Welcome to the exciting world of payments! In this fascinating industry, acquiring is a key aspect. But what exactly is acquiring? And how does it differ from an issuing bank or a payment processor? Read on to learn more about this important part of the

payments ecosystem.

A customer’s transaction is just a tap away with their card. But what they don’t see is the complex web of financial institutions that make it all possible. The merchant acquiring bank is the backbone of it all. Merchant acquiring banks are financial institutions

that provide merchants with the ability to accept card payments (credit and debit cards).

Note: An acquiring bank can also be referred to as ‘merchant acquiring bank’ or the ‘merchant acquirer’. They are typically referred to as “acquirers.”

The Classical Payment Model: Step By Step

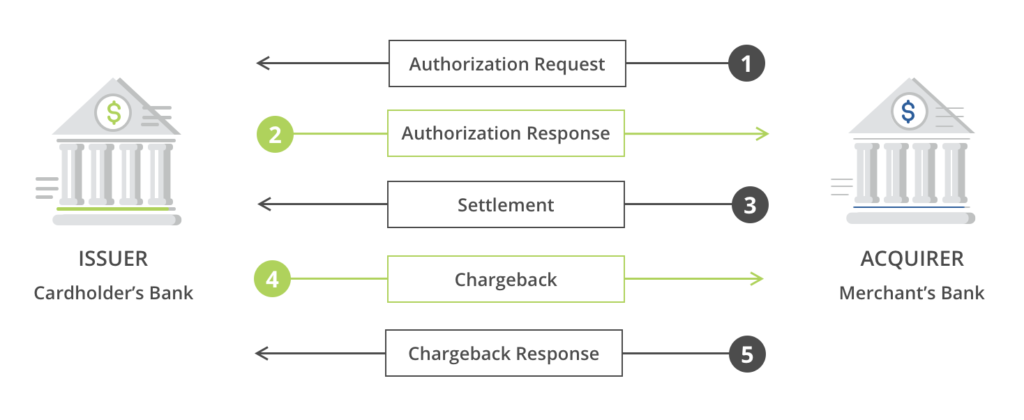

The classical payment model is a process that takes place each time a customer makes a purchase with their debit or credit card. The steps involved in this process are: Authorization, Clearing, and Settlement. Let’s take a closer look at each of these steps:

-

Authorization: When the customer’s card is used (either online or physically in the store) the cardholder’s bank is contacted to approve the transaction. The cardholder’s bank will then either approve or decline the transaction based on

a number of fraud rules and a balance check to ensure there are sufficient funds. -

Clearing: The cardholder’s bank exchanges daily payment information with the merchant’s bank via the Card Scheme, resulting in the generation of a settlement file which is used for the following stage.

-

Settlement: The settlement step is when the cardholder’s bank pays the merchant’s bank for the transaction, who then settles the funds to the merchant beneficiary.

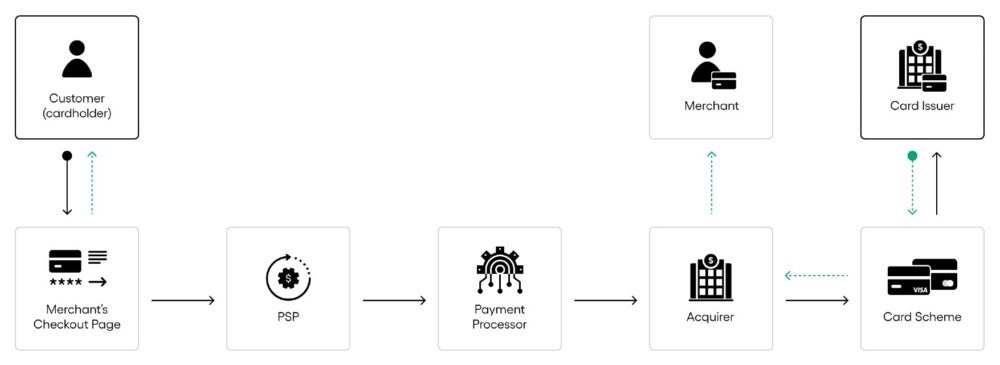

The best way to become familiar with the process is to take a look at the detailed explanation below. When you are a merchant, you will often work with a payment service provider (PSP), but the actual funds will come from your acquiring bank.

The standard practice in the card acquiring industry is for the consumer (the cardholder) to authenticate the purchase at checkout by entering their credit or debit card information (card number, cardholder name, expiration date, CVV number). Online payment

security can be enhanced with the use of 3DS (Visa Secure,

Mastercard SecureCode,

Amex SafeKey) which is a form of Strong Customer Authentication (“SCA”).

The card scheme then routes the payment details to the correct issuing bank for authorization. The process of

authorization includes confirming with the issuing bank that the card is valid and there are sufficient funds in the account to complete the transaction. The card issuer (or issuing bank) then verifies the customer’s identity and approves or

declines the transaction.

If approved by the issuing bank, the transaction is authorised and will be initially ‘captured’ by the merchant, meaning they submit the payment for processing. Once captured, the payment will be cleared and subsequently settled. Settlement

takes place typically 2 – 5 days afterwards where funds are transferred from the issuing bank, via the card network, to the acquiring bank, before being credited to the merchant bank account.

The time it takes for a merchant to access their funds can vary depending on the merchant acquirer agreements, the currencies being exchanged (payment currency, settlement currency), the countries of the issuing and acquiring banks, delivery times and type

of products and service.

Note: In the classical online payment model, the processor and acquirer are usually two different companies. The processor handles the technical aspects of the payment and then sends the transaction details to the acquirer.

PSP, Acquirer, Issuer, Processor: What’s The Difference?

Let’s take a look at the terms that have caused many heads to be scratched. Below we explain what a PSP is, and outline the differences between an acquiring bank vs. an issuing bank and a merchant acquirer vs. payment processor. Let us guide you through

the jungle of terminology.

Payment Service Provider (PSP)

A PSP is an entity that provides card services and access to alternative payment methods to businesses by having relationships and contractual agreements with several merchant acquirers and alternative payment method providers. Hence, rather than a merchant

needing to seek out multiple partners for different acceptance methods, the PSP does this on their behalf.

The PSP functions as the intermediary, meaning that it manages the connections between merchants and acquirers, but typically is never involved in the actual processing of payments. The PSP will provide the technical integration for the merchant, while the

acquirer is responsible for processing the payments and managing the associated risks.

One key role of the PSP is to route your payments to different acquirers to optimize for acceptance rates, price and risk.

Acquiring bank vs. issuing bank

In simple terms, the cardholder’s bank is the issuing bank and the merchant’s bank is the acquiring bank.

The issuing bank is the entity responsible for issuing cards to cardholders. They are incentivized to do so by receiving a small percentage (interchange fee) of each transaction. In addition to providing the cards, they authorise transactions after checking

for any fraudulent behaviour and whether the balance is sufficient to cover for the purchase.

The acquiring bank is responsible for settling funds to the merchant. They also take on the risk associated with any merchant fraud or failure to deliver on goods or services – hence, should the merchant go bankrupt (or vanish into thin air) and is unable

to fulfil any outstanding orders, the acquiring bank is responsible for refunding the cardholders. For this reason, opening a merchant account can sometimes be challenging for new businesses without a trading history.

Merchant acquirer vs. payment processor

Payment processors are important for facilitating the transaction on behalf of the acquirers and issuers. They act as the communication layer between the banks and the card schemes, sending and receiving the necessary information to authorise, clear and

settle a transaction. Note: the payment processor has a strictly technical function, meaning they are not involved in the money flow. However, people often use the term “payment processor” to refer to counterparties involved in the settlement of funds to the

merchant, helping to add to the confusion.

Processors are typically integrated directly with acquirers to accept transactions, who in turn provide the financial institution and card scheme licensing to process the transaction.

Acquirers play an important role in the payment process by receiving funds from the card networks and ensuring that merchants receive the amounts due for their customer purchases. Acquirers are often, but not always, part of the technical transaction flow,

and regardless of their participation in the technical aspect they play a vital role in making sure that payments are processed smoothly and efficiently.

Now that we have a better understanding of what merchant acquiring banks are, let’s take a closer look at how they serve their merchants.

The Role of Merchant Acquirers: More Than Just Credit and Debit Card Processing

The role of the merchant acquirer is not limited to accepting and processing credit and debit card payments. They also provide a number of value-added services that can help merchants run their businesses more efficiently. Understanding the role of acquirers

can help you make educated decisions about your payment processing options.

Some of the critical roles fulfilled by merchant acquiring banks are as follows:

- Opening a merchant account. Ensuring the merchant identity is verified and confirmed that they are indeed selling what they claim to be selling.

- Settlement. Works with the card issuer to make sure that the merchant gets paid for the transaction.

- Chargebacks. In the event that a customer disputes a charge, the acquirer will work with the merchant and card issuer to try to resolve the issue.

- Fraud prevention. Using transaction monitoring tools to identify and prevent fraudulent activity. Acquirers take on the risk of fraud & chargebacks, so they have a vested interest in preventing it.

- Analytics. Providing real-time insights into your sales and customer health metrics, so you can always stay on top of your game. This allows you to make informed decisions about your business in order to keep it running smoothly.

- Customer support. Provides customer support for both merchants and cardholders in case there are any issues with a transaction.

How To Choose An Acquirer For Your Business

Whether you are starting your online business or looking to expand, acquirers can play a crucial role in your success. There are several factors that you have to take into account when choosing a merchant acquirer for your business:

- Make sure they support the type of cards you want to accept.

- You need to know which locations and currencies your acquirer supports. Make sure they cover the country your company is registered in, as well as the currencies you will be accepting on your website.

- Be sure to ask your potential acquirer about their acceptance rate. Losing out on customers because their transactions aren’t supported could be costly.

- How quickly can your business be onboarded? When time is of essence, it’s important to know how fast the

onboarding process will be. The sooner you’re onboarded, the sooner you can start taking orders. - The speed of settlement is an important consideration for businesses with a limited cash flow. It is essential to know how quickly you will receive payment so that you have access to working capital as soon as possible.

- You never know when payment issues will arise. That’s why responsive support is important. How quickly does the acquirer respond to merchant queries? Do they have a dedicated support team? Check what other merchants are saying about the

customer service. - How much is each transaction costing you? This will help you calculate the

cost of your transactions and figure out how much you’ll be charged. Acquirers typically charge a merchant varying fees. These fees cover network processing and merchant account-related services. - Maintaining the cost of your business is important. One way to do this is to make sure you’re aware of

how many transactions you can process each month before you have to pay extra fees. - Check if there is a limit to the volume of transactions you can process each month. For this reason, you may require more than one acquirer.

- Ensure that the collateral requirements are not too prohibitive to your business. I.e. how much of your sales receipts will the acquirer reserve and for what period?

Now that you understand the key factors to consider when selecting a merchant acquirer for your business, it is beneficial to have a detailed understanding of the associated costs and fees.

Merchant acquiring: deciphering cost and fees

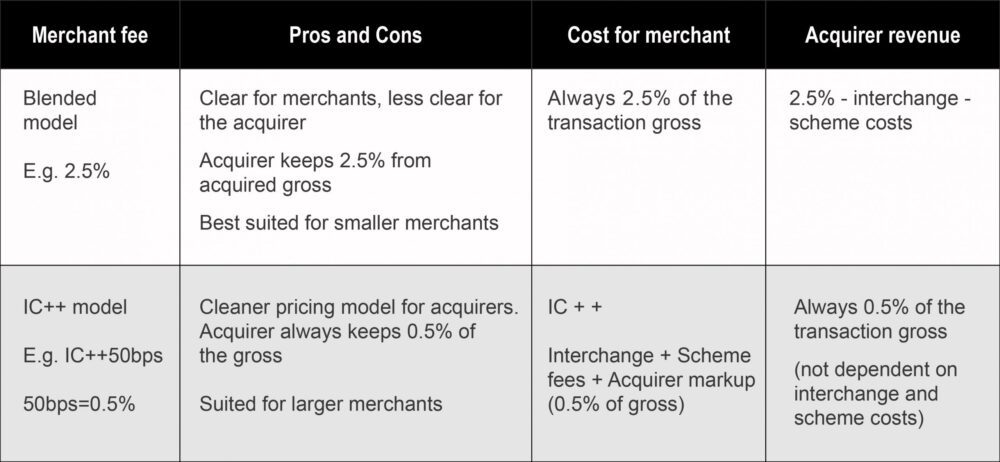

Pricing models can be very confusing, especially when it comes to card processing. There are two main pricing concepts: blended and Interchange Plus (‘Intercharge+’).

Blended pricing is more common for small merchants and is an ‘all-in’ rate. With blended pricing, the merchant does not see the granularity of each transaction and hence the merchant profit can increase materially depending on the type and location of the

customer’s card.

For larger or more established merchants, Interchange+ pricing is more widely used as it is more transparent and allows for more granularity around processing fees. Interchange+ pricing is one model often used by merchant acquirers to help determine the

cost per transaction for merchants. This fee consists of two components: the interchange fee set by the card network, and the markup set by the card processor itself.

An example of how this works is as follows: Visa* interchange fees are 1.51% + $0.10 for a standard transaction. Let’s say a merchant acquirer charges a flat markup of 0.25% on top of these interchange fees. If a merchant were to process a transaction for

$100 using Visa, they would be charged 1.51% + $0.10 + 0.25% = $2.01 in fees.

* This is only an example, and actual pricing will vary depending on the card type, transaction amount, MCC market, and merchant acquirer.

When it comes to Interchange Plus Plus (Interchange++) pricing, there is not a world of difference between the two. The key distinction lies in the fact that with Interchange++, the acquirer also passes on the scheme fees from the card networks. This means

that there are three components to this type of pricing: the interchange, the first plus (the acquirer’s fee), and the second plus (the card scheme fee).

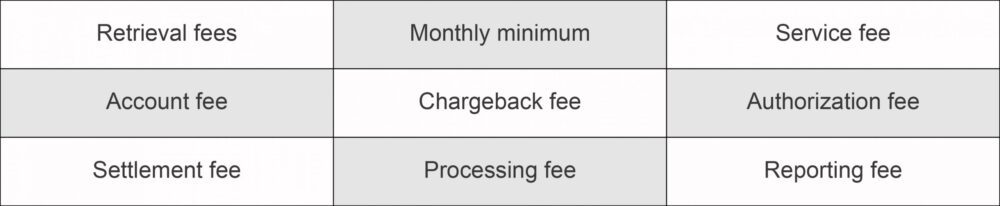

Now that you know about the two main pricing models, let’s take a look at the other fees that can vary depending on the acquirer. Some of the fees that you may see on your statement can include:

Some of these fees can be negotiable. Merchants who take the time to review and understand their monthly statements might be able to effectively negotiate different pricing with their acquirers.

What About Security?

With the

recent increase in data breaches, it’s important that all parties involved in the credit and debit card payment process follow security standards for fraud prevention.

The Payment Card Industry Security Standard (PCI DSS) has guidelines to keep your customers’ information safe. If a company processes credit or debit cards, it should be fully compliant with

the PCI standard. This ensures that your customer’s information is secure when they make a purchase from your online store.

Fraud is a real threat to businesses, but it doesn’t have to be. Choosing the right type of PSP and acquirer can help you to significantly fend off fraudsters. We recommend using PSPs that offer anti-fraud solutions and fraud prevention tools to help prevent

cyberattacks and fraudulent activity.

Key takeaways

There you have it — everything you need to know about merchant acquiring. We hope this guide has given you a better understanding of what acquiring is, how it works, and what to look for when choosing a merchant acquirer for your business. Don’t forget to

check out this list of the top

merchant acquirers to help you find the best fit for your business needs.

- ant financial

- blockchain

- blockchain conference fintech

- chime fintech

- coinbase

- coingenius

- crypto conference fintech

- fintech

- fintech app

- fintech innovation

- Fintextra

- OpenSea

- PayPal

- paytech

- payway

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- stripe

- tencent fintech

- xero

- zephyrnet