After crashing under $50,000 earlier this week, Bitcoin (BTC) is struggling to make a move northward. The world’s largest cryptocurrency has lost its trillion-dollar status and continues to remain under pressure. At press time, Bitcoin is trading at a price of $49,023 with a market cap of $924 billion.

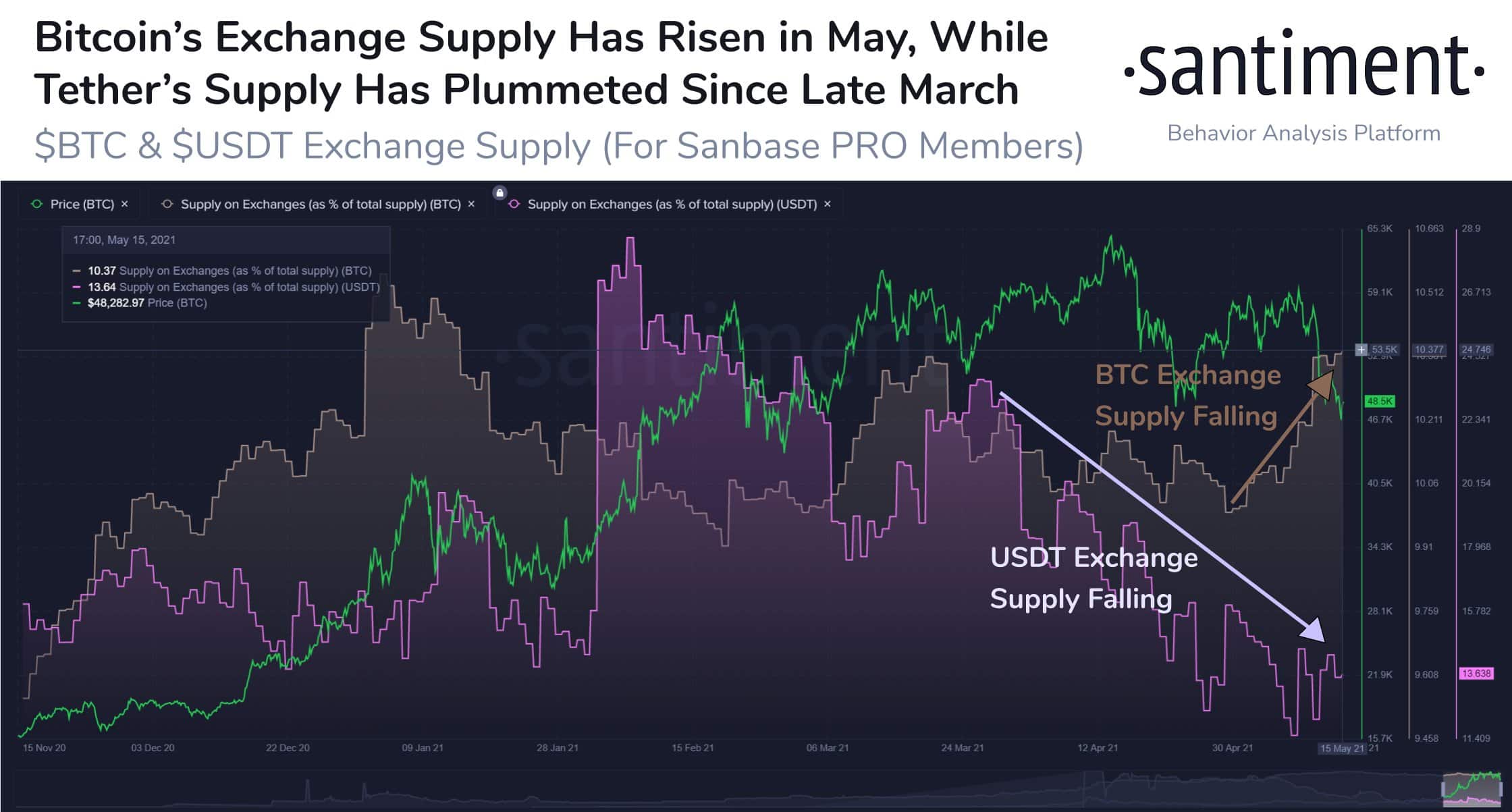

This happens as Bitcoin inflows at the exchanges continue to rise further. Traders have been depositing a large number of BTC to the exchanges, a bearish indicator that suggests liquidation. On the other hand, the USDT supply at exchanges is dropping showing lower buying interest. As on-chain data provider Santiment reports:

“The supply of #Bitcoin sitting on exchanges is currently back to its highest level since January 14th. The 4-month high is indicative of fear, and the supply of #Lega being near a 2021-low is also an indication traders are hesitant to buy this dip.”

Bitcoin (BTC) Whales Reduce Supply In the Last 5 Weeks

Even before the market crash following Tesla’s decision, the Bitcoin whales had started reducing their supplies. Bitcoin (BTC) whale addresses holding between 100 to 10,000 coins have liquidated over 100,000 BTC worth $5.74 billion over the last five weeks. This is the lowest supply held by these addresses since February.

🐳 Our data indicates that the high-alpha group of ‘#Bitcoin Millionaires’ holding between 100 to 10,000 $ BTC, have now shed 120,000 coins ($5.74b) from their wallets in the last 5 weeks. This is the least amount of coins held by this group since Feb. 10. https://t.co/qD77au0oIu pic.twitter.com/6puL77KTkR

- Santiment (@santimentfeed) 15 Mai, 2021

Also, there’s a clear sign that the Bitcoin network has been on a declining trend. The BTC percent miner revenue coming from fees alone has reached a 4-month low.

📉 #Bitcoin $ BTC Procentul de venituri miniere din taxe (7d MA) tocmai a atins un minim de 4 luni de 7.576%

Minima anterioară de 4 luni de 7.585% a fost observată pe 14 mai 2021

Vizualizați metrica:https://t.co/NphJIZNcsL pic.twitter.com/cSDngMOE2E

- alerte pentru glassnode (@glassnodealerts) 16 Mai, 2021

Some Positive Bitcoin (BTC) Indicators

But not everything is a bad sign for Bitcoin at the moment. There’s are some positive indicators and historical trends that suggest that Bitcoin (BTC) might be heading ahead for a further bull run in the coming months.

Based on historical trends, popular analyst PlanB mentions that we are in the mid-bull run currently as Bitcoin’s relative strength index (RSI) has dropped to levels seen between 2013 and 2017. As seen from the below chart, the Bitcoin price surged once again to new highs.

#bitcoin relative strength index (RSI): we are at the typical mid-bull-cycle drop in RSI (yellow circles), in between 2013 and 2017. Excited about next couple of months. pic.twitter.com/3OrC20FZFo

- PlanB (@ 100trillionUSD) 15 Mai, 2021

Also, as reported by Glassnode, Bitcoin’s Spent Output Profit Ratio (SOPR) has dropped below 1 indicating a bottom formation. Hopeful that Bitcoin (BTC) shall resume its upward journey from here onwards.

Another bottom again according to SOPR #Bitcoin https://t.co/FFXcO6i3ey pic.twitter.com/pLTkL6DtKD

- Yann & Jan (@Negentropic_) 14 Mai, 2021

- 000

- 100

- 7

- Absolut

- analist

- Auto

- Avatar

- de urs

- Miliard

- Bitcoin

- Prețul Bitcoin

- balenele bitcoin

- blockchain

- Tehnologia blocurilor

- frontieră

- BTC

- Alergarea taurilor

- cumpăra

- Cumpărare

- Monede

- venire

- continua

- continuă

- Cuplu

- Crash

- cripto

- cryptocurrencies

- cryptocurrency

- de date

- Picătură

- scăzut

- Economie

- Platforme de tranzacţionare

- Taxe

- finanţa

- financiar

- FinTech

- urma

- Gratuit

- Georgia

- nod de sticlă

- bine

- grup

- aici

- Înalt

- deţine

- HTTPS

- index

- interes

- investind

- cunoştinţe

- mare

- învăţare

- Nivel

- Lichidare

- Piață

- Capul pieței

- de cercetare de piață

- pieţe

- menționează

- Comerciant

- milionari

- luni

- muta

- În apropiere

- reţea

- Opinie

- Altele

- Popular

- presa

- presiune

- preţ

- Profit

- reduce

- Rapoarte

- cercetare

- venituri

- Alerga

- Ecran

- Distribuie

- aptitudini

- Sponsorizat

- început

- Stare

- livra

- Tehnologia

- timp

- semn

- top

- Comercianti

- Trading

- Tendinţe

- stare de nervozitate

- actualizări

- us

- USDT

- Portofele

- săptămână

- valoare