Boasting security and privacy, including untraceable transactions, Monero (XMR) is among the most popular and controversial cryptocurrencies in an increasingly saturated market. Like other cryptocurrencies, Monero features an open-source blockchain that records transactions and creates new units through mining. What sets Monero apart is its opaque blockchain, which prevents transactions and their amounts from being traced to specific addresses — providing an extra layer of protection to the identities of its users.

In this beginner’s guide to Monero, we will go over:

The history of Monero starts in 2013 when a white paper outlining an application layer protocol for powering digital currencies called CryptoNote was released. The author of the paper used the pseudonym Nicolas van Saberhagen to protect their identity similar to Satoshi Nakamoto, the mysterious creator of Bitcoin.

Typically, white papers lay out a mission statement and then introduce technical plans for a technology’s implementation. The CryptoNote white paper, however, doubles as a thorough criticism of Bitcoin — citing major privacy and censorship issues.

Saberhagen quickly addresses their concern with the privacy of Bitcoin:

“Unfortunately, Bitcoin does not satisfy the untraceability requirement. Since all the transactions that take place between the network’s participants are public, any transaction can be unambiguously traced to a unique origin and final recipient. Even if two participants exchange funds in an indirect way, a properly engineered path-finding method will reveal the origin and final recipient.”

Not long after the paper was published, developers began working on realizing the platform’s mission, resulting in the creation of the transitory digital currency Bytecoin.

It didn’t take long for the controversy to start with Bytecoin as the founding team decided to “pre-mine” coins and distribute amongst themselves before the currency was available to the public. This, along with other questionable behavior, resulted in an eruption of drama that is chronicled here.

Some of the developers, led by Riccardo Spagni, decided to carry out a re-launch through a hard fork of the Bytecoin network. They decided to call it BitMonero (Monero is the Esperanto word for coin). Supporters of the digital currency decided on a shortened name of Monero.

Monero climbed the ranks of cryptocurrencies, with incredible growth in market capitalization throughout 2016 largely due to adoption by darknet marketplace AlphaBay, which has since been shut down due to illegal activity. The untraceability of Monero predictably lends itself to use among seedy individuals for illegal transactions.

The high-flying digital currency has been making its way into headlines for more than just a meteoric rise in market cap.

Recently, there have been a number of instances of hackers distributing malware that turn infected web pages into mining systems without the consent of users. Monero is uniquely susceptible to such problems because — unlike other cryptocurrencies like Bitcoin, which require specialty hardware — it is possible to mine Monero with normal CPUs.

Team

Monero has a thriving community made up of more than 240 active developers contributing to the Monero project, including 30 core developers. Much of the Monero core team is made up of a group of pseudonymous developers who tend to stay out of the crypto limelight, the exception being the outspoken Riccardo Spagni also known by his twitter handle @fluffypony.

Spagni, the controversial face of Monero, is a South African resident who seems to thrive on disrupting the world, particularly the banking system. A self-described Twitter troll, Spagni is notorious for repeatedly claiming that he lost his private keys “in a series of horrible boating accidents,” while simultaneously flaunting his love for Rolex watches and elaborate wine racks.

Serious question: if you don’t have an LED wine rack are you even an altcoin developer? pic.twitter.com/Gdgray2cJG

— Riccardo Spagni (@fluffypony) April 13, 2017

In regard to the re-launch of Monero, Spagni was quoted as saying,

“I thought, ‘I’m going to pump it and dump it,’ because I was interested in taking the ideas and implementing them in bitcoin. The bitcoin code base was far more interesting to me than Monero, and I thought, ‘I’m not going to work on this codebase, it’s terrible,’”

Despite his initial disinterest in Monero, Spagni stuck around with the Monero team and remains the cryptocurrency’s loudest voice and lead maintainer.

Three different privacy measures are used in the Monero blockchain to maintain the anonymity of users.

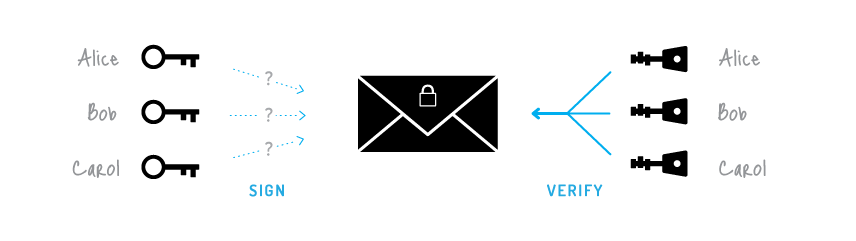

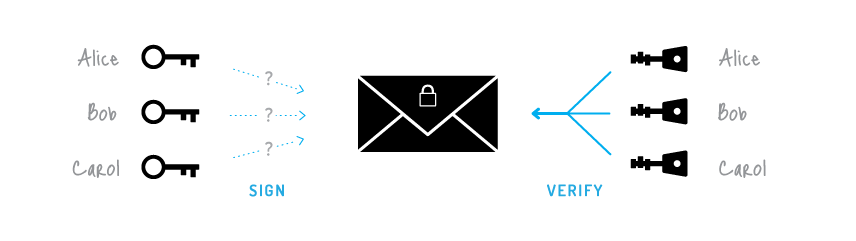

Ring signatures allow the sender in the transaction to hide among a group of sending addresses on the network. Basically, when a transaction occurs, there is a group of possible senders represented by their keys but the actual sender is never revealed in the data recorded on the blockchain.

Here is a visualization of ring signature tracking.

Ring confidential transactions or RingCT, is how transaction amounts are hidden. It was implemented on the Monero blockchain in January of 2017 and after September 2017, all transactions on the network feature RingCT by default. This upgrade improved upon ring signatures and other transactional components by allowing for completely hidden amounts, destination and origin address, and trustless coin generation.

Stealth addresses allow the sender to create a one-time address for a transaction that is randomly generated. The transaction is recorded as taking place between these addresses, yet they cannot be linked back to either the recipient or sender.

Unsurprisingly, there are those who are concerned about the secrecy of Monero transactions. The obfuscating of senders, recipients, and transaction amounts are the perfect features for criminals looking to do business and avoid detection. But privacy is something that people hold dear. Everyone has things that they would like to be kept private and the vast majority of those things are perfectly legal.

Fungibility is an economic term that is used to describe individual units of a good or commodity that are interchangeable. The easiest example of this is to use something like US dollars. Two 10 dollar bills can be exchanged for a 20 dollar bill without any value being gained or lost on either end of the transaction.

Most digital currencies, including Bitcoin, follow the basics of fungibility, as one Bitcoin will typically be worth 1 Bitcoin. However, one of the weaknesses of Bitcoin pointed out by the creators of Monero is its transparency that leaves users open to censorship and other problems.

Say that there was an exchange hack and Bitcoins were stolen from users who left their funds in their exchange’s wallet (try to avoid doing this). Those coins could be given to unsuspecting users, not aware that the coins are stolen, and then be rendered useless by those with the knowledge and means to identify the stolen funds.

Imagine that you were given cash in exchange for an item or service sold to someone else. If some or all of that cash is found to be counterfeit, you lose out on that money and are potentially open to an investigation into how you obtained that illegal currency, despite you doing nothing wrong.

Monero’s privacy features protect users from something like this happening, but it has also earned Monero a bit of an unsavory reputation. The untraceability of Monero transactions undoubtedly attracts some as a way to conduct illicit activity, but its supporters would point to this being a natural side effect of the currency’s effectiveness as a form of digital cash.

Mining is the process in which transactions on a blockchain network are compiled and verified until a block of transactions and their data are completed. Using a proof-of work system, miners connected to the network are essentially volunteering the computing power of their hardware to solve puzzles that, when completed, deliver a reward in the form of the network’s currency. This is how new coins are created and how these systems incentivize people to maintain the network.

Monero is built around the CryptoNight proof-of-work hash algorithm — one of the features of CryptoNote that was designed to create a more egalitarian approach to cryptocurrency mining compared to Bitcoin.

Bitcoin started out as a currency that could be mined using graphics processing units (GPUs). As the system grew, the complexity of the puzzles that needed to be solved in order to complete blocks and earn rewards had to be increased. At this point, GPU miners did not have the power to mine in any sort of profitable way and they gave way to specialized hardware in the form of application-specific integrated circuits (ASICs).

Monero is designed to be ASIC resistant, meaning that the mining process can be carried out using a mixture of GPU and central processing unit (CPU) functions. This is possible due to the system’s proof-of-work mechanism. Instead of a standard proof-of-work hash algorithm, the network is really a voting system where users vote for the right order of transactions on the blockchain.

Every participant has equal rights using this method, and it was specifically developed to create a more uniform distribution of coins throughout the lifetime of the currency. ASIC resistance is bolstered further by regular hard forks with the explicit goal of keeping ASICs at bay.

While Monero’s egalitarian approach allows almost anyone with computer access to participate in the maintenance of the network, it does have some exploitable features.

Coinhive is a Monero miner that is implemented through JavaScript, allowing websites to turn web traffic into full-scale mining operations. Basically, when Coinhive is active on a web page, any visitor on the website is now having their electricity and computer’s processing power used to mine Monero, often without permission. Examples of illegal Coinhive operation were common over the last couple of years. However, Coinhive recently announced that they would be shutting the platform down because the business model was no longer “economically viable.”

Monero (XMR) is available for trading on many of the major cryptocurrency exchanges. A handful of exchanges allow Monero to be traded for fiat currencies such as the US dollar, Euro, and British pound. However, most exchanges only allow for trading pairs between Monero and other cryptocurrencies, most often Bitcoin and Ether, the Ethereum network’s cryptocurrency. For those interested in obtaining XMR, we recommend using Bitcoin or Ethereum to buy Monero on the Binance exchange.

Like all other digital currencies, Monero needs to be stored in a wallet which can be in the form of a desktop application on your computer or smart phone, a web wallet, or a hardware wallet. Despite the popularity of Monero, the wallet options are actually pretty sparse. This is because the security measures built into the Monero blockchain pose a challenge to many of the most common wallets. But due to its standing in the market cap rankings, a good portion of wallets are working on Monero integration.

For a comprehensive guide to the best Monero wallets, check out our guide.

Monero is an interesting digital currency that truly lives up to the term digital cash. Fast, cheap, and anonymous transactions are possible thanks to the unique technology that underlies the Monero blockchain. It was developed not to increase the wealth of the already wealthy, but as a means of transacting for the common person who wants to break free from the often restrictive practices of traditional financial institutions and their instruments.

Though Monero is not free from scandal, the use of the currency for illegal purposes is not encouraged by the underlying technology or caused by any flaws within its design. Monero was developed to be a truly disruptive force in the world of personal finance. “Be your own bank” is a phrase often uttered in cryptocurrency conversations, and while sometimes Monero is more like “A digital mattress stuffed with cash”, it definitely has utility in a market full of projects without much to offer outside of mere potential.

Source: https://unhashed.com/cryptocurrency-coin-guides/what-is-monero-xmr/

- 11

- 2016

- access

- active

- Adoption

- African

- algorithm

- All

- All Transactions

- Allowing

- Altcoin

- Ambiguity

- among

- Anonymity

- Application

- around

- asic

- Banking

- Basics

- Bay

- BEST

- Bill

- Bills

- Bit

- Bitcoin

- blockchain

- British

- business

- business model

- buy

- call

- Cash

- caused

- Censorship

- challenge

- code

- Coin

- Coins

- commodity

- Common

- community

- computing

- controversy

- conversations

- Counterfeit

- Couple

- creator

- Criminals

- crypto

- cryptocurrencies

- cryptocurrency

- Cryptocurrency Mining

- Currency

- Darknet

- data

- Design

- Detection

- Developer

- developers

- DID

- digital

- digital currencies

- digital currency

- Dollar

- dollars

- Drama

- Economic

- electricity

- Ether

- ethereum

- Euro

- exchange

- Exchanges

- Face

- Feature

- Features

- Fiat

- finance

- financial

- Financial institutions

- flaws

- follow

- form

- Free

- full

- funds

- good

- GPU

- Group

- Growth

- guide

- hack

- hackers

- Hardware

- Hardware Wallet

- hash

- Headlines

- Hide

- history

- hold

- How

- HTTPS

- identify

- Identity

- Illegal

- Including

- Increase

- institutions

- integration

- investigation

- issues

- IT

- JavaScript

- keeping

- keys

- knowledge

- lead

- Led

- Legal

- Long

- love

- major

- Majority

- Making

- malware

- Market

- Market Cap

- Market Capitalization

- marketplace

- Miners

- Mining

- Mission

- model

- Monero

- money

- network

- Nicolas van Saberhagen

- offer

- open

- Operations

- Options

- order

- Other

- Paper

- People

- platform

- power

- privacy

- private

- Private Keys

- project

- projects

- Proof-of-Work

- protect

- protection

- public

- records

- Rewards

- Ring

- Satoshi

- Satoshi Nakamoto

- security

- Series

- Share

- smart

- sold

- SOLVE

- South

- start

- started

- Statement

- stay

- stolen

- store

- system

- Systems

- Technical

- Technology

- The Basics

- Tracking

- Trading

- traffic

- transaction

- Transactions

- Transparency

- us

- US Dollar

- users

- utility

- value

- visualization

- Voice

- Vote

- Voting

- Wallet

- Wallets

- Wealth

- web

- Website

- websites

- What is

- WHO

- within

- Work

- works

- world

- worth

- XMR

- years

- youtube