ADVERTISEMENT

The BTC selling pressure could hit zero soon due to the Grayscale 16,000 BTC unlocking that marks the biggest single unlocking that will flush sellers from the market and will open up volatility but also bullish potential as we can see more in our latest Bitcoin news.

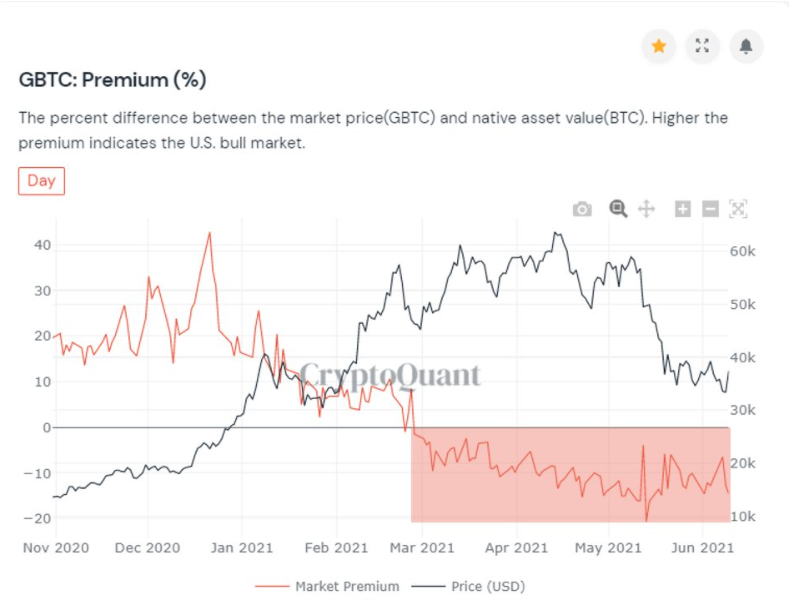

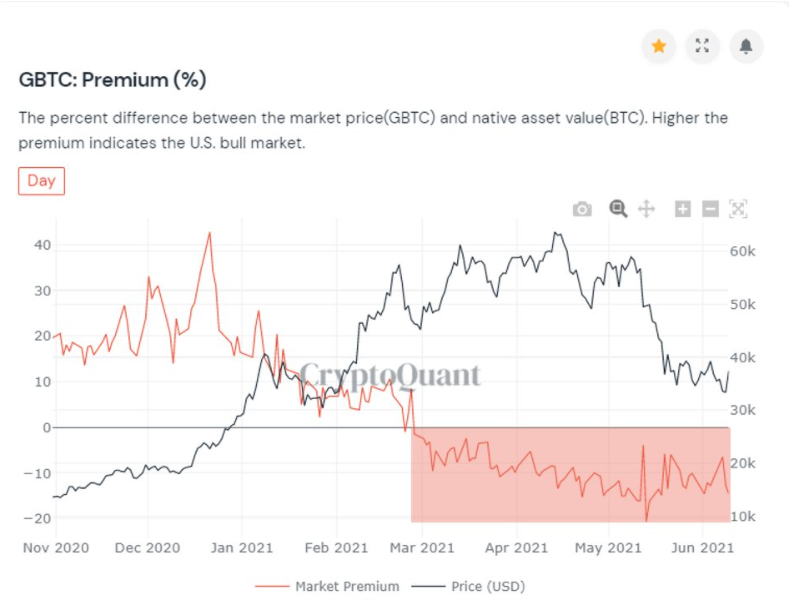

The institutional BTC investors are in the spotlight now as the upcoming major cashout date is sparking new waves of fresh volatility. Twitter commentator Loomdart shifted the attention to the buyers and sellers of the grayscale Bitcoin trust as the number one cryptocurrency hovers near $40K. the giant in the institutional BTC space GBTC has over $24 billion in assets under management but it is not available constantly. The trust operates with periodic closures and this year it coincided with the buy-in price trading at the discount spot price.

The negative GBTC premium formed a major talking point in its own right as the invested funds are locked up for a set period of time and then released which allows investors to cash out at certain times depending on when they are purchased. The combination of negative premium relative to spot and larger unlocking of funds means that July will be interesting for the Bitcoin price action. These alignments increased volatility in the past. By July 19 we will see the biggest single-day unlocking day with 16,000 BTC released.

The BTC selling pressure could hit zero right after and for Loomdart this provides a strong chance for selling pressure to stabilize paving the way for BTC bulls to crush the resistance lines. This will form a refreshing counterpoint to the bearish picture on institutional markets that will open interest in BTC futures way down versus before the May price dip to $30K. On-chain analytics resource CrypoQuant noted that the decline is something which in turn came in tandem with a dramatic decline in BTC transactions number.

ADVERTISEMENT

As recently reported, BTC crashed by around 44% from its ATH of $64,899 signaling an end to the second biggest bull run that started in March 2020. Most analysts including the ones from BiotechValley Insights see the terrible technicals on the BTC market, noting that the flagship cryptocurrency could extend the ongoing decline until $20K. Glassnode Insights newsletter issued by Glassnode anticipated a BTC price recovery in the sessions ahead based on the indicators that serve as a metric to gauge institutional interest in the crypto.

- 000

- 2020

- Action

- analytics

- around

- Assets

- bearish

- Biggest

- Billion

- Bitcoin

- Bitcoin News

- Bitcoin Price

- BTC

- btc price

- btc transactions

- BTCUSD

- Bull Run

- Bullish

- Bulls

- Cash

- counterpoint

- crypto

- Crypto News

- cryptocurrency

- Dates

- day

- Discount

- Editorial

- form

- Free

- fresh

- funds

- Futures

- GBTC

- Glassnode

- Grayscale

- HTTPS

- Including

- insights

- Institutional

- interest

- Investors

- IT

- July

- major

- management

- March

- march 2020

- Market

- Markets

- Near

- news

- Newsletter

- offer

- open

- picture

- policies

- Premium

- pressure

- price

- recovery

- resource

- Run

- Sellers

- set

- Space

- Spot

- Spotlight

- standards

- started

- talking

- time

- Trading

- Transactions

- Trust

- us

- Versus

- Volatility

- waves

- Website

- year

- zero