Unique NFTs that dynamically change based on a crypto bond where you can chicken in and chicken out, is the latest development in the decentralized finance (defi) and stablecoins space.

That’s in LUSD, a project similar to DAI where collateral is only in eth with it having a Liquity Stability Pool. If you have LUSD or even LQTY, their DAO token, you get rewards by locking the funds.

“The yield consists of two components: users buy ETH at a discount from liquidations, and they receive continuous LQTY rewards for providing the LUSD which is used to pay off the debts of undercollateralized loans,” the project says.

So what do chickens have to do with this? Well, you can take this LUSD and turn it into bUSD instead, or bond USD.

The process of doing so, of linking LUSD to bUSD, creates a unique token since every bond is unique. The project thus thought since these are NFTs anyway, why not give them jpegs too.

“bLUSD provides user access to a yield optimizer strategy that amplifies and auto-compounds the existing Stability Pool yield,” the project says.

The difference being that you can get out of the bond anytime you want, you can chicken out, but you won’t get any of the accrued interest.

While where NFTs are concerned you’re more likely to get unique traits the more you are a user of the dapp.

Naturally if you sell the NFT then you sell the bond as well, making this one of the first project to visualize financial instruments.

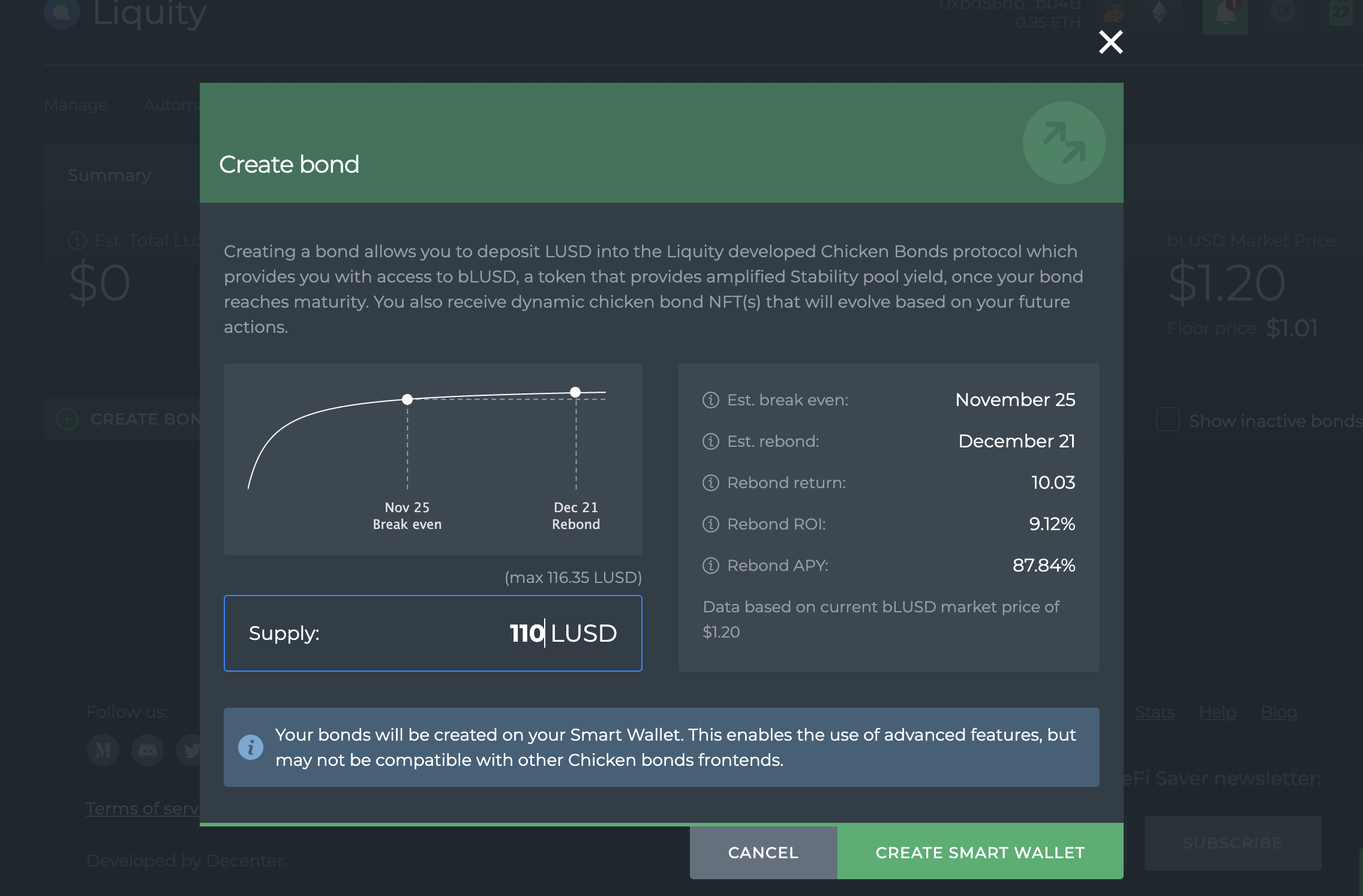

So naturally we tried it. First we have to pick a front-end because the project does not provide one to be more decentralized.

Unfortunately there aren’t too many good choices, so we went with DefiSaver just because we’ve heard of it and can be reasonably sure it’s a credible dapp.

Above it says 110, but we went with a 100 LUSD bond. We first had to create a smart wallet. This appears to be a new development among these aggregator front-ends which seem to use different ‘smart wallets,’ something that can have locking-in effects.

We didn’t even quite know what it was at first, but it’s a smart contract that acts as your wallet, allowing the wallet to have the full Turing complete functionalities and automations, like auto-compounding, stop loss, etc.

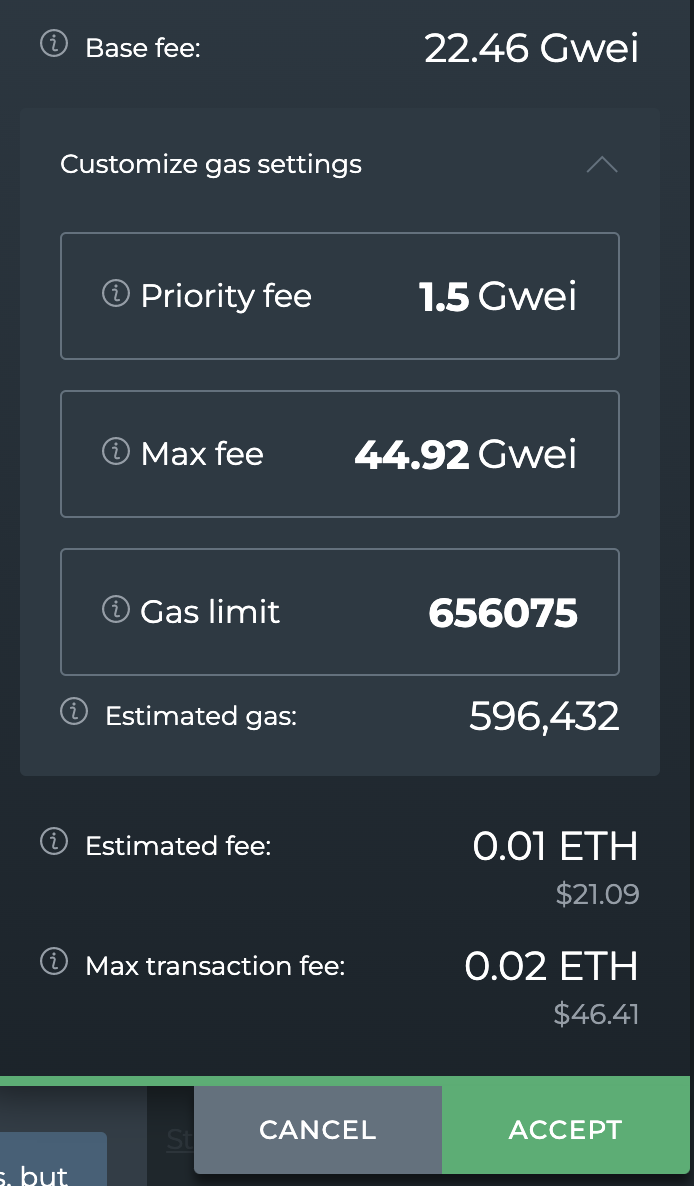

It cost us about $20 to get this wallet which we don’t even want really, but whatever, we at least got to see the new network fees structure for ethereum.

We got fairly competent at playing with network fees and correcting auto suggestions when wrong or we wanted cheap, but now we’re met with something new, and so as first go we just left it all unchanged.

We probably should have changed that max fee however, with another new development being ‘private transactions’ to avoid miner-extracted value (MEV).

The way these private transactions seem to work is that the ‘order’ goes to a private pool first, and then from there to the actual place, which means more transactions are made and so we’re paying a higher network fee.

By the end of it we wanted to turn it off because it probably doesn’t make sense for such small amounts, but MetaMask gives no guidance whatever on how exactly you can do so.

Anyway, we had a simple transaction to approve LUSD actions, and then another smart contract transaction to create the actual bond, which also cost about $20.

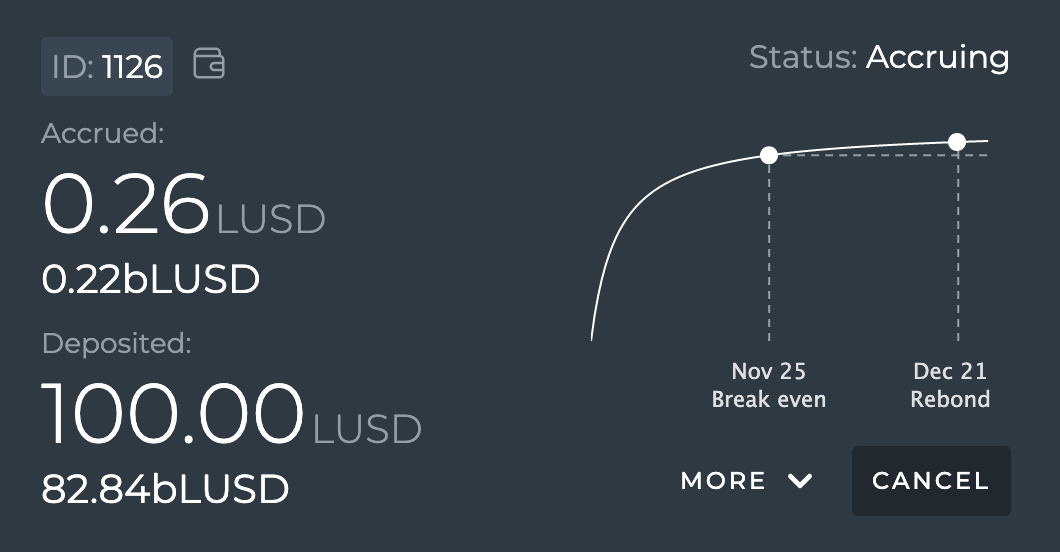

So this is the bond. We have less bLUSD because that’s worth $1.22 now, $1.20 yesterday when this was created. More importantly however we have just 26 cent because there’s that curve there and so we have to wait another circa three weeks to just break even, 100 LUSD.

It’s only after that when we start making money. Within a month, we’d be making $10 according to the calculations provided.

At that point, near Christmas day, we should rebond this says so that we can put 110 LUSD and thus get about 11 LUSD in two months to presumably rebond again.

With small amounts, it probably wouldn’t make a difference but this is giving us 10% interest in a month after the breakeven, presuming it continues to curve up after December.

That’s obviously huge yield, with risks in as far as if the peg goes off, then this 100 LUSD might be taken to restore it, although we can Chicken out. If all stays fine however, the dapp is basically automatically giving us the fees from the dapp users, like liquidation fees. Pretty cool.

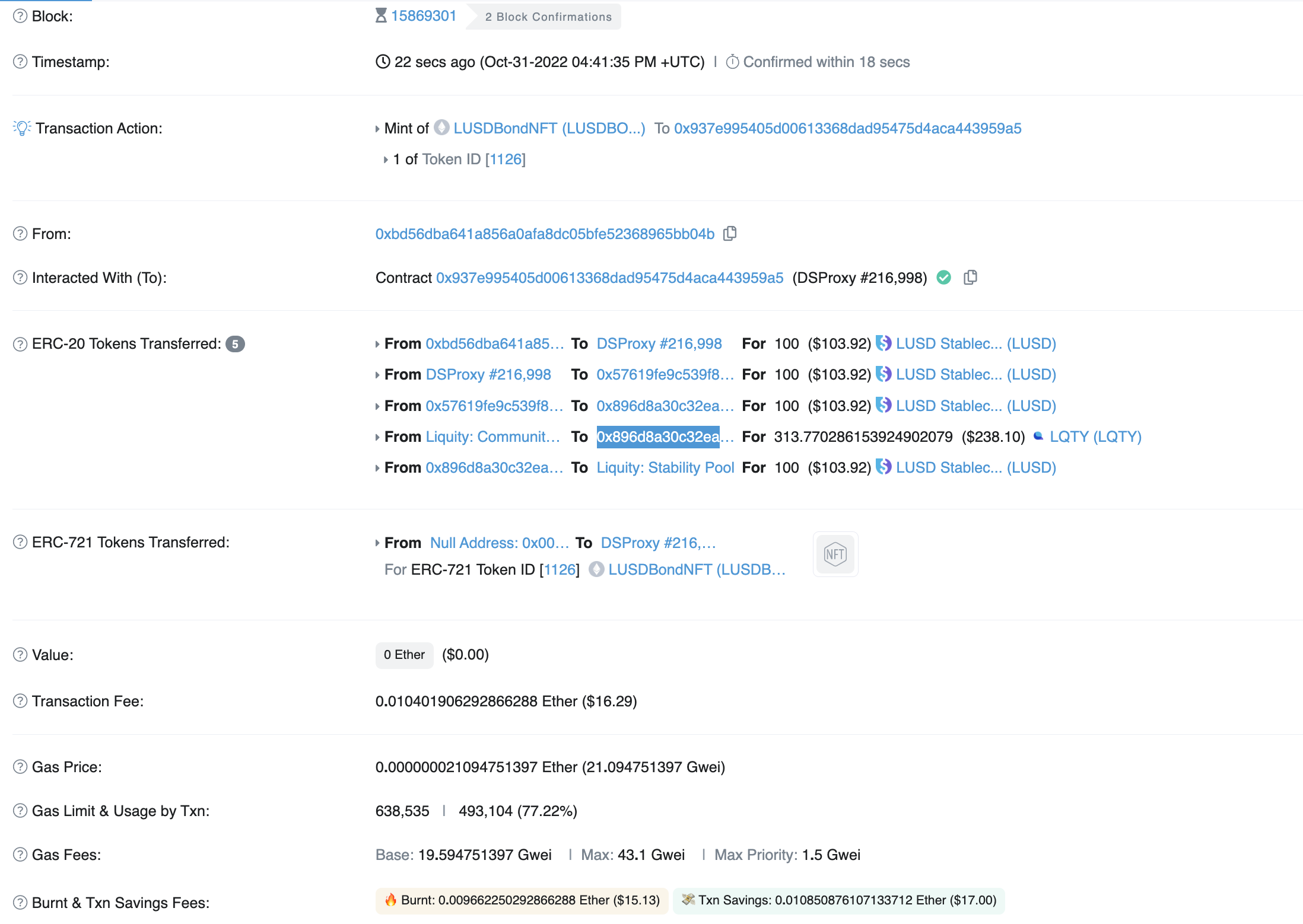

This is how it actually looks like. We’ve just given you all $15 dollars in burnt fees, so Thanksnode, with the actual fee paid being not too bad, $16.

Then you can see what the smart wallet is, a DSProxy which is apparently what MakerDAO uses for DAI minting, so this wallet can be reusable for Maker.

The dapp has sent the funds from our address to the smart wallet, from that wallet we move to the bond contract, we got $240 worth of LQTY printed, the LUSD finally make it to the stability pool, and to top it off we get the NFT.

Except we can’t see this NFT, the jpeg. It doesn’t show on OpenSea maybe because it is in the smart contract wallet and OpenSea doesn’t know how to deal with those.

We do have the NFT tho, it’s just we don’t have the egg visualization for the bond creation, with that egg apparently algorithmically produced by the smart contract itself, so the jpeg is on the blockchain.

Yet since we can’t see it, the NFT is a bit less real. Sorry chickens. Otherwise, this was a very smooth testrun, one of the smoothest in fact from a UI perspective and we’ve done many many testruns.

It’s just tap tap, aaaa fees, tap tap. Due to those fees, this isn’t something you should do with small amounts. We’re just test-running so whatever, but really even with the current low fees you probably want to start with a base of at least $1,000.

Unlike apenodes you probably want to do a bit of research as well before telling MetaMask they can use private transactions, or going ahead with a smart wallet. Especially in regards to the latter, you probably want to use a dapp that uses the most interoperable smart wallet, or if you won’t use any smart wallet capabilities, preferably one that doesn’t use them at all because their use does increase costs as we saw with the arguably unnecessary transaction to the smart wallet first.

Considering the network is congested, you’d expect developers to come with efficient methods, rather than the opposite in encouraging unnecessary transactions, but lock-in is tempting of course.

Not least because if we wanted such one extra transaction, we could have gone to a second layer with it a bit unclear actually why this wasn’t offered except lock-in.

And we keep saying lock-in because the only other dapp pointed out for these bonds that we are familiar with, InstaDapp, uses a different smart wallet… which for us means a different address and so even higher costs to move.

Anti-synergy tools, would probably be too strong of a word after just one test-run with all these being fairly new since it is the first time we’ve come across them in the wild.

Yet, at least in this case and at least where these two dapps are concerned, it is what has happened which can become a real problem if dapps don’t come to one solution.

Where the project itself is concerned however, there isn’t really much to point out since it all went smoothly.

We now have 24 LUSD accrued a day later, 20 bUSD, with it unclear whether they’re one and the same or otherwise until we rebond, but it shows the curve is clearly working.

So we just have to wait for it to do its job and earn our fees back, in this case. In plenty of other potential cases, the base fee is fixed of course so if you lock $1,000, you get $100 in two months, making it about $80 profit minus that $20 fee.

The question being whether eth’s price will rise by more than 10% in two months, a question no one can answer.

Making this bond more ‘a lower risk than eth volatility’ alternative, but with potentially lower rewards depending on what eth does.

Where a USD to LUSD comparison is concerned however, a 10% gain even per year is miles ahead of anything the bank will give.

LUSD is higher risk however, but generally and logically speaking, if you’re keeping funds in the bank at 2% interest, this project might be more for that part of the market that would take 10% of those savings for a bit of higher risk to send it to this dapp.

So making it interesting as defi keeps developing and from a front-end usability perspective has gotten a lot smoother.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- news

- NFTs

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Third

- Trustnodes

- W3

- zephyrnet