Let’s finish the 4th chapter once and for all, book lovers. As promised, we’re going to take government money to court and analyze its track record. How do you think it did? We’ll also analyze the hyperinflation phenomenon, which as it turns out, “is a form of economic disaster unique to government money.” How does it work? You’ll know by the end of this article.

Last but not least, we have a definition of “sound money.” A key concept for understanding Bitcoin and what it brings to humanity. A key concept for understanding what has gone wrong with the world in these last few… centuries.

Citire asemănătoare Fed Inflation Metric Soars To Three Decade High, What It Means For Bitcoin

Without further ado, let’s get into it. But first…

Despre cel mai tare club de carte de pe pământ

Clubul de carte Bitcoinist are două cazuri de utilizare diferite:

1.- Pentru superstarul-executiv-investitor pe fugă, vom rezuma cărțile care trebuie citite pentru entuziaștii criptomonedelor. Unul câte unul. Capitol cu capitol. Le citim, astfel încât să nu trebuiască și să vă oferim doar bucățile de carne.

2.- Pentru viermele meditativ care este aici pentru cercetare, vă vom oferi note de linie pentru a vă însoți lectura. După ce clubul nostru de carte se termină cu cartea, puteți reveni oricând pentru a reîmprospăta conceptele și a găsi citate cruciale.

Toată lumea câștigă.

Până în prezent, am acoperit:

Și acum este timpul pentru "Chapter 4, Part 3: Hyperinflation

Government Money’s Track Record

The amounts are scary, to say the least. And they won’t stop growing.

The total U.S. M2 measure of the money supply in 1971 was around $600 billion, while today it is in excess of $12 trillion, growing at an average annual rate of 6.7%. Correspondingly, in 1971, 1 ounce of gold was worth $35, and today it is worth more than $1,200.

În Bitcoin 2021 conference, Mark Yusko said that to get to a trillion, “You’d have to sit here with us for 31.770 years” (…) “And you’d have to spend a Dollar a second.” His point was that the U.S. had “tocmai am adoptat un proiect de lege pentru a tipări șase trilioane.” So, the growth is exponential. And the beast won’t stop eating. And most of the world’s currencies are doing even worse. By a wide margin.

Government Money And Hyperinflation

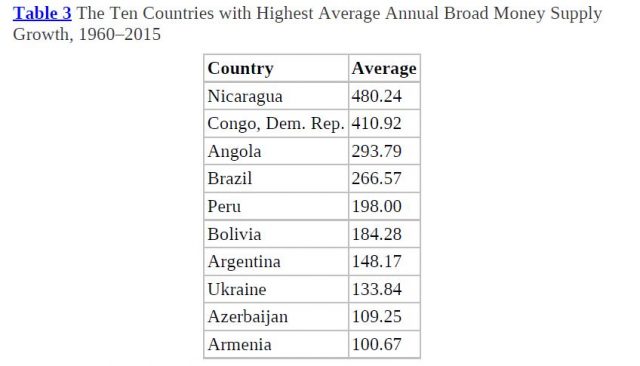

The world’s major national currencies generally have their supply grow at predictably low rates. Developed economies have had slower increases in the supply of their currencies than developing economies, which have witnessed faster price rises and several hyperinflationary episodes in recent history.

It’s worth noting that, “Hyperinflation is a form of economic disaster unique to government money. There was never an example of hyperinflation with economies that operated a gold or silver standard.” The effects of this process are far and wide. Societies collapse when the money stops working.

As these lines are written, it is Venezuela’s turn to go through this travesty and witness the ravages of the destruction of money, but this is a process that has occurred 56 times since the end of World War I, according to research by Steve Hanke and Charles Bushnell, who define hyperinflation as a 50% increase in the price level over a period of a month.

As the money supply expands, the wealth of the holders decreases. Said wealth is transferred to the printers and those who are close to them.

It is ironic, and very telling, that in the era of government money, governments themselves own far more gold in their official reserves than they did under the international gold standard of 1871–1914.

The Definition Of “Sound Money”

If your aim is to understand Bitcoin, this concept is crucial. Austrian economists pose that, “the best money revolved around understanding salability and what the market would choose as money.” Saifedean Ammous adds one more thing.

… the salability of money according to the will of its holder and not some other party. Combining these criteria together formulates a complete understanding of the term sound money as the money that is chosen by the market freely and the money completely under the control of the person who earned it legitimately on the free market and not any other third party.

Citire asemănătoare Semnalul tehnic sugerează că aurul este pregătit pentru răzbunare împotriva Bitcoin

And this, of course, brings us to the topic at hand.

In its infancy, Bitcoin already appears to satisfy all the requirements of Menger, Mises, and Hayek: it is a highly salable free-market option that is resistant to government meddling.

Destul spus.

BTC price chart on Binance US | Source: BTC/USDT on TradingView.com

- 9

- TOATE

- în jurul

- articol

- CEL MAI BUN

- Proiect de lege

- Miliard

- binance

- Bitcoin

- Bitcoinist

- Manuale

- BTCUSDT

- cazuri

- Charles

- club

- Conferință

- Tribunal

- cryptocurrency

- Moneda

- FĂCUT

- dezastru

- Dolar

- Economic

- se extinde

- urma

- formă

- Gratuit

- Aur

- Guvern

- guvernele

- Crește

- În creştere

- Creștere

- aici

- Înalt

- istorie

- Cum

- HTTPS

- hiperinflația

- Crește

- inflaţiei

- Internațional

- IT

- Cheie

- Nivel

- major

- marca

- Piață

- măsura

- bani

- oficial

- Opțiune

- Altele

- preţ

- tarife

- Citind

- Cerinţe

- cercetare

- Alerga

- Silver

- SIX

- So

- petrece

- livra

- timp

- urmări

- ne

- us

- război

- Bogatie

- OMS

- Apartamente

- lume

- valoare