Due to the inherent volatility of the crypto market, stablecoins are instrumental in transferring on-chain value and securing loans.

Unit Protocol is a decentralized finance (DeFi) protocol that mints USDP stablecoins by collateralizing them with multiple tokens. Investors then use USDP to issue stabilized loans, without having to worry if the value of the collateral will go down overnight.

USDP Stablecoin Confusion

Unfortunately, there is confusion surrounding the USDP stablecoin because there are two tokens with the same ticker.

A New York-based company called Paxos launched Pax Dollar (USDP) stablecoin in September 2018, and it is fully regulated and backed by U.S. dollars deposited in a bank. For every USDP stablecoin Paxos issues as an ERC-20 token on Ethereum, it is backed in a one-to-one ratio with the dollar. So, $1 USD = 1 USDP, or Pax Dollar. Just to make matters more complicated, Pax Dollar (USDP) itself was previously called Paxos Standard (PAX).

Sushi’s Ambitious Revamp May Be ‘Too Complex’

Head Chef Jared Grey Aims to Roll Out NFT Marketplace and DEX Aggregator

There is a second USDP stablecoin that was launched by Unit.xyz in November 2020. The fact it has an identical ticker symbol — USDP — as Pax Dollar doesn’t make things easier for investors.

Unit.xyz also issues USDP as an ERC-20 token on Ethereum, but the Unit protocol does it differently because it runs as a decentralized platform, not a centralized company like Paxos.

What Is USDP Stablecoin?

The whole purpose of the Unit Protocol is to issue USDP stablecoins as loans, without resorting to traditional banks to do so. For example, centralized stablecoins like Pax Dollar (USDP), USD Coin (USDC), and Tether (USDT) are all issued by companies, with their stablecoins backed by cash held in banks.

Unit Protocol adheres to the spirit of decentralized finance (DeFi) by solely using cryptocurrencies to back USDP’s redeemable reserves, much like Dai stablecoins. This should not be confused with an algorithmic stablecoin like the defunct TerraUSD from the collapsed Terra ecosystem.

While algorithmic stablecoins rely on dynamic minting and burning of the network’s native token, such as LUNA-UST, USDP Stablecoin is simply collateralized by tokens instead of fiat money. Originally, USDP Stablecoin was collateralized by 11 tokens, coming mainly from the most popular lending and yield farming dApps on Ethereum, including ETH itself.

These were KP3R, ETH, AAVE, MKR, WBTC, COL, YFI, UNI, CRV, COMP, and STAKE. Since then, USDP Stablecoins can be collateralized by over 20 tokens.

How Does Unit Protocol Work?

For a stablecoin to be properly backed, collateral may not be withdrawn at will. Otherwise, there would be a constant risk of a bank run. This is why Unit Protocol issues USDP by making users lock-in their tokens for a time period. In return, users receive staking rewards.

When users deposit tokens to collateralize and issue USDP, they create a Collateralized Debt Position (CDP) smart contract.

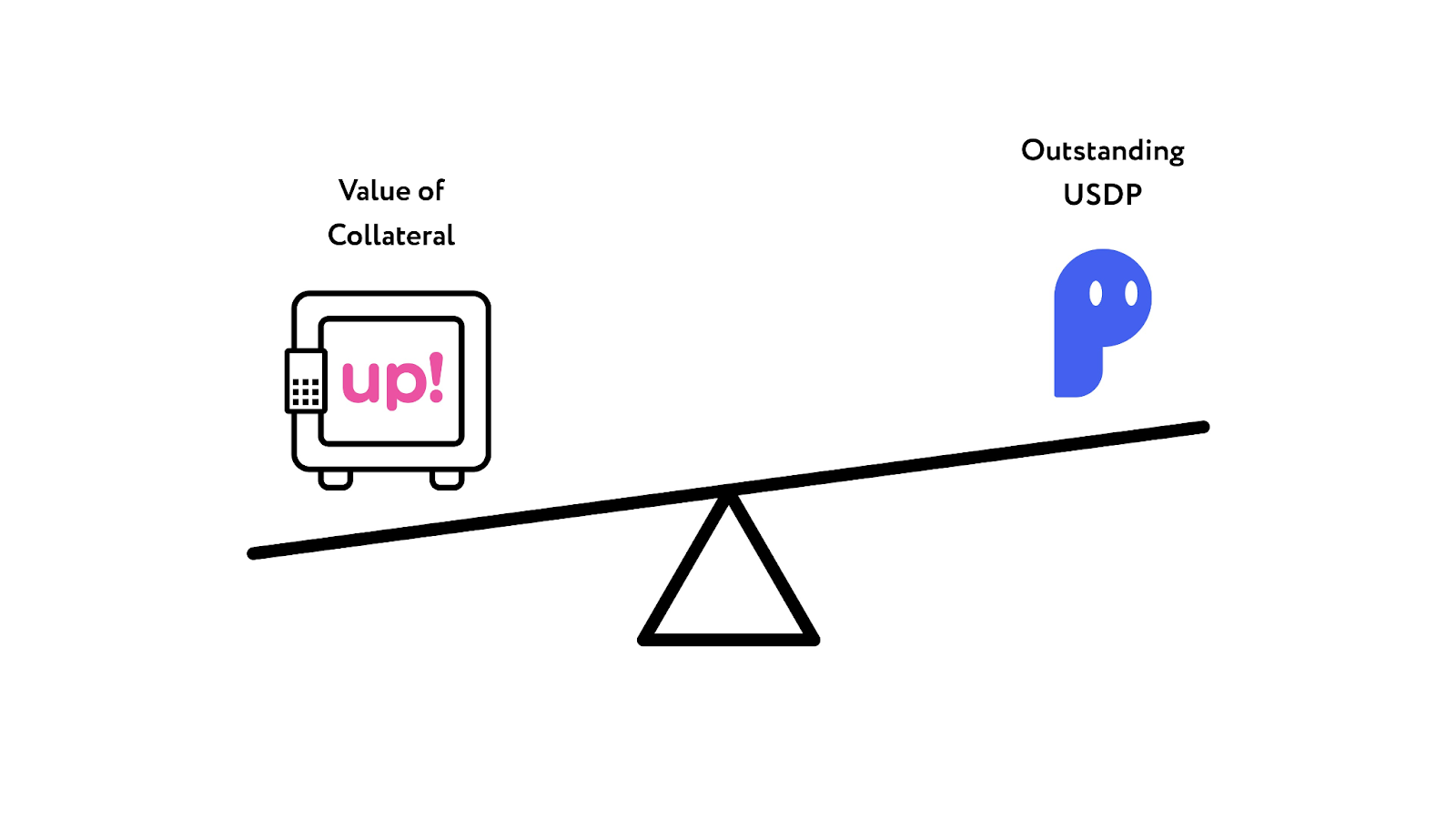

In other words, Unit Protocol equalizes the action between depositing a collateral for a loan and minting a stablecoin. Depending on which token is deposited as a collateral, the borrower receives USDP Stablecoin. Nevertheless, depending on which type of token is picked as a collateral, the resulting USDP issuance will be different. That’s because each token has a different Initial Collateral Ratio (ICR).

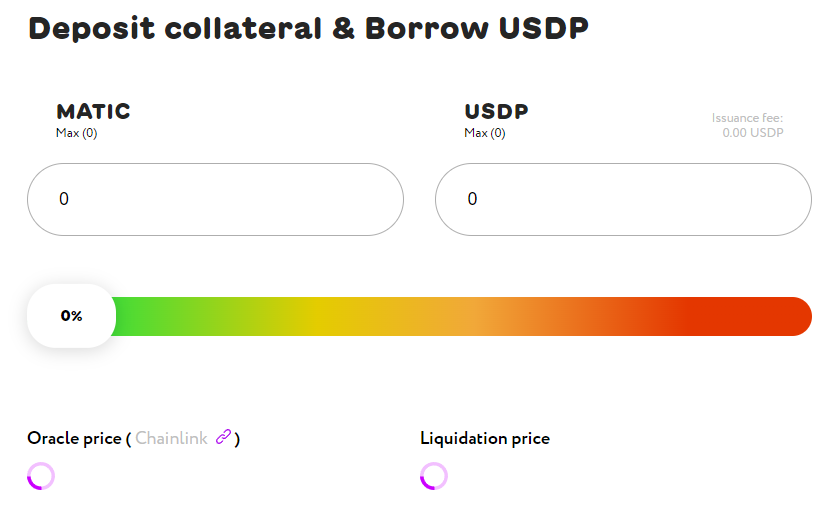

For example, to issue a USDP loan using MATIC as a collateral, one would have to deposit $1,000 worth of MATIC tokens to receive $690 worth of USDP Stablecoin. This follows from the fact the ICR for MATIC deposits is 69%.

Of course, if one were to pick another stablecoin as a collateral, then the ICR would be 100%. For example, depositing $1000 worth of USG stablecoin would allow one to borrow $1000 worth of USDP Stablecoin.

Canto Rallies After Variant Discloses Stake

Ethereum-compatible Layer 1 is the Fifth-Largest Blockchain on Cosmos

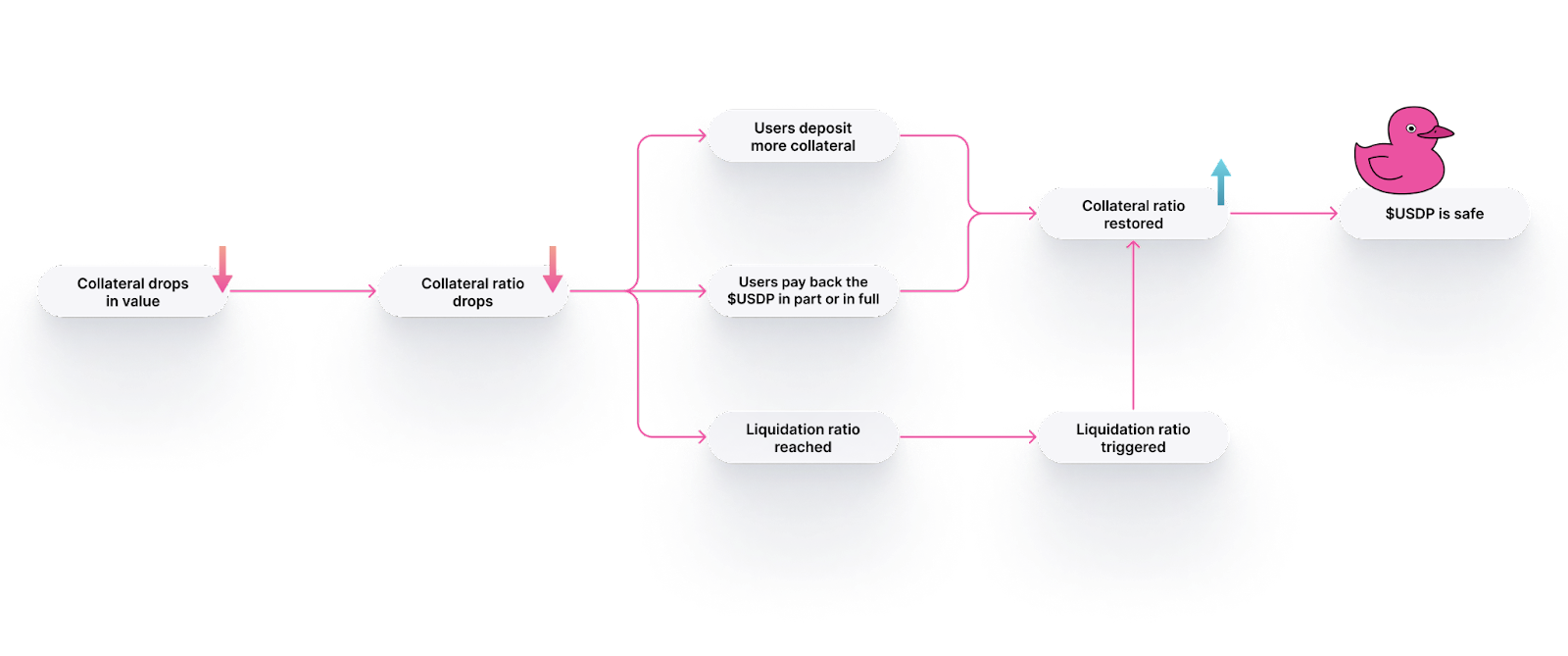

Likewise, each token deposited has its liquidation price, which is dependent on its volatility. More volatile tokens have higher liquidation ratios (LR), as a measure of debt vs. collateral. Case in point, if the collateral has 70% LR, this will mean that the CDP is in risk of liquidation if the collateral is worth less than the USDP issued (which is a loan).

This is why the LR percentage is always higher than the ICR percentage.

With these value-safeguarding mechanisms, USDP maintains its peg to the dollar. To avoid losing a portion of the collateral to liquidation, they have to deposit more tokens. And if they fail to pay, the LR is triggered, as shown below.

Unit Protocol uses Chainlink network to gauge real-time prices of deposited tokens in order to trigger collateral liquidations.

Like any dApp, Unit.xyz can be permissionlessly accessed with a non-custodial wallet, such as MetaMask. Then, it is just a matter of picking the right collateral to issue USDP stablecoins as a loan. Once the USDP amount is repaid, the CDP smart contract unlocks the collateral, so it can be withdrawn.

DUCK Tokenomics

The Unit Protocol picked a duck for its symbolic mascot. Likewise, DUCK is Unit’s governance and utility token, previously named COL (as in collateral). The renaming took place during the lockdrop coin offering (LCO) in May 2020, while the protocol was still going under the brand ThePay.Cash.

DUCK tokens dropped in December 2020, when COL tokens were swapped in a 100:1 ratio, so 1 COL = 0.01 DUCK. The DUCK token smart contract can be viewed here.

The initial total supply of DUCK tokens was 2B. Originally, ~97% of tokens was supposed to go to staking rewards. But the team decided to conduct many buybacks and burns, to appreciate the value of each coin. This significantly reduced DUCK circulating supply to 160M DUCK tokens, as of November 2022.

DUCK tokens cannot be used as a collateral to issue USDP, but they can be used for voting and regulating the protocol’s fees.

Unit Protocol Fees

Unit.xyz has three types of fees to consider when depositing tokens for a USDP loan:

- Issuance fee — a percentage charged any time a depositor enters CDP to issue USDP.

- Liquidation fee — a penalty fee when the collateral is liquidated, based on the percentage of the loan that has to be paid The liquidation fee is automatically deducted from the collateral.

- Stability fee — a fixed percentage fee paid any time when depositing a collateral to borrow USDP. This is the cost of issuing USDP debt over a 12-month period.

All fees are subject to change, voted on by DUCK token holders.

Unit.xyz Background

The team behind Unit Protocol is anonymous. The platform itself launched as PayCahs, later to be rebranded as Unit Protocol in July 2020. Nonetheless, even before the official launch, the platform was somewhat popular. In May 2020, it had locked nearly 4,000 ETH during the first lockdrop week.

Series Disclaimer:

This series article is intended for general guidance and information purposes only for beginners participating in cryptocurrencies and DeFi. The contents of this article are not to be construed as legal, business, investment, or tax advice. You should consult with your advisors for all legal, business, investment, and tax implications and advice. The Defiant is not responsible for any lost funds. Please use your best judgment and practice due diligence before interacting with smart contracts.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://thedefiant.io/what-is-unit-protocol/

- $1000

- 000

- 1

- 100

- 11

- 2018

- 2020

- 2022

- 7

- a

- aave

- accessed

- Action

- advice

- advisors

- After

- aims

- algorithmic

- algorithmic stablecoin

- algorithmic stablecoins

- All

- always

- ambitious

- amount

- and

- Anonymous

- Another

- appreciate

- article

- automatically

- back

- backed

- backed by cash

- Bank

- Bank run

- Banks

- based

- because

- before

- Beginners

- behind

- below

- BEST

- between

- bigger

- blockchain

- borrow

- brand

- business

- called

- cannot

- case

- Cash

- centralized

- Chainlink

- change

- charged

- circulating

- Coin

- collapsed

- Collateral

- collateralized

- collateralizing

- coming

- COMP

- Companies

- company

- complicated

- Conduct

- confused

- confusion

- Consider

- constant

- contents

- contract

- contracts

- Cost

- Course

- create

- CRV

- crypto

- Crypto Market

- cryptocurrencies

- DAI

- dapp

- DApps

- data

- Debt

- December

- decentralized

- Decentralized Finance

- decentralized finance (DeFi)

- decentralized platform

- decided

- DeFi

- defunct

- Demand

- dependent

- Depending

- deposit

- deposited

- deposits

- Dex

- different

- diligence

- Discloses

- Doesn’t

- Dollar

- dollars

- down

- dropped

- during

- dynamic

- each

- easier

- ecosystem

- Enters

- ERC-20

- ETH

- ethereum

- Even

- Every

- example

- FAIL

- farming

- fee

- Fees

- Fiat

- Fiat Money

- finance

- First

- fixed

- follows

- For Investors

- from

- fully

- function

- funds

- General

- Go

- going

- governance

- guide

- having

- Held

- higher

- holders

- HTTPS

- identical

- image

- implications

- important

- in

- Including

- information

- inherent

- initial

- instead

- instrumental

- interacting

- investment

- Investors

- issuance

- issue

- Issued

- issues

- issuing

- IT

- itself

- Jared Grey

- July

- launch

- launched

- layer

- layer 1

- Legal

- lending

- LIQUIDATED

- Liquidation

- liquidations

- loan

- Loans

- locked

- losing

- Lost Funds

- maintains

- make

- Making

- many

- Market

- marketplace

- Matic

- Matter

- Matters

- measure

- MetaMask

- minting

- MKR

- money

- more

- most

- Most Popular

- multiple

- Named

- native

- nearly

- network

- Nevertheless

- New

- New York-Based

- NFT

- nft marketplace

- non-custodial

- Non-custodial wallet

- November

- offering

- official

- On-Chain

- ONE

- order

- originally

- Other

- otherwise

- overnight

- paid

- participating

- pax

- Pax Dollar (USDP)

- Paxos

- Pay

- Peg

- percentage

- period

- pick

- picked

- Place

- platform

- plato

- Plato Data Intelligence

- PlatoData

- please

- Point

- Popular

- position

- practice

- previously

- price

- Prices

- properly

- protocol

- protocols

- purpose

- purposes

- rallies

- Rates

- ratio

- real-time

- receive

- receives

- redeemable

- Reduced

- regulated

- reserves

- responsible

- responsive

- resulting

- return

- Rewards

- Risk

- Roll

- Run

- same

- securing

- September

- Series

- should

- shown

- significantly

- simply

- since

- slider

- smart

- smart contract

- Smart Contracts

- So

- somewhat

- Source

- spirit

- stablecoin

- Stablecoins

- stake

- Staking

- standard

- Still

- subject

- such

- supply

- Supply and Demand

- supposed

- Surrounding

- symbol

- tax

- team

- Terra

- Terra ecosystem

- TerraUSD

- Tether

- Tether (USDT)

- The

- The Defiant

- their

- things

- three

- ticker

- time

- to

- token

- token holders

- Tokens

- Total

- traditional

- Transferring

- trigger

- triggered

- types

- u.s.

- U.S. Dollars

- under

- UNI

- unit

- unlocks

- USD

- USD Coin

- USD Coin (USDC)

- USDC

- usdp

- USDT

- use

- users

- utility

- Utility Token

- value

- Variant

- volatile

- Volatility

- voted

- Voting

- Wallet

- wBTC

- week

- What

- What is

- which

- while

- will

- without

- words

- Work

- worth

- would

- YFI

- Yield

- yield farming

- You

- Your

- zephyrnet