While Bitcoin has been moving sideways after a rejection above $40,000, Ethereum has been running hot from a low of around $1,7000. The second cryptocurrency by market cap trades at $2,702, an area that has been flipped into support after a 10% rally yesterday.

Before the crash, ETH has more signs of a strong price action conviction than Bitcoin and others in the crypto top 10. Now, the trend could continue as investor maintain their hopes for Ethereum to surpass Bitcoin in terms of market cap.

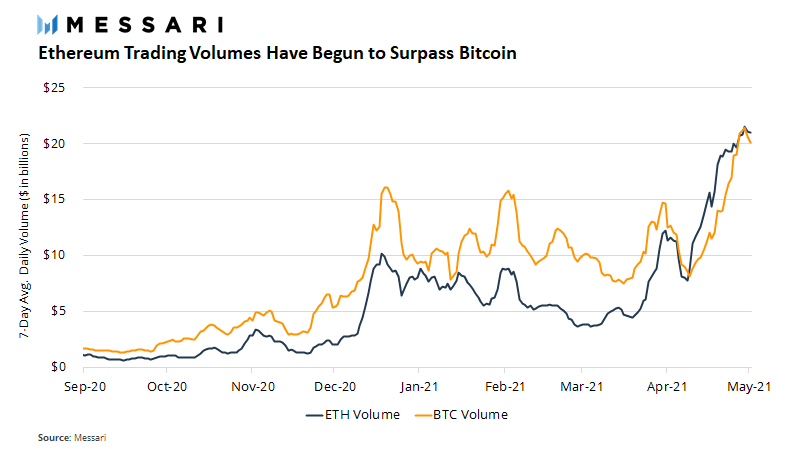

Data from Messari indicates that the Flippening is already in place in other metrics. Researcher Ryan Watkins claimed that ETH trading volume has started to rise above Bitcoin’s since September 2020, as shown below.

In 2021, ETH trading volume has increased with the rise in the cryptocurrency’s price. After a brief drop in Mach, the metric has been recovering and reached an all-time high at $20 billion for the spot market, as Watkins said.

The research believes ETH has more chances of becoming a global store of value than Bitcoin due to its use cases. He predicts growth in ETH’s and its practical applications as more investors, users, and developers leverage its tools. Watkins said:

In hindsight it will look obvious that the winning digital store of value was the asset that was used as money rather than meme’d as money.

Banking giant Goldman Sachs recently published a report on the possibility of ETH beating BTC. Similarly, to Watkins, the report claims that there are more “real uses” for the former.

Supported by an ecosystem with smart contracts, non-fungible tokens, and other decentralized applications, Ethereum could rule over the future financial system. Goldman Sachs said:

The greater number of transactions in ether versus bitcoin reflects this dominance. As cryptocurrency use in DeFi and NFTs becomes more widespread, ether will build its own first mover advantage in applied crypto technology.

Ethereum Based Derivatives Skyrocket During May

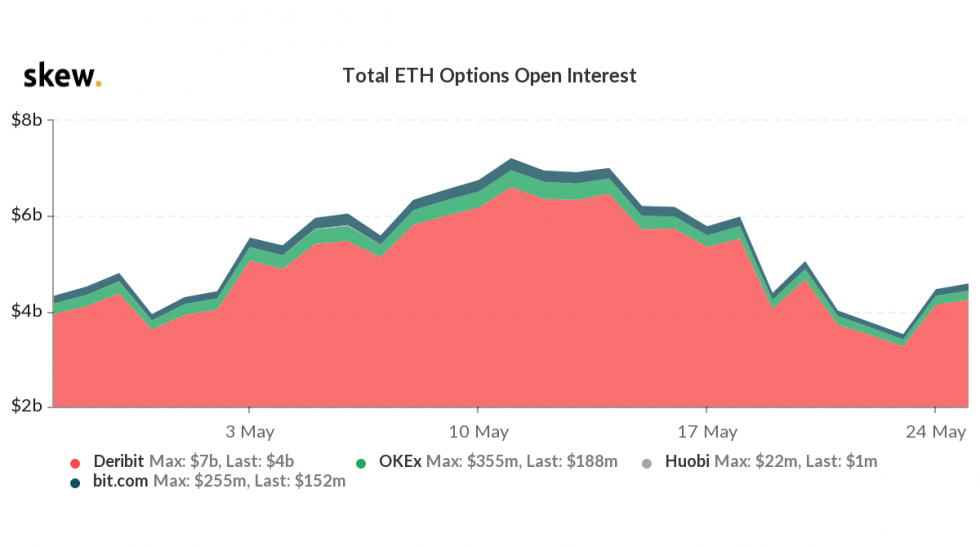

Data from Skew display reveal a rise in Total Open Interest (OI) for Ethereum’s options. As of May 24, this metric stood at around $4.5 billion. Still far from Bitcoin $8 billion in total OI, ETH-based options reached a monthly high on May 11th when all options traded across Deribit, OKEx, Huobi, and bit.com stood at $7 billion.

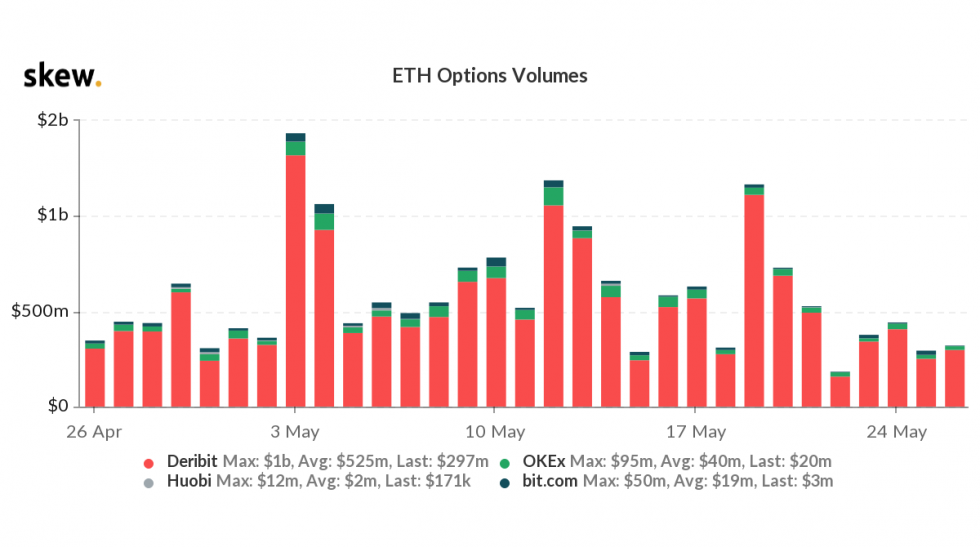

In terms of trading volume, ETH Options saw a monthly high at $2 billion on May 3rd with a steady rise until the crash in the crypto market. BTC Options saw a similar performance in terms of volume with a $3 billion high on May 17th.

In total, ETH option volume reached a new all-time high in May with $15 billion after a flash increase in 2021. The metrics for Ethereum’s derivatives sector have declined with its price. However, they show a rise in interest for ETH as an institutional investment asset a narrative that gains more strength by the minute.

Ethereum options volume hitting new ATH touching $15 billion this month. pic.twitter.com/MfGwDMOSYT

— Documenting Ethereum 🧾 (@DocumentEther) May 26, 2021

- 2020

- Action

- ADvantage

- All

- applications

- AREA

- around

- asset

- Billion

- Bit

- Bitcoin

- BTC

- build

- Bullish

- cases

- chances

- claims

- continue

- contracts

- Crash

- crypto

- Crypto Market

- cryptocurrency

- decentralized

- Decentralized Applications

- DeFi

- deribit

- Derivatives

- developers

- digital

- Drop

- ecosystem

- ETH

- Ether

- ethereum

- ETHUSD

- financial

- First

- Flash

- follow

- future

- Global

- goldman

- Goldman Sachs

- Growth

- High

- HTTPS

- Huobi

- Increase

- Institutional

- interest

- investment

- investor

- Investors

- IT

- Leverage

- Market

- Market Cap

- Messari

- Metrics

- money

- NFTs

- non-fungible tokens

- OKEx

- open

- Option

- Options

- Other

- performance

- price

- rally

- report

- research

- running

- Signs

- smart

- Smart Contracts

- Spot

- started

- store

- support

- system

- Technology

- Tokens

- top

- trades

- Trading

- Transactions

- users

- value

- Versus

- volume