XRP finds itself at a crucial juncture, as it eyes $0.53 to break above the upper trendline of a month-long symmetrical triangle, with the bears seeking to push prices further below.

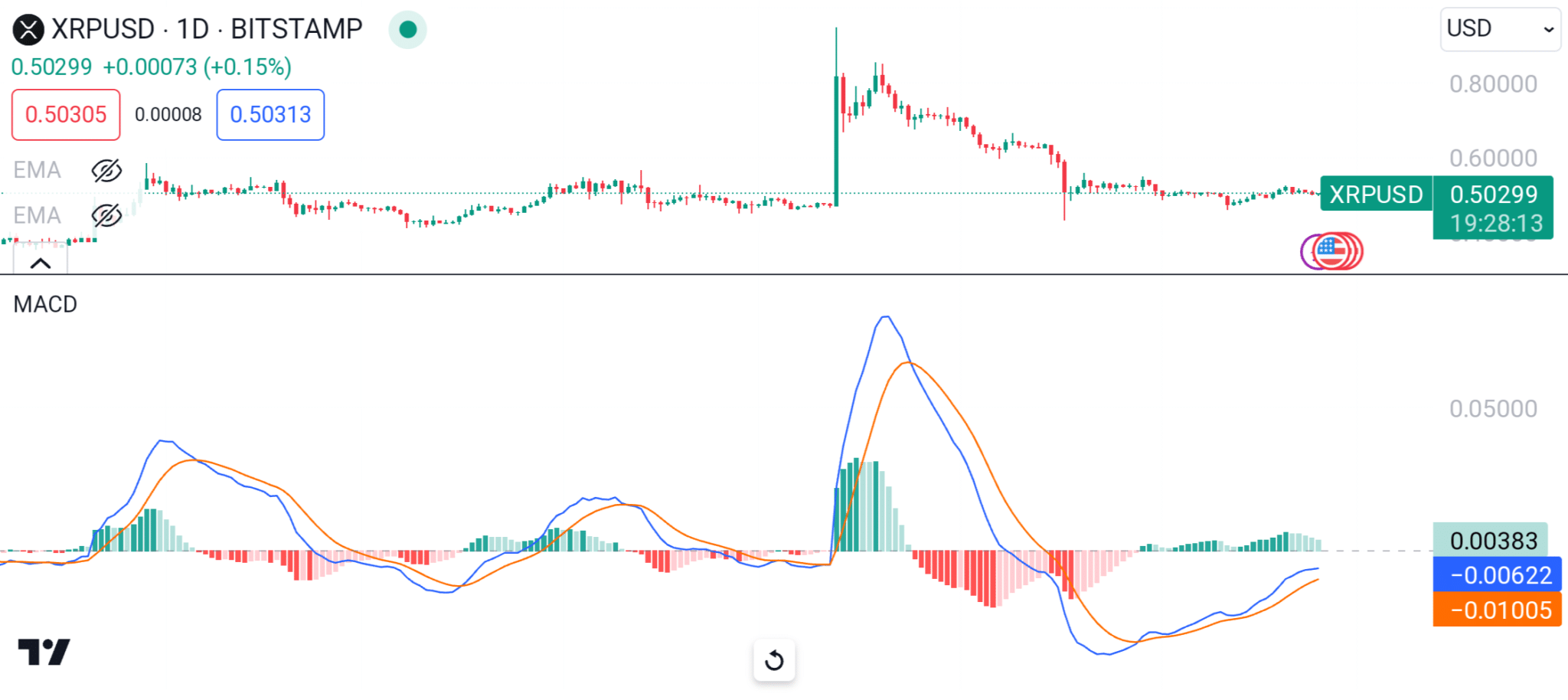

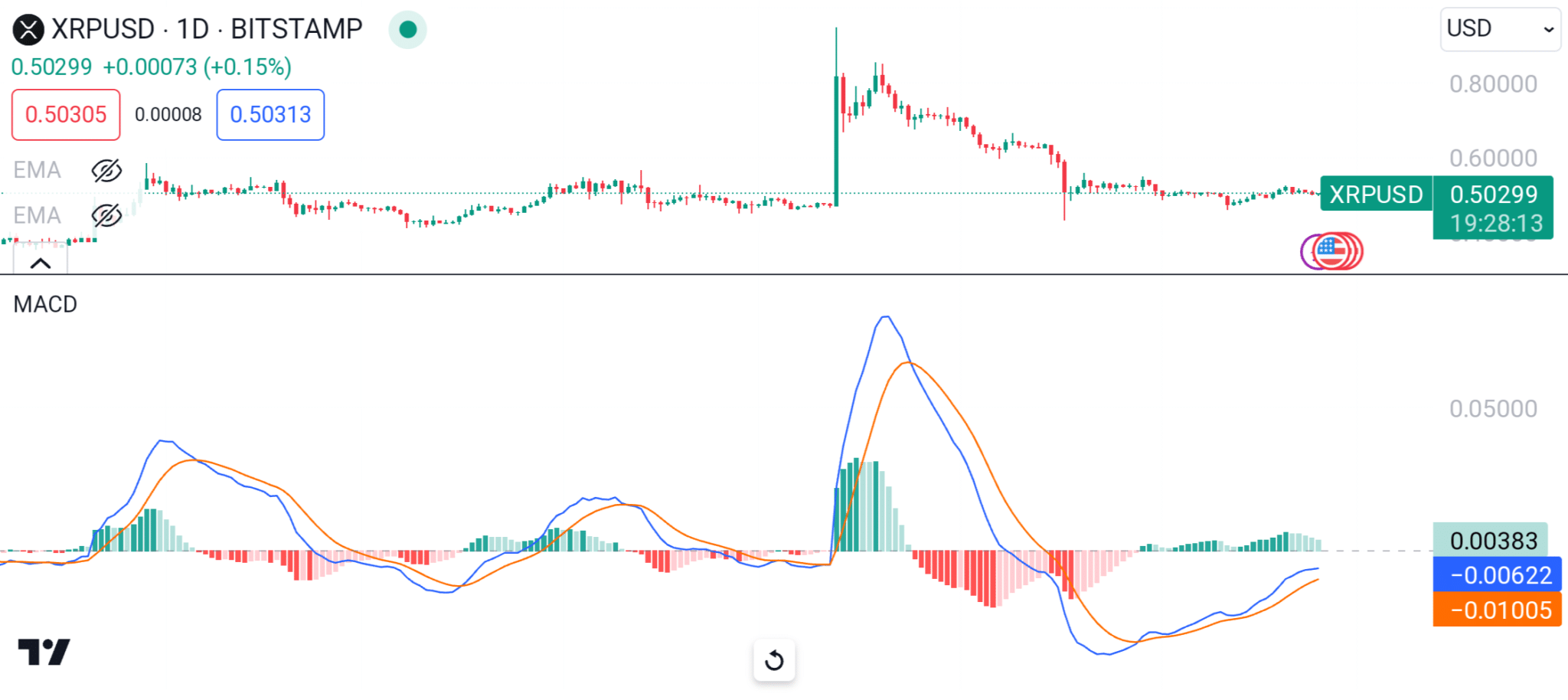

XRP is currently trading at $0.5029. This price level places it beneath the 50-day Exponential Moving Average (EMA) at $0.5298 and the 200-day EMA at $0.51970.

These moving averages serve as key market sentiment indicators and potential trend reversals. Trading below both crucial moving averages signals bearish sentiments in the short and long terms.

XRP In a Symmetrical Triangle

For the past month, XRP has remained within the confines of a symmetrical triangle, a pattern that often signifies market indecision.

– Advertisement –

This formation has captured the attention of both bulls and bears, with each camp vying for control. On Sept. 11, the bears made a valiant attempt to push XRP below the lower trendline of the triangle.

This pressure from the bears led to a three-week low of $0.4590, with further dips on the horizon. However, XRP demonstrated resilience, returning from this downward pressure and staging a remarkable comeback.

Conversely, last week witnessed a surge in XRP’s value to $0.5256, momentarily retesting the upper trendline of the symmetrical triangle. Unfortunately for the bulls, resistance from the bears brought XRP back into the triangle’s embrace.

Currently, XRP is following a mildly downward trajectory, painting a picture of uncertainty in the market. A significant factor contributing to this uncertainty is the lack of substantial updates regarding the battle between Ripple and the U.S. SEC.

A Pivotal Point

XRP must overcome a few critical hurdles to chart a bullish course forward. Reclaiming and surging beyond the $0.52 price point would be promising. This move would again test the upper trendline, potentially opening the door to further gains.

Breaking above the psychological resistance at $0.51 and establishing supremacy over the 200-day EMA could signify the strength required for XRP to make a convincing move above $0.52.

Yet, the path upward is not without its challenges. XRP currently grapples with a downward slope, demanding vigilance from the bullish camp.

The bulls must staunchly defend the $0.48 level to stave off potential losses. A breach below this point could spell trouble, leading XRP below the lower trendline and potentially setting $0.45 as the next target for the bears.

XRP Technicals

Digging deeper into the technical indicators, the Relative Strength Index (RSI) on the daily timeframe presents some intriguing data.

Currently at 45.50, the RSI indicates a market that isn’t decisively bullish or bearish. Simultaneously, the RSI-based Moving Average (MA) line, standing at 43.24, suggests a steady increase, hinting at a potential shift in momentum favoring the bulls.

The Moving Average Convergence Divergence (MACD) indicator offers another perspective. Over the past few weeks, the MACD Line (blue) has been on an upward trajectory, maintaining its position above the Signal Line (yellow).

This configuration is often seen as a bullish signal, suggesting the potential for continued positive price action for XRP. Meanwhile, trade volume for XRP has increased by 30% over the past 24 hours, sitting at $488 million. This signals a re-entry of market participants.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thecryptobasic.com/2023/09/25/xrp-at-a-pivotal-point-bulls-need-to-defend-0-48-to-break-above-month-long-symmetrical-triangle/?utm_source=rss&utm_medium=rss&utm_campaign=xrp-at-a-pivotal-point-bulls-need-to-defend-0-48-to-break-above-month-long-symmetrical-triangle

- :has

- :is

- :not

- 11

- 24

- 50

- 51

- 7

- a

- above

- Action

- Advertisement

- advice

- again

- an

- and

- Another

- any

- ARE

- article

- AS

- At

- attention

- author

- average

- back

- basic

- Battle

- BE

- bearish

- Bears

- been

- before

- below

- beneath

- between

- Beyond

- Blue

- both

- breach

- Break

- brought

- Bullish

- Bulls

- by

- Camp

- captured

- challenges

- Chart

- Comeback

- Configuration

- considered

- content

- continued

- contributing

- control

- Convergence

- could

- Course

- critical

- crucial

- crypto

- Currently

- daily

- data

- decisions

- deeper

- demanding

- demonstrated

- Divergence

- do

- Door

- downward

- each

- EMA

- embrace

- encouraged

- establishing

- exponential

- exponential moving average

- expressed

- Eyes

- factor

- few

- financial

- financial advice

- finds

- following

- For

- formation

- Forward

- from

- further

- Gains

- horizon

- HOURS

- However

- http

- HTTPS

- Hurdles

- in

- include

- Increase

- increased

- index

- indicates

- Indicator

- Indicators

- Informational

- into

- intriguing

- investment

- IT

- ITS

- itself

- Key

- Lack

- Last

- leading

- Led

- Level

- Line

- Long

- losses

- Low

- lower

- MACD

- made

- Maintaining

- make

- Making

- Market

- market sentiment

- max-width

- May..

- Meanwhile

- million

- Momentum

- Month

- move

- moving

- moving average

- moving averages

- must

- Need

- next

- of

- off

- Offers

- often

- on

- opening

- Opinion

- Opinions

- or

- over

- Overcome

- painting

- participants

- past

- path

- Pattern

- personal

- perspective

- picture

- pivotal

- Places

- plato

- Plato Data Intelligence

- PlatoData

- Point

- position

- positive

- potential

- potentially

- presents

- pressure

- price

- PRICE ACTION

- Prices

- promising

- Push

- readers

- reflect

- relative

- relative strength index

- remained

- remarkable

- required

- research

- resilience

- Resistance

- responsible

- returning

- Ripple

- rsi

- s

- seeking

- seen

- sentiment

- sentiments

- sept

- serve

- setting

- shift

- Short

- should

- Signal

- signals

- significant

- signifies

- signify

- simultaneously

- Sitting

- some

- SPELL

- staging

- steady

- strength

- substantial

- Suggests

- surge

- surging

- Symmetrical Triangle

- Target

- Technical

- terms

- test

- that

- The

- The Crypto Basic

- this

- timeframe

- to

- Trading

- TradingView

- trajectory

- Trend

- trouble

- true

- u.s.

- Uncertainty

- unfortunately

- Updates

- upward

- views

- vigilance

- volume

- W3

- webp

- week

- Weeks

- with

- within

- without

- would

- xrp

- zephyrnet