Usually, my Tuesday column is focused on a specific coin or token. It goes into depth regarding its technical and fundamental positioning, but this week, rather than focus on a single project, I’m going to cast a wider net (or field, I suppose) and talk about the broader topic of yield farming.

Yield farming was the hottest trend in DeFi in 2020. While it may not see as much hype now, it’s still alive and well. For anyone who holds any meaningful amount of crypto (or wants to), it’s imperative to understand at least the basics of yield farming.

Although the topic can get quite complex, the basics of yield farming are exactly that: basic. In today’s column we’ll look at ways anyone can get involved with yield farming, then discuss some of the complexities involved with this DeFi growth strategy.

Defining Yield Farming

There have been many ways in which the term “yield farming” has been tossed about. I like to have a very clear and precise definition, so we will define yield farming as follows:

Yield farming is managing various passive strategies to earn a defined interest on cryptocurrency holdings or positions.

Interestingly, there are many parallels between yield farming in traditional finance and crypto. Yes, yield farming in the traditional financial world is a thing. Consider the following cases:

- Many people hold cash in a bank account. That is not yield farming because there is no management strategy involved. However, an investor who constantly opens new high-yield savings accounts to earn bonuses and promotional rates would be yield farming their fiat cash holdings.

- Holding stock in a company, even if it pays a dividend, is not yield farming because there is no active strategy involved, but what about those who move in and out of stocks just to capture dividends? What about those who lend their shares to short sellers for returns? There are also covered calls, which allow stock investors to capture additional yield by selling options on the shares they own. These are all examples of yield farming.

Now that we have a clear and precise definition of yield farming, let’s look at how it applies to crypto.

Getting Started: The Basics of Yield Farming

The simplest way to start yield farming is through staking (read our Guide to Crypto Staking here). As a beginner, you can start staking easily via many online crypto exchanges or platforms with a few easy steps:

- Sign up on an online exchange/staking platform.

- Compare different cryptos (APY, lock-up period, minimum stakes, etc.)

- Buy the required number of crypto tokens.

- Enter the amount you wish to stake.

- Confirm to add crypto to the staking pool.

If you aren’t comfortable leaving your coins on an exchange or third-party platform (not your key, not your coins), there are several cryptocurrencies that allow you to stake by holding coins in your own non-custodial wallet.

For example, if you use Algorand and Algorand-based assets only, the official wallet from Algorand is a great option to earn ALGO staking rewards. If you have more than one ALGO in your wallet, you’ll automatically start earning rewards.

Other coins like Polkadot and Cardano allow you to hold your coins in your own wallet, nominate validators, and collect regular staking rewards without the bother of running your own node (which can be expensive, time-consuming, and require technical know-how).

If staking sounds interesting to you, we also have a staking rewards page that covers some of the top staking coins and their current yields.

Growing More: Intermediate Yield Farming

Those ready to move beyond simple staking might consider lending as a way to increase the yield they’re earning. The potential downside is that crypto lending comes with additional risks, which is why we call it an intermediate strategy.

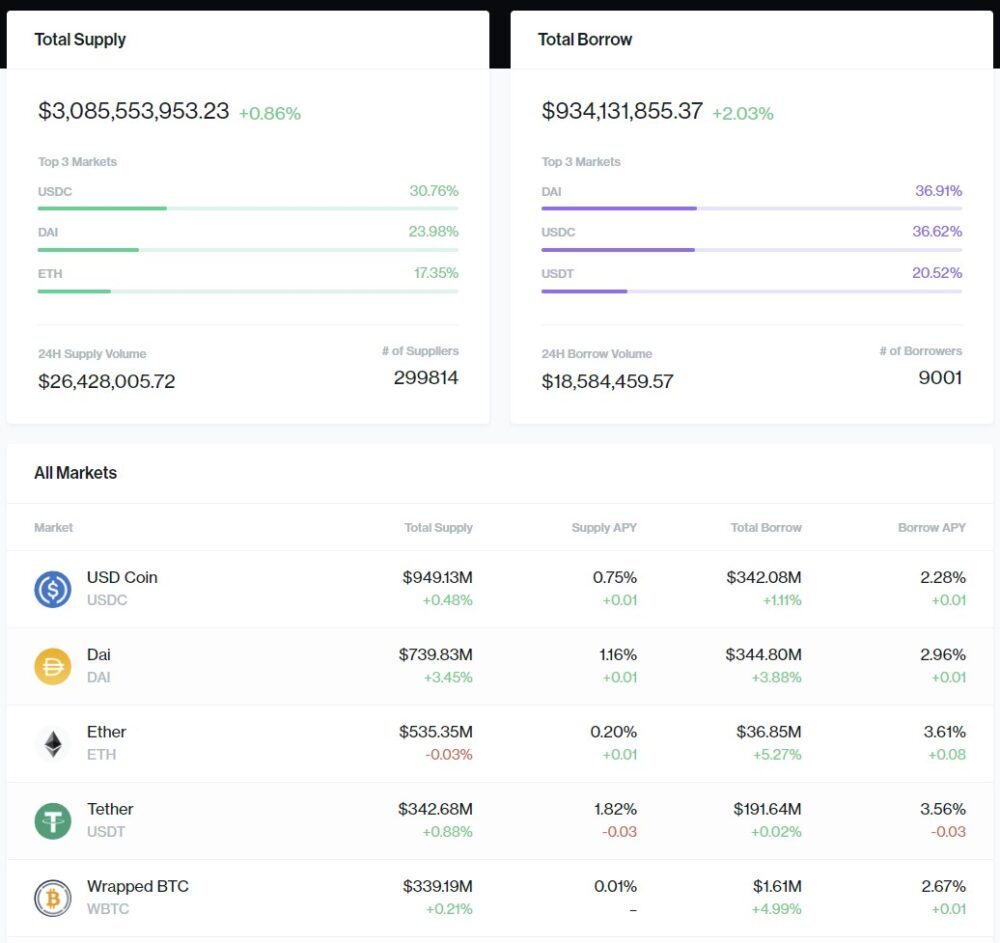

Lending is an extension of staking. With staking, you’re in essence lending your coins to the protocol or to those running validator nodes. Crypto lending opens things up so you can lend to anyone. There are centralized lending platforms (like Nexo and BlockFi) and decentralized lending platforms (like Aave, Compound, and Anchor).

The centralized platforms take deposits from lenders and distribute them to borrowers. The APY earned by lenders and paid by borrowers is dependent on supply and demand. As we’ve seen in 2022, the risk with these platforms is under-capitalization, which causes them to close down.

In the case of these decentralized platforms, lending and borrowing is controlled by smart contracts. These protocols keep track of deposits by issuing lenders new synthetic tokens (e.g., “aUST” for Anchor) which lenders can use to redeem original positions and accrued interest later. These protocols focus on over-capitalized lending to maintain adequate reserves, but they face the risk of impermanent loss.

Advanced Yield Farming

The next step in the yield farming continuum is liquidity providing. This involves lending to decentralized exchanges to increase the liquidity of said exchanges or other platforms. In return, lenders receive portions of trading revenues generated on their assets.

Two of the best-known liquidity platforms are Curve and Uniswap. These were created for EVM compatible chains, but there are many other liquidity platforms including Serum and Raydium on Solana, TraderJOE on Avalanche, and application-specific DEX chains like Thorchain.

These pools act as centralized liquidity hubs, facilitating trades between many different pairs of assets. By using these platforms, yield farmers provide liquidity in crypto markets, thus minimizing the market impact of traders. In essence, this helps to lower volatility. In return, liquidity providers are compensated in three main ways:

- Trading fees and spreads from borrowers are distributed to liquidity providers.

- Platforms often issue rewards in their own native tokens. One example is Curve, which issues the CRV token.

- Some protocols pay rewards to those who provide them with liquidity.

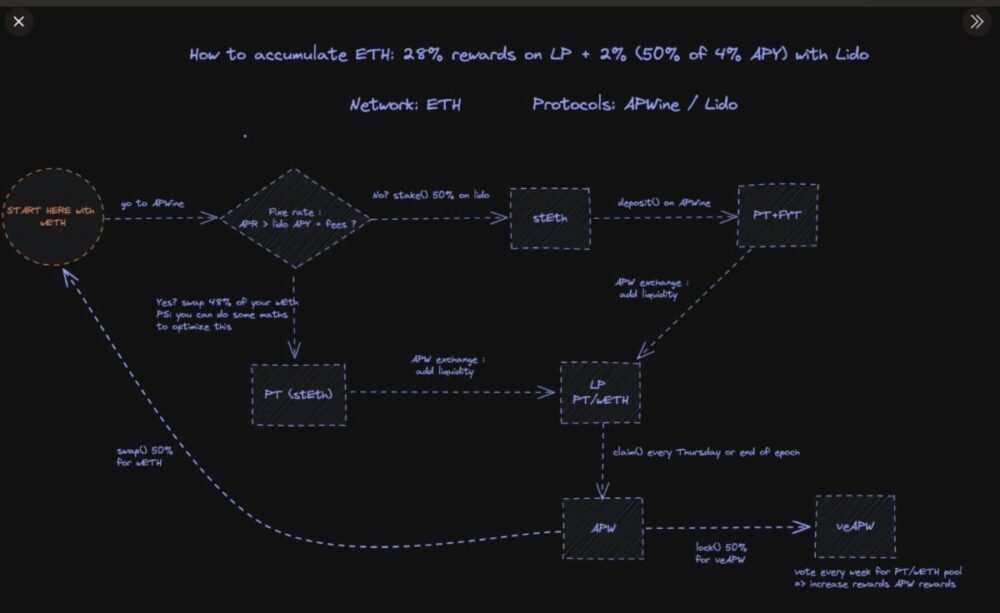

This opens up even more advanced yield farming methods. Consider the following example of a popular yield farming strategy:

Depositing stablecoins and other major assets like BTC and ETH to stableswaps like Compound or Curve Finance as liquidity, then getting compensated with native token rewards.

It’s possible to stake idle ETH on Compound, getting cETH tokens in return. The cETH earns interest, which leads to COMP rewards. You can then take the cETH and COMP to Uniswap and deposit them there to earn more returns.

This example just scratches the surface of what’s available. Look at the chart below to get an idea of the complex strategies that professional yield farmers design:

Investor Takeaway

Because such strategies are so complex and difficult for most of us to visualize, many have been frightened away from yield farming.

However, it’s possible to implement complex strategies via yield generation services that have sprung up like yearn.finance for Ethereum or YieldYak for Avalanche. Obviously, these aren’t for everyone, and if you choose to explore them, you should be sure to fully understand their workings before investing your money.

Fortunately, there are basic yield farming strategies like staking that anyone can take advantage of without in-depth knowledge of finance and without the need to constantly monitor changing rates from DeFi platforms.

This is one area where the bear market is your friend. You can buy more crypto at bargain-basement prices, then increase your holdings via staking.

Given what you now know about yield farming, there’s no reason to let your crypto sit idle. Instead, you can plant your assets in the various protocols and grow more wealth.

- Altcoin Investing

- Bitcoin

- Bitcoin Investing

- Bitcoin Market Journal

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- What is

- zephyrnet