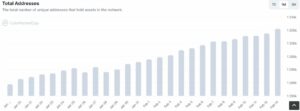

The Bitcoin ($BTC) network has officially surpassed a massive milestone, with users on it having created over 1 billion address since its launch over a dcade ago. The milestone comes amid an ongoing bear market that has seen BTC drop below the $20,000 after hitting a new all-time high above $69,000 late last year.

According to blockchain analytics firm Glassnode, the total number of addresses created on the Bitcoin network has kept on growing even with the cryptocurrency’s price plunging to surpass the new milestone, which was shared on social media.

Este de remarcat faptul că o adresă nu este neapărat egală cu un utilizator din rețea. Fiecare participant al rețelei Bitcoin poate crea câte adrese dorește, iar unii experți sfătuiesc utilizatorii să facă acest lucru pentru a-și spori confidențialitatea în rețea.

Pe de altă parte, unele adrese dețin fonduri pentru potențial mii de utilizatori, deoarece aparțin furnizorilor de servicii de criptomonede. Schimburile cripto, de exemplu, dețin adesea fondurile utilizatorilor la adrese cu sume mari de fonduri, astfel încât acestea să poată fi stocate în siguranță offline.

În săptămânalul său raportează, Glassnode has detailed that cryptocurrency holders with “diamond hands” are facing pressure to hold onto their funds and avoid capitulation amid the ongoing bear market, with data suggesting BTC hasn’t seen its bottom yet.

The report details that the proportion of Bitcoin held by long-term holders compared to short-term holders hasn’t reached the depths of the previous bear market, in which long-term holders saw their supply surpass34% of all circulating BTC, while short-term holders controlled between 3% and 4%.

Currently, short-term holders control 16% of the cryptocurrency’s supply at a loss, which suggests that coins still need to be redistributed to long-term holders over time. Per the firm, while numerous bottom formation signals are in place, the market may still need more time and pain to “establish a resilient bottom.”

The firm also pointed to BTC holders potentially having to sell their funds in the next few months to stay afloat. It wrote that the “duration of miner capitulation in the 2018-2019 bear market was around 4-months, with the current cycle only having started in 1-month ago.” Glassnode added:

Miners currently hold approximately 66.9k BTC in aggregate in their treasuries, and thus the next quarter is likely to remain at risk of further distribution unless coin prices recover meaningfully.

As reported, a popular cryptocurrency trader has predicted that the flagship cryptocurrency Bitcoin will hit a new all-time high next year after an unexpected rally helps it surpass the six-figure mark, before the bear market returns in 2024 and 2025.

Image Credit

Imagine recomandată prin Unsplash

- Bitcoin

- blockchain

- respectarea blockchain-ului

- conferință blockchain

- coinbase

- coingenius

- Consens

- conferință cripto

- cripto miniere

- cryptocurrency

- CryptoGlobe

- descentralizată

- DEFI

- Active digitale

- ethereum

- masina de învățare

- jeton non-fungibil

- Plato

- platoul ai

- Informații despre date Platon

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- dovada mizei

- W3

- zephyrnet