In the ever-volatile world of cryptocurrencies, Polygon’s native token, MATIC, witnessed a notable price correction, triggering a flurry of activity from significant investors known as “whales.” These investors took advantage of the price decline, splashing a staggering $90 million into acquiring MATIC tokens, indicating a potential trajectory towards a price recovery.

Amid recent market fluctuations, MATIC experienced a retracement from its earlier peak of $0.92 to $0.765 at the current time. This downward movement came after a remarkable performance from mid-October to early November, aligning with the anticipation and subsequent realization of Polygon Labs’ transformation of MATIC tokens into the newly launched POL token.

On-Chain Insights: Whales’ Strategic Accumulation of MATIC

However, the initial euphoria surrounding this event has subsided, leading to a reduction in speculation-driven activities related to this digital asset. Interestingly, on-chain data analysis reveals a starkly different narrative – a sustained interest and accumulation of MATIC by cryptocurrency whales.

Prominent analyst and crypto trader Ali Charts shed light on this movement, showcasing how whales strategically acquired over 120 million MATIC tokens in just the past week. This accumulation spree translated into a significant inflow of $90 million, indicating substantial confidence among these major investors despite the recent price volatility.

The impact of this whale activity on MATIC’s price action has been palpable. Observably, the token has rebounded from its recent lows around $0.72, showcasing resilience and retaining a substantial portion of its monthly gains, with an overall 20% increase within the evaluated period.

In the world of cryptocurrencies, whale activity often serves as a bellwether for market bottoms, influencing both short-term fluctuations and long-term trends. These substantial whale acquisitions provide optimism for MATIC holders, suggesting that increased network activity and recent whale buys may pave the way for the asset’s recovery.

Polygon’s Rising Network Activity Fuels MATIC’s Prospects

Beyond the price dynamics, the growth of the Polygon network and MATIC’s price movement, the blockchain ecosystem has witnessed substantial expansion. Over the past three years, the number of active addresses on the Polygon network has surged from approximately 120,000 to an impressive 387 million, showcasing notable growth and adoption.

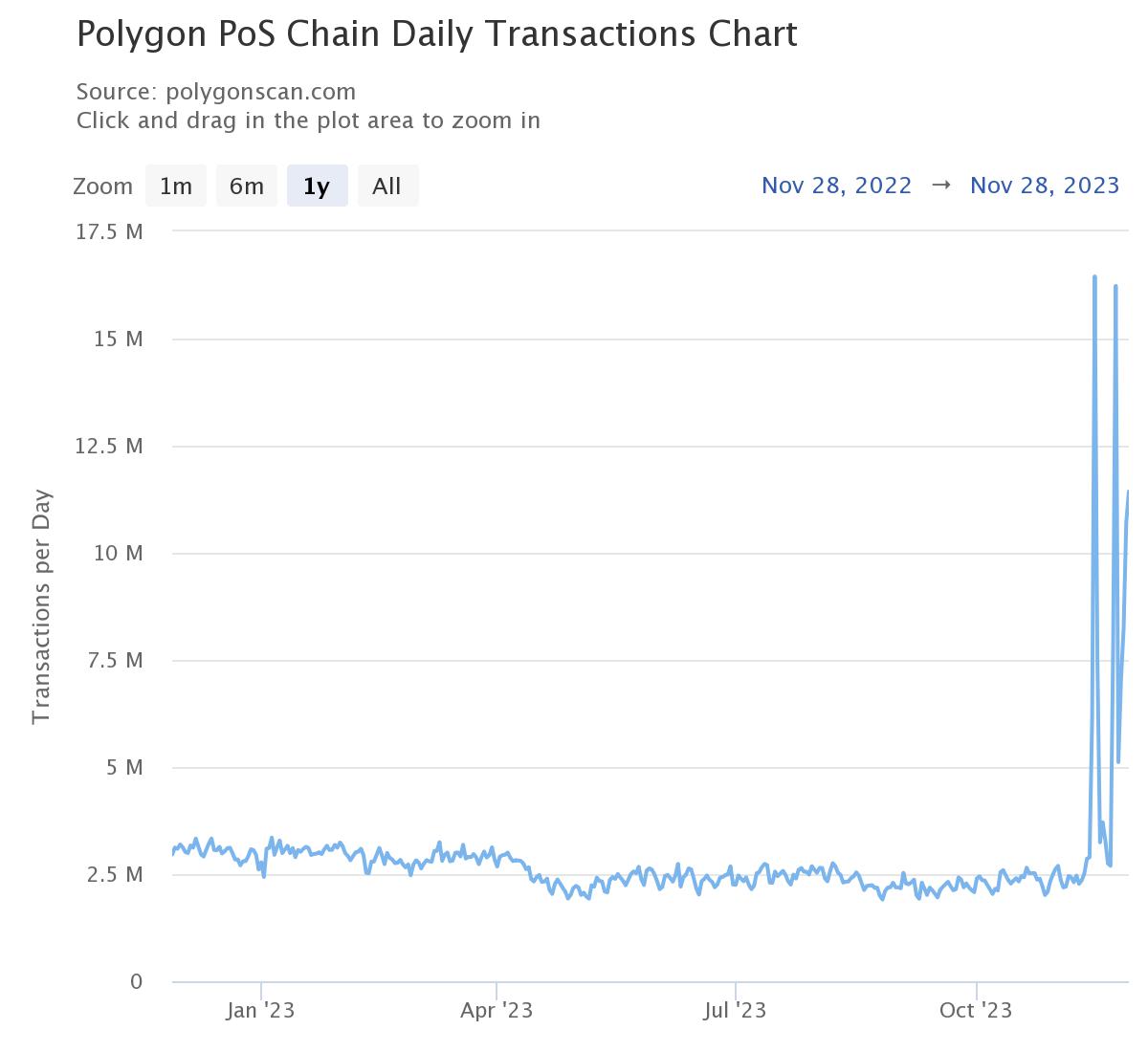

Additionally, there has been a significant increase in daily transactions, evidence of increased user activity on the network. These transactions soared to yearly highs, surpassing six million, subsequently leading to a surge in network fees, painting a promising picture for Polygon’s ecosystem growth and potential prospects.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://zycrypto.com/whales-seize-polygon-matic-dip-90m-inflows-hint-at-price-recovery/

- :has

- 000

- 120

- 700

- 72

- a

- accumulation

- acquired

- acquiring

- acquisitions

- Action

- active

- activities

- activity

- addresses

- Adoption

- ADvantage

- After

- aligning

- among

- an

- analysis

- analyst

- and

- anticipation

- approximately

- around

- AS

- asset

- At

- been

- blockchain

- blockchain ecosystem

- both

- Buys

- by

- came

- chain

- Chart

- Charts

- coinbase

- confidence

- content

- crypto

- cryptocurrencies

- cryptocurrency

- Current

- daily

- daily transactions

- data

- data analysis

- Decline

- Despite

- different

- digital

- Digital Asset

- Dip

- downward

- dynamics

- Earlier

- Early

- ecosystem

- evaluated

- Event

- evidence

- expansion

- experienced

- Fees

- fluctuations

- flurry

- For

- from

- fuels

- Gains

- Growth

- Highs

- holders

- How

- HTTPS

- image

- Impact

- impressive

- in

- Increase

- increased

- inflows

- influencing

- initial

- insights

- interest

- into

- Investors

- ITS

- jpg

- just

- known

- launched

- leading

- light

- long-term

- Lows

- major

- Market

- Matic

- max-width

- May..

- million

- monthly

- movement

- NARRATIVE

- native

- Native Token

- network

- newly

- notable

- November

- number

- of

- often

- on

- On-Chain

- on-chain data

- Optimism

- over

- overall

- painting

- palpable

- past

- pave

- Peak

- performance

- period

- picture

- plato

- Plato Data Intelligence

- PlatoData

- Polygon

- Polygon Network

- Polygon’s

- portion

- PoS

- potential

- price

- PRICE ACTION

- promising

- prospects

- provide

- realization

- recent

- recovery

- reduction

- related

- remarkable

- resilience

- retaining

- retracement

- Reveals

- rising

- Seize

- serves

- shed

- short-term

- showcasing

- significant

- SIX

- soared

- Source

- spree

- staggering

- Strategic

- Strategically

- subsequent

- Subsequently

- subsided

- substantial

- surge

- Surged

- surpassing

- Surrounding

- that

- The

- the world

- There.

- These

- this

- three

- time

- to

- token

- Tokens

- took

- towards

- trader

- trajectory

- Transactions

- Transformation

- Trends

- triggering

- Unveils

- User

- versatile

- Volatility

- Way..

- week

- Whale

- whales

- with

- within

- witnessed

- world

- yearly

- years

- zephyrnet