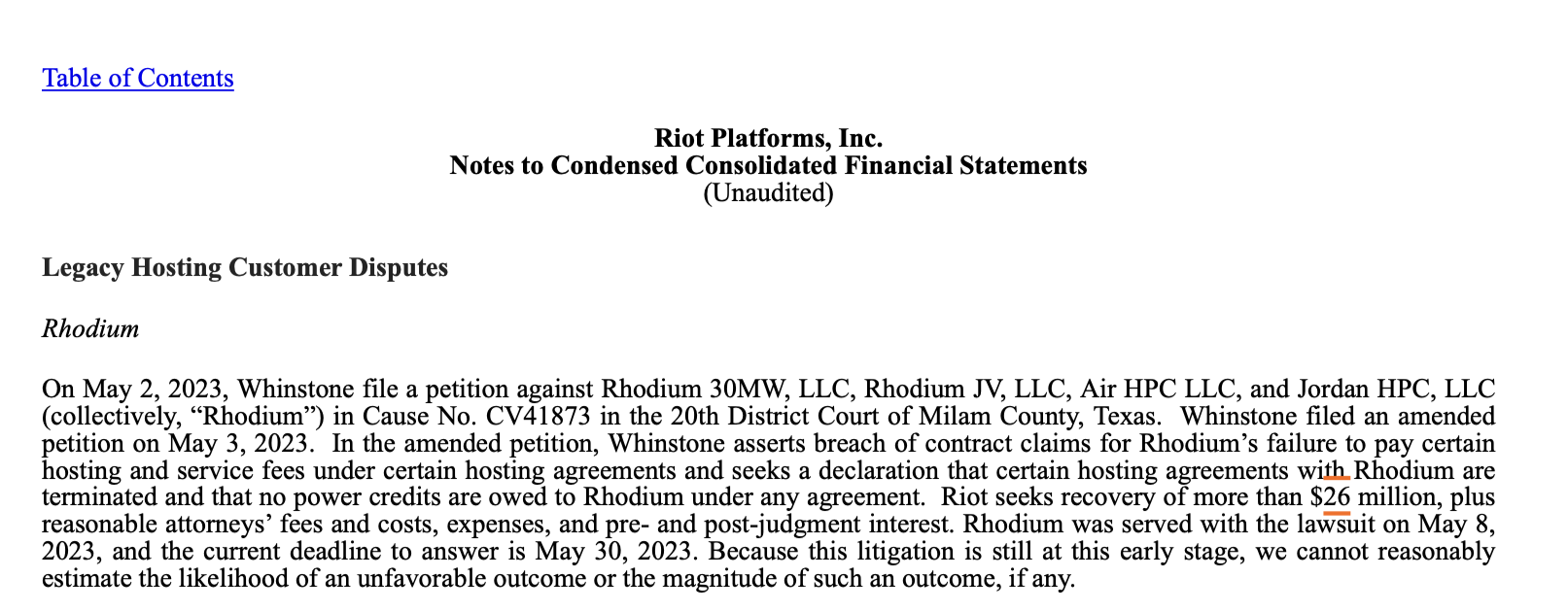

Crypto mining firm Riot Platforms – formerly Riot Blockchain – has taken legal action against Texas-based Bitcoin (BTC) miner, Rhodium Enterprises, in an effort to recover “more than $26 million” in alleged unpaid mining facility fees.

According to Riot Platform’s Q1 2023 financial Denunciar published on May 10, Rhodium Enterprises allegedly breached its contract with Riot by failing to pay hosting and service fees associated with the use of Whinstone’s Bitcoin mining facilities, a wholly owned subsidiary of Riot.

A petition was filed against Rhodium Enterprises on May 2 in the District Court of Milam County in Texas, seeking to recover “more than $26 million,” as well as reimbursement for legal fees incurred during the legal proceedings.

A Riot solicitou ainda que “certos acordos de hospedagem” fossem rescindidos e propôs que ela estivesse isenta de reembolsar quaisquer créditos de energia pendentes à Rhodium.

It was acknowledged that estimating “the likelihood” of recovering the unpaid fees at this stage is uncertain. It noted:

“Como esse litígio ainda está em estágio inicial, não podemos estimar razoavelmente a probabilidade de um resultado desfavorável ou a magnitude de tal resultado, se houver.”

Rhodium was served on May 8, and have a deadline to respond by May 30, according to the report.

Relacionado: Reclamação apresentada contra a Compass Mining por perder máquinas de mineração BTC atinge um obstáculo

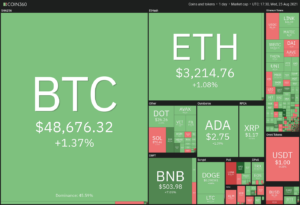

Meanwhile, Riot stated that it had mined “2,115 Bitcoins” in Q1 2023, an increase of 50.5% compared to Q1 2022.

It was further noted that Riot did not have any affiliations with the banks that have experienced collapses in recent times. It noted:

“Não tínhamos nenhum relacionamento bancário com o Silicon Valley Bank, o Silvergate Bank ou o First Republic Bank e, atualmente, mantemos nosso caixa e equivalentes de caixa em várias instituições bancárias.

Riot anticipates that crypto mining companies will continue to experience challenges in 2023 due to the “significant price decline of Bitcoin” and “other national and global macroeconomic factors.”

It was stated that Riot’s “relative position” in the industry, as well as its “liquidity and absence of long-term debt,” makes it well positioned to “benefit from such consolidation.”

- Conteúdo com tecnologia de SEO e distribuição de relações públicas. Seja amplificado hoje.

- PlatoAiStream. Inteligência de Dados Web3. Conhecimento Amplificado. Acesse aqui.

- Cunhando o Futuro com Adryenn Ashley. Acesse aqui.

- Compre e venda ações em empresas PRE-IPO com PREIPO®. Acesse aqui.

- Fonte: https://cointelegraph.com/news/btc-miner-rhodium-lawsuit-alleged-26-m-in-unpaid-fees

- :tem

- :é

- :não

- $UP

- 10

- 2022

- 2023

- 30

- 50

- 7

- 8

- a

- Segundo

- reconhecido

- Açao Social

- afiliações

- contra

- alegado

- alegadamente

- an

- e

- qualquer

- SOMOS

- AS

- Ásia

- associado

- At

- Bank

- Bancário

- bancos

- Bitcoin

- Bitcoin Miner

- Mineração Bitcoin

- Bitcoins

- blockchain

- Bruce

- bruce lee

- BTC

- Minerador de BTC

- mineração btc

- by

- não podes

- dinheiro

- desafios

- Cointelegraph

- colapsos

- Empresas

- comparado

- Bússola

- mineração de bússola

- consolidação

- continuar

- contract

- condado

- Tribunal de

- Créditos

- cripto

- crypto mining

- Atualmente

- prazo de entrega

- Dívida

- Rejeitar

- DID

- distrito

- tribunal distrital

- dois

- durante

- Cedo

- estágio inicial

- esforço

- empresas

- equivalentes

- estimativa

- isento

- vasta experiência

- experiente

- rostos

- instalações

- Facilidade

- fatores

- falta

- Taxas

- Empresa

- Primeiro nome

- Escolha

- Antigamente

- da

- mais distante

- Global

- tinha

- Ter

- acessos

- segurar

- hospedagem

- HTTPS

- if

- in

- Crescimento

- indústria

- instituições

- IT

- ESTÁ

- ação judicial

- Lee

- Legal

- Ação legal

- procedimentos legais

- Litígio

- longo prazo

- perder

- máquinas

- Macroeconômico

- FAZ

- Março

- Posso..

- milhão

- minado

- mineiro

- Mineração

- Empresas de mineração

- instalações de mineração

- máquinas de mineração

- múltiplo

- Nacional

- NTF`s

- notado

- of

- on

- or

- A Nossa

- Resultado

- marcante

- Acima de

- propriedade

- Pagar

- significativo

- plataforma

- Plataformas

- platão

- Inteligência de Dados Platão

- PlatãoData

- posição

- posicionado

- poder

- preço

- Proceedings

- proposto

- publicado

- Q1

- recentemente

- Recuperar

- recuperação

- Relacionamentos

- Denunciar

- República

- Responder

- Ródio

- Tumulto

- Riott Blockchain

- s

- SEC

- busca

- serviço

- periodo

- Silício

- Vale do Silício

- Banco do Vale do Silício

- Silvergate

- BANCO SILVERGATE

- fonte

- Etapa

- estabelecido

- Ainda

- Storm

- subsidiário

- tal

- Surtos

- texas

- do que

- que

- A

- isto

- vezes

- para

- Incerto

- usar

- Vale

- foi

- we

- BEM

- totalmente

- precisarão

- de

- zefirnet