Data has shown that long-term Bitcoin (BTC) holders are holding firm on their commitment to the firstborn crypto, with no aim to liquidate their portfolio despite recording a substantial profit in recent weeks.

In a recent update, on-chain intelligence firm IntoTheBlock disclosed that despite Bitcoin breaking into the $40k range this week, staunch BTC holders are not taking profits.

Note that Bitcoin last traded in the $40k range in January 2022. As a result, it becomes intriguing that after nearly 24 months of Bitcoin’s bearish trend, top holders have chosen not to offload their holdings at a profit.

Long-term BTC Holders Add $15B

On the contrary, these Bitcoin holders have proceeded to hoard more of the cryptocurrency. Specifically, IntoTheBlock noted that the long-term BTC holders have collectively acquired more than 360,000 BTC since early November.

– Advertisement –

These amassed tokens now hold a market value of $15,089,713,200 ($15 billion) – at the time of reporting. Moreover, the market tracking platform mentioned that this group of Bitcoin-accumulating investors now commands a Bitcoin portfolio of 13.8 million BTC.

To put it in perspective, the stocked BTC translates to a dollar value of $578.34 billion, which is effectively 70% of the circulating BTC.

Potential Dump in Full-blown Bull Market

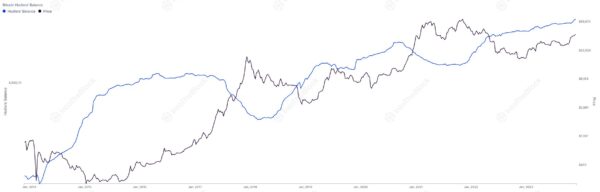

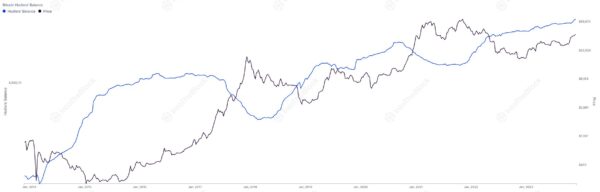

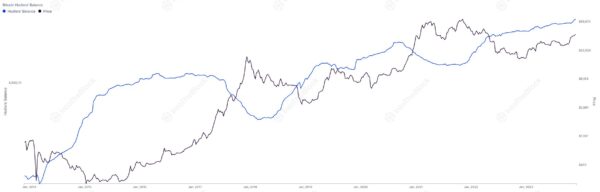

Furthermore, the chart accompanying IntoTheBlock’s tweet illustrated a fascinating trend in long-term BTC holders’ accumulation and sell-off behaviors. Notably, from January 2015, when BTC traded at $264, to January 2017, when Bitcoin reached $999, the accumulation trend showed a considerable increase.

However, the balances of Bitcoin holders experienced a notable depletion in correlation with the elevated BTC prices witnessed in 2017/2018. Similar sell-off and reaccumulation patterns are observable through 2019, 2020, and 2021, when Bitcoin reached a new peak.

Interestingly, the chart from IntoTheBlock indicates that Bitcoin holders have resumed the accumulation spree, taking advantage of the lower prices this year. This strategic stockpiling may be in anticipation of more profitable liquidation in a full-blown bull market, mirroring scenarios of previous market cycles.

It is noteworthy to mention that at the current price of Bitcoin, over 80% of holders are in a profitable position. Those currently experiencing losses are mostly individuals who purchased Bitcoin during the peak of 2021.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thecryptobasic.com/2023/12/05/whales-amass-15b-in-bitcoin-resisting-profit-taking-despite-profitability/?utm_source=rss&utm_medium=rss&utm_campaign=whales-amass-15b-in-bitcoin-resisting-profit-taking-despite-profitability

- :has

- :is

- :not

- 000

- 11

- 13

- 200

- 2014

- 2015

- 2017

- 2019

- 2020

- 2021

- 2022

- 24

- 360

- 7

- 8

- a

- accumulation

- acquired

- add

- ADvantage

- Advertisement

- advice

- After

- aim

- amassed

- and

- anticipation

- any

- ARE

- article

- AS

- At

- author

- balances

- basic

- BE

- bearish

- becomes

- before

- behaviors

- Billion

- Bitcoin

- BTC

- BTC Prices

- bull

- Bull Market

- Chart

- chosen

- circulating

- collectively

- commitment

- considerable

- considered

- content

- contrary

- Correlation

- crypto

- cryptocurrency

- Current

- Currently

- cycles

- data

- decisions

- Despite

- do

- Dollar

- dump

- during

- Early

- effectively

- elevated

- encouraged

- experienced

- experiencing

- expressed

- fascinating

- financial

- financial advice

- Firm

- For

- from

- Group

- Have

- High

- hold

- holders

- holding

- Holdings

- http

- HTTPS

- ID

- in

- include

- Increase

- indicates

- individuals

- Informational

- Intelligence

- into

- intotheblock

- intriguing

- investment

- Investors

- IT

- January

- jpg

- Last

- liquidate

- Liquidation

- long-term

- losses

- lower

- Making

- Market

- market value

- max-width

- May..

- mentioned

- million

- mirroring

- months

- more

- Moreover

- mostly

- nearly

- New

- no

- notable

- notably

- noted

- noteworthy

- November

- now

- of

- on

- On-Chain

- Opinion

- Opinions

- patterns

- Peak

- personal

- perspective

- platform

- plato

- Plato Data Intelligence

- PlatoData

- portfolio

- position

- previous

- price

- Prices

- Profit

- profitability

- profitable

- profits

- purchased

- put

- range

- reached

- readers

- recent

- recording

- reflect

- Reporting

- research

- responsible

- result

- s

- scenarios

- sell-off

- should

- showed

- shown

- similar

- since

- span

- specifically

- spree

- Strategic

- substantial

- TAG

- taking

- than

- that

- The

- The Crypto Basic

- their

- These

- this

- this week

- this year

- those

- Through

- time

- to

- Tokens

- top

- Tracking

- traded

- Trend

- tweet

- value

- views

- W3

- webp

- week

- Weeks

- weight

- whales

- when

- which

- WHO

- with

- witnessed

- year

- zephyrnet