.

Further shrinkage in the 10-year US Treasury-JGB yield premium may trigger further downside pressure in USD/JPY

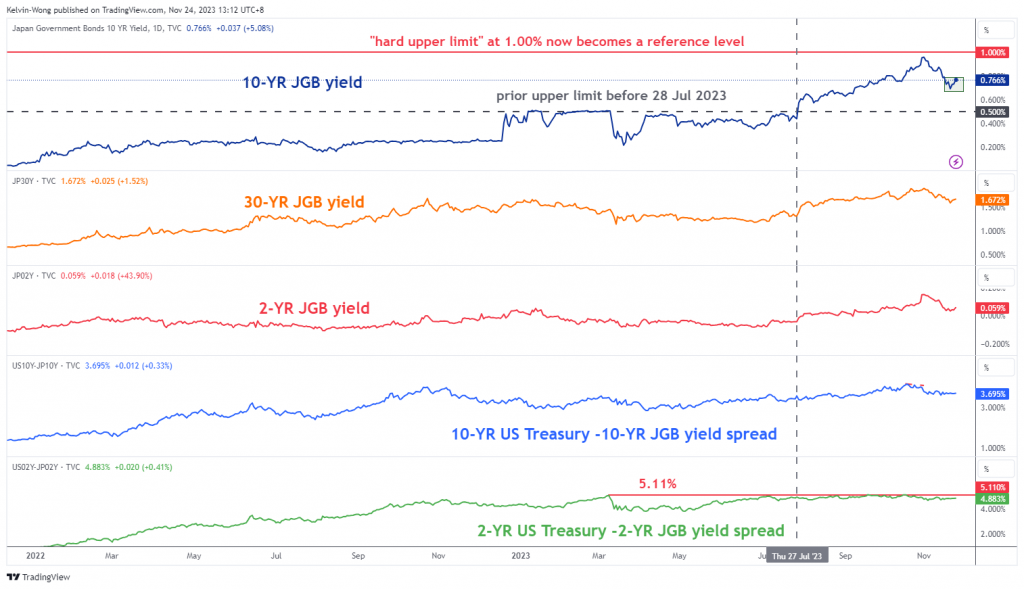

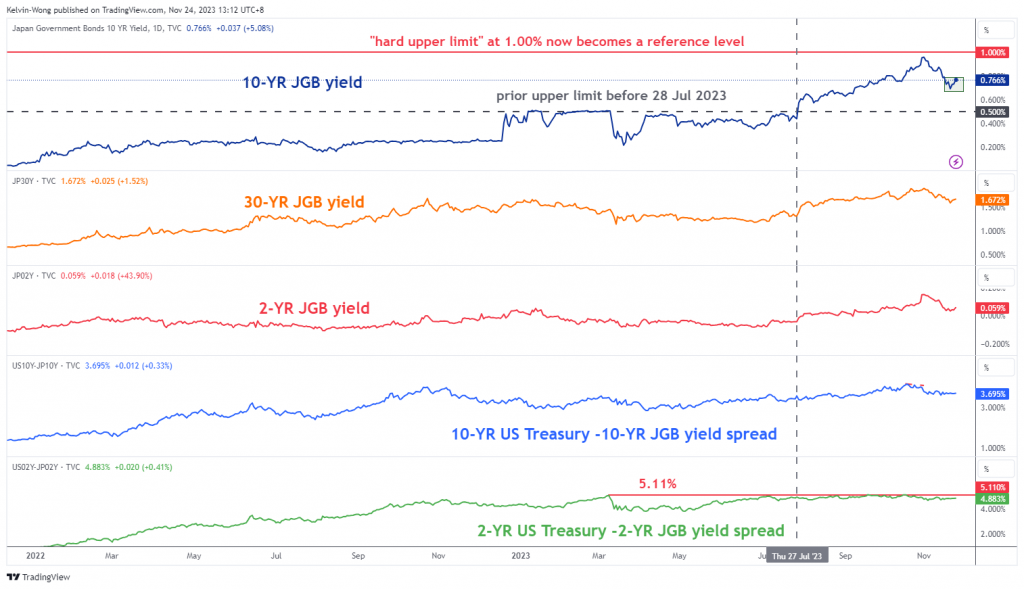

Fig 1: JGB yields with US Treasury-JGB yield spreads as of 24 Nov 2023 (Source: TradingView, click to enlarge chart)

The current elevated inflationary pressure in Japan has reinforced a further uptick in the 10-year Japanese government bond (JGB) yield that continued to rise to 0.77% at this time of the writing from an 11-week low of 0.69% printed on Tuesday, 21 November.

Hence, the latest recovery seen in n the 10-year JGB yield is likely to put downside pressure on the declining 10-year US Treasury-JGB yield premium since 19 October 2023 which in turn may undermine the recent 3-day US dollar rebound against the JPY.

Short-term minor corrective rebound in USD/JPY may have reached its terminal point

Fig 2: USD/JPY medium-term trend as of 24 Nov 2023 (Source: TradingView, click to enlarge chart)

Fig 3: USD/JPY minor short-term trend as of 24 Nov 2023 (Source: TradingView, click to enlarge chart)

Technically speaking, the +260 pips rebound seen in the USD/JPY from its 21 November 2023 low of 147.15 has started to show bullish exhaustion signals at its 20 and 50-day moving averages.

The short-term hourly RSI oscillator has continued to exhibit bearish momentum readings after an earlier bearish divergence condition being flashed out at its overbought zone on Wednesday, 22 November.

Watch the 150.20 key short-term pivotal resistance (also the 20-day moving average & close to the 61.8% Fibonacci retracement of the prior minor decline from 13 November 2023 high to 21 November 2023 low) and a break below the near-term support of 148.40 may expose the next intermediate supports of 147.30 and 146.60/20.

However, a clearance above 150.20 invalidates the bearish tone for a squeeze up towards the next intermediate resistance at 151.40 (minor swing high of 16 November 2023).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.marketpulse.com/forex/usd-jpy-japans-inflation-accelerated-a-struggle-for-bulls-at-the-50-day-moving-average/kwong

- :has

- :is

- :not

- :where

- $UP

- 1

- 13

- 15 years

- 15%

- 150

- 16

- 19

- 2%

- 2% Inflation

- 20

- 2023

- 22

- 24

- 30

- 40

- 51

- 7

- 700

- a

- About

- above

- accelerated

- access

- Act

- activities

- addition

- adopted

- advice

- affiliates

- After

- against

- also

- an

- Analyses

- analysis

- and

- Another

- any

- approach

- approval

- ARE

- around

- AS

- At

- AUGUST

- author

- authors

- avatar

- average

- award

- away

- Bank

- bank of japan

- BE

- bearish

- bearish divergence

- Bearish Momentum

- beat

- before

- being

- below

- Benchmark

- boj

- bond

- boost

- Box

- Break

- broad-based

- Bullish

- Bulls

- business

- but

- buy

- by

- Chart

- clearance

- click

- Close

- COM

- combination

- Commodities

- condition

- conditions

- conducted

- Connecting

- consecutive

- Consensus

- consumer

- contact

- content

- continued

- contraction

- contrast

- contribute

- Core

- core inflation

- Costs

- courses

- Current

- Decline

- Declining

- Directors

- Divergence

- Dollar

- Dovish

- down

- downside

- driver

- drivers

- due

- Earlier

- Economic

- effect

- effects

- elevated

- Elliott

- embarking

- energy

- energy prices

- enlarge

- evidence

- exchange

- excluding

- exhibit

- experience

- expert

- Face

- factors

- far

- FAST

- February

- Fibonacci

- financial

- Find

- First

- first time

- Flash

- flow

- food

- For

- foreign

- foreign exchange

- forex

- found

- four

- fresh

- from

- fund

- fundamental

- further

- General

- Global

- global markets

- Government

- Governor

- Have

- he

- High

- higher

- highest

- his

- Hit

- HTTPS

- if

- import

- improve

- in

- Inc.

- Increases

- increasing

- indicates

- Indicators

- Indices

- inflation

- inflation rate

- Inflationary

- Inflationary pressures

- information

- interest

- Interest Rates

- investment

- IT

- ITS

- Japan

- Japan Core Inflation

- Japan’s

- Japanese

- JAPANESE GOVERNMENT

- JGB

- JPY

- Kelvin

- Key

- Last

- latest

- Led

- Level

- levels

- like

- likely

- Line

- Low

- lower

- lowest

- lowest level

- Macro

- Main

- major

- manufacturing

- Market

- market outlook

- market research

- MarketPulse

- Markets

- max-width

- May..

- minor

- mixed

- Momentum

- Monetary

- Monetary Policy

- Month

- months

- more

- most

- moving

- moving average

- moving averages

- Nationwide

- necessarily

- negative

- news

- next

- nov

- November

- numerous

- october

- of

- officers

- Oil

- on

- ONE

- only

- Opinions

- or

- order

- out

- Outlook

- over

- overall

- passionate

- path

- perspectives

- photo

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- please

- Plummet

- pmi

- policy

- political

- positioning

- Posts

- potential

- Premium

- pressure

- pressures

- Prices

- primary

- Prime

- Prior

- Produced

- providing

- purposes

- put

- Putting

- rallies

- Rate

- Rates

- ratings

- reached

- rebound

- recent

- recovery

- remained

- renewed

- research

- Resistance

- retail

- retracement

- Reversal

- Rise

- ROSE

- rsi

- rss

- Second

- sector

- Securities

- see

- seen

- sell

- senior

- sentiment

- September

- service

- Services

- set

- several

- sharing

- short-term

- show

- signals

- significant

- since

- Singapore

- site

- sixth

- So

- so Far

- solution

- Source

- speaking

- specializing

- Spot

- Spreads

- Squeeze

- stance

- start

- started

- stayed

- Still

- stock

- Stock markets

- Strategist

- Struggle

- substantial

- support

- Supports

- Swing

- Target

- Technical

- Technical Analysis

- ten

- Terminal

- that

- The

- this

- this week

- thousands

- time

- to

- TONE

- towards

- Traders

- Trading

- TradingView

- Training

- Trend

- trigger

- Tuesday

- TURN

- Undermine

- unique

- us

- US Dollar

- USD/JPY

- using

- v1

- via

- Visit

- wage

- wait

- Wave

- weakness

- Wednesday

- week

- WELL

- were

- which

- winning

- with

- wong

- would

- writing

- years

- Yield

- yields

- You

- zephyrnet