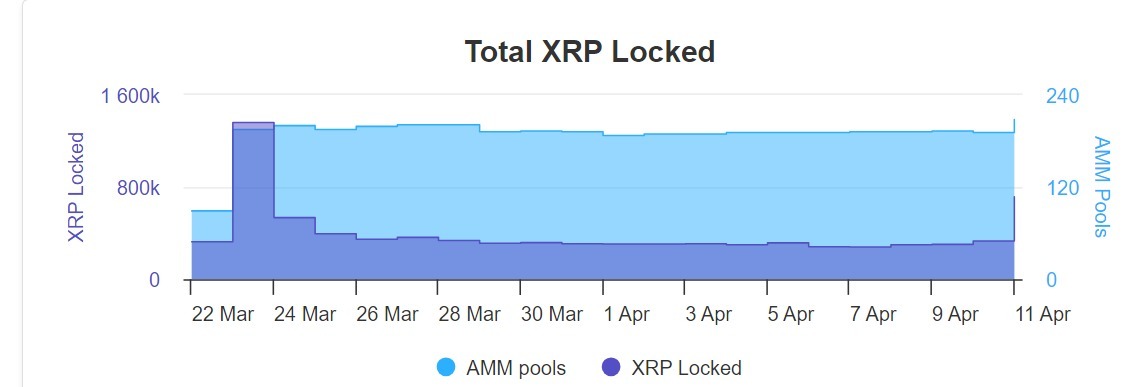

The total amount of XRP locked onto the XRP Ledger’s recently launched automated market maker (AMM) platform has recently surged from around 330,000 XRP tokens to over 715,000 XRP, worth over $400,000, at a time in which the AMM platform is set to get key bug fix.

According to data from XRP Ledger explorer XRPScan, the total amount of XRP locked onto the AMM surged recently along with the number of liquidity pools on the platform, which rose from around 193 to 208.

Notably, the rise came as the XRP Ledger rolled out a a critical update to its recently launched AMM engine. The update, dubbed “fixAMMOverflowOffer,” addresses a technical glitch that hindered the AMM’s ability to handle large trades on decentralized exchanges (DEXes) built on XRP Ledger.

The AMM amendment, introduced last month, was a significant step for XRP Ledger, allowing for a more automated system of exchanging digital assets and earn a yield by locking up assets in liquidity pools. However, a flaw in the initial implementation prevented the AMM from functioning properly with sizable swap requests.

Further amendments, including “fixDisallowIncomingV1” and “fixNFTokenReserve,” are also in the pipeline, suggesting continued refinement of the XRP Ledger ecosystem.

<!–

–>

Liquidity pools, it’s worth noting, are used to settle trades, with the prices of tokens within them being determined through the use ofblockchain oracles.

Those who provide liquidity to the pools will receive revenue every time a trade is conducted using that pool, but the revenue comes with the risk of impermanent loss. Impermanent loss occurs when price fluctuations alter the ratio of the tokens within the pool, meaning token providers could be better off if they simply held the tokens in their wallets.

The loss is considered to be impermanent because the ratio of tokens can be restored, in which case the token provider would be gaining the fees collected over time.

The rise in locked XRP also comes shortly after Ripple, a a leading provider of enterprise blockchain and crypto solutions, announced its plans to launch a stablecoin pegged 1:1 to the US dollar (USD). The stablecoin would be fully bakced by a reserve of US dollar deposits, short-term US government treasuries, and other cash equivalentes.

As CryptoGlobee reported, the firm expects the stablecoin market to exceed $2.8 trillion by 2028, and its own stablecoin will be launched both on the XRP Ledger and on Ethereum.

Featured image via Unsplash.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.cryptoglobe.com/latest/2024/04/xrp-locked-on-ledgers-amm-platform-surges-as-it-gets-key-bug-fix/

- :has

- :is

- :not

- $UP

- 000

- 1

- 2028

- 8

- a

- ability

- addresses

- Ads

- After

- All

- Allowing

- along

- also

- alter

- amendment

- amendments

- AMM

- amount

- and

- announced

- ARE

- around

- AS

- Assets

- At

- Automated

- Automated Market Maker

- BE

- because

- being

- Better

- blockchain

- both

- Bug

- built

- but

- by

- came

- CAN

- case

- Cash

- comes

- conducted

- considered

- continued

- could

- critical

- crypto

- crypto solutions

- CryptoGlobe

- data

- decentralized

- decentralized-exchanges

- deposits

- determined

- DEXes

- digital

- Digital Assets

- Dollar

- dubbed

- earn

- ecosystem

- Engine

- Enterprise

- ethereum

- Every

- exceed

- Exchanges

- exchanging

- expects

- explorer

- Fees

- Firm

- Fix

- flaw

- fluctuations

- For

- from

- fully

- functioning

- gaining

- get

- gets

- glitch

- Government

- handle

- Held

- hindered

- However

- HTTPS

- if

- image

- impermanent

- implementation

- in

- Including

- initial

- IT

- ITS

- jpeg

- Key

- large

- Last

- launch

- launched

- leading

- Ledger

- Liquidity

- liquidity pools

- locked

- locking

- loss

- maker

- Market

- market maker

- max-width

- meaning

- more

- noting

- number

- of

- off

- on

- onto

- Oracles

- Other

- out

- over

- own

- pegged

- pipeline

- plans

- platform

- plato

- Plato Data Intelligence

- PlatoData

- pool

- Pools

- prevented

- price

- Price Fluctuations

- Prices

- properly

- provide

- provider

- providers

- ratio

- receive

- recently

- requests

- Reserve

- revenue

- Ripple

- Rise

- Risk

- Rolled

- ROSE

- Screen

- screens

- set

- settle

- short-term

- Shortly

- significant

- simply

- sizable

- sizes

- Solutions

- stablecoin

- Step

- Surged

- Surges

- swap

- system

- Technical

- that

- The

- their

- Them

- they

- Through

- time

- to

- token

- Tokens

- Total

- trade

- trades

- Treasuries

- Trillion

- Update

- us

- US Dollar

- us government

- USD

- use

- used

- using

- via

- Wallets

- was

- when

- which

- WHO

- will

- with

- within

- worth

- would

- xrp

- XRP Ledger

- Yield

- zephyrnet