- Direct Agent 5, Inc. (DA5) collaborated with Gurufin to launch the PHMU stablecoin.

- PHMU will be pegged to the Philippine peso.

- The stablecoin will be launched within the combined ecosystems of DA5 and Gurufin; it will initially be available in the SurgePay Community Wallet.

Aiming to expedite the money transfer process in the country, money service business Direct Agent 5, Inc. (DA5) introduced the PHMU stablecoin project. It was formalized during DA5’s partnership with Gurufin, a Layer-1 Hybrid Mainnet that claims to integrate real-economy payment services with blockchain technology, on August 9, 2023.

What is PHMU Stablecoin

Stablecoins are cryptocurrencies that are linked to a reference asset, such as a fiat currency, exchange-traded commodities, or another cryptocurrency. This means their value is intended to remain constant, as it is pegged to a reference asset. The PHMU stablecoin is backed by the Philippine Peso at a 1:1 ratio.

(Citit: Ce sunt Stablecoins? O introducere, descriere și cazuri de utilizare)

Together with Gurufin, DA5 assured its users in a statement that the project will provide consistent transaction costs, not subject to the volatile gas fees associated with other major chains, as it runs on its own Layer 1 chain.

“PHMU’s standout feature lies in its full fiat-backing by the Philippine Peso, with real-time verification capabilities,” the money service business emphasized. “This revolutionary coin transcends existing stablecoin standards by ensuring compliance with all requisite legal frameworks and licensing, paving the way for genuine scalability and broad application.”

DA5, a known Philippine Western Union Agent, is licensed as a virtual asset service provider (VASP), electronic money issuer (EMI), and provider of electronic payment and financial services (EPFS) by the Bangko Sentral ng Pilipinas (BSP).

Moreover, the stablecoin is scheduled to be launched within the combined ecosystems of DA5 and Gurufin and will initially be featured in the SurgePay Community Wallet. Following this, it will be accessible across DA5’s more than 1,800 branches.

“Leveraging the pinnacle of technological innovation, DA5 remains unwavering in its commitment to offering Filipinos the safest, most efficient means of transferring money to the Philippines,”

Raymond Babst, DA5 President and CEO

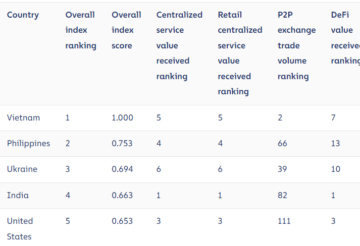

Stablecoins in the Philippines

Stablecoins pegged to the Philippine Peso may not yet be widely popular in the country.

In 2019, UnionBank of the Philippines launched the stablecoin PHX la facilita tranzacții transfrontaliere de remitențe pe un blockchain. Mișcarea a făcut din UnionBank prima bancă din țară care a lansat o monedă stabilă și a efectuat remitențe prin blockchain.

During its launch, the bank expressed its plans to make PHX usable on various platforms and wallets globally.

Meanwhile, UnionDigital Bank, a subsidiary of UnionBank in the Philippines, also announced its plans to launch the Philippine Peso UnionDigital stablecoin (PHD).

The stablecoin will bear the ticker symbol ‘PHD.’

In August 2022, Cebu City Vice Mayor Raymond Alvin Garcia dezvăluit that the city, in collaboration with C Pass Inc., has been developing C-Peso, a stablecoin aiming to be a way to promote cashless payments in the city. Garcia said the coin has entered the third stage of the registration process for Furnizori de servicii virtuale de active atunci.

Then in March, C PASS asigurat a license to extend its send-and-receive cryptocurrency operation on the European continent, the virtual asset firm confirmed.

„Acest lucru va permite utilizatorilor să trimită, să primească și să schimbe criptomonede în Uniunea Europeană și celor cu sediul în altă parte, dar care fac tranzacții cu clienții acolo.”

Charlie Seo, C PASS Vice President

Banco De Oro (BDO), the largest bank in the country, recently a participat in a pilot program examining the use of stablecoins, in this case Monedele digitale ale băncilor centrale, in remittances between the U.S. and the Philippines.

In September last year, during a panel discussion at Forkast’s “Crypto Rising: CBDCs & Stablecoins: The Asia Perspective”, BSP Director Mhel Plabasan emphasized that the central bank sees stablecoins as a plausible solution for more efficient payment transactions in the country.

„Am văzut că are într-adevăr potențialul de a revoluționa atât plățile interne, cât și cele transfrontaliere mai accesibile, mai rapide și chiar posibilitatea de a utiliza stablecoins pentru a eficientiza remitențele transfrontaliere.”

Mhel Plabasan, Director at BSP

Acest articol este publicat pe BitPinas: DA5, GuruFin Introduces PHMU: A Peso-Backed Stablecoin

Disclaimer: articolele BitPinas și conținutul său extern nu sunt sfaturi financiare. Echipa servește pentru a furniza știri independente, imparțial, pentru a oferi informații pentru Philippine-crypto și nu numai.

- Distribuție de conținut bazat pe SEO și PR. Amplifică-te astăzi.

- PlatoData.Network Vertical Generative Ai. Împuterniciți-vă. Accesați Aici.

- PlatoAiStream. Web3 Intelligence. Cunoștințe amplificate. Accesați Aici.

- PlatoESG. Automobile/VE-uri, carbon, CleanTech, Energie, Mediu inconjurator, Solar, Managementul deșeurilor. Accesați Aici.

- PlatoHealth. Biotehnologie și Inteligență pentru studii clinice. Accesați Aici.

- ChartPrime. Crește-ți jocul de tranzacționare cu ChartPrime. Accesați Aici.

- BlockOffsets. Modernizarea proprietății de compensare a mediului. Accesați Aici.

- Sursa: https://bitpinas.com/business/ph-crypto-exchange-da5-peso-stablecoin/

- :are

- :este

- :nu

- 1

- 1: raportul 1

- 2019

- 2022

- 2023

- 7

- 9

- a

- accesibil

- peste

- sfat

- accesibil

- Agent

- Urmarind

- TOATE

- de asemenea

- an

- și

- a anunțat

- O alta

- aplicație

- SUNT

- articol

- bunuri

- AS

- Asia

- activ

- asociate

- asigurat

- At

- August

- disponibil

- sprijinit

- Bangko Sentral din Pilipinas

- Bangko Sentral din Pilipinas (BSP)

- Bancă

- bazat

- extensia BDO

- BE

- Urs

- fost

- între

- Dincolo de

- BitPinas

- blockchain

- Tehnologia blocurilor

- atât

- ramuri

- larg

- BSP

- afaceri

- dar

- by

- C Pass Inc

- capacități

- caz

- cashless

- plăți fără numerar

- CBDC

- Cebu

- central

- Banca centrala

- lanţ

- lanţuri

- Charles

- Oraș

- creanțe

- clientii

- Monedă

- a colaborat

- colaborare

- combinate

- angajament

- Mărfuri

- comunitate

- conformitate

- Conduce

- CONFIRMAT

- consistent

- constant

- conţinut

- continent

- Cheltuieli

- ţară

- transfrontaliere

- cripto

- cripto-schimb

- cryptocurrencies

- cryptocurrency

- Monedă

- DA5

- David

- livra

- descriere

- în curs de dezvoltare

- digital

- direcționa

- Agent direct 5

- Director

- discuţie

- Intern

- în timpul

- ecosistemele

- eficient

- Electronic

- plata electronica

- în altă parte

- accentuat

- permite

- asigurare

- a intrat

- european

- Uniunea Europeana

- Chiar

- examinator

- schimb

- tranzacționat la bursă

- existent

- accelera

- și-a exprimat

- extinde

- extern

- mai repede

- Caracteristică

- Recomandate

- Taxe

- Decret

- Fiat monedă

- financiar

- sfaturi financiare

- Servicii financiare

- Firmă

- First

- următor

- Pentru

- cadre

- din

- Complet

- GAS

- comisioane pentru gaz

- veritabil

- La nivel global

- Avea

- HTTPS

- Hibrid

- in

- Inc

- independent

- informații

- inițial

- Inovaţie

- integra

- destinate

- introdus

- Prezintă

- Introducere

- emitent

- IT

- ESTE

- jpg

- cunoscut

- cea mai mare

- Nume

- Anul trecut

- lansa

- a lansat

- strat

- stratul 1

- Legal

- Licență

- Autorizat

- de licențiere

- se află

- legate de

- făcut

- retea principala

- major

- face

- Martie

- max-width

- Mai..

- Primar

- mijloace

- bani

- mai mult

- mai eficient

- cele mai multe

- muta

- ştiri

- of

- oferind

- on

- operaţie

- or

- Altele

- propriu

- panou

- Discuții de grup

- Asociere

- trece

- Pavaj

- plată

- Servicii de plată

- tranzacții de plată

- plăți

- pegged

- greutate

- PhD

- Filipine

- Filipine

- pilot

- vârf

- Planurile

- Platforme

- Plato

- Informații despre date Platon

- PlatoData

- plauzibil

- Popular

- posibilitate

- potenţial

- preşedinte

- proces

- Program

- proiect

- promova

- furniza

- furnizorul

- publicat

- raport

- Citeste

- în timp real

- într-adevăr

- a primi

- recent

- Înscriere

- rămâne

- rămășițe

- remitere

- Remitențele

- necesar

- revoluționar

- revoluţiona

- în creștere

- ruleaza

- s

- cel mai sigur

- Said

- scalabilitate

- programată

- văzut

- vede

- trimite

- SEO

- Septembrie

- servește

- serviciu

- Furnizor de servicii

- Servicii

- soluţie

- stablecoin

- Stablecoins

- Etapă

- standarde

- Declarație

- subiect

- filială

- astfel de

- schimba

- simbol

- echipă

- tehnologic

- Tehnologia

- decât

- acea

- Filipine

- lor

- Acolo.

- Al treilea

- acest

- aceste

- ceas de buzunar

- timp

- la

- tranzacționând

- tranzacție

- Costurile tranzactiei

- Tranzacții

- transcende

- transfer

- transferare

- ne

- uniune

- UnionBank

- UnionDigital

- Banca UnionDigital

- neclintit

- utilizabil

- utilizare

- utilizatorii

- folosind

- valoare

- diverse

- VASP

- Verificare

- de

- viciu

- Virtual

- activ virtual

- Furnizor de servicii de active virtuale

- furnizor de servicii de active virtuale (VASP)

- volatil

- Portofel

- Portofele

- a fost

- Cale..

- pe larg

- voi

- cu

- în

- an

- încă

- zephyrnet