The post Which is Safer: USDC or Tether? by Ryan McNamara appeared first on Benzinga. Visit Benzinga to get more great content like this.

The phrase “X coin is going to zero!” is not to be taken lightly in the crypto market because many coins have proven to do just that. Many experienced crypto traders know this, so they resort to other avenues outside of their altcoin or Bitcoin portfolio to protect their gains while also preparing for the next leg up in the market. Historically, investing in stablecoins is a decent way to hedge against market volatility and protect capital.

These two centralized Stablecoins are backed by fiat and other assets in treasuries. USDC and USDT are both in charge of making sure their stablecoin doesn’t crash in a potential bank run.

window.LOAD_MODULE_LAYOUT = true;

Table of contents [Show]

What’s the Difference Between USDC and USDT?

JOIN THE MOON OR BUST EMAIL LIST

Our team is diligently working to keep up with trends in the crypto markets. Keep up to date on the latest news and up-and-coming coins.

.mob-button { margin-bottom: 0; }

Disclosure: eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

JOIN THE MOON OR BUST EMAIL LIST

Our team is diligently working to keep up with trends in the crypto markets. Keep up to date on the latest news and up-and-coming coins.

.mob-button { margin-bottom: 0; }

Most if not all readily available stablecoins are pegged 1 to 1 with the U.S. dollar. Among stablecoins, two are the most popular: USDC and USDT or Tether.

History of USDT

USDT was founded in 2014 by Tether Limited in Hong Kong, which is controlled by the exchange Bitfinex. In 2014, if you wanted to exit crypto the only way was back into a fiat currency, so Tether set out to bridge the gap between these two worlds.

History of USDC

USDC was founded in September 2018 and is four years younger than the first mover USDT. Fintech giant Circle founded USDC and has quickly built it up to a top-five coin in a couple of years.

How are USDT and USDC Backed?

Both USDT and USDC are not perfect by any means and have seen price fluctuations above and below the $1 level. Usually, the swings have gone in one direction or the other by only a penny. The most notable swing for Tether and USDC was in April 2017, when USDT plunged to $0.91 and when USDC dipped in March 2020 to $0.97.

Key Idea: The largest differences between USDT and USDC are issuance and collateral levels determined by the respective centralized companies.

How is USDT Backed?

USDT has come under heavy scrutiny over the years because of Bitfinex’s tendency to spin up the Tether printer by minting when the Bitcoin market is in turmoil.

When you track the history of Tether printing against the movement of Bitcoin’s price, a suspicious story arises. If Tether mints, the price of Bitcoin seems to grow quickly, but the price declines when printing stops.

According to an article by Trustnodes.com, Tether printed $300 million in the month of June 2019 and had been printing for months before that.

It conducted more printing in January and April 2020 into the explosive Bitcoin bull market of 2021.

In addition to concerns with printing, some market participants doubt that Tether is backed by U.S. dollars in the amount it claims.

Tether had claimed that each USDT token is backed by one U.S. dollar, but in March 2019 Tether Limited changed the backing to include loans to affiliate companies.

After the revelation, the New York Attorney General dropped a lawsuit on the Bitfinex exchange, Tether Limited’s parent company, for using Tether’s funds to cover up $850 million in funds missing since mid-2018. The investigation concluded that Tether’s claim that its token was backed by U.S. dollars was a lie and Bitfinex had used some, if not all, of these missing funds to cover up losses by its company.

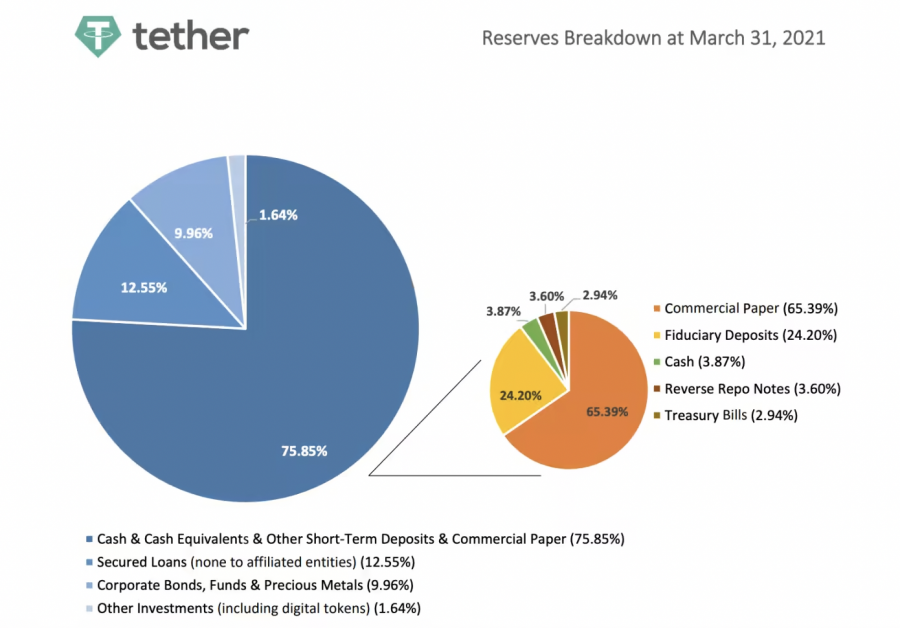

In April 2019 Stuart Hoegner, Tether Limited’s lawyer, claimed that each Tether was backed by $0.74. In May 2021, Tether published a report showing that 2.9% of Tether reserves were backed by cash, with over 65% backed by commercial paper. As you take a closer look, you will find this commercial paper is short-term unsecured promissory notes issued by companies mainly in China, which is basically an IOU.

How is USDC Backed?

USDC seems to be doing its best to comply with future regulatory structures by doing monthly audits of their backing. Centre Consortium, the governing body of USDC also pledged to only hold their reserves in U.S. dollars and short-term Treasury bills.

Is USDT Safe?

USDT remains the largest stablecoin by market cap and is used more often than USDC for transactions, but it is not as safe as its counterpart USDC, which has done more to stay transparent with its cash reserves and backing.

Shortly after the collapse of Terra’s UST stablecoin, Tether redeemed $7 billion for large investors over 48 hours. The Chief of Technology at Tether argued this was a signal of strength and liquidity for Tether. The catch to redeeming Tether is that the minimum is $100,000, which prioritizes whales over retail.

At the end of the day, it still seems that Tether is not that safe a stablecoin. USDT looks to have become a tool for exchanges to manipulate the markets.

Is USDC Safe?

The collapse of Terra’s UST was a clear message to the crypto community that even stablecoins are not without risk.

USDC is certainly not perfect either, but the fact that the Centre Consortium has gone out of its way to provide transparency and audits its backing frequently adds to the argument that USDC is a relatively safe stablecoin.

USDC vs. USDT: Which Stablecoin is Best?

USDC and USDT are only two of many stablecoins that exist today. While USDT is the most heavily traded, Tether has been repeatedly unclear about its backing, refused to provide vital information and been caught in legally suspicious behavior.

You might be able to earn great returns on staking or depositing your USDT in an exchange for interest, but at what cost if it is not backed with cash or cash equivalents like short-term Treasury bills?

In early 2022, the Biden administration pushed regulatory agencies to act on regulating not only stablecoins but crypto as a whole. Legislation may require stablecoin issuers to become insured depository institutions similar to a bank.

Stablecoin regulation is inevitable and, at this point, only a matter of time. Stablecoin issuers will likely begin taking steps necessary to be prepared for these laws when they pass.

USDC has planned for future government regulation into stablecoins. The Centre Consortium has positioned USDC well for when regulation because of transparency and the Centre Consortium’s monthly audits.

The post Which is Safer: USDC or Tether? by Ryan McNamara appeared first on Benzinga. Visit Benzinga to get more great content like this.

- '

- "

- 000

- 2019

- 2020

- 2021

- 2022

- a

- About

- Absolute

- Act

- addition

- administration

- Affiliate

- against

- All

- Altcoin

- among

- amount

- April

- article

- Assets

- available

- backed

- Bank

- Basically

- because

- become

- before

- below

- BEST

- between

- biden

- Billion

- Bills

- Bitcoin

- Bitcoin bull

- Bitfinex

- Block

- body

- border

- BRIDGE

- bull

- bust

- buy

- capital

- Cash

- Catch

- caught

- centralized

- charge

- chief

- China

- Circle

- claim

- claims

- closer

- Coin

- CoinGecko

- Coins

- come

- commercial

- community

- Companies

- company

- concluded

- Console

- content

- contents

- Couple

- cover

- Crash

- crypto

- Crypto Market

- Crypto Markets

- crypto traders

- Currency

- day

- difference

- Display

- Doesn’t

- Dollar

- dollars

- dropped

- each

- Early

- earn

- equivalents

- etoro

- Event

- exchange

- Exchanges

- Exit

- experienced

- Fiat

- Fiat currency

- fintech

- First

- form

- forms

- Founded

- funds

- future

- gap

- General

- going

- Government

- great

- Grid

- Grow

- heavily

- history

- hold

- Hong Kong

- HTTPS

- idea

- include

- Including

- information

- institutions

- interest

- investigation

- investing

- Investments

- Investors

- issuance

- IT

- January

- Keep

- Know

- large

- largest

- latest

- Latest News

- Laws

- lawsuit

- lead

- Legislation

- Level

- levels

- LG

- likely

- Limited

- Liquidity

- LLC

- Loans

- Look

- losses

- Making

- March

- march 2020

- Market

- Market Cap

- Markets

- Matter

- means

- might

- million

- minimum

- minting

- Month

- monthly

- months

- Moon

- more

- most

- Most Popular

- movement

- necessary

- New York

- news

- next

- notable

- Notes

- Other

- Paper

- participants

- partner

- perfect

- planned

- Point

- Popular

- portfolio

- positioned

- possible

- potential

- price

- Principal

- protect

- provide

- published

- pushed

- quickly

- region

- Regulation

- regulatory

- remains

- report

- require

- Resort

- retail

- returns

- Risk

- Run

- safe

- safer

- set

- short-term

- similar

- since

- So

- some

- Spin

- Sponsored

- stablecoin

- Stablecoins

- Staking

- stay

- Still

- Story

- strength

- subject

- taking

- team

- Technology

- Tether

- The

- time

- today

- token

- tool

- track

- Traders

- Transactions

- Transparency

- transparent

- Trends

- u.s.

- under

- unsecured

- USA

- USD

- USD Coin

- USDC

- USDT

- usually

- value

- vital

- Volatility

- wanted

- whales

- What

- while

- without

- working

- world’s

- X

- years

- Your