Comitetul de la Basel pentru Supravegherea Bancară, organismul global de standardizare pentru reglementarea bancară, a publicat o consultare joi, acest lucru, dacă va intra în vigoare în cele din urmă, ar impune cerințe stricte de capital pentru băncile care au expunere la bitcoin și alte criptomonede.

It’s a notable release, given that major banks around the world pursue custodie Servicii in response to demand from their clients and customers. But the consultation — which has a September response date attached — signals that the world’s banking regulators intend to take a conservative approach to oversight, requiring that banks hold enough capital to cover the entirety of potential losses.

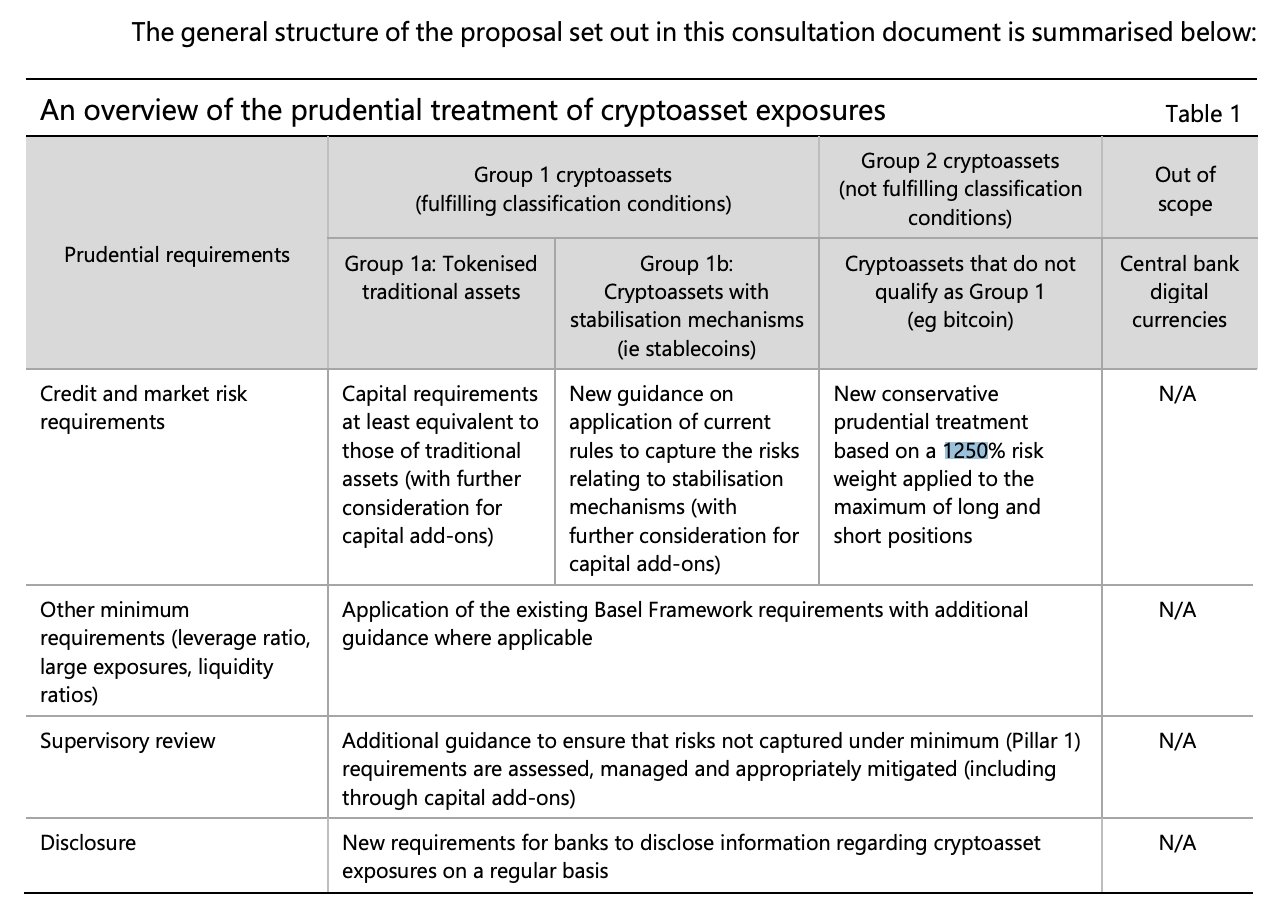

The paper outlines two areas. One group includes tokenized assets and stablecoins, with another encompassing bitcoin and others. It’s the latter group, as shown in the chart below, that would carry with it the strict capital requirements due to the perceived risks.

Comitetul de la Basel a indicat pentru prima dată că dorește să prezinte reguli prudențiale pentru criptoactivele la sfârșitul anului 2019. În decembrie XNUMX, grupul a publicat un document de discuție, declarând la acea vreme că creșterea criptomonedelor ar putea prezenta riscuri pentru stabilitatea financiară și bănci. Un tratament „prudențial conservator” pentru expunerea la criptomonede ar trebui, prin urmare, instituit pentru bănci, conform ziarului.

In the consultation paper’s introduction, the Committee noted that the proposals would constitute a “minimum,” opening the door to even tighter requirements at the discretion of banks themselves.

“Any Committee-specified prudential treatment of cryptoassets would constitute a minimum standard for internationally active banks. Jurisdictions would be free to apply additional and/or more conservative measures if warranted. As such, jurisdictions that prohibit their banks from having any exposures to cryptoassets would be deemed compliant with a global prudential standard,” the group said.

Citire asemănătoare

- "

- 2019

- activ

- Suplimentar

- în jurul

- bunuri

- Bunuri

- Bancă

- Bancar

- Băncile

- de

- Bitcoin

- corp

- capital

- cripto

- cryptocurrencies

- cryptocurrency

- clienţii care

- de date

- Cerere

- financiar

- First

- Înainte

- Gratuit

- Caritate

- grup

- Creștere

- deţine

- HTTPS

- ICON

- IT

- major

- Altele

- Hârtie

- Citind

- Regulament

- Autoritățile de reglementare

- Cerinţe

- răspuns

- norme

- Stabilitate

- Stablecoins

- standarde

- timp

- tratament

- lume