I recently read an article in The Economist talking about how some so-called experts thought that the coronavirus pandemic would be a massive driver in automation. On the surface that idea makes sense: A disease causes problems for in-person workers, but machines don’t have that problem because machines don’t get sick, so the machines get the big “W.”

But, like so many other mistaken assumptions, this one ignored the fact that other people would also be reacting to the situation. In this case, the humans in government took far-reaching steps to prevent the economy and society from collapsing.

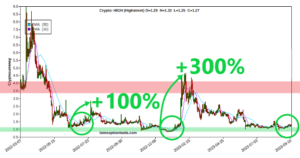

Specifically, they provided billions in material assistance to workers including direct payments and subsidized unemployment insurance. Here again, humans were the big spoiler. That extra cash gave more than a few workers the flexibility to decide they hated their jobs and didn’t want to do them anymore. Coincidentally, it was this same windfall that led a lot of them to get into crypto speculating, fueling the 2020-2021 rally.

Just like that rally had to end eventually, so did a lot of that government assistance, but in the age-old struggle between Labor and Capital, the field had shifted and now favored Labor – you know, the employees. The predicted wave of automation completely failed to take shape, and that means Old Man Capital got the pointy end of the stick.

But it wouldn’t be much of a struggle if one side stayed pinned down forever…

Here’s When Automation Will Really Begin to Change Things

I’m not at all surprised. See, business investment decisions are usually pretty short on nuance; the humans making those big calls don’t usually go much further than “in or out,” “yes or no,” “this quarter or next.” Incidentally, this is exactly why crypto goes down when stocks do.

So I’m not surprised to see businesses did not plow tons of (lower-case “c”) capital on new automated systems during the pandemic. If businesses are facing uncertainty, and feeling too risk-averse to invest in new employees or even take big crypto positions, they’re not suddenly going to want to splurge on robots instead. They’re going to spend as little money as possible.

That’s what it comes down to: investors and businesses are either in a mood to invest or they aren’t. They’re not going to get robots because they can’t afford employees at all, rather, they’re going to get robots because they don’t feel like paying what employees cost – and I can say confidently that they won’t make this decision in a crisis.

Businesses will make this investment decision because the artificial intelligence (AI) that underlies automation will become too good, too powerful, and too cheap to ignore.

And that’s the point at which the automation trickle we’ve seen over the past 50 years or so will become that massive, powerful wave. Up until this point, getting “automated” out of your job has been something that’s happened to “other people,” but that’s going to change in the next 10 or 20 years – powerful artificial intelligences will see to that. It’s going to happen to me. It’s going to happen to all of us. We’re going to come rapidly to a point where if you can describe your job, an AI will be able to do it faster and more cheaply… and eventually maybe even better.

It’s happening right before our eyes if we look. In just the last month or so, controversy has exploded over the possibility of AI replacing graphical artists. There’s a furious debate about whether these AIs are stealing the work of human artists – not going to go there. But it’s enough to say that, up until this year, art was one of those “big” concepts a lot of people thought would be among the last things to be automated, but… nope.

When the technology is there, the transition begins. When the technology becomes cost-effective and cheaper than human workers, the transition hits breakneck speed.

And that is precisely why we’re investing right now – in crypto. Crypto is the ultimate hedge against the future, and cryptos that exist in the AI space are the best of them all. I’ve already doubled my exposure, and I expect I’ll be going even bigger on AI tokens in the year ahead.

There’s one coin in particular that I’m looking at for 2023, Algorand (ALGO) whose developers boast can be used to support very data collection that allows machine learning to function in the first place. It’s selling for less than 20 cents and less than one-tenth of its ATH, but I expect to return to its former value at the very least, and most likely exceed it.

- AICI Daily

- aicinvestors

- American Institute for Crypto Investors

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet