Deși există o mulțime de proiecte blockchain axate pe dApps și conversia jetoanelor, unul care iese în evidență este Rețeaua Bancor și tokenul său BNT.

Indeed, this project is one of the most well known in the cryptocurrency space. It has also had its fair share of ups and downs. From a blockbuster ICO to legal challenges. From widespread partnerships to a widely publicized hack.

However, is it something you should consider?

În această recenzie Bancor Network Token, vă voi oferi tot ce trebuie să știți. De asemenea, voi arunca o privire asupra perspectivelor pe termen lung și potențialului de adoptare al BNT.

Ce este Rețeaua Bancor?

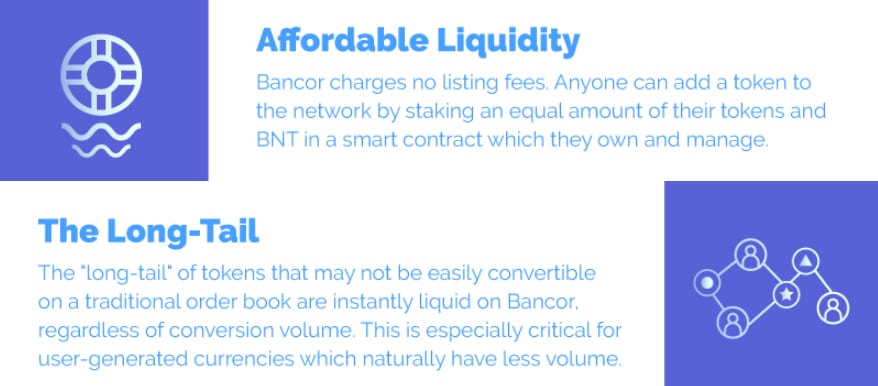

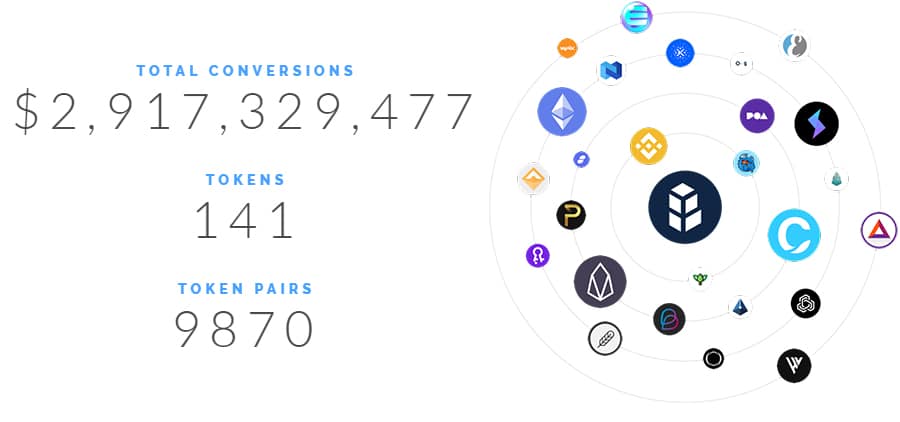

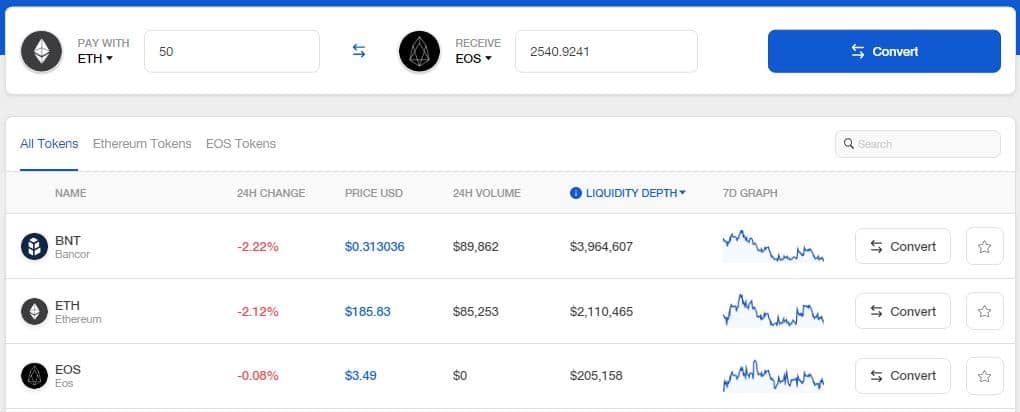

Rețeaua Bancor has created an elegant solution in its decentralized network which allows traders to swap ERC-20 ad EOS tokens seamlessly across nearly 10,000 token pairs, and all with a single click.

Image via Bancor Website

Bancor allows users to instantly convert between two tokens without needing a counterparty to the trade. This is all done right within the Bancor wallet, and this model has allowed Bancor to provide traders with automatic liquidity for trades.

Mai important, permite rețelei să rămână complet descentralizată, iar o mare parte din funcționalitatea rețelei se datorează utilizării inovatoare a simbolului BNT pentru a facilita tranzacțiile.

Deci, toate acestea sună cu adevărat intrigant, dar pentru a înțelege adevărata greutate din spatele Bancor, trebuie să trecem peste istoria sa relativ plină de evenimente.

Bancor Network Background

The Bancor Network is overseen by the Bancor Foundation, which is based in Zug, Switzerland. The company also operates a Research & Development center in Tel Aviv, Israel, which gives the company a foothold in the rising blockchain hub in Zug as well as the rising Middle Eastern technology center of Tel Aviv.

The company was founded in 2016 by a group is Israelis with a background in Silicon Valley start-ups, as well as experience in scaling startups and blockchain technologies. It was named after the international trade balancing currency initially envisioned by John Maynard Keynes.

Token Sale Page for the Bancor Network Token

The Bancor Network is perhaps most well-known for holding one of the most successful ICOs ever. In 2017 it set a world record by raising over $153 million in Jetoane Ethereum in mai putin de 3 ore. De atunci, recordul mondial a fost depășit de mai multe proiecte (inclusiv SIRIN Labs și Tezos), but remains an impressive beginning for the project.

Since the ICO the Bancor Network has seen over $1.5 billion in token conversions take place on its platform, all facilitated by the BNT token. In addition, there are over 100 liquidity providers serving as Bancor nodes, and these nodes provide over $13 million in liquidity by staking BNT tokens to power token conversions.

Mai recent, la 1 ianuarie 2020, Bancor și-a adăugat în mod dramatic fondul său de lichidități prin eliminarea tuturor rezervei sale Ethereum, care totalizau 10% din capitalizarea pieței BNT la acea vreme, sub forma ETHBNT Bancor Pool Tokens.

In effect this added 60,000 liquidity providers, although it’s understood that many of the airdrop recipients simply turned around and sold the tokens. Still, the Bancor network has gone from liquidity of just under $4 million on January 1, 2020 to over $17 million as of mid-June 2020.

Conversie în lanțuri încrucișate

Bancor has made the user experience of exchanging tokens quite easily. The intuitive wallet app is slick and allows for the quick and easy conversion of tokens similar to what users get when using Coinbase Pro or other custodial wallets.

While the user interface makes it look simple, behind the scenes the Bancor wallet is transacting directly with BNT smart contracts on the blockchain, all while allowing users to retain full control of their private keys and funds at all times.

Cross Chain Token Swap on Bancor

Avantajul evident al portofelului Bancor este că nu numai că permite schimbul de jetoane, dar o face fără a fi nevoie de o contraparte. Acest lucru o face prima rețea care permite conversii încrucișate fără a solicita utilizatorilor să renunțe la cheile private în procesul de schimb.

Bancor began their cross-chain integration efforts with EOS and Ethereum, however, they have plans to add other bridges over time, eventually enabling them to function as a multi-chain liquidity solution that can provide instant token conversions for many of the popular blockchains such as Bitcoin, Tron, and Ripple.

Gama de conversii

Already Bancor gives traders and investors an amazing range of conversion options, with fee-less, instant trades available for Ethereum and EOS tokens across more than 8,700 token pairs right through the Bancor wallet.

Pentru a face o comparație, unul dintre cele mai populare schimburi Binance are aproximativ 196 de jetoane disponibile, dar doar 586 de perechi de tranzacționare.

Lichiditate automată

Unul dintre cele mai mari beneficii ale Bancor și token-ului BNT este că aduc lichiditate pe piețele de criptomonede și, fără lichiditate, monedele sunt predispuse să se ofilească și să moară. Până la urmă, cine vrea să dețină o monedă care nu poate fi ușor cumpărată și vândută.

Desigur, cele mai importante criptomonede precum Ethereum, Ripple, Litecoin, and others in the top 20 have enough trading volume on their own, but the Bancor Protocol brings a unique solution that delivers automatic decentralized liquidity to any token.

Prin Protocolul Bancor, orice token, chiar și cel creat privat, poate obține lichiditate instantanee, indiferent de dimensiunea volumului de tranzacționare de care se bucură jetonul. Aceasta este o funcționalitate incredibil de importantă atunci când vine vorba de facilitarea adoptării aplicațiilor descentralizate.

Since many dApps have their own tokens, and now those tokens are able to be converted with other cryptocurrencies instantly and with a single click right within a user’s wallet.

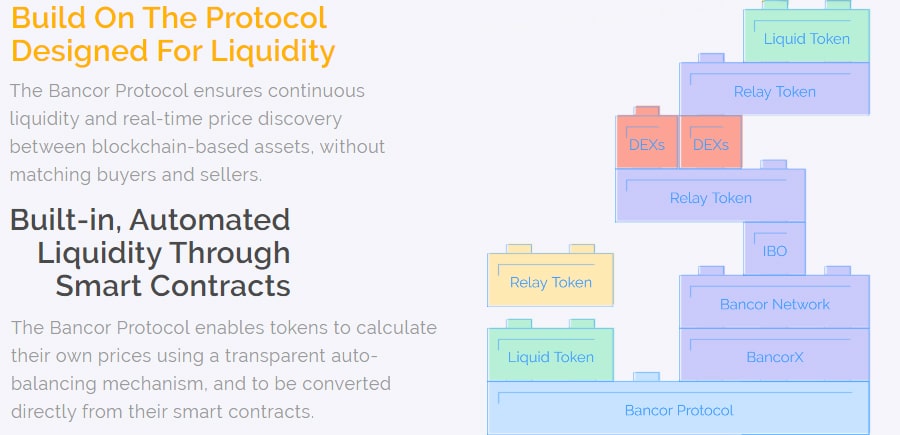

Cum funcționează protocolul Bancor

În acest moment, s-ar putea să vă întrebați dacă este cu adevărat necesar să aveți un alt schimb descentralizat. La urma urmei, schimburile centralizate par mult mai populare în acest moment și există zeci de schimburi active care oferă deja o platformă de tranzacționare și lichiditate pentru criptomonede.

In short, yes the world does need another exchange, or at least it needs an exchange like Bancor. That’s because the Bancor platform provides a much-needed service of increasing liquidity for any token, and of creating a platform where any token can be exchanged without the need for a counterparty.

Acesta este ceva ce nu poate fi realizat cu niciun alt activ. Luați ca exemplu monedele fiat. Dacă doriți să schimbați dolari americani cu yeni, trebuie să găsiți pe cineva dispus să vândă yeni pentru a finaliza tranzacția. Fiecare atu este așa. Pentru ca tranzacția să funcționeze, trebuie să existe un cumpărător și un vânzător.

Prezentare generală a Protocolului Bancor pentru dezvoltatori externi

Bancor necesită doar o singură persoană pentru a finaliza o tranzacție, cu lichiditatea oferită de tokenul nativ BNT și contractele sale inteligente. Contractele inteligente ale jetonului BNT asigură un echilibru între tokenuri în orice moment. Odată ce orice tranzacție este încheiată, va rămâne și un total rămas care reprezintă soldul BNT codificat în contractul inteligent.

Această structură elimină necesitatea ca schimbul să acționeze ca o terță parte pentru tranzacții. Cu Bancor și tokenul său BNT, puteți efectua în mod continuu schimburi pentru token-uri compatibile Ethereum și EOS chiar prin portofelul Bancor.

Vă puteți gândi la sistem ca la o clepsidră. Este un sistem inchis si nu conteaza cum invarti clepsidra, tine mereu aceeasi cantitate de nisip. În această analogie, clepsidra reprezintă contractul inteligent BNT, iar boabele de nisip sunt jetoanele tranzacționate.

And next up from the team will be a development marketplace for dApps that will also make use of the cross-chain compatibility and balanced smart contracts. Also in the pipeline for the future is staking rewards to incentivize liquidity, and a BancorDAO to add self-governance to the blockchain and fully decentralize.

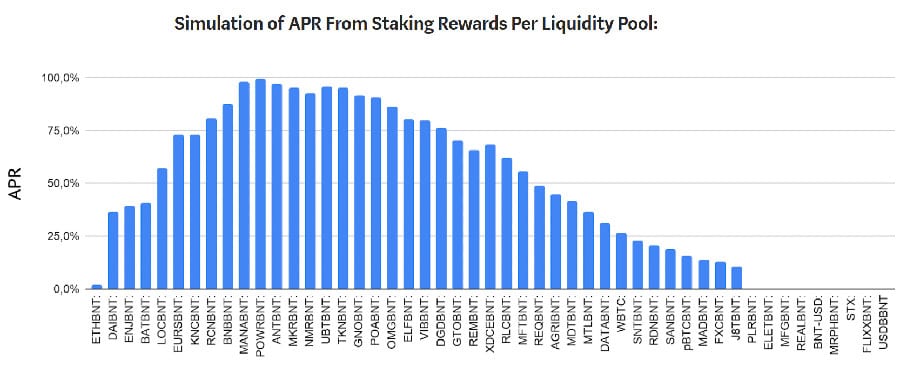

Bancor Staking Rewards

Recompensele de miza BNT sunt o îmbunătățire viitoare care este planificată pentru a stimula utilizatorii să furnizeze lichidități pentru rețea. Baza pentru adăugarea mizei este că Bancor are nevoie de lichiditate pentru a reduce comisioanele pentru comercianți, crescând în același timp volumul de tranzacționare și comisioanele generale de rețea. Oferind utilizatorilor un stimulent pentru a adăuga lichiditate rețelei, Bancor se așteaptă să-și vadă rețeaua să crească și să înflorească.

APR de miză simulate. Imagine prin blogul Bancor

While plans for adding staking rewards are in the early stages the basics are that users will receive rewards of BNT for holding their BNT in an existing liquidity pool such as MKR/BNT or ETH/BNT. The amount of new BNT that will be created as staking rewards and the distribution of staking rewards to different pools on the network will be decided by users voting in the BancorDAO.

This type of reward system is expected to pull new users into the ecosystem thanks to the APR generated by fees and staking rewards. Bancor is carefully designing their staking rewards system to avoid concentrating the rewards in a small number of pools, choosing instead to provide an even distribution across dozens of network pools.

Echipa Bancor

The Bancor Network was founded in 2016 by Israeli siblings Guy and Galia Benartzi. Both remain active with the project, with Guy on the Foundation Council, while Galia is in charge of business development. She is also a strong proponent of women in blockchain and crypto.

The Foundation Council president was Bernard Lietaer until his death in February 2019. Since then I have been unable to locate any update that names his successor.

Galia & Guy Benartzi & Yudi Levi. Images via Bancor & Twitter

The CTO of Bancor is Yudi Levi, și a ocupat această funcție de la începutul Bancor în 2016. Înainte de aceasta, a fost co-fondator și CTO al AppCoin. De asemenea, a petrecut peste un deceniu ca arhitect șef al mai multor proiecte mobile, inclusiv Real Dice, Mytopia și Particle Code.

The team also has an impressive list of advisors, including Brock Pierce, the Chairman of the Board at the Bitcoin Foundation, and venture capitalist TimDraper.

The BNT Token

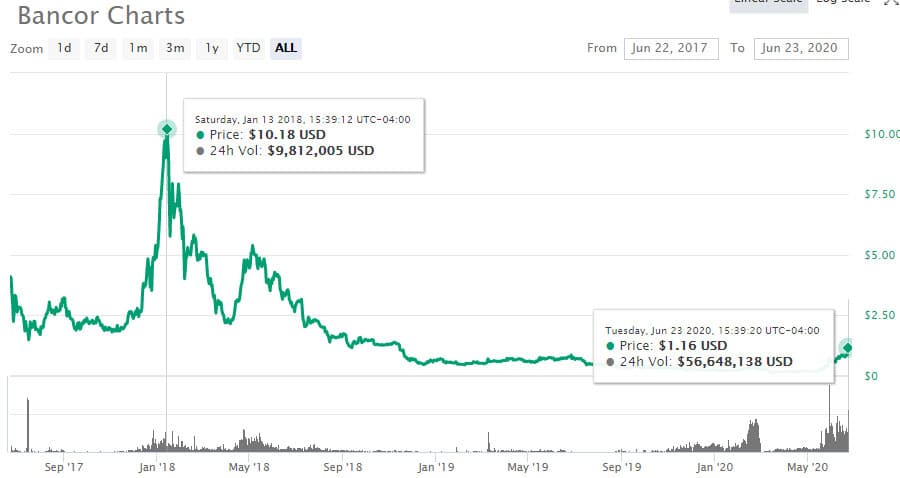

As was mentioned earlier, Bancor held an ICO on June 12, 2017 that raised $153 million in just three hours. That ICO sold roughly 40 million BNT tokens at an average price of $3.92 each. Currently, there’s a circulating supply of BNT of nearly 70 million tokens.

The BNT token hit its all-time high of $10.00 on January 10, 2018 and its all-time low of $0.117415 on March 13, 2020. As of mid-June 2020 it has recovered remarkably from its March all-time low and trades at $1.17 for an amazing gain of 1,500% in three months! That gain was primarily powered by news of the July 2020 release of Bancor V2.

The circulating supply can change however since BNT is created as needed to initiate exchanges. The Bancor protocol will create as much BNT as needed to match the value of currencies held within the smart contract. Once staking rewards are added the circulating supply will necessarily increase more rapidly and regularly.

Trading & Storing BNT

Interestingly, the Bancor Network only handles around 2% of the trading volumes of BNT. The largest trading volumes by far can be found at Coinbene, followed by Bilaxy, Binance, and OKEx, and then comes the Bancor Network. There are a handful of other exchanges that also handle BNT exchanges, but trading volumes are minimal at best.

In fact, Coinbene controlled over half of the total token trading volume for BNT when I checked. This could actually be a problem from a market liquidity perspective. It means that trading is highly dependent on one exchange and any disruption there could cause a collapse volume.

Moreover, if we were to take a look at the order books on an individual exchange such as Binance it is clear that there is a lack of liquidity there. You will need to be very careful when placing an order there as if reasonable sized orders are likely to lead to slippage.

Once you have your BNT tokens you are going to want to store them in a secure offline wallet. Given that these are ERC20 tokens it means that you can store it any Ethereum compatible wallet. There is also a mirror-image EOS based token that was created to mimic the ERC-20 token and to allow exchanges of EOS based tokens.

If you’re trading or staking (once that’s available) then storing BNT in the native Bancor Wallet will make sense.

Bancor V2

La sfârșitul lunii aprilie 2020, cu tokenul BNT care slăbește în jurul nivelului de 0.20 USD, echipa a anunțat că va lansa în curând Bancor V2. Tokenul nu a răspuns imediat, dar până la jumătatea lunii mai a început un rally serios, iar o lună mai târziu se tranzacționează la 1.17 USD. Acest lucru este deosebit de uimitor, având în vedere că jetonul a fost la cel mai scăzut nivel istoric cu puțin timp înainte, la mijlocul lui martie 2020.

Anunț Bancor V2. Imagine prin blogul Bancor

Protocolul Bancor V2 este de așteptat să adauge câteva caracteristici importante care îl vor pune pe Bancor în fruntea pachetului de proiecte de finanțare descentralizată. Schimbările sunt menite să abordeze patru probleme cheie citate în mod obișnuit ca obstacole în calea adoptării pe scară largă a producătorilor de piață automati (AMM):

- Exposure to “impermanent loss”

- Expunerea la mai multe active

- Ineficiența capitalului (adică, alunecare mare)

- Costul de oportunitate al furnizării de lichiditate

It’s interesting to see that the new features will be opt-in and users are able to create and fund new AMMs with some, all, or none of the new features. Technical details, documentation, and source code has been promised to be released prior to the July launch of Bancor V2.

Dezvoltare & Foaie de parcurs

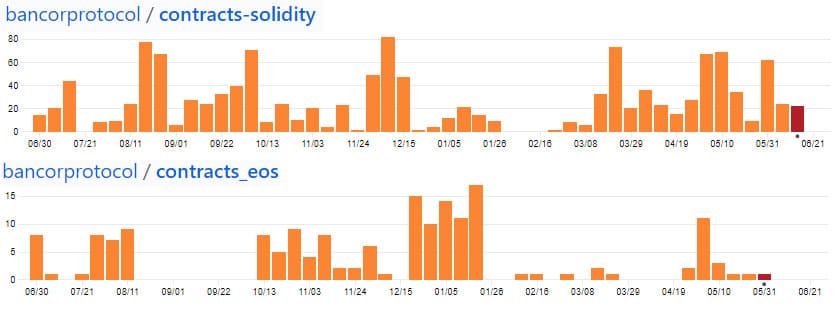

The Bancor network is an interesting mix of open source and closed source software. Some of the core code is known only by the company whereas there are open source repositories for developers to build on.

Some people argue that the lack of full open source code means that potential vulnerabilities could exist which have not been vetted by the community. Indeed, this may have been the case with the hack we cover below.

Having said that, we can still get a good idea of how much work is being done on the Bancor protocol based on these two repositories.

Below you have the total commits to two smart contract repositories in the Bancor GitHub. These are the total commits over the past 12 months to the repos.

Commits to Select Repos over last year

As you can see, there has been a relatively steady flow of commits that have been pushed to these repos. This shows that the developers are still actively working on the protocol.

Of course, this may exclude all the work that is being done in the private repositories. Indeed, if we were to take a look at the roadmap it would seem as if the project has quite a bit in front of them.

Roadmap

In September of this year, the Bancor team eliberat their updated roadmap for the next 6-12 months. Some of the most important things to look out for include the following:

- Community Staking: This will allow anyone on the Bancor Network to stake their tokens and add to the liquidity of the network. In return for this they will earn a staking reward

- Stable BNT: This will be a stablecoin Bancor Token which will hold its value with USD. This will provide liquidity to the ecosystem while eliminating the risk posed by a fluctuating BNT price.

- BNT Airdrop: Those who hold BNT on Ethereum & EOS can look forward to an airdrop of BNT’s Ethereum reserve

- BNT Inflation: The team hopes to upgrade the BNT token to an inflationary model where the initial inflation level will be set to 0%

- BNT Voting: A governance component will be added. With voting, holders of BNT tokens will be able to take part in decisions that will affect the ecosystem

The team has not released defined milestones for these steps but they have managed to execute on previously defined goals. This includes the BancorX launch on the EOS MainNet and the EOS / ETH cross chain experience.

Bancor Roadmap

As of June 2020 the only goals from this roadmap that have been achieved are the BNT Airdrop and the stable BNT token, which is the USDB. We can only presume the other goals will be achieved after Bancor V2 is released, supposedly in July 2020.

If you wanted to keep up to date with developments on the Bancor protocol then you can read follow their blog-ul oficial sau lor Twitter cont.

Concluzie

One of the major roadblocks in mass adoption is the lack of liquidity, and difficulty in exchanging various tokens for each other. The Bancor Protocol has done away with this problem through the automation of liquidity.

Este adevărat că începătorii completi se vor confrunta cu o mică curbă de învățare, dar interfața de utilizare a portofelului este la fel de simplă pe cât vin. Oricine este nou în criptomonede ar trebui să învețe fără probleme cum să facă schimburi folosind portofelul Bancor.

Moreover, the Bancor Protocol is making it easier for developers to build a seamless exchange application between a plethora of tokens. There are also a host of updates that have been planned for the next 6 to 12 months.

Of course, there are still questions linger around the project including the issues of regulations in the U.S. and beyond. Potential centralisation of control in the three year transition period may deter some who fear the potential for arbitrary frozen accounts.

You also have the really paltry token performance of BNT especially over the past year. Yes, it is true that many other tokens are in a rut but BNT appears to have been hit particularly hard. Perhaps this was all in relation to the legal challenges?

Either way, Bancor does have some great technology, use cases and a strong team powering it forward. Those ICO funds are likely to help them weather the storm and further refine their offering.

Imagine prezentată prin Shutterstock

Disclaimer: Acestea sunt opiniile scriitorului și nu ar trebui să fie considerate sfaturi de investiții. Cititorii ar trebui să își facă propriile cercetări.

Source: https://www.coinbureau.com/review/bancor-network-token-bnt/

- &

- 000

- 100

- 2016

- 2019

- 2020

- activ

- Ad

- Adoptare

- Avantaj

- sfat

- consilieri

- Airdrop

- TOATE

- Permiterea

- a anunțat

- Anunț

- aplicaţia

- aplicație

- aplicatii

- Aprilie

- APT

- în jurul

- activ

- Automata

- Automatizare

- Bancor

- Noțiuni de bază

- în spatele scenelor

- CEL MAI BUN

- Miliard

- binance

- Pic

- Bitcoin

- blockchain

- proiecte de blocaj

- tehnologii blockchain

- bord

- Manuale

- construi

- afaceri

- cazuri

- Provoca

- președinte

- Schimbare

- taxă

- şef

- închis

- Co-fondator

- cod

- comunitate

- companie

- component

- contract

- contracte

- Convertire

- Consiliu

- contraparte

- Crearea

- cripto

- cryptocurrencies

- cryptocurrency

- CTO

- Moneda

- Monedă

- curba

- DApps

- de date

- descentralizată

- Aplicații descentralizate

- Schimbul descentralizat

- Finanțe descentralizate

- rețea descentralizată

- Dezvoltatorii

- Dezvoltare

- Ruptură

- de dolari

- Devreme

- de est

- ecosistem

- EOS

- CEC-20

- ERC20

- ETH

- ethereum

- schimb

- Platforme de tranzacţionare

- Față

- echitabil

- DESCRIERE

- Taxe

- Decret

- finanţa

- First

- debit

- urma

- formă

- Înainte

- Complet

- funcţie

- fond

- Fondurile

- viitor

- GitHub

- bine

- guvernare

- mare

- grup

- Crește

- hack

- Înalt

- istorie

- deţine

- Cum

- Cum Pentru a

- HTTPS

- ICO

- Icos

- idee

- imagine

- Inclusiv

- Crește

- inflaţiei

- integrare

- Internațional

- investiţie

- Investitori

- Israel

- probleme de

- IT

- iulie

- Cheie

- chei

- lansa

- conduce

- învăţare

- Legal

- Nivel

- Lichiditate

- furnizori de lichiditate

- Listă

- Lung

- major

- Efectuarea

- Martie

- Piață

- piaţă

- pieţe

- Meci

- milion

- Mobil

- model

- luni

- Cel mai popular

- nume

- reţea

- Funcții noi

- ştiri

- noduri

- oferind

- OKEx

- deschide

- open-source

- Avize

- Opţiuni

- comandă

- comenzilor

- Altele

- parteneriate

- oameni

- performanță

- perspectivă

- platformă

- mulțime

- piscină

- piscine

- Popular

- putere

- preşedinte

- preţ

- privat

- Cheile private

- proiect

- Proiecte

- raliu

- gamă

- cititori

- regulament

- cercetare

- Returnează

- revizuiască

- Recompense

- Ripple

- Risc

- sare

- scalare

- fără sudură

- vinde

- sens

- servire

- set

- Distribuie

- Pantaloni scurți

- Silicon Valley

- simplu

- Mărimea

- mic

- inteligent

- contract inteligent

- Contracte inteligente

- So

- Software

- vândut

- Spaţiu

- stablecoin

- miză

- Staking

- Începe

- Startup-urile

- stoca

- Furtună

- de succes

- livra

- Elveția

- sistem

- Tehnic

- Tehnologii

- Tehnologia

- Tel Aviv

- Noțiuni de bază

- timp

- semn

- indicativele

- top

- comerţului

- Comercianti

- meserii

- Trading

- tranzacție

- Tranzacții

- TRON

- ne

- ui

- Actualizează

- actualizări

- UPS

- USD

- utilizatorii

- valoare

- aventura

- volum

- Vot

- Vulnerabilitățile

- Portofel

- Portofele

- Ce este

- OMS

- în

- Femei

- Apartamente

- lume

- an

- Yen

- Zug